- Home

- »

- Medical Devices

- »

-

Continuous Peripheral Nerve Block Catheters Market Report, 2030GVR Report cover

![Continuous Peripheral Nerve Block Catheters Market Size, Share & Trends Report]()

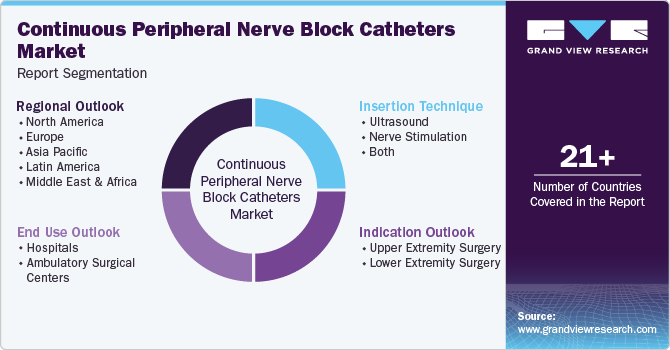

Continuous Peripheral Nerve Block Catheters Market (2025 - 2030) Size, Share & Trends Analysis Report By Insertion Technique (Ultrasound, Nerve Stimulation), By Indication, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-183-2

- Number of Report Pages: 193

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global continuous peripheral nerve block catheters market size was estimated at USD 314.1 million in 2024 and is projected to reach USD 402.1 million by 2030, growing at a CAGR of 4.3% from 2025 to 2030. The growth is driven by the rising number of surgical procedures and a growing geriatric population, which is more prone to health conditions. As the Department of Economic and Social Affairs reported, the global population aged 65 and over is expected to more than double, increasing from 761 million in 2021 to 1.6 billion by 2050.

The increasing prevalence of orthopedic conditions like arthritis can increase demand for orthopedic surgeries utilizing continuous peripheral nerve block (CPNB) catheters. According to the study published by the University of Washington in August 2023, it is projected that by 2050, around 1 billion people will be affected by osteoarthritis. Osteoarthritis patients often require surgeries, such as shoulder replacements. Moreover, using CPNB catheters in shoulder replacement surgeries enables same-day discharge. In procedures like knee or shoulder replacements, CPNB not only speeds up the time to meet discharge criteria but also allows for continued pain control outside the hospital for patients recovering at home. Therefore, the growing prevalence of orthopedic diseases and the expanded use of CPNB in surgeries like shoulder replacements are expected to drive market growth.

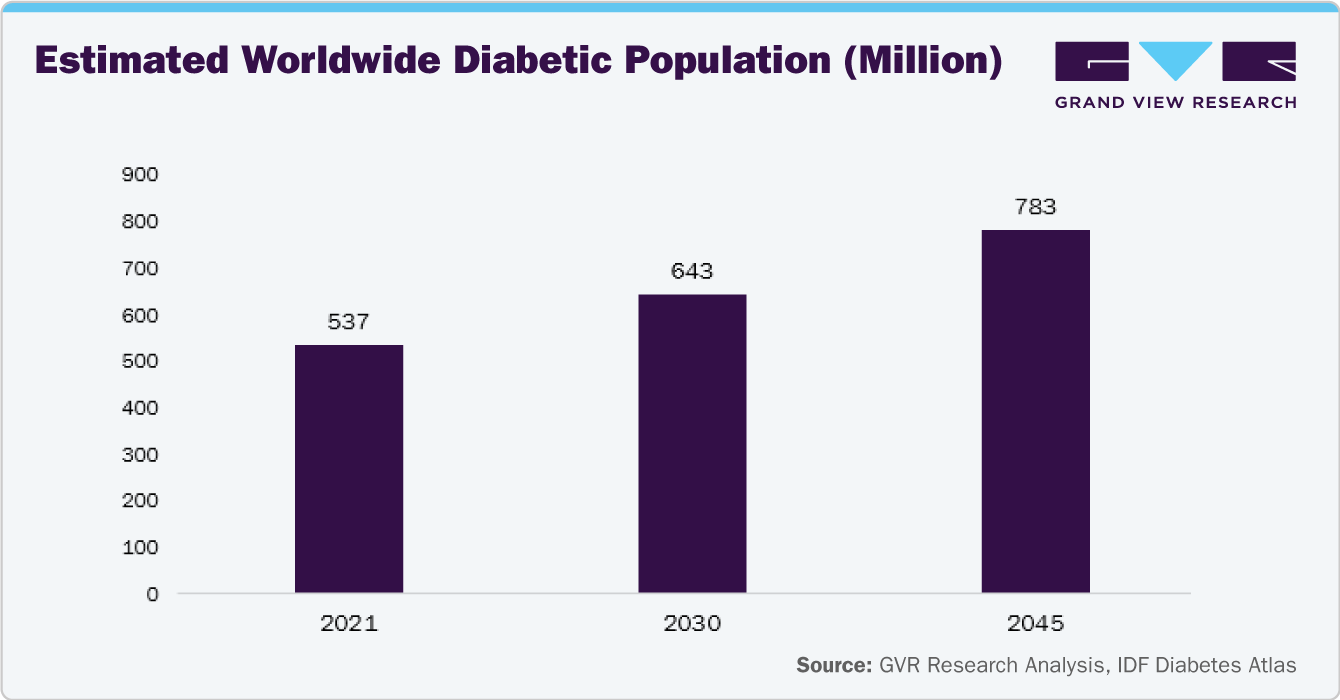

The rising prevalence of chronic conditions such as diabetes, which increases the risk of amputations, is expected to drive market growth in the coming years. According to the International Diabetes Federation, approximately 783 million people worldwide will have diabetes by 2045. Common causes of amputation include diabetes mellitus, neuropathy, peripheral vascular disease, and trauma. According to the study published by the National Library of Medicine in August 2022, around 150,000 patients in the U.S. undergo lower extremity amputations annually.

Moreover, several studies are exploring the use of CPNB catheters after lower extremity amputations. For instance, a study published by Elsevier Inc. in April 2021 found that preemptive use of CPNB in patients undergoing lower extremity amputation can help enhance recovery by lowering pulmonary complications and providing effective pain control. It also helps reduce opioid consumption.

In addition, another study published by Elsevier Inc. in July 2024 highlighted positive outcomes for continuous infusion of popliteal nerve blocks in diabetic foot surgery, demonstrating improved pain management and hemodynamics. This continuous infusion method offers a longer duration of pain relief and superior analgesia. Such encouraging results from studies focusing on the use of CPNB in lower extremity amputations and diabetic foot surgery are anticipated to drive market growth further over the forecast period.

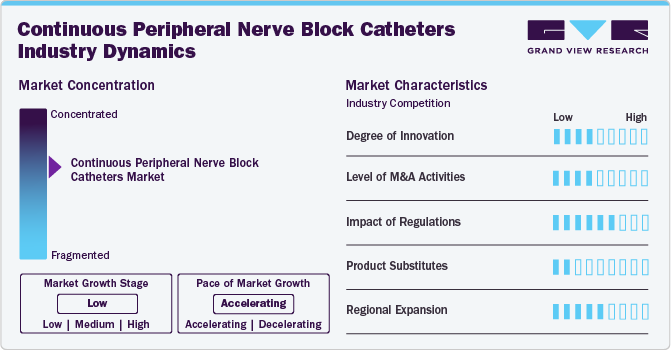

Market Concentration & Characteristics

The market growth stage is low, and the pace of growth is accelerating. The continuous peripheral nerve block catheters market is characterized by growth owing to rising cases of chronic diseases and the growing availability of these devices.

Industry players and researchers are working on various initiatives to bring innovation to the continuous peripheral nerve block catheters market. A study published by the Korean Association for the Study of Pain in June 2023 revealed that percutaneously inserted, ultrasound-guided CPNB Catheters can effectively reduce short-term and long-term pain in a significant number of patients with Abdominal Cutaneous Nerve Entrapment Syndrome (ACNES). These studies, which evaluate the use of these catheters in different conditions, are expected to drive innovation in the market.

Regulatory agencies such as the European Union, Health Canada, the Food and Drug Administration (FDA), and others set quality and safety standards for medical equipment, including continuous peripheral nerve block catheters. The regulatory authorities categorize medical devices into various categories according to the risk associated with them and oversee the marketing authorizations for these catheters.

The substitutes for continuous peripheral nerve block catheters include opioids and single-injection peripheral nerve blocks.

The market for continuous peripheral nerve block catheters is fragmented. This fragmentation can be attributed to numerous small, medium, and large-sized companies offering various continuous peripheral nerve block catheters. For instance, B. Braun SE., an industry participant, offers numerous products, such as the Contiplex D Set NRFit and the Contiplex S Ultra 360. The firms operating in the market often compete based on product differentiation and price

Manufacturers and firms in the industry focus on expanding their presence in numerous countries. Several industry participants, such as B. Braun SE, Teleflex Incorporated, and PAJUNK, offer their products in multiple countries, such as the U.S. and UK.

Insertion Technique Insights

The ultrasound segment dominated the market and accounted for a revenue share of 61.13% in 2023. Ultrasound-guided CPNB techniques can be conducted in various areas: along the brachial plexus, sciatic nerve, paravertebral space, femoral nerve, and iliohypogastric and ilioinguinal nerves, as well as within the transversus abdominis plan. Thus, the broad utility of this technique is anticipated to support the segment's growth over the forecast period.

On the other hand, the nerve stimulation segment is anticipated to witness significant growth over the forecast period. This growth can be attributed to the rising prevalence of chronic diseases and a growing number of surgeries across the globe. In addition, the increasing demand for pain management solutions is anticipated to support the segment’s growth in the coming years.

Indication Insights

The lower extremity surgery segment dominated the market in 2023. A large number of lower extremity surgeries are being performed. The widespread use of continuous peripheral nerve block catheters is expected to drive the growth of this segment in the coming years. These catheters can enhance recovery and provide adequate pain control after this surgery.

The upper extremity surgery segment is expected to grow fastest, with a CAGR of 4.4% during the forecast period. Continuous peripheral nerve block catheter catheters are increasingly being employed for effective pain management in major upper limb surgeries, including total shoulder replacement, rotator cuff repair, and elbow replacements that involve chronic post-operative pain. This trend is causing the upper extremity surgeries segment to expand steadily during the forecast period.

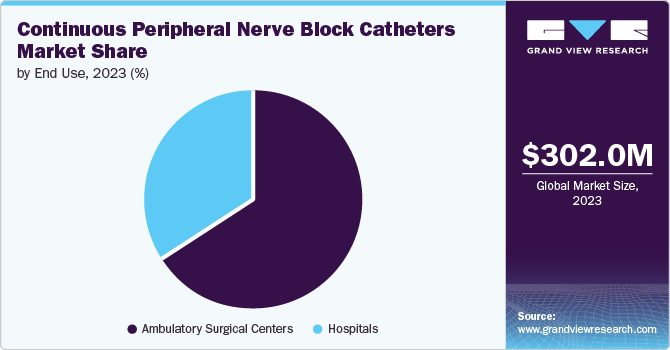

End Use Insights

In 2023, the ambulatory surgical centers (ASCs) segment dominated the market. It is also anticipated to grow fastest due to several advantages, such as shorter waiting times, faster patient discharge, lower overall procedural costs, and the capacity to treat a higher volume of patients. These benefits are expected to drive increased demand for this segment in the coming years. In addition, the growing number of ASCs is anticipated to support segment growth throughout the forecast period further.

The hospital segment is expected to register significant growth over the forecast period. The availability of well-trained and experienced healthcare professionals and technologically advanced equipment is anticipated to support the segment's growth in the coming years. Furthermore, the informative articles published by hospitals about continuous peripheral nerve block catheter use are anticipated to propel the segment's growth.

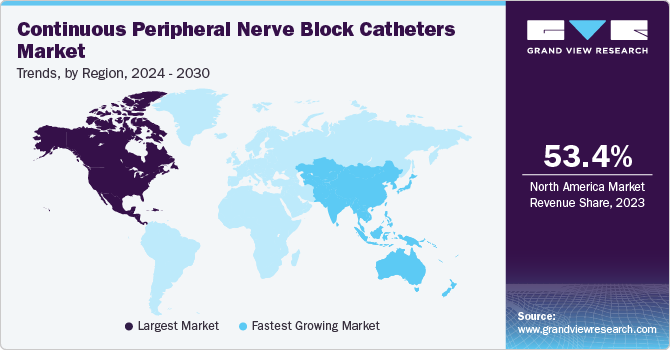

Regional Insights

North America held the largest revenue share of 53.44% in the market in 2023 due to the rising prevalence of chronic disorders and growing product launches. For instance, in April 2021, the U.S.-based company Solo-Dex introduced the Fascile continuous peripheral nerve block catheter. It is helpful in several common procedures, such as shoulder repair, knee and hip replacement, and other general surgical procedures.

U.S. Continuous Peripheral Nerve Block Catheters Market Trends

The continuous peripheral nerve block catheters market in the U.S. is expected to dominate the North American market over the forecast period. The presence of players such as Teleflex Incorporated, ICU Medical, Inc., and Solo-Dex, Inc., among others, is anticipated to support the country's market growth.

Europe Continuous Peripheral Nerve Block Catheters Market Trends

The continuous peripheral nerve block catheters market in Europe is anticipated to grow significantly in the coming years. This growth can be attributed to the rising number of individuals undergoing surgeries. Moreover, the availability of domestic and international companies offering continuous peripheral nerve block catheters is anticipated to boost the market growth. For instance, B. Braun SE. is a Germany-based company that produces and manufactures continuous peripheral nerve block catheters.

The UK continuous peripheral nerve block catheters market is expected to grow moderately over the forecast period. The growing number of diabetes patients is anticipated to propel the country’s market growth over the forecast period. According to the data published by the British Diabetic Association in May 2024, over 5.6 million individuals in the UK are living with diabetes.

The continuous peripheral nerve block catheters market in France is expected to experience growth over the forecast period, driven by the rising prevalence of chronic conditions and substantial healthcare spending. For instance, according to the 2023 Health Statistics published by the OECD, France dedicates 12.1% of its GDP to healthcare, compared to the OECD average of 9.2%.

Germany continuous peripheral nerve block catheters market is witnessing steady growth owing to the large number of orthopedic surgeries conducted nationwide. According to the HEALTH AT A GLANCE 2023 report published by the OECD, Germany, Switzerland, Finland, and Austria had some of the highest rates for hip and knee replacement in 2021.

Asia Pacific Continuous Peripheral Nerve Block Catheters Market Trends

The continuous peripheral nerve block catheters market in Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The market in the Asia Pacific region has been experiencing significant growth, driven by several key factors, such as the increasing prevalence of chronic diseases, including diabetes, among the region's population. These chronic diseases can increase the number of surgeries and procedures that use continuous peripheral nerve block catheters. Furthermore, a study published by Springer Nature Limited in February 2023 revealed that India had 74.9 million diabetics among the age group in 2021, and it is projected to rise to 124.9 million by 2045.

China continuous peripheral nerve block catheters market is expected to grow throughout the forecast period, driven by increasing demand for these catheters and the high volume of surgeries being performed.

The continuous peripheral nerve block catheters market in Japan is expected to grow over the forecast period owing to several key factors, such as technological advancements, the rising number of patients suffering from lifestyle-associated diseases, and many surgical procedures conducted in Japan.

Middle East and Africa Continuous Peripheral Nerve Block Catheters Market Trends

The market for continuous peripheral nerve block catheters in the Middle East and Africa is expected to witness significant growth in the coming years due to the growing healthcare expenditure and rising prevalence of orthopedic diseases. According to a study published by Brieflands in June 2024, the prevalence rates of osteoarthritis in the UAE range from 1.4% to 47.1%.

Saudi Arabia continuous peripheral nerve block catheters market is anticipated to grow over the forecast period. The growing patient population suffering from diabetes, advancing healthcare infrastructure, and rising health expenditures can boost market growth in the coming years.

Global Diabetes Statistics:

The continuous peripheral nerve block catheters market in Kuwait is expected to grow over the forecast period due to rising healthcare expenditures and the increasing number of orthopedic procedures in the coming years.

Continuous peripheral nerve block catheters are helpful in diabetic foot surgery. Thus, the growing prevalence of diabetes and the rising number of diabetics worldwide are anticipated to drive the demand for Continuous peripheral nerve block catheters. The IDF Diabetes Atlas estimated that there will be around 643 million diabetic patients worldwide by 2030, and this number is estimated to increase to 783 million by 2045.

Key Continuous Peripheral Nerve Block Catheters Company Insights

B. Braun SE, Teleflex Incorporated, PAJUNK, Ace-medical, Vygon SAS, AVNS, ICU Medical, Inc., Scilex Holding, Henan Tuoren Medical Device Co., Ltd., and Solo-Dex, Inc. are some of the major players in the continuous peripheral nerve block catheters market. Companies are launching products to gain a competitive advantage in the coming years.

Key Continuous Peripheral Nerve Block Catheters Companies:

The following are the leading companies in the continuous peripheral nerve block catheters market. These companies collectively hold the largest market share and dictate industry trends.

- B. Braun SE

- Teleflex Incorporated

- PAJUNK

- Ace-medical

- Vygon SAS

- AVNS

- ICU Medical, Inc.

- Scilex Holding

- Henan Tuoren Medical Device Co., Ltd.

- Solo-Dex, Inc.

Recent Developments

-

In July 2023, Solo-Dex, the U.S.-based industry player, formed a master distribution agreement with Farouk, Maamoun Tamer & Co, and CH Trading Group LLC for distributing its Fascile products in North Africa and Middle East markets. The Fascile products include continuous peripheral nerve block catheters.

-

In May 2023, Epimed International, Inc., a provider of nerve block products, introduced the product line named Epimed Essentials, which includes Epidural Nerve Block Needles and Epidural Needles.

Continuous Peripheral Nerve Block Catheters Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 326.1 million

Revenue forecast in 2030

USD 402.1 million

Growth rate

CAGR of 4.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Insertion technique, indication, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

B. Braun SE, Teleflex Incorporated., PAJUNK, Ace-medical,Vygon SAS, AVNS.,ICU Medical, Inc, Scilex Holding, Henan Tuoren Medical Device Co., Ltd., Solo-Dex, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Continuous Peripheral Nerve Block Catheters Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global continuous peripheral nerve block catheters market report based on insertion technique, indication, surgeries, end use, and region:

-

Insertion Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Ultrasound

-

Nerve Stimulation

-

Both

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremity Surgery

-

Lower Extremity Surgery

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global continuous peripheral nerve block catheters market size was estimated at USD 302.03 million in 2023 and is expected to reach USD 314.09 million in 2024.

b. The global continuous peripheral nerve block catheter market is expected to witness a compound annual growth rate of 4.20% from 2024 to 2030, reaching USD 402.12 million by 2030.

b. North America held the largest revenue share of 53.44% in the market in 2023 due to the rising prevalence of chronic disorders and increasing product launches.

b. Some of the key players operating in the market are B. Braun SE, Teleflex Incorporated, PAJUNK, Ace-medical, Vygon SAS, AVNS., ICU Medical, Inc, Scilex Holding, Henan Tuoren Medical Device Co., Ltd., and Solo-Dex, Inc.

b. An increasing number of surgical procedures and the growing prevalence of chronic diseases are expected to boost the adoption of continuous peripheral nerve block catheters over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.