- Home

- »

- Smart Textiles

- »

-

Cooling Fabrics Market Size & Share, Industry Report, 2030GVR Report cover

![Cooling Fabrics Market Size, Share & Trends Report]()

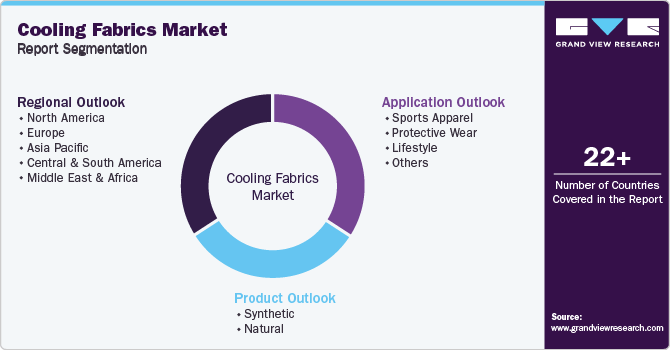

Cooling Fabrics Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Synthetic, Natural), By Application (Sports Apparel, Protective Wear, Lifestyle), By Region (North America, Europe, Central & South America, MEA), And Segment Forecasts

- Report ID: GVR-2-68038-007-1

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Cooling Fabrics Market Summary

The global cooling fabrics market size was estimated at USD 1.83 billion in 2024 and is projected to reach USD 2.94 billion by 2030, growing at a CAGR of 8.3% from 2025 to 2030. This growth is attributed to the increasing demand for comfortable and performance-enhancing apparel, particularly in sports and outdoor activities.

Key Market Trends & Insights

- North America cooling fabrics market dominated the global industry and accounted for the largest revenue share of 33.8% in 2024.

- The cooling fabrics market in Asia Pacific is expected to grow at a CAGR of 9.0% over the forecast period.

- Based on application, the sports apparel segment led the market and accounted for the largest revenue share of 41.97% in 2024.

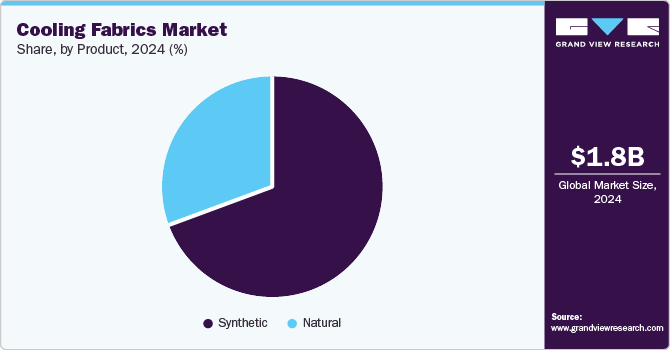

- Based on product, the synthetic segment dominated the market and accounted for the largest revenue share of 69.2% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.83 Billion

- 2030 Projected Market Size: USD 2.94 Billion

- CAGR (2025-2030): 8.3%

- North America: Largest market in 2024

In addition, factors such as rising consumer awareness about the benefits of cooling fabrics, including better temperature regulation, moisture management, and enhanced comfort, fuel market growth. Moreover, the advancements in textile engineering and innovative materials, including synthetic and natural fibers with inherent cooling properties, contribute to the market expansion. The growing popularity of active lifestyles and the need for cooling garments in regions with high temperatures further propel the demand for cooling fabrics globally.

Cooling fabrics work by soaking up heat and moisture and then dispersing them into the air, enhancing the breathability and ventilation of the clothes. They also help regulate body temperature during physical activity and stabilize the overall conditions in hot conditions. Due to their great thermal conductivity and physical qualities, cooling textiles are used to produce sports clothing on a global scale. The military use and industrial fields, where individuals often face extreme heat, critical conditions, are influencing the rise of demand for cooling fabrics, driving revenue growth in the cooling fabrics market in the upcoming years.

Another reason for the market growth is the growing awareness of the harmful impacts of UV radiation and the need for protective clothing. Cooling fabrics are ideal for protective clothing such as firefighting gear and hazardous material suits, as they provide great UV protection and retain no heat. Moreover, due to the growing population of sports fans worldwide, numerous companies are providing cooling clothing that enhances oxygen uptake, boosts circulation to the active muscles, and lowers the chance of inflammation during sports events.

Furthermore, leading manufacturers are investing time in research and development (R&D) efforts to create a functional cooling garment capable of reducing the brain temperature in stroke and head trauma patients. Customers interested in fashion are more frequently preferring to wear clothing items such as dresses, skirts, and shirts made from cooling fibers. Similarly, the need for trendy clothing made with cooling fabrics is expected to increase due to higher temperatures in many regions and the preference for cozy, breathable attire. In addition, companies are launching upgraded clothing apparel that results in better performance, durability, and cost efficiency of cooling fabrics.

Utilizing cutting-edge manufacturing technologies allows for the mass production of high-quality cooling fabrics. The emergence of smart textiles integrating cooling capabilities alongside additional features, including sensors and connectivity, offers wide opportunities in the market. The increasing need for eco-friendly textiles is driving the creation of cooling fabrics using recyclable or low-impact materials.

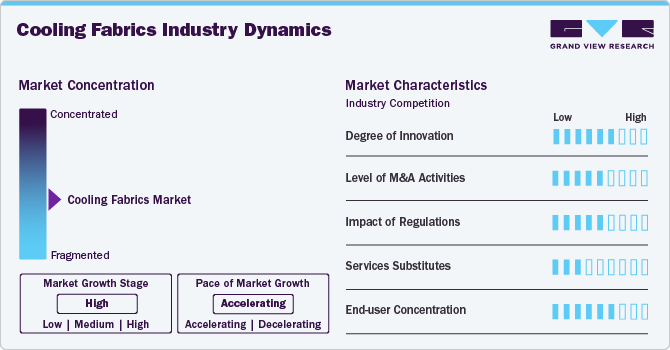

Market Concentration & Characteristics

The industry is moderately concentrated, with a few key players such as Coolcore LLC, Ahlstrom-Munksjö, and Nike, Inc. dominating through proprietary technologies and established brand value. The degree of innovation is high, as manufacturers are actively developing advanced fabrics incorporating phase change materials (PCMs), moisture-wicking properties, and smart textiles capable of thermal regulation.

Companies are investing in R&D to differentiate products for diverse Products such as sportswear, military uniforms, medical textiles, and casual apparel. Additionally, strategic collaborations between textile manufacturers and apparel brands are driving technology transfer and customization in end-use sectors.

Mergers and acquisitions have occurred at moderate levels, particularly to expand product portfolios and gain access to patented technologies. Regulatory impacts are growing due to the global focus on sustainability and safety in textiles, with compliance to standards such as OEKO-TEX, REACH, and EPA guidelines influencing production. Substitution by conventional breathable fabrics remains limited, as cooling fabrics offer distinct performance advantages under extreme thermal conditions.

End-user concentration is high in sectors like sports and outdoor apparel, but the market is witnessing increasing traction in healthcare, defense, and industrial Products, which is gradually balancing the customer base and enhancing market diversification.

Application Insights

Sports apparel led the market and accounted for the largest revenue share of 41.97% in 2024. The popularity of outdoor sports and fitness activities can be attributed to people's increasing focus on specialized fabric designs that have the advantage of helping sweat evaporate easily from the body, leading to better cooling performance. These materials are widely utilized in athletic clothing to offer athletes improved comfort and performance during physical activities. Therefore, it influences the demand for sports equipment made from breathable fabrics. Cooling fabrics are becoming increasingly popular in the production of sportswear as they help regulate body temperature during exercise and in hot conditions. The rising adoption of sports apparel from many countries results in the growth of the cooling fabrics market.

Protective wear is expected to grow significantly over the forecast period. It safeguards the human body from outside elements such as heat, chemicals, physical dangers, harsh weather, etc., by providing a barrier against the external environment. However, the demand for protective wear clothing is predicted by the increasing need for cooling materials from the military & defense and healthcare sectors. Individuals actively involved in the military, mining sites, metal & steel, energy & utility, oil & gas refineries, and others face consistent exposure to severe temperatures and heat, emphasizing the essential need for temperature-regulating and protective cooling fabrics.

Product Insights

The synthetic segment dominated the market and accounted for the largest revenue share of 69.2% in 2024 due to its superior moisture and cooling management capabilities. With their widespread availability and lightweight nature, synthetic fibers such as spandex, nylon, and polyester are commonly favored when producing synthetic cooling materials. Synthetic fabrics are increasingly preferred for producing sports gear and protective apparel due to their superior durability, strength, and cost efficiency compared to natural fibers.

The natural segment is projected to grow significantly at a CAGR of 7.8% over the forecast period. Natural fabrics such as cotton and wool possess cooling capabilities, making them ideal for cooling fabrics and other clothing apparel designed for hot, humid environments. These fabrics provide a natural cooling sensation and are breathable, comfortable, and cozy. Moreover, cotton, linen, and bamboo have natural properties that help absorb moisture. There will be a high demand for natural cooling fabrics in the coming years, propelling the cooling fabrics market expansion.

Regional Insights

North America cooling fabrics market dominated the global industry and accounted for the largest revenue share of 33.8% in 2024. The expansion in this area is due to the significant rise of the fashion and sports sectors and the adoption of more efficient cooling fabrics, which are gaining popularity and contributing to market growth. There is a strong need for cooling fabrics in sportswear and outdoor apparel, and increasing demand for advanced textile technologies will influence more opportunities for market growth for cooling fabrics.

U.S. Cooling Fabrics Market Trends

The cooling fabrics market in the U.S. dominated the North American region with the largest revenue share in 2023. Cooling fabrics are getting considerable emphasis from the textile sector due to the rise in demand for the performance of apparel and activewear. However, with the wider accessibility of cooling fabrics on e-commerce websites, the cooling fabrics market in the U.S. is expected to grow in the coming years to meet a variety of customer needs and preferences. These cooling fabrics are designed to improve comfort by maintaining body temperature and managing moisture efficiently.

Asia Pacific Cooling Fabrics Market Trends

The cooling fabrics market in Asia Pacific is expected to grow at a CAGR of 9.0% over the forecast period, attributed to the expanding population and rising disposable incomes. Demand is surging as more consumers become aware of the benefits of cooling fabrics, particularly in the context of fitness and outdoor activities. The region's humid climate further necessitates using such fabrics, which provide comfort and enhance performance during physical exertion. In addition, a robust textile manufacturing industry in countries such as China and India supports market expansion through innovation and accessibility.

China cooling fabrics market is fueled by increasing consumer awareness regarding health and wellness and a growing interest in thermoregulatory clothing. As disposable incomes rise, consumers are more willing to invest in high-performance textiles that enhance comfort in hot weather. The Chinese textile sector is also growing rapidly, with manufacturers developing advanced cooling technologies to meet the rising demand. This trend is further supported by strategic partnerships between fabric producers and clothing brands, enhancing the availability of cooling apparel across various products.

Europe Cooling Fabrics Market Trends

The cooling fabrics market in Europe is expected to grow significantly over the forecast period. This growth is driven by the increasing demand for fashionable and functional apparel, particularly in response to the region's rising temperatures due to climate change. The growing trend of active lifestyles and the need for comfortable sportswear further propel the market's growth. Furthermore, the availability of advanced materials and technologies enables manufacturers to produce high-performance cooling fabrics that cater to consumer preferences. Collaborations between fashion brands and textile innovators contribute to Europe's market expansion.

The UK cooling fabrics market is driven by the growing popularity of athleisure wear and the increasing participation in sports and outdoor activities. The rising consumer awareness about the benefits of cooling fabrics, such as moisture management and temperature regulation, fuels the demand for these products. The UK's fashion industry also plays a significant role in driving the market, as designers incorporate cooling fabrics into their collections to meet the needs of fashion-conscious consumers. The availability of advanced manufacturing techniques and key regional players further supports the market growth in the UK.

Latin America Cooling Fabrics Market Trends

The cooling fabrics market in Latin America is driven by a rising interest in sports and fitness activities, alongside an expanding middle-class population that is increasingly willing to spend on performance-enhancing apparel. Countries such as Brazil, Argentina, and Mexico are seeing growth in the athleisure and sportswear segments, where cooling fabrics play a key role in moisture management and temperature control. Additionally, the textile industry in the region is modernizing, with investments in sustainable and functional fabric technologies gaining traction. Growing awareness of climate-related health concerns and rising urban heat levels are further accelerating demand for thermoregulation fabric solutions in both commercial and consumer markets.

Middle East & Africa Cooling Fabrics Market Trends

The cooling fabrics market in the Middle East and Africa (MEA) is primarily driven by the region’s extreme climatic conditions and increasing demand for thermal comfort in everyday wear and work uniforms. The high temperatures prevalent across countries like Saudi Arabia, the UAE, and parts of North Africa create strong demand for functional apparel that helps in regulating body temperature. Moreover, growing government initiatives focused on improving labor conditions and safety standards, especially for outdoor and construction workers, are further fueling demand for advanced cooling textiles. The adoption of smart textiles in the defense and healthcare sectors is also contributing to the market's expansion in the MEA region.

Key Cooling Fabrics Companies Insights

Key players operating in the cooling fabrics market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Cooling Fabrics Companies:

The following are the leading companies in the cooling fabrics market. These companies collectively hold the largest market share and dictate industry trends.

- Nan Ya Plastics Corporation

- Ahlstrom

- Asahi Kasei Corporation

- Columbia Sportswear Company

- Coolcore

- Everest Textile

- FORMOSA TAFFETA CO., LTD.

- HeiQ Materials AG

- Libolon

- Liebaert

Recent Developments

- In January 2023, NILIT introduced a new version of its SENSIL EcoCare recycled Nylon 6.6, now produced entirely from U.S. materials at its Martinsville, VA, facility. This product complies with the Berry Amendment, USMCA, and CAFTA and is available in various fibers and yarns for diverse textile Products. NILIT emphasizes sustainability by using post-industrial recycled materials, resulting in a lower environmental impact. The new offering caters to U.S. brands and agencies seeking locally produced, eco-friendly fabrics for multiple uses, including activewear and medical Products.

Cooling Fabrics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.97 billion

Revenue forecast in 2030

USD 2.94 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Nan Ya Plastics Corporation; Ahlstrom; Asahi Kasei Corporation; Columbia Sportswear Company; Coolcore; Everest Textile; FORMOSA TAFFETA CO., LTD.; HeiQ Materials AG; Libolon; Liebaert.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cooling Fabrics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cooling fabrics market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Natural

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Sports Apparel

-

Protective Wear

-

Lifestyle

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.