- Home

- »

- Medical Devices

- »

-

Continuous Glucose Monitoring Devices Market Report, 2030GVR Report cover

![Continuous Glucose Monitoring Devices Market Size, Share, & Trends Report]()

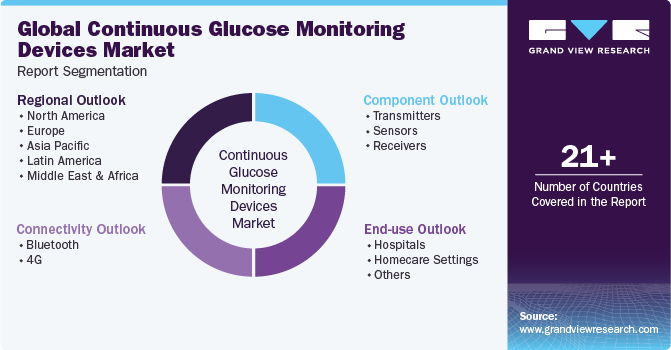

Continuous Glucose Monitoring Devices Market Size, Share, & Trends Analysis Report By Component (Transmitters, Sensors, Receivers), By End-use (Hospitals, Homecare), By Connectivity, By Region and Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-875-6

- Number of Report Pages: 175

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

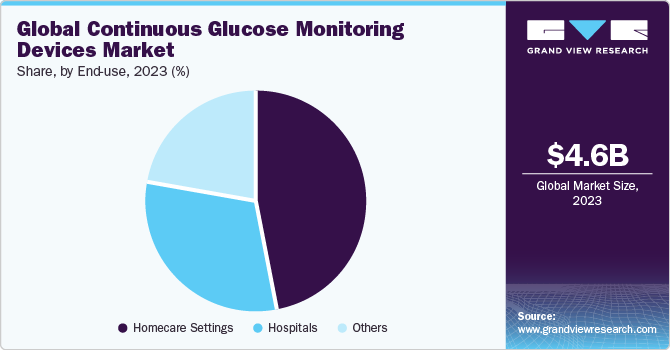

The global continuous glucose monitoring devices market size was estimated to be valued at USD 4.60 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.19% from 2024 to 2030. The increase in the prevalence of diabetes due to aging, obesity, and unhealthy lifestyle is one of the factors contributing to the growth of the continuous glucose monitoring (CGM) devices market. Obesity is a major factor leading to diabetes. According to WHO, in 2022, the number of obese individuals worldwide exceeded 1 billion, including 650 million adults, 340 million adolescents, and 39 million children. This number continues to grow. If things continue as they are, WHO predicts that by 2025, around 167 million people, both adults and children, will experience worsening health problems due to their weight issues. In addition to obesity, diabetes is becoming increasingly prevalent globally. The International Diabetes Federation (IDF) estimates that there were 537 million adults (aged 20–79) living with diabetes in 2021, and this number is expected to increase to 642 million by 2040. The IDF also reports that the prevalence of diabetes is growing globally, with the highest increase witnessed in low- and middle-income countries.

CGM devices are minimally invasive and offer an easy and effective way to manage diabetes. They can also detect drastic changes in blood glucose levels, thereby preventing hypoglycemic conditions. The CGM devices facilitate the analysis of blood glucose levels at different time intervals with the help of a sensor. Respective readings fed into the diabetes management software through a wireless network allow patients to understand the disease better, thereby helping them to manage it in a more effective way. Smoking, obesity, physical inactivity, high blood pressure, and high cholesterol are the common risk factors associated with diabetes complications.

The increasing incidence of prediabetes is also fueling the market growth. Prediabetes is a condition in which sugar levels in blood are higher than normal but not high enough to be classified as type 2 diabetes. It is a serious health condition that can increase the risk of developing type 2 diabetes, heart disease, and stroke. Unfortunately, the number of people diagnosed with prediabetes is rapidly growing. The main reason for the increase in prediabetes cases is the rise in obesity rates. Obesity is a major risk factor for developing prediabetes and type 2 diabetes. As more and more people adopt a sedentary lifestyle and consume unhealthy diet, the prevalence of obesity increases, which in turn leads to a rise in prediabetes cases. According to the CDC and the U.S. Department of Health & Human Services, it is estimated that 97.6 million adults in the U.S. 18 years or above had prediabetes in 2021.

As the geriatric population continues to grow, the demand for CGM devices is also increasing. CGM devices are vital for people with diabetes, especially elderly individuals who may not be able to monitor their blood glucose levels as frequently as required. These devices provide real-time glucose readings and help patients and healthcare professionals manage their diabetes more effectively. As a result, the market is expected to significantly grow in the coming years due to the increasing prevalence of diabetes and the growing need for better disease management tools. According to WHO, chronic conditions, such as diabetes, are highly prevalent in people aged 65 and above.

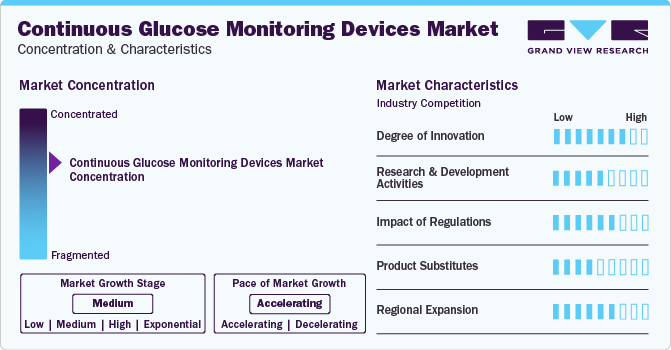

Market Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The continuous glucose monitoring devices market is characterized by a higher degree of growth owing to increasing prevalence of diabetes, rising adoption continuous glucose monitoring devices due to demonstrated benefits associated with the CGM devices, technological advancements, such as the development of smaller and more accurate sensors.

The market is consolidated and highly competitive with some of the leading market players accounting for the largest share. Key players are implementing strategies such as merger & acquisition, product launch, regulatory approvals, partnership and collaborations to maintain leading position in the market. For instance, in February 2023, DexCom, Inc. launched the Dexcom G7 CGM System in the U.S. The company has introduced the CGM system through a Super Bowl commercial starring Nick Jonas, who is suffering from diabetes. The commercial was expected to be watched by over 4.8 million diabetic U.S. individuals, of which 3.3 million were not using CGM and 2.3 million had CGM coverage. Hence, the ad was expected to create awareness about diabetes and have an influential product launch.

The continuous glucose monitoring devices market has been characterized by a high degree of innovation. With the increasing prevalence of diabetes globally, companies are developing new and improved CGM devices that offer better accuracy, more convenience, and greater patient affordability. Some of the latest innovations in CGM technology include improved sensor accuracy, smaller and more discreet devices, real-time data sharing with healthcare providers and caregivers, and integration with insulin pumps and other diabetes management tools.

The level of research and development activities in the continuous glucose monitoring devices market is moderate. Such activities help companies to innovate their business, leading to new product development. CGM market leaders such as Medtronic Plc, DexCom Inc., Senseonics Holdings, Inc., Abbott are constantly involved in the R&D procedures to deliver new edge CGM devices. For instance, in September 2023, Senseonics Holdings, Inc. announced the completion of the ENHANCE Pivotal Clinical Study. It demonstrated the accurate and safe performance of Eversense to facilitate effective and lasting diabetes management.

The impact of regulations is moderate to high in the continuous glucose monitoring devices market. Regulatory bodies such as the US FDA and the European Medicines Agency (EMA) have set guidelines and requirements for manufacturers to ensure the safety, performance, and efficacy of CGM devices. These regulations have contributed to increased patient safety and improved health outcomes in the market. However, the regulatory process can also be a barrier to entry for new players, as it requires significant investment and resources to complete the necessary clinical trials and obtain regulatory approval.

The product substitutes have been characterized by low to moderate levels in the continuous glucose monitoring devices market. Traditional blood glucose monitoring (BGM) devices are a major substitute for CGM devices. They are preferred due to factors such as familiarity, cost of the device, and ease of use, as some patients may find fingerstick testing to be more convenient or less intrusive than wearing a sensor on their body.Additionally, flash glucose monitoring (FGM) devices and insulin pumps can be used instead of CGM devices.

The continuous glucose monitoring devices market has expanded rapidly due to increased demand for diabetes management devices across regions, growing adoption of CGM devices in emerging markets, such as Asia-Pacific and Latin America, and continued expansion in established markets like North America and Europe. As manufacturers continue to develop new and improved CGM technologies, consumers' demand for these devices is growing, further fueling the market's growth.

Component Insights

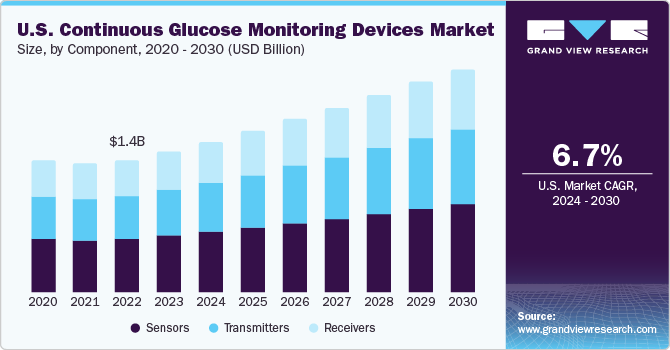

Based on the components, the sensors segment led the market with the largest revenue share of 40.66% in 2023. Technological advancements to improve the accuracy of sensors is expected to fuel the segment growth during the forecast period. Sensors are an important part of continuous glucose monitoring (CGM) devices. CGM sensors consist of a metallic filament thinner than a needle, which is inserted into the fatty layer just below the skin. The sensor is held in place with adhesive tape to monitor glucose levels in the surrounding region. The CGM monitors use glucose oxidase to monitor blood glucose levels. Glucose is converted to hydrogen peroxidase by the glucose oxidase, which reacts with platinum present in the sensor, generating an electrical signal that is communicated to the transmitter. The sensor also has chemical layers on top of glucose oxidase, keeping sensors functional under poor working conditions inside the human body.

The transmitters segment is expected to witness the highest CAGR of 7.83% during the forecast period. The transmitters are placed on the skin and communicate wirelessly with a sensor inserted under the skin. The sensor measures the glucose levels in the interstitial fluid. The transmitter then sends the data to a receiver or a smartphone app, where users can monitor their glucose levels & receive signals for high or low blood sugar levels. Radiofrequency transmitters are generally used in CGM devices. These transmitters use radiofrequency waves to send data from the sensor to the receiver or smartphone app. Additionally, Near-field Communication (NFC) transmitters and Bluetooth transmitters are also employed in the CGM devices.

Connectivity Insights

Based on the connectivity, the Bluetooth segment led the market in 2023 with the largest revenue share of 59.63%. CGM sensors are equipped with Bluetooth chips within them. As the patient hovers the recording device over the sensor, detailed information on the blood glucose levels is transferred via Bluetooth into the device. Further, the information is displayed on the reading device. The data may or may not be shared via 4G network to be saved in the monitor center database. These chips are mainly outsourced by CGM manufacturers to provide precise and accurate data capture from the sensor. Companies like Nordic Semiconductors, Renesas Electornic, Onsemi and many others, develop these chips for CGM devices. The chip is replaced every 14 days as the sensors needs to be changed.

The 4G network segment is experiencing fastest CAGR of 7.75% during the forecast period. The 4G network includes data transfer from receiving unit to central monitoring database to the providers systems and storage of numerous data points within specific CGM mobile applications. Such data transfer is said to be utmost crucial, to determine fair treatment regime, enable monitoring alert, and trigger insulin release. Numerous apps are available in the market that stores patient data and allow them to understand glucose fluctuation easily. Apps such as Glucose Buddy, Diabetes Connect, MySugar, Fooducate, MyFitnessPal and several others are purchased at a rate of ~USD 2 to USD 20 per month or ~USD 30 to USD 80 per year. Various other apps such as Sugarsense or BlueStar Diabetes are available for free download.

End-use Insights

Based on the end-use, the homecare segment led the market with a largest revenue share of 46.7% in 2023 and is anticipated to witness the highest CAGR of 7.73% during the forecast period. These devices offer patients with reduced intake of insulin doses and facilitate continuous monitoring of blood glucose levels. Homecare settings are expected to fuel the demand for CGM devices because of efficient and easy monitoring of blood glucose. Additionally, the fear of virus spread, increased vulnerability of diabetic patient during Covid-19, and the need to strictly monitor blood glucose levels during the pandemic period, led to its increased adoption among patients.

The hospital segment accounted for the significant market share in 2023, due to the rising number of hospital visits for diabetes treatment and sudden complications arising due to diabetes, such as retinopathy, nephropathy, and neuropathic conditions, require immediate attention and hospital admissions. Many hospitals and healthcare settings have increased the use of CGM devices to identify blood sugar levels in patients suffering from diabetes mellitus. CGM devices have been shown to perform considerably better compared to Self-monitoring Blood Glucose (SMBG) devices during clinical studies involving gestational diabetes mellitus, according to the National Center for Biotechnology Information (NCBI).

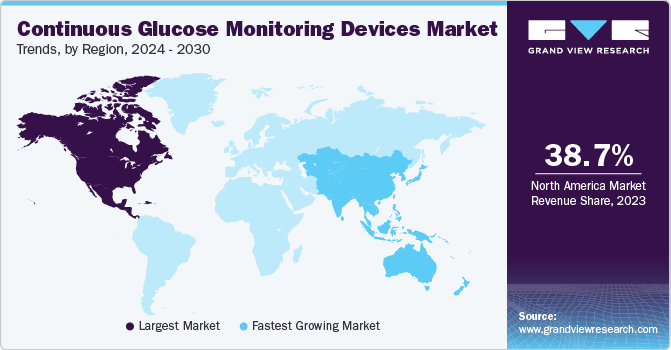

Regional Insights

The North America region captured the largest market share of 38.66% in 2023. This is due to increasing prevalence of diabetes, rising adoption of CGM devices, technological advancements, and the presence of key companies are some of the factors contributing to the market growth. Additionally, the efforts taken by the federal government to manage the disease at a larger level is fueling the market growth.

The U.S. continuous glucose monitoring devices market has captured almost 85% of the North America market shares in 2023 due to a large diabetic population and favorable reimbursement policies. According to the National Diabetes Statistics Report 2022 by the CDC, over 130 million adults in the United States are either suffering from diabetes or have prediabetes. The high per capita income and increasing healthcare spending are among the key factors likely to drive market growth. The American Diabetes Association released the Economic Costs of Diabetes in the U.S. report in November 2023, highlighting the economic impact of diabetes in 2022. According to the report, the total cost of diabetes in 2022 was USD 412.9 billion, including USD 306.6 billion in direct medical costs and USD 106.3 billion in indirect costs. Key players in the U.S. are executing various strategies to expand their market share. For instance, Abbott introduced a more affordable version of Libre at around USD 75 for a month's supply (which includes two sensors lasting up to 14 days each) in May 2022. This move aims to reduce the financial burden on diabetic patients in the country.

Asia Pacific region is anticipated to witness the highest CAGR of 8.69 % during the forecast period. According to the Asian Diabetes Prevention Initiative, almost 60% of the world’s diabetic population resides in the Asia Pacific region. The high prevalence of the disease in developing countries such as India and China have been propelling market growth in the region. Moreover, rising healthcare expenditure, increasing investment by companies, and favorable regulatory policies are also positively affecting the market growth in this region.

Key Companies & Market Share Insights

The market is consolidated with the dominance of market players such as of Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., and Signos, Inc. Most of these leading companies are involved in strategic collaborations, mergers, and acquisitions, and regional expansions to gain high revenue share in the industry. Market players are entering into partnerships & collaborations to grow & innovate and improve their competitiveness by combining the expertise & efforts of different organizations. Key companies involved are Abbott, Ypsomed AG, and A. Menarini Diagnostics S.r.l. For instance, in January 2024, Abbott and Tandem Diabetes Care, Inc. recently announced that their t:slim X2 insulin pump, which uses Control-IQ technology, has become the first Automated Insulin Delivery (AID) system to integrate with Abbott's latest Continuous Glucose Monitoring (CGM) technology, the FreeStyle Libre 2 Plus sensor.

This development has enabled users of FreeStyle Libre technology in the U.S. to experience the benefits of a hybrid closed-loop system. With this system, users can predict and prevent high & low blood sugar levels. The continuous glucose monitoring devices market is highly competitive, with each player offering unique features and benefits to patients. As the prevalence of diabetes continues to rise, the demand for non-invasive glucose monitoring devices is expected to grow, further fueling the market growth.

Key Continuous Glucose Monitoring Devices Companies:

- Dexcom, Inc.

- Abbott

- Medtronic

- Ypsomed AG

- Senseonics Holdings, Inc.

- A. Menarini Diagnostics S.r.l.

- Signos, Inc.

Recent Developments

-

In January 2024, Medtronic plc declared that their MiniMed 780G system with Simplera Sync received the CE Mark approval. Simplera Sync is a technology that enhances the user experience through a simplified two-step insertion process. IN addition, this new sensor is half the size of its precursors. The MiniMed 780G system with Simplera Sync sensor is anticipated to be launched in Europe through a limited release in the spring of 2024, followed by a phased commercial launch in the summer of the same year

-

In December 2023, Dexcom, Inc. announced the integration of Dexcom G7 CGM with tslim X2 insulin pump by Tandem Diabetes Care

-

In October 2023, Dexcom, Inc. expanded its presence in Canada by launching Dexcom G7

-

In September 2023, Senseonics Holdings, Inc. announced the completion of the ENHANCE Pivotal Clinical Study. It demonstrated the accurate and safe performance of Eversense to facilitate effective and lasting diabetes management

-

In April 2023, Medtronic Inc. announced the U.S. FDA approval for its MiniMed 780G system with the Guardian 4 sensor

Continuous Glucose Monitoring Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.95 billion

Revenue forecast in 2030

USD 7.51 billion

Growth rate

CAGR of 7.19% from 2024 to 2030

Base year of estimation

2023

Historical period

2018 – 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, connectivity, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; China; India; Japan; Thailand; South Korea; Australia; Mexico; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Dexcom, Inc.; Abbott, Medtronic; Ypsomed AG; Senseonics Holdings, Inc.; A. Menarini Diagnostics S.r.l.; and Signos, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Glucose Monitoring Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, & country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2016 to 2028. For this report, Grand View Research has segmented the continuous glucose monitoring devices market report based on component, end use, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Transmitters

-

Sensors

-

Receivers

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Bluetooth

-

4G

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare Settings

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Italy

-

France

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continuous glucose monitoring devices market size was estimated at USD 4.60 billion in 2023 and is expected to reach USD 4.95 billion in 2024.

b. The global continuous glucose monitoring devices market is expected to grow at a compound annual growth rate of 7.19% from 2024 to 2030 to reach USD 7.51 billion by 2030.

b. North America dominated the global continuous glucose monitoring devices market with a share of 38.66% in 2023. This is attributable to increasing cases of diabetes and efforts taken by the national government to manage the disease.

b. Some key players operating in the continuous glucose monitoring devices market include Dexcom, Inc., Abbott, Medtronic, Ypsomed AG, Senseonics Holdings, Inc., A. Menarini Diagnostics S.r.l., and Signos, Inc.

b. Key factors that are driving the continuous glucose monitoring devices market growth include growing cases of diabetes, coupled with the increasing adoption of continuous glucose monitoring (CGM) devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."