- Home

- »

- Next Generation Technologies

- »

-

Contact Center Intelligence Market Size, Share Report, 2030GVR Report cover

![Contact Center Intelligence Market Size, Share & Trends Report]()

Contact Center Intelligence Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Service), By Technology, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-030-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Contact Center Intelligence Market Summary

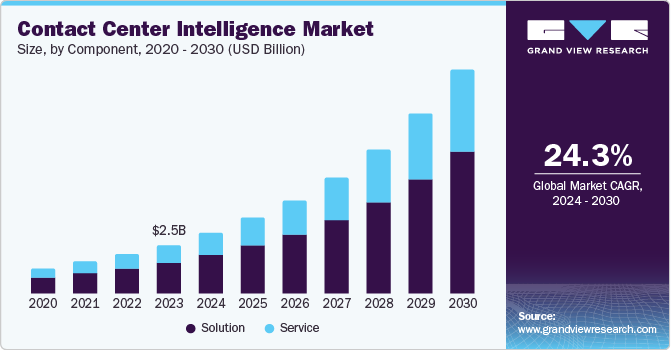

The global contact center intelligence market size was valued at USD 2.46 billion in 2023 and is projected to reach USD 11.20 billion by 2030, growing at a CAGR of 24.3% from 2024 to 2030. Businesses increasingly recognize that customer satisfaction is pivotal to their success, leading them to invest in technologies that enhance interactions.

Key Market Trends & Insights

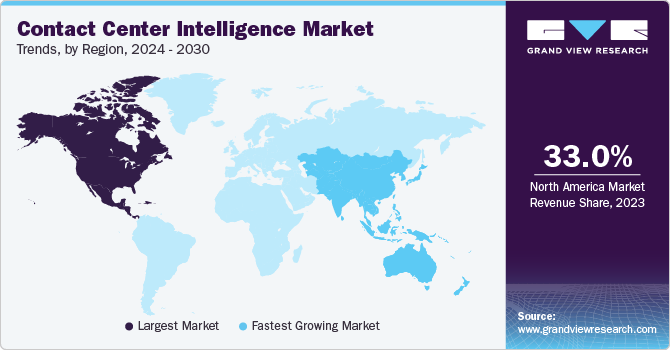

- North America contact center intelligence market accounted for the largest market revenue share of 33.0% in 2023.

- Asia Pacific contact center intelligence market is anticipated to register the fastest CAGR over the forecast period.

- Based on component, the solution segment dominated the market, accounting for a revenue share of 67.1% in 2023.

- Based on technology, the Natural Language Processing (NLP) segment accounted for the largest market revenue share in 2023.

- Based on deployment, the on-premises segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.46 Billion

- 2030 Projected Market Size: USD 11.20 Billion

- CAGR (2024-2030): 24.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

Contact center intelligence solutions leveraging artificial intelligence (AI) and machine learning (ML) enable organizations to analyze customer interactions in real-time, providing insights that help tailor responses and improve service quality.

The rising need for AI solutions in customer service is a major factor driving the market growth. Businesses use artificial intelligence to improve customer engagements, streamline operations, and offer tailored services. AI-driven chatbots and virtual assistants enhance productivity by managing common questions, enabling human agents to concentrate on more intricate problems. Social media has become an essential platform for engaging with customers. The increasing amounts of data produced by interactions on social media require sophisticated analytics tools to gain a deeper understanding of customer opinions and choices. Companies are embracing contact center intelligence solutions with social media monitoring features to improve customer interaction and responsiveness.

Organizations are increasingly automating customer service interactions to enhance operational efficiency. Automation decreases the time spent on handling tasks and the call deflection rate while improving the overall quality of service. The move towards automation is leading to increased investments in intelligent technologies for contact centers. Furthermore, as customer interactions become more complex, businesses need advanced data analytics tools to understand customer behavior and preferences. Contact center intelligence solutions provide advanced analytics features that enable organizations to make informed decisions using live data.

Component Insights

The solution segment dominated the market, accounting for a revenue share of 67.1% in 2023. Businesses increasingly recognize that providing timely, accurate, personalized responses to customer inquiries is crucial for maintaining competitive advantage. Chatbots and Intelligent Virtual Assistants (IVAs) can handle many queries simultaneously, reducing wait times and improving service efficiency. This capability allows companies to offer 24/7 support without extensive human resources, which is particularly valuable in today’s fast-paced digital environment, where customers expect immediate assistance.

The service segment is projected to grow at the fastest CAGR over the forecast period. The ability to gather, analyze, and interpret data from various sources enables organizations to make informed decisions about their service offerings. Services such as integration & deployment services play a crucial role in ensuring that analytics tools are effectively integrated into existing systems. This integration allows for real-time monitoring of performance metrics, enabling companies to identify areas for improvement and implement changes swiftly.

Technology Insights

The Natural Language Processing (NLP) segment accounted for the largest market revenue share in 2023. NLP technologies enable automated responses to customer inquiries, allowing contact centers to handle more calls without additional human resources. This enhances operational efficiency and leads to faster response times, which is crucial in improving customer satisfaction. Integrating NLP into contact center intelligence becomes essential as organizations adopt AI-driven solutions.

The Machine Learning (ML) segment is anticipated to register the fastest CAGR over the forecast period. Contact centers generate enormous volumes of data from various sources, such as calls, emails, chats, and social media interactions. Machine learning models can process this data to extract actionable insights that inform strategic decisions regarding staffing, training needs, product offerings, and marketing strategies. By leveraging these insights, organizations can optimize their operations and improve performance metrics such as average handling time (AHT) and first-call resolution (FCR), further driving the adoption of machine learning technologies.

Deployment Insights

The on-premises segment accounted for the largest market revenue share in 2023. The trend towards greater control and autonomy in managing IT resources is fueling the on-premises segment's expansion. Organizations with in-house IT teams often prefer to manage and maintain their contact center systems internally rather than relying on third-party cloud providers. On-premises solutions enable these teams to have direct oversight of system performance, updates, and troubleshooting, which can lead to quicker response times and enhanced operational stability. This direct control is particularly valued by large enterprises that need to ensure the highest levels of reliability and performance in their contact center operations.

The hosted segment is projected to grow at the fastest CAGR over the forecast period. Businesses recognize that timely and effective support is crucial for retaining customers and fostering loyalty. Hosted contact center intelligence solutions offer omnichannel support, real-time analytics, and customer journey mapping that help organizations better understand and respond to customer needs. By leveraging these capabilities, companies create more personalized interactions that enhance satisfaction and drive repeat business.

Enterprise Size Insights

Large enterprises accounted for the largest market revenue share and dominated the market in 2023. Large enterprises often operate across multiple regions and channels, necessitating sophisticated contact center solutions that can handle high volumes of interactions and provide integrated insights across diverse platforms. Advanced contact center intelligence systems enable large enterprises to manage and analyze vast amounts of data, streamline processes, and deliver a seamless customer experience, making them essential for maintaining competitive advantage in a complex business environment.

The small & medium enterprises (SME) segment is anticipated to register the fastest CAGR over the forecast period. Cloud-based solutions have made it easier for smaller enterprises to adopt sophisticated contact center tools without substantial upfront investments in hardware or infrastructure. The availability of scalable solutions allows SMEs to pay only for what they use, making it financially viable to implement advanced features such as omnichannel support, AI-driven chatbots, and predictive analytics. This democratization of technology empowers SMEs to compete with larger organizations by providing enhanced customer experiences.

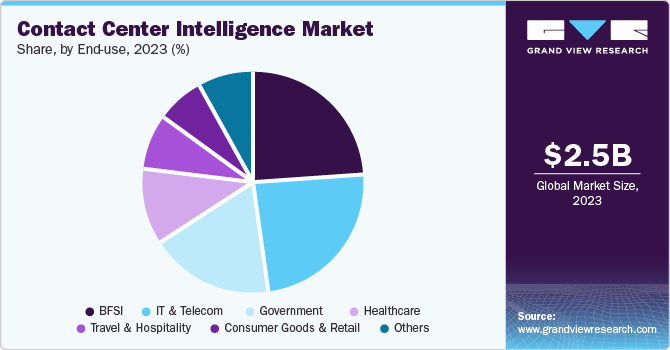

End Use Insights

The BFSI segment held the largest market revenue share in 2023. Contact center intelligence solutions have emerged as critical tools for BFSI organizations to streamline operations, improve customer interactions, and drive efficiency. The growth drivers in this segment are multifaceted, encompassing technological advancements, regulatory compliance needs, and changing consumer behaviors. AI-driven chatbots and virtual assistants enhance customer service by providing instant responses to inquiries, thereby reducing wait times and improving overall satisfaction. Additionally, analytics tools enable BFSI companies to gain insights from customer interactions, allowing them to tailor services more effectively.

The consumer goods & retail segment is projected to grow at the fastest CAGR over the forecast period. Retailers increasingly recognize the value of leveraging data analytics to inform their strategies. Contact center intelligence solutions provide actionable insights from customer interactions that can guide product development, marketing campaigns, and service improvements. By analyzing trends in customer feedback or identifying common pain points through sentiment analysis tools, businesses can adapt their offerings more effectively to meet consumer demands while staying competitive in a rapidly evolving marketplace.

Regional Insights

North America contact center intelligence market accounted for the largest market revenue share of 33.0% in 2023. Customers in the region today expect seamless interactions across various channels—be it phone calls, emails, social media, or live chats. Providing a unified experience across these channels is essential for maintaining customer engagement. For instance, platforms such as Zendesk offer tools that allow businesses to manage all customer interactions from a single interface, ensuring that agents have access to complete customer histories regardless of the channel used. This integration not only streamlines operations but also enhances the overall efficiency of contact centers.

U.S. Contact Center Intelligence Market Insights

The U.S. contact center intelligence market dominated the North America market in 2023. In a highly competitive U.S. market, companies invest heavily in technologies that provide superior customer service and engagement. Advanced contact center intelligence solutions, including artificial intelligence (AI) and machine learning, enable organizations to analyze customer interactions, predict needs, and deliver personalized experiences. By leveraging these technologies, U.S. companies can differentiate themselves through exceptional customer service, which is crucial for maintaining and expanding their customer base.

Europe Contact Center Intelligence Market Insights

Europe contact center intelligence market was identified as a lucrative region. The rapid adoption of cloud-based contact center solutions is a key factor fueling European market expansion. Cloud-based platforms appeal to businesses of all sizes because they provide scalability, flexibility, and lower initial expenses. The European Commission is enhancing the promotion of cloud services and infrastructure, which is leading to even faster growth in the contact center intelligence market.

The UK contact center intelligence market is anticipated to grow significantly over the forecast period. Data privacy and regulatory compliance are critical factors driving the contact center intelligence market in the UK. With stringent regulations such as the General Data Protection Regulation (GDPR), UK businesses ensure that their contact center operations comply with data protection laws. Contact center intelligence solutions that offer robust security features, data encryption, and compliance tools are in high demand. These solutions help organizations safeguard sensitive customer information and maintain regulatory compliance, which is crucial for building trust and avoiding potential legal and financial penalties.

Asia Pacific Contact Center Intelligence Market Insights

Asia Pacific contact center intelligence market is anticipated to register the fastest CAGR over the forecast period. The Asia Pacific region has witnessed a substantial increase in startups and small to medium enterprises (SMEs) over recent years. According to a report by StartupBlink, India and China combined accounted for 9,90,139 startups in 2023. Startups increasingly recognize the importance of customer experience as a key differentiator in competitive markets. As these businesses scale, they require efficient customer service solutions that can be provided through contact center intelligence technologies.

India contact center intelligence market is projected to grow rapidly in the coming years. As businesses in India embrace digital technologies, there is a growing need for sophisticated contact center solutions that integrate seamlessly with other digital platforms and enhance overall operational efficiency. Cloud-based contact center intelligence solutions are particularly popular due to their scalability, flexibility, and cost-effectiveness. These solutions enable businesses to scale their contact center operations quickly, implement new features, and adapt to changing market conditions without the burden of maintaining physical infrastructure, making them an attractive option for Indian companies aiming to stay competitive.

Key Contact Center Intelligence Company Insights

Some key companies in the contact center intelligence market include Amazon Web Services, Inc., TENEO.AI, Avaya LLC, and others.

-

Amazon Web Services, Inc. offers a suite of services under the umbrella of Contact Center Intelligence that aims to enhance customer interactions through advanced technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP). AWS offers self-service virtual agents for managing routine inquiries, real-time call analytics for instant insights and recommended responses, and post-call analytics for extracting valuable information such as customer sentiment.

-

Teneo.AI provides AI-driven virtual agents that can handle various customer inquiries without human intervention. These virtual agents are designed to understand and respond to customer queries in real time, utilizing NLP to interpret the intent behind user inputs. This capability allows businesses to automate responses for frequently asked questions, thereby reducing wait times and improving customer satisfaction.

Key Contact Center Intelligence Companies:

The following are the leading companies in the contact center intelligence market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- TENEO.AI

- Avaya LLC

- IBM Corporation

- Microsoft

- Oracle

- SAP SE

- Zendesk

- Talkdesk

Recent Developments

-

In March 2024, Zendesk announced the acquisition of Ultimate, a service automation provider for delivering the most complete AI offerings for customer experience (CX) in the market. With Ultimate, Zendesk aims to provide AI agents that have improved intelligence and can solve problems proactively in addition to reacting, which will complement human knowledge.

-

In June 2024, SAP SE announced the agreement to acquire WalkMe, a provider of digital adoption platforms (DAPs). The envisioned combination enhances SAP's Business Transformation Management offerings with SAP Signavio and SAP LeanIX solutions to support customers' transformation processes.

Contact Center Intelligence Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.04 billion

Revenue forecast in 2030

USD 11.20 billion

Growth Rate

CAGR of 24.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, deployment, enterprise size, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, Australia, South Korea, Brazil, South Africa, Saudi Arabia, and UAE

Key companies profiled

Amazon com, Inc.; TENEO.AI; Avaya LLC; Google; IBM Corporation; Microsoft; Oracle; SAP SE; Zendesk; Talkdesk

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contact Center Intelligence Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the contact center intelligence market report based on component, technology, deployment, enterprise size, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Chatbot

-

Intelligent Virtual Assistant (IVA)

-

Intelligent Interactive Voice Response (IVR) System

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

Managed Services

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural Language Processing

-

Machine Learning

-

Automatic Speech Recognition

-

Computer Vision

-

Video Recognition

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Consumer Goods & Retail

-

Government

-

Healthcare

-

IT & Telecom

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.