- Home

- »

- Consumer F&B

- »

-

Cooking Sauces Market Size, Share & Trends Report, 2030GVR Report cover

![Cooking Sauces Market Size, Share & Trends Report]()

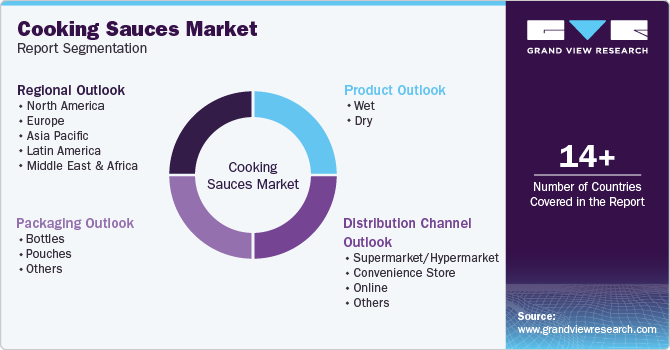

Cooking Sauces Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Packaging (Bottles, Pouches, Others), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-509-0

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cooking Sauces Market Summary

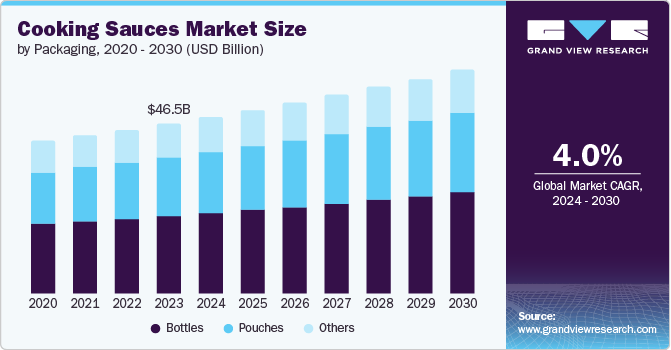

The global cooking sauces market size was valued at USD 46.50 billion in 2023 and is projected to reach USD 61.10 billion by 2030, growing at a CAGR of 4.0% from 2024 to 2030. The increasing demand for convenient and time-saving meal solutions has been a major driver of the growth of the cooking sauces market.

Key Market Trends & Insights

- North America cooking sauce market accounted for the largest market revenue share of 33.7% in 2023.

- Europe cooking sauces market was identified as a lucrative region in 2023.

- By product, wet cooking sauces accounted for the largest market revenue share of 88.2% in 2023.

- By packaging, the bottles segment accounted for the largest market revenue share in 2023.

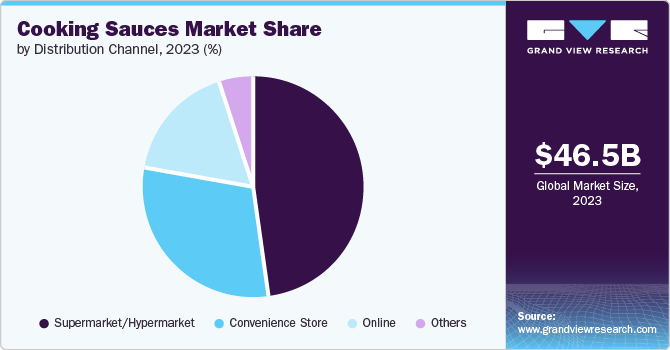

- By distribution channel, the supermarket/hypermarket segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 46.50 Billion

- 2030 Projected Market Size: USD 61.10 Billion

- CAGR (2024-2030): 4.0%

- North America: Largest market in 2023

Busy lifestyles and the desire for quick yet flavorful meals have led consumers to turn to cooking sauces as a convenient option for preparing delicious dishes quickly. As consumers become more adventurous with food choices, the demand for cooking sauces with authentic international flavors has risen. This trend has been further fueled by the increasing diversity in the population and the exposure to different cuisines through travel and social media, leading to a greater demand for a variety of cooking sauces to recreate these flavors at home. Furthermore, the rising awareness of healthy eating habits and the demand for natural and organic ingredients have also contributed to the growth of the cooking sauces market.

Consumers seek cooking sauces free from artificial additives, preservatives, and excessive sodium while being mindful of their dietary restrictions and preferences. This has led to developing a wide range of healthy and organic cooking sauces to cater to this growing segment of health-conscious consumers. The e-commerce boom has also played a significant role in driving the growth of the cooking sauces market. With the increasing popularity of online shopping and its convenience, consumers have easy access to a wide variety of cooking sauces worldwide. This has expanded the reach of cooking sauces to a global audience and allowed smaller, niche brands to gain visibility and compete with larger, established players in the market.

Furthermore, the growing influence of cooking shows, food blogs, and social media has significantly impacted the cooking sauces market. The rise of food influencers and celebrity chefs has increased consumer interest in experimenting with different cuisines and flavors, thereby driving the demand for cooking sauces that enable them to recreate restaurant-quality dishes at home.

Product Insights

Wet cooking sauces accounted for the largest market revenue share of 88.2% in 2023. Wet cooking sauces, known for their convenience and capacity to deliver authentic and intricate flavors, have gained widespread appeal, particularly among individuals with demanding schedules and professionals seeking expedient meal solutions. Their adaptability across a spectrum of culinary applications and their time-saving advantages have engendered a surge in popularity. This surge is further propelled by their characteristic uniformity in taste and texture, diverse international flavor profiles, and capacity to accommodate various dietary requirements.

Dry cooking sauces is anticipated to register the fastest CAGR of 4.4% during the forecast period. These sauces have the advantage of extended shelf life compared to their liquid counterparts, making them a practical choice for consumers looking to stock up on pantry essentials without worrying about spoilage. This has contributed to the growing popularity of dry cooking sauces as a go-to option for home cooks and food service establishments. These sauces are made from organic ingredients and are better for the body due to their natural content.

Packaging Insights

The bottles segment accounted for the largest market revenue share in 2023. Sauces are often packaged in bottles and jars due to their convenience, durability, and ability to preserve the freshness and quality of the product. They are suitable for retail and restaurant uses and are often available in various sizes. Both consumers and producers prefer bottles and jars due to their ease of pouring, sealing, and storing.

The pouches segment is expected to register the fastest CAGR during the forecast period. Pouches offer a convenient solution for opening and resealing, thereby reducing the potential for spills and waste. They are available in various sizes to cater to individual portions as well as larger family-sized options. The ample surface area of pouches allows for the display of compelling designs and essential product information, thereby contributing to bolstering brand recognition and enhancing marketing initiatives.

Distribution Channel Insights

The supermarket/hypermarket segment dominated the market in 2023. The expanding variety of cooking sauces available in supermarkets and hypermarkets has played a pivotal role in driving market growth. As consumer palates become more diverse, there is a growing demand for a wide selection of cooking sauces, including international and specialty flavors. Supermarkets and hypermarkets have responded to this trend by stocking an extensive array of cooking sauces, catering to their customer base's evolving tastes and preferences.

The online segment is projected to grow at the fastest CAGR over the forecast period. The shift towards e-commerce platforms and online grocery stores has played a crucial role in driving the growth of the online segment in the cooking sauces market. Many consumers now prefer to shop for groceries online due to time constraints, convenience, and a more comprehensive selection of products. This trend has been further accelerated by the COVID-19 pandemic, which prompted more consumers to shop online for their daily needs, including cooking sauces.

Regional Insights

North America cooking sauce market accounted for the largest market revenue share of 33.7% in 2023. The rising interest in exotic and gourmet selections and the demand for healthier and more premium sauce options have fueled the market's growth in North America. Consumers increasingly prioritize health-oriented products tailored to their specific dietary needs, driving manufacturers to introduce organic, low-sodium, and vegan options. Concurrently, the rise in disposable incomes and exposure to diverse international flavors via media and travel has spurred growth in the North American cooking sauce market.

U.S. Cooking Sauces Market Trends

The U.S. cooking sauces market is anticipated to register a significant CAGR over the forecast period. As lifestyles become busier, more individuals are turning to cooking sauces to enhance the flavor of their meals quickly and easily. The demand for international cuisines in the U.S. also fuels market growth, with consumers seeking diverse flavors and experiences beyond traditional American dishes. Additionally, the inclination towards health and wellness trends influences the market, as consumers look for cooking sauces that offer flavor and nutritional benefits.

Europe Cooking Sauces Market Trends

Europe cooking sauces market was identified as a lucrative region in 2023. The rising food service industry, the increasing demand for convenience and ready-to-eat foods, and the convenience and accessibility of cooking sauces have played crucial roles in meeting consumers' evolving needs. Consumers are increasingly mindful of their dietary choices and prefer healthier options, even in convenience foods such as cooking sauces. Consequently, there is a rising demand for nutrient-enriched, organic, preservative-free, and salt-free cooking sauces.

Germany cooking sauces market held a substantial market share in 2023. Consumers with hectic schedules are seeking suitable and delectable meal alternatives. Cooking sauces offer an advantageous value proposition by delivering taste efficiency and meeting the escalating inclination towards diverse ethnic culinary traditions. The escalating emphasis on wellness also prompts producers to introduce novel selections such as organic, low-sodium, and vegan products to encompass a broader consumer base.

Asia Pacific Cooking Sauces Market Trends

The Asia Pacific cooking sauces market is anticipated to witness significant growth over the forecast period. The increasing consumption of ethnic foods and the growing interest in spices and seasonings have significantly contributed to the cooking sauces market in the Asia Pacific. The trend toward internationalization and the rising consumption of ethnic foods have created a growing interest in spices and seasonings, driving the demand for cooking sauces. This trend is particularly evident in countries such as China, India, and Japan, where the increasing population of working women, changing lifestyles, and the penetration of retail channels have led to a significant increase in consumer spending on savory snacks, soups, noodles, beverages, and ready-to-eat food.

India cooking sauces market held a substantial market share in 2023. The increasing cross-cultural interaction and inclination towards consuming Western food and cuisines have fueled the growth of the cooking sauces market in India. This trend has led to a growing number of modern retail outlets offering price and convenience advantages to customers, providing ample opportunities for the market to thrive. Additionally, the emergence of diet sauces and other condiments is expected to further fuel growth in the market, reflecting the evolving dietary preferences and health-conscious consumer behavior.

Key Cooking Sauces Company Insights

Some of the key companies in the cooking sauces market include Nestle SA, Tas Gourmet Sauce Co., McCormick & Company Incorporated, Conagra Brands Inc., Bolton Group, and General Mills Inc., Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Nestle's cooking sauces encompass a variety of flavors and cuisines, providing options for different preferences and cooking styles. These sauces are crafted using high-quality ingredients and innovative recipes to deliver authentic flavors and enhance consumers' overall cooking experience. Nestle's cooking sauce offerings include popular products such as Maggi Liquid Seasoning, which adds depth and flavor to dishes, and Maggi Hot & Sweet Tomato Chilli Sauce, known for its unique blend of sweet and spicy notes.

-

Kikkoman Corporation offers a diverse range of cooking sauces catering to different culinary preferences and styles. Their signature soy sauce is a staple in many kitchens globally, known for its rich umami flavor and ability to enhance the taste of various dishes. In addition to soy sauce, Kikkoman produces teriyaki sauces perfect for grilling, stir-frying, or marinating meats and vegetables.

Key Cooking Sauces Companies:

The following are the leading companies in the cooking sauces market. These companies collectively hold the largest market share and dictate industry trends.

- Nestle SA

- Tas Gourmet Sauce Co.

- Kikkoman Corporation

- McCormick & Company Incorporated

- Conagra Brands Inc.

- Bolton Group

- General Mills Inc.

- The Unilever Group

- The Kraft Heinz Company

- Del Monte Foods Inc.

Recent Developments

-

In February 2024, Kikkoman Corporation launched dark soy sauce made specifically for the Indian market. The dark soy sauce was developed to achieve a natural and deep color without using any food additives, aligning with Kikkoman’s commitment to quality and authenticity in its products.

-

In June 2023, The Kraft Heinz Company launched six new cooking sauces, which are Buffalo Ranch, Honeyracha, Tartar-Tantrum, Cranch, Ketchili, and Wasabioli. These new sauces offer customers unique flavors to enhance their dining experience.

Cooking Sauces Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 48.29 billion

Revenue forecast in 2030

USD 61.10 billion

Growth Rate

CAGR of 4.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, and MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, and South Africa

Key companies profiled

Nestle SA, Tas Gourmet Sauce Co., Kikkoman Corporation, McCormick & Company Incorporated, Conagra Brands Inc., Bolton Group, General Mills Inc., The Unilever Group, The Kraft Heinz Company, and Del Monte Foods Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cooking Sauces Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cooking sauces market report based on product, packaging, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Wet

-

Dry

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Bottles

-

Pouches

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Convenience Store

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.