- Home

- »

- Medical Devices

- »

-

Contraceptive Market Size & Share Analysis Report, 2030GVR Report cover

![Contraceptive Market Size, Share & Trends Report]()

Contraceptive Market Size, Share & Trends Analysis Report By Product (Contraceptive Devices, Contraceptive Drugs), By Region (North America, APAC, EU, Latin America), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-448-2

- Number of Pages: 100

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

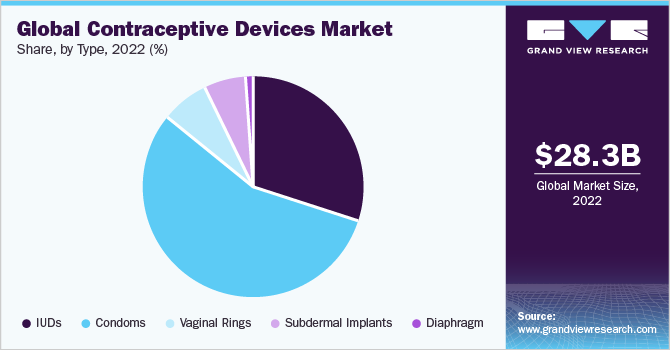

The global contraceptive market was valued at USD 28.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.06% from 2023 to 2030. The growing prevalence of Sexually Transmitted Diseases (STDs) and the rising number of women with unmet contraceptive drugs & device demands are expected to propel the industry growth during the forecast period. According to the World Health Organization, among 1.9 billion reproductive-age women (15 - 49 years) globally in 2019, around 1.1 billion women require family planning. Among them, around 842 million women are using contraceptive methods for family planning and around 270 million women have an unmet demand for contraception.

The implementation of programs targeted at reducing unwanted pregnancies and related healthcare costs and increasing user awareness levels are anticipated to propel the growth of the industry during the forecast period. Moreover, the rising number of unintended pregnancies is expected to contribute to the growth of the market during the forecast period. According to The Lancet Global Health, on average, around 121 million unintended pregnancies occurred from 2015 - 2019 globally, which accounts for about 64 unintended pregnancies per 1000 reproductive-age women. Several initiatives, such as Every Woman Every Child, Millennium Development Goals, the 2030 Sustainable Development Goals (SDGs), and Family Planning 2020 (FP2020), have been launched by governments and healthcare organizations for family planning, which is promoting the use and manufacturing of contraceptives.

For instance, Family Planning 2020 was the initiative launched in 2012 and ran up to 2020, which offered global partnerships to share knowledge and offer a right-based, person-centered approach to family planning. The initiative was further expanded to 2030 to ensure the accessibility of contraceptives and other family planning resources globally. Both the private sector (pharmacy/drug shop; general store/market; private clinics; and NGOs or Faith-based organizations) and public sector are the key providers of contraceptives globally. The private sector is primarily utilized for short-acting resupply contraceptive methods, such as condoms and contraceptive pills, and has captured and maintained a relatively stable share of the industry.

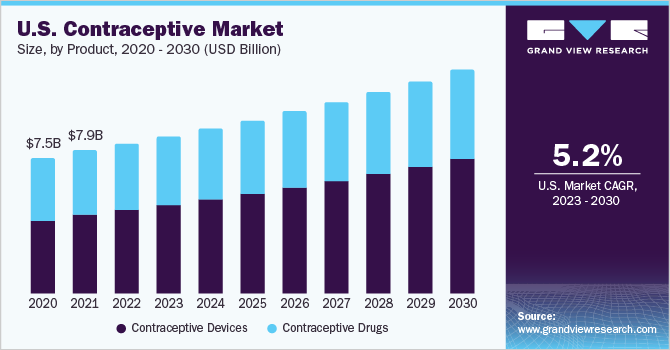

COVID-19 Contraceptive Market Impact: 5.60% increase from 2020 to 2021

Pandemic Impact

Post COVID Outlook

The COVID-19 pandemic negatively impacted the industry owing to the disruption of reproductive & sexual health services due to the contraceptive supply chain halts. As per the research article published in Relias Media, a decline of 46% was reported for long-active contraceptive usage in the U.S. in 2020

The demand for condoms & pills increased from the second half of 2020 to the first half of 2021 in the U.S. toward the end of 2021, the demand for condoms reduced to pre-pandemic levels as ease in restrictions and vaccination drives improved access to the prescribed methods of contraception.

Access to contraceptives declined during the pandemic owing to guidelines associated with the use of contraceptives hampering the vaccine efficacy and side effects, such as blood clotting associated with it. For instance, in April 2021, the Central Epidemic Command Center (CECC) of Taiwan Centers for Disease Control announced to take precautions before vaccinating with the AstraZeneca vaccine. The reminder notice was circulated, which states undergoing hormone therapy and taking contraceptive pills could lead to a risk for blood clotting, and was advised to stop taking these treatments before 28 days of vaccination.

The adoption of telehealth is expected to propel the demand for contraceptives post-pandemic. Many service providers are broadening access via telehealth and are offering contraception consulting

According to the article published in 2022 in Global Health: Science and Practice journal, around 41% of females who use contraceptives in Asia obtain contraceptives from private-sector sources, and around 56% of females use public sources. In the total average of 36 countries evaluated in the Low- and Middle-income Countries (LMIC), around 63% of women obtain it from private-sector sources, and around 34% of women use public-sector sources. Governments in various countries have been conducting extensive campaigns and sex education programs to enhance awareness among youth and promote the usage of contraceptives against STDs and unwanted pregnancies. International and government healthcare bodies, such as World Health Organization (WHO) and the Centre for Disease Control and Prevention (CDC), are playing a significant role in raising awareness regarding safe sex by using condoms.

Product Insights

Based on products, the global industry has been segmented into contraceptive drugs and contraceptive devices. The contraceptive devices segment dominated the industry with the largest revenue share of more than 65.66% in 2022 and is expected to witness the highest growth with a CAGR of 7.12% over the forecast period. This is attributed to an increase in the awareness level of STDs and the efficiency of condoms to prevent infections, including HIV. In a recent study, subdermal implants have been identified to have an immense potential to meet the requirement of women for family planning. The contraceptive device segment is further sub-segmented into condoms, subdermal implants, IUDs, vaginal rings, and diaphragms.

The condoms segment held the largest share in 2021 owing to the rising demand in the regions of Europe and the Asia Pacific. The growth can also be attributed to the demand from the public sector source. According to the Family Planning Report 2021 report, around 378.1 million units of condoms were supplied by the Department of Health & Family Welfare in India. The contraceptive drugs segment is expected to witness lucrative growth during the forecast period. The segment is further sub-segmented into contraceptive pills, patches, and injectables. The contraceptive pill segment held the largest share of the segment in 2021.

The growth is attributed to the increased procurement volumes by public-sector organizations. As per the Family Planning 2021 report by Clinton Health Access Initiative, the market volumes for contraceptive pills including combined hormonal contraceptive and progestin-only pills accounted for around 201 million FP2020 market volumes. These pills are more affordable compared to contraceptive devices. As per the article published in The Lancet, around 14.8% of the total contraceptive prevalence in 2019 was attributed to contraceptive pills.

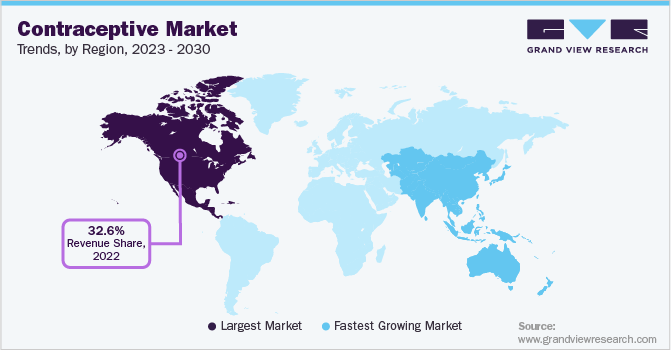

Regional Insights

North America dominated the global industry in 2021 with the maximum revenue share of more than 32.90% and is expected to maintain its position throughout the forecast period owing to the high incidence of abortion, rising population of women within the age group of 15-44 years, and high patient awareness levels in the region. The launch of generic and low-cost drugs and devices has also led to an increase in the demand for contraceptives by teenagers. In April 2022, Reckitt Benckiser launched a new condom category, Durex Intense. Asia Pacific is projected to witness the fastest CAGR during the forecast period.

The growth can be attributed to the rising number of government initiatives, growing demand for population control, and a decrease in the unintended pregnancy rate. According to the Center for Reproductive Rights, around 53.8 million unintended pregnancies occur every year in Asia, and around 65% of those are abortion cases. The contraception prevalence rate among married adolescents in Asia is around 41%. Europe held a significant market share in 2021 due to suitable reimbursement scenarios for the use of contraceptives.

According to the Center for Reproductive Rights, Access to Contraceptives in European Union Report, in Germany, IUDs, emergency contraception, and hormonal contraceptives with a prescription are covered under the mandatory health insurance scheme for females under the age of 18. There is a 10% co-payment for women aged 18 to 19 years of age with a capped value of 10 euros per prescription. Contraceptives are covered under the scheme for women aged 20 years and above when intended for other reasons apart from the prevention of pregnancy.

Key Companies & Market Share Insights

The industry is highly competitive due to the presence of several major manufacturers and constant R&D investment by them. Mergers & acquisitions, new product launches, growing geographical presence, and expanding product pipelines are the major strategies adopted by the companies to stay competitive. For instance, in July 2021, HRA Pharma received approval from MHRA to launch a contraceptive pill (Desogestrel-only pill), which will be available OTC in the U.K. Some of the prominent players in the global contraceptive market include:

-

Bayer AG

-

China Resources Zizhu Pharmaceutical Co., Ltd. (CR Zizhu)

-

Cupid Ltd.

-

Helm AG

-

Church & Dwight

-

Organon Group Of Companies

-

Pfizer Inc.

-

Viatris (Mylan)

-

Abbvie, Inc.

-

Afaxys, Inc.

-

Veru, Inc.

-

Agile Therapeutics

-

Janssen Pharmaceuticals, Inc.

Contraceptive Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.9 billion

Revenue forecast in 2030

USD 45.1 billion

Growth rate

CAGR of 6.06% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Japan; China; India; Australia; South Korea; Mexico; Brazil; Argentina; South Africa; UAE

Key companies profiled

Bayer AG; China Resources Zizhu Pharmaceutical Co., Ltd. (CR Zizhu); Cupid Ltd.; Helm AG; Church & Dwight; Organon Group Of Companies; Pfizer Inc.; Viatris (Mylan); Abbvie, Inc.; Afaxys, Inc.; Agile Therapeutics; Janssen Pharmaceuticals, Inc.; Veru, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Contraceptive Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global contraceptive market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Contraceptive Drugs

-

Contraceptive Pills

-

Patch

-

Injectables

-

-

Contraceptive Devices

-

Condoms

-

Male Condoms

-

Female Condoms

-

-

Subdermal Implants

-

IUDs

-

Copper IUDs

-

Hormonal IUDs

-

-

Vaginal Rings

-

Diaphragm

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global contraceptive market was estimated at USD 28.3 billion in 2022 and is expected to reach USD 29.9 billion in 2023.

b. The global contraceptive market is expected to grow at a compound annual growth rate of 6.03% from 2023 to 2030 to reach USD 45.1 billion by 2030.

b. The contraceptive devices segment dominated the contraceptives market with the highest share in 2022. This is attributable to the availability of more advanced and long-lasting contraceptive devices in the market.

b. Key players operating in the contraceptive drugs and devices market include Bayer Healthcare AG, Organon Group Of Companies, Church & Dwight Co. Inc., Warmer Chilcott Company inc., Agile Therapeutics Inc., Pfizer Inc., BioSante Pharmaceuticals, Mayer Laboratories Inc., Pantarhei Bioscience B.V., and Teva Pharmaceutical Industries Ltd.

b. Key factors that are driving the market growth include easy availability of contraceptive products and a rising number of government initiatives to spread awareness regarding contraceptive use.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."