- Home

- »

- Medical Devices

- »

-

Continuous Renal Replacement Therapy (CRRT) Market Report, 2030GVR Report cover

![Continuous Renal Replacement Therapy Market Size, Share & Trends Report]()

Continuous Renal Replacement Therapy Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (System, Consumables), By Modality, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-607-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global continuous renal replacement therapy market size was valued at USD 1,356.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.6% from 2023 to 2030. Rising incidence of acute kidney injury (AKI), increasing incidence of sepsis, rapid increase in the volume of hospitals and urgent care centers, growing hospital admissions rate, and constant product launches by prominent market players are a few factors driving the demand for CRRT, thereby propelling the market growth. According to the American Kidney Fund, 37 million U.S. citizens are living with kidney disease and 807,000 people in the U.S. are diagnosed with kidney failure.

In the pre-COVID-19 era, the burden of COVID-19-associated AKI climbed to almost 4 million cases per year. CRRT was utilized to treat roughly 23,105 AKI patients per year prior to COVID-19. The need for CRRT appeared to be 5 times higher in COVID-19 patients, i.e., 4.9 percent, than in historical populations (0.9 percent). In community cohort datasets, 5%–15% of people hospitalized with COVID-19 needed dialysis. Moreover, in some North America regions, the number of people utilizing CRRT jumped by 370 percent over normal levels due to which the demand for the product increased during the pandemic. For instance, Fresenius Medical Care North America's Renal Therapies Group (FMCNA) released the first batch of multiBic dialysate solutions to U.S. hospitals in May 2020, according to an FDA emergency use authorization. These medicines were intended to provide CRRT to COVID-19-related individuals with acute renal failure.

Furthermore, the pandemic also led to a surge in demand for CRRT worldwide. As a result, the market for continuous renal replacement therapy witnessed an increase in financial incentives as well as regulatory support from various government agencies. In addition, the FDA imposed tight regulations requiring manufacturers to ensure the availability of high-quality CRRT devices in intensive care units.

The increased demand for advanced CRRT devices as a result of improved patient outcomes is a high-impact major driver of the market for continuous renal replacement therapy. The current CRRT technology has made it possible to analyze and respond to technical data in a complete manner. These improvements have resulted in a detailed examination of prescription and delivery patterns, which has had a favorable impact on clinical results from the standpoint of quality assurance. The most recent CRRT machines allow automated data gathering and uniform language, allowing for cross-institutional comparisons. Several major market manufacturers have introduced sophisticated CRRT machines that use these technologies, which is expected to boost the growth of the market.

Furthermore, the development of improved pediatric CRRT products is projected to the market for continuous renal replacement therapy in the near future. Pediatric patients who require CRRT have traditionally been treated with systems that are created and indicated for adults and are not licensed for pediatric usage, which can lead to clinical problems in neonates. As a result, various manufacturers currently offer a range of renal care solutions that enhance access to care, results, and quality of life for patients with severe renal disease or injury anywhere in the globe, regardless of their size or age, which is projected to fuel market expansion.

According to American Hospital Association in 2023, there were 5,157 community hospitals, 206 federal government hospitals, and 107 other hospitals in the U.S. In addition, the significant increase in the number of hospital admissions for AKI along with the increasing geriatric population is boosting the demand for CRRT systems, thereby propelling market growth. Moreover, according to the Centers for Disease Control and Prevention in 2021, nearly 786,000 people in the U.S. were living with ESKD, also known as end-stage renal disease (ESRD), with 71% on dialysis and 29% with a kidney transplant. As of 2020, there were around 7,500 dialysis clinics in the U.S.

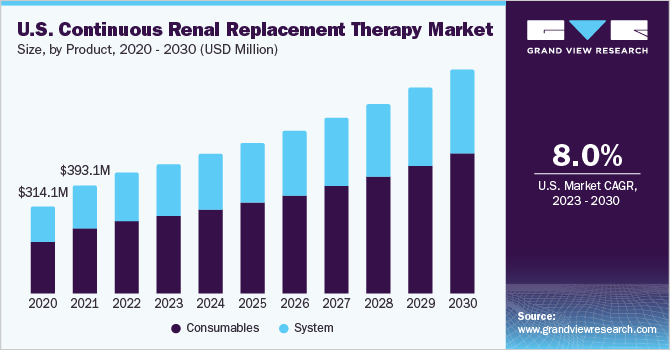

Product Insights

Based on product, the market is segmented into systems and consumables. The consumables segment held the largest revenue share of 60.6% in 2022 and is expected to grow at the fastest CAGR of 9.1% over the forecast period. The increase in the utilization of charcoal filters, haemofilter, fluid and other consumable products in CRRT has been a contributing factor to the segment growth. Hemofilters, often known as artificial kidneys, are made out of a hollowfiber membrane that decides how much solute and fluid is removed. For patients with significant renal illnesses, businesses like Baxter and Fresenius offer a variety of consumables across modalities. Although these products are inexpensive, they are frequently purchased as compared to other segments.

In April 2020, Baxter International Inc. provided updates on its efforts to boost the global supply of critically required dialysis. As a result of an unprecedented spike in COVID-19 patients requiring CRRT, the company witnessed demand for numerous acute dialysis products up to five times higher than historical levels. In addition, companies continued to work with partners and governments around the world to address these issues, as well as to maximize consumables such as fluids and setting capacity and supply to meet unprecedented surges in demand for its acute dialysis products in Europe and the U.S.

Over the projection period, the system segment is expected to witness a moderate CAGR of 7.8%. The CRRT machines are mainly intended to deliver renal therapy. It consists of blood and fluid pumps, a user-friendly interface, scales, and integrated safeguards. Significant technological advancements, such as high-volume permeability of CRRT, and integration of Electronic Medical Record (EMR) connectivity, are likely to drive segment growth. Manufacturers are currently developing sophisticated devices that are safe and provide consistent performance throughout CRRT procedures. These machines also include a user-friendly interface for easy use. For instance, Baxter International Inc., in May 2021, announced the launch of PrisMax 2 worldwide, the most recent version of the company’s next-generation platform. PrisMax 2 is developed to help hospitals meet the special demands of the Intensive Care Unit (ICU) while simplifying the transfer of organ support along with continuous renal replacement therapy.

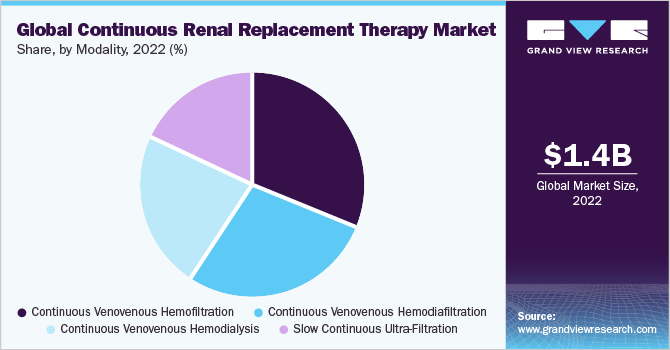

Modality Insights

Based on modality, the market is segmented into slow continuous ultra-filtration (SCUF), continuous venovenous hemofiltration (CVVH), continuous venovenous hemodialysis (CVVHD), and continuous venovenous hemodiafiltration (CVVHDF). The continuous venovenous hemofiltration (CVVH) segment dominated the market and accounted for a revenue share of 31.6% in 2022. Over the projection period, the rising prevalence of fluid overload cases, which are commonly observed in acute kidney injury patients in critical care units, is predicted to move the CVVH segment forward. An article published by Elsevier stated that congestive heart failure accounted for approximately five percent of all-cause mortality among dialysis patients. This condition is closely associated with fluid overload, which will consequently lead to an increase in demand and usage of CVVH treatment.

The CVVHDF segment is expected to witness the fastest CAGR of 9.2% during the forecast period. CVVHDF uses a highly efficient hemodiafilter to remove both fluid and solute, combining hemodialysis and hemofiltration modalities. This treatment method results in the total removal and replacement of fluid and solute from the blood, and it is the most prevalent way of CRRT for AKI in diverse nations. Until 2008, when CVVHDF was released and became the major CRRT treatment mode, CVVH was the primary therapy modality for CRRT. The market for CVVHDF is currently predicted to increase significantly during the projection period, as it is linked to a higher survival rate than other CRRT modalities.

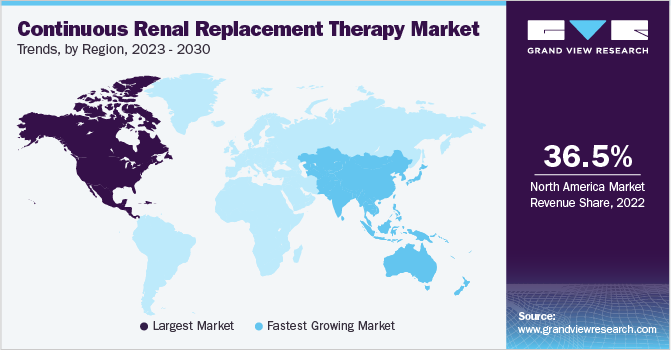

Regional Insights

North America dominated the market and accounted for the largest revenue share of 36.5% in 2022. Key factor that is expected to contribute to the continuous renal replacement therapy market growth in this region is increasing prevalence of geriatric population base. with the increasing population being diagnosed with kidney disorders in the region, alternative and better methods are being followed more rigorously. Furthermore, the increasing adoption of sedentary lifestyles and unhealthy food habits is considered the highest rendering drivers for the growth of various lifestyle-related disorders such as kidney dysfunction, hypertension, and diabetes. For instance, according to the U.S. Department of Health and Human Services in 2021, more than 1 in 7 U.S. adults may have Chronic Kidney Disease (CKD), which is expected to drive market growth in North America.

Asia Pacific is expected to grow at the fastest CAGR of 9.8% over the forecast period owing to increasing incidence rate of diabetes, CKD and hypertension, coupled with increasing healthcare expenditure and increased R&D investment in the region. In recent years, China has proven to be an attractive market for medical devices. In March 2019, the Chinese government reduced the Value Added Tax (VAT) for medical manufacturing companies from 13.3% to 13.0%.

Key Companies & Market Share Insights

With the increased demand for CRRT products, global manufacturers are speeding up manufacturing while also improving it with cost-effective solutions. For instance, in March 2022, Nipro, a leader in manufacturing of renal products, announced full-scale commercial launch of SURDIAL DX. It is a futuristic hemodialysis system that is designed to create optimal dialysis treatment.

In April 2022, Baxter International announced the FDA (510k) clearance of ST set used in continuous renal replacement therapy. It is pre-connected, extracorporeal, and uses a semipermeable membrane to purify blood and is used with PrisMax or Prismaflex.

Leading organizations in the market are enforcing improved product quality through mergers and acquisitions along with increasing awareness regarding diseases to support education for healthcare professionals. For instance, in June 2021, Fresenius Medical Care inaugurated its training center in Korea, to support education for healthcare professionals in critical care, renal care, and treatment strategies. Some of the prominent players in the global continuous renal replacement therapy market include:

-

B. Braun Melsungen AG

-

Baxter International, Inc.

-

Fresenius Medical Care AG & Co. KGaA

-

Asahi Kasei Corporation

-

NIPRO Corporation

-

Toray Medical Co., Ltd

-

NxStage Medical, Inc.

-

Medtronic PLC

Continuous Renal Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.460.3 million

Revenue forecast in 2030

USD 2,603.8 million

Growth rate

CAGR of 8.6% from 2023 to 2030

Base year for estimation

2022

Actual estimates/Historic data

2018 – 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors & trends

Segments covered

Product, modality, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Key companies profiled

B. Braun Melsungen AG; Baxter International, Inc.; Fresenius Medical Care AG & Co. KGaA; Asahi Kasei Corporation; NIPRO Corporation; Toray Medical Co., Ltd; NxStage Medical, Inc.; Medtronic plc & Others

Global Continuous Renal Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the continuous renal replacement therapymarket based on product, modality, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

System

-

Consumables

-

-

Modality Outlook (Revenue, USD Million, 2018 - 2030)

-

Slow Continuous Ultra-Filtration (SCUF)

-

Continuous Venovenous Hemofiltration (CVVH)

-

Continuous Venovenous Hemodialysis (CVVHD)

-

Continuous Venovenous Hemodiafiltration (CVVHDF)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the continuous renal replacement therapy market growth include an increasing number of patients suffering from renal failure, congestive heart failure, and technical advancements.

b. The global continuous renal replacement therapy market was estimated at USD 1,356.7 million in 2022 and is expected to reach USD 1.460.3 million in 2023.

b. The global continuous renal replacement therapy market is expected to grow at a compound annual growth rate of 8.6% from 2023 to 2030 to reach USD 2,603.8 million by 2030.

b. North America dominated the continuous renal replacement therapy market with a share of 35.73% in 2022. This is attributable to the increasing demand for CRRT procedures, and advanced innovation in the manufacture of machines and systems in the region.

b. Some key players operating in the CRRT market include B. Braun Melsungen AG, Baxter Inc., Fresenius Medical Care AG & Co. KGaA, Asahi Kasei Corporation, NIPRO Corporation, Toray Medical Co., Ltd, NxStage Medical, Inc., Medtronic plc.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.