- Home

- »

- Medical Devices

- »

-

Coronary Stents Market Size & Share, Industry Report, 2030GVR Report cover

![Coronary Stents Market Size, Share & Trends Report]()

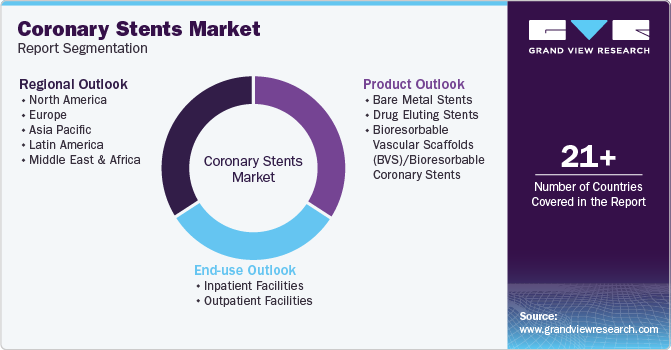

Coronary Stents Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bare Metal Stents (BMS), Drug Eluting Stents (DES), Bioresorbable Vascular Scaffold), By End Use (Inpatient and Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-106-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coronary Stents Market Summary

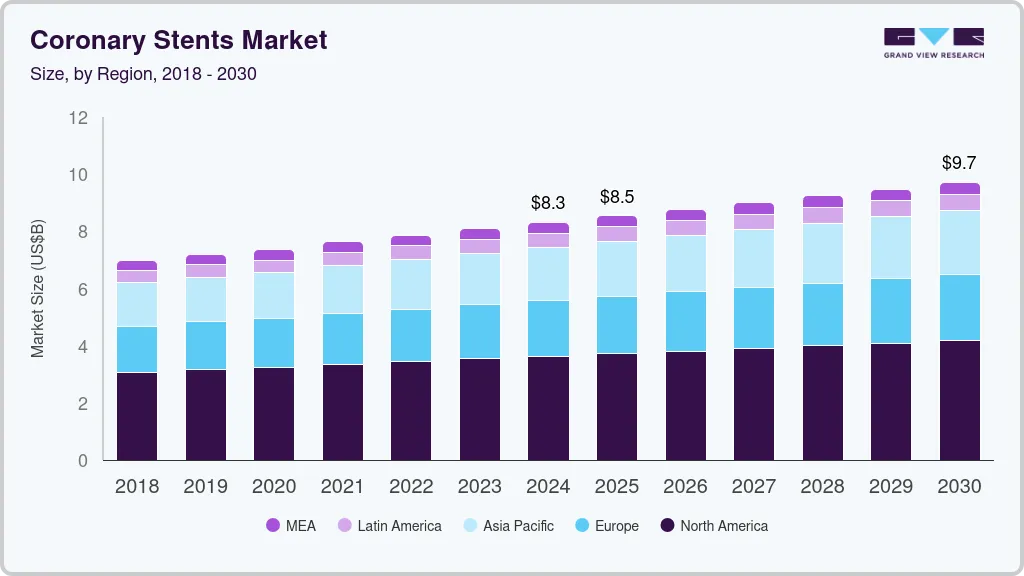

The global coronary stents market size was estimated at USD 8,317.6 million in 2024 and is projected to reach USD 9,716.6 million by 2030, growing at a CAGR of 2.6% from 2025 to 2030. The increasing prevalence of coronary artery diseases (CAD) due to aging, poor diets, and sedentary lifestyles has heightened the demand for coronary stents.

Key Market Trends & Insights

- The North America coronary stents industry is dominated the market with a 43.6% market share in 2024.

- In the U.S., the coronary stent market is characterized by a high incidence of coronary artery diseases, extensive healthcare spending.

- By product, the drug-eluting stents segment holds the highest market share of 82.3% in 2024.

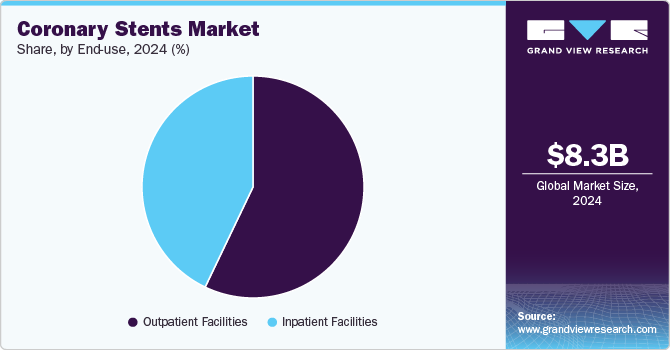

- By end Use, the outpatient facilities segment holds the largest revenue share of 57.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8,317.6 Million

- 2030 Projected Market Size: USD 9,716.6 Million

- CAGR (2025-2030): 2.6%

- North America: Largest market in 2024

In September 2024, an article published in Biomedical and Environmental Sciences reported that cardiovascular disease (CVD) remains a leading health threat in China, exacerbated by an aging population and unhealthy lifestyles. Innovations in stent design, such as bioresorbable and drug-eluting stents, have improved their effectiveness and reduced complications, further driving market growth. Enhanced healthcare infrastructure and greater awareness of CAD treatments also contribute to more patients seeking stent-based interventions.

The rising number of people suffering from coronary artery diseases (CAD) due to factors like aging, unhealthy diets, sedentary lifestyles, and high-stress levels is a key driver. This has led to a greater demand for coronary stents as a common treatment option for patients with blocked or narrowed arteries. In October 2024, the CDC reported that coronary artery disease (CAD), which is a type of coronary heart disease, is the most prevalent heart condition. In 2022, it was responsible for 371,506 deaths. Approximately 5% of adults aged 20 and older are affected by CAD, which equates to about 1 in 20 individuals.

Continuous innovation in the design and material of coronary stents, such as bioresorbable stents and drug-eluting stents (DES), has improved their effectiveness and reduced complications like restenosis (re-narrowing of arteries). These advancements have significantly boosted their adoption in the market. In July 2024, MicroPort Scientific Corporation announced that its subsidiary, Shanghai MicroPort Medical, received NMPA approval for Firesorb, the world's first fully bioresorbable cardiac stent. Clinical studies show that Firesorb performs on par with permanent stents, with a 3-year target lesion failure rate of only 3.5% and a thrombosis rate of just 0.32%. Its superior endothelial coverage further distinguishes it from existing stents.

With improved healthcare infrastructure, better access to medical treatments, and greater awareness of coronary artery disease treatment options, more people seek stent-based interventions for heart-related issues, driving market growth. In December 2023, Terumo India introduced the Ultimaster Nagomi, a cutting-edge drug-eluting stent to treat coronary artery disease. This stent uses advanced technology to improve clinical outcomes and reduce restenosis rates. The Ultimaster Nagomi features a bioabsorbable polymer and a unique drug coating, designed to enhance healing and minimize complications, offering a promising solution for patients suffering from coronary artery blockages.

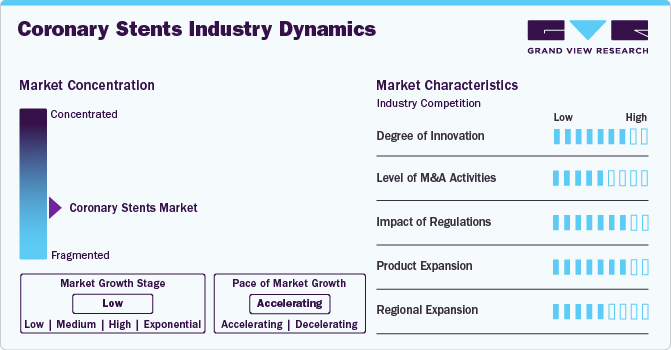

Market Concentration & Characteristics

The degree of innovation in the coronary stents industry is high, as manufacturers continually focus on improving stent technology. This includes the development of advanced drug-eluting stents (DES), bioresorbable stents, and integrating new materials such as polymers and metals that reduce the risk of complications like restenosis. Innovations are also seen in the design of stents, making them more flexible, durable, and easier to deploy, leading to better patient outcomes and a higher rate of adoption among healthcare professionals.

The level of mergers and acquisitions (M&A) in the coronary stents industry is medium. While not as frequent as in other industries, M&A activity occurs when companies look to enhance their product portfolios, gain access to new technologies, or enter new geographical markets. Large medical device companies often acquire smaller firms with cutting-edge innovations in stent technology or related vascular treatments, consolidating their position in the market and enabling them to compete more effectively. In July 2024, private equity firms including KKR, TPG Capital, and Apax Partners, were reportedly evaluating the acquisition of Sahajanand Medical Technologies (SMT), the largest cardiac stent manufacturer in India, with the company valued in the millions.

The impact of regulation on the coronary stents industry is high. Regulatory approval for coronary stents, particularly in major markets like the U.S. and Europe, is a critical factor that affects market entry and product availability. Stents must meet stringent safety and efficacy standards set by regulatory bodies like the FDA and the European Medicines Agency (EMA). In April 2024, a study in PLoS One examined the effects of coronary stent policies in Shanghai on acute coronary syndrome (ACS) patients undergoing percutaneous coronary interventions (PCI). It found an increase in the use of multiple stents post-policy, but no significant change in the risk of major adverse cardiovascular events (MACEs) within one year.

The coronary stents industry is expanding rapidly, with manufacturers constantly working to introduce new stent designs, materials, and drug coatings. The market is characterized by various products, ranging from bare-metal stents to advanced drug-eluting and bioresorbable stents. Companies are also expanding their product offerings to cater to different patient needs, such as those with complex coronary artery disease, contributing to growth in the overall market.

The level of regional expansion in the coronary stents industry is medium. While companies are actively expanding into emerging markets like India, China, and Latin America, growth is sometimes constrained by factors such as healthcare infrastructure, economic barriers, and local regulatory challenges. However, increasing awareness of cardiovascular diseases and the adoption of modern medical technologies in these regions are contributing to steady market expansion, albeit at a more moderate pace compared to developed markets.

Product Insights

The drug-eluting stents segment holds the highest market share of 82.3% in 2024. Drug-eluting stents (DES) are a significant advancement in coronary artery disease treatment, designed to reduce the risk of restenosis (re-narrowing of arteries) after stent implantation. These stents are coated with a medication that is slowly released to prevent the excessive growth of tissue around the stent. The drug coating helps reduce inflammation and scar tissue formation, improving long-term outcomes and fewer complications. In May 2023, an article in the Journal of the Society for Cardiovascular Angiography & Interventions discussed the SPIRIT 48 trial, which evaluated Abbott's XIENCE Skypoint 48 drug-eluting stents for treating long de novo coronary lesions. The trial reported a target lesion failure rate of 5.7% and a high device success rate of 97.2%, demonstrating the stent's safety and effectiveness.

The bioresorbable vascular scaffolds (BVS)/bioresorbable coronary stents segment is anticipated to grow at the fastest CAGR over the forecast period. Bioresorbable vascular scaffolds (BVS), or bioresorbable coronary stents, are a cutting-edge innovation in stent technology. Unlike traditional metallic stents, BVS is designed to be absorbed by the body over time, leaving no permanent foreign material behind in the artery. In August 2024, an article in Frontiers in Bioengineering and Biotechnology investigated bioresorbable polymer-coated stents for treating coronary artery perforations and neointimal hyperplasia. The study highlighted the performance of various polymers, revealing that polylactide-co-caprolactone membranes showed promise despite increased thrombogenicity. The authors emphasized the need for further preclinical studies that better replicate clinical conditions.

End Use Insights

The outpatient facilities segment holds the largest revenue share of 57.1% in 2024 in the coronary stents market. It is anticipated to grow at the fastest CAGR over the forecast period, primarily due to the growing trend of performing elective stent placements in less invasive settings. With advancements in stent technologies like drug-eluting stents and bioresorbable scaffolds, many coronary interventions can be safely performed in outpatient settings. These procedures involve shorter recovery times, lower costs, and minimal patient downtime, contributing to increased demand for outpatient care. In April 2024, an article presented at the American College of Cardiology 73rd Annual Scientific Session indicated that same-day discharge after elective PCI procedures is increasingly common and safe, with low readmission rates.

Inpatient facilities are expected to grow significantly over the forecast period. In inpatient facilities, coronary stent procedures are performed on patients with complex coronary artery disease or those who need close monitoring after stent implantation. These facilities are equipped with advanced angioplasty equipment and catheterization labs (cath labs) and are staffed with cardiologists and other specialists. Inpatient care is crucial for patients undergoing coronary stent placements, especially in high-risk situations such as patients with comorbidities, advanced heart disease, or complications like restenosis or stent thrombosis. In July 2024, Inova Health System announced it was among the first hospitals to introduce groundbreaking treatment for blocked or narrowed coronary arteries. The innovative approach focuses on advanced stenting techniques to improve patient outcomes, reduce complications, and enhance recovery times.

Regional Insights

The North America coronary stents industry is dominated the market with a 43.6% market share in 2024, driven by a high prevalence of cardiovascular diseases, advancements in medical technology, and a well-established healthcare infrastructure. The demand is fueled by a large aging population, growing healthcare awareness, and strong reimbursement policies. A March 2024 article in WIREs Nanomedicine and Nanobiotechnology discussed the significant role of nanotechnology in enhancing coronary stents, which had been vital in treating atherosclerosis. The review highlighted advancements such as nanocoating’s that improved drug delivery, stent properties, and various nanoparticle-based formulations for local drug delivery. It also addressed the potential cytotoxic effects and hypersensitivity reactions associated with nanoparticle delivery in these medical devices.

U.S. Coronary Stents Market Trends

In the U.S., the coronary stent market is characterized by a high incidence of coronary artery diseases, extensive healthcare spending, and a sophisticated healthcare system. The market benefits from advanced medical infrastructure, skilled healthcare professionals, and the availability of a wide range of stent types, including drug-eluting and bioresorbable stents. In January 2023, the FDA approved the BioFreedom Drug Coated Coronary Stent System developed by Biosensors International. This system is intended for the treatment of narrowed coronary arteries resulting from coronary artery disease. It includes a catheter delivery mechanism, and a stent made of 316L stainless steel, which is coated with the drug Biolimus A9, lacking any additional polymers or carriers for controlled drug release.

Europe Coronary Stents Market Trends

The coronary stents market in Europe is experiencing significant growth driven by high healthcare standards and strong demand for advanced stent technologies. Countries such as Germany, Italy, and Spain contribute substantially to market growth, driven by an aging population and a rising prevalence of heart diseases. European healthcare systems also encourage the use of the latest coronary interventions, including drug-eluting and bioresorbable stents, supported by a favorable regulatory environment. In November 2024, SLTL Medical showcased its laser-based solutions at MEDICA 2024 in Düsseldorf, Germany, attracting over 83,000 attendees. Among the highlighted devices were implantable heart stents, valve frames, and customizable Nitinol components made from biocompatible materials.

The UK coronary stent market is a key part of Europe, benefiting from a well-established healthcare system under the National Health Service (NHS). Coronary stent usage is growing due to the increasing prevalence of cardiovascular diseases, the aging population, and the adoption of minimally invasive procedures. In 2024, the British Heart Foundation reported that there were 68,078 deaths in the UK due to coronary heart disease. The NHS’s focus on cost-effective treatments and the availability of advanced stent technologies like drug-eluting stents help improve patient outcomes

France’s coronary stent market is characterized by a robust healthcare system, high patient awareness, and the increasing prevalence of coronary artery disease. The market is marked by the widespread adoption of advanced stent technologies, such as drug-eluting and bioresorbable stents, which help reduce restenosis and improve long-term outcomes. In June 2024, MicroPort showcased advancements in coronary intervention and structural heart diseases at EuroPCR in Paris. Five-year study results for the Firehawk Rapamycin Stent indicated comparable safety and efficacy for bifurcation lesions with the lowest drug dose in its category, showing no significant differences in key outcome rates.

Asia Pacific Coronary Stents Market Trends

The Asia Pacific coronary stents market is experiencing significant growth driven by rising cardiovascular disease incidence, improving healthcare access, and increasing disposable incomes in countries like China and India. Technological advances and the availability of cost-effective stents, including drug-eluting stents, also contribute to the market's growth. A January 2024 study in Nature Communications introduced a drug-free stent coating made with recombinant humanized type III collagen, demonstrating improved endothelialization and reduced in-stent restenosis in animal models. This innovative coating exhibited anticoagulation and anti-inflammatory properties, positioning it as a promising alternative to traditional drug-eluting stents.

The Japanese coronary stents market is experiencing significant growth driven by its aging population and the high incidence of coronary artery diseases. The country has a sophisticated healthcare system and a strong demand for advanced medical devices like drug-eluting and bioresorbable stents. Japan’s healthcare policies encourage the adoption of innovative treatments, and the market is supported by a high level of research and development in the medical device sector. In October 2024, an article in the European Heart Journal reported that prasugrel monotherapy without aspirin is safe and feasible after coronary stent implantation in chronic coronary syndrome patients. One-year follow-up showed low adverse event rates, with a 7.0% Patient-Oriented Composite Endpoint (POCE) rate and no cardiovascular deaths.

The coronary stents market in India is witnessing robust growth due to a rising burden of cardiovascular diseases, urbanization, and an improving healthcare system. The market is also growing due to the increasing affordability of medical devices, particularly drug-eluting stents and greater awareness of heart diseases among the population. As more people in India access advanced medical treatments, the demand for coronary stents, especially in metropolitan areas, continues to rise.

Latin America Coronary Stents Market Trends

The coronary stents market in Latin America is experiencing a notable shift driven by an increasing incidence of heart diseases, urbanization, and improvements in healthcare infrastructure. Countries like Brazil and Argentina are seeing a rise in demand for coronary interventions, including drug-eluting stents. In July 2024, an article from Med Device Online highlighted Argentina's strong hospital infrastructure, making it an ideal location for clinical trials.

The Brazilian coronary stents market is characterized by an increasing incidence of cardiovascular diseases and a growing middle class with better access to healthcare. In February 2024, according to Cardiovascular Statistics - Brazil, 72% of deaths in Brazil are attributed to non-communicable diseases (NCDs). Among these, 30% are caused by cardiovascular diseases (CVD), while 16% are linked to cancer. The demand for coronary stents is rising due to greater awareness, improved healthcare infrastructure, and the availability of advanced technologies like drug-eluting and bioresorbable stents.

Middle East & Africa Coronary Stents Market Trends

The coronary stents market in the Middle East and Africa is growing rapidly due to the rising rates of cardiovascular diseases, better healthcare access, and economic development, particularly in the Gulf Cooperation Council (GCC) countries. The growing use of drug-eluting stents and other advanced coronary interventions in countries like the UAE and Saudi Arabia supports the market. In September 2024, Translumina Therapeutics, India’s largest coronary stent manufacturer, announced its launch in the UAE, aiming to boost its presence in the Middle East. This initiative is part of a strategy to expand globally and provide cost-effective, high-quality cardiovascular solutions. The company hopes to replicate its successful stent offerings from India in the UAE market.

The coronary stents market in Saudi Arabia is witnessing robust growth fueled by high rates of cardiovascular diseases and a government commitment to improving healthcare services. The country’s advanced medical infrastructure, high standard of care, and rising demand for sophisticated coronary treatments like drug-eluting stents contribute to the market’s expansion. In July 2024, Middle East Health published an article about the DynamX Bioadaptor. This coronary stent utilizes uncaging technology. This innovative stent adjusts to the natural movements of the artery, enhancing flexibility and minimizing the risk of restenosis, which contributes to improved vascular healing. The Bioadaptor marks a major breakthrough in coronary stent technology, intending to improve patient outcomes.

Key Coronary Stents Company Insights

Key companies in the market are actively pursuing various strategic initiatives to enhance their market presence. These initiatives include investing in research and development to innovate and improve the properties of coronary stents, which aims to achieve better clinical outcomes and enhance patient comfort. To meet the global market's diverse needs, these players focus on product diversification, offering various types of cement suitable for different procedures.

Key Coronary Stents Companies:

The following are the leading companies in the coronary stents market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Medtronic

- Boston Scientific Corporation

- Terumo Corporation

- B Braun SE

- Biotronik

- Stentys SA

- MicroPort Scientific Corporation

- C. R. Bard, Inc.

- Cook Medical

Recent Developments

-

In September 2024, Uppsala University launched a flexible stent to reduce complications in coronary artery surgery. The Infinity-Swedeheart study, involving 2,400 patients from 20 Swedish hospitals, compared this new stent to the conventional Resolute Onyx stent. This innovation can potentially improve patient recovery and long-term success rates in cardiac surgery.

-

In May 2024, Abbott launched the XIENCE Sierra Everolimus Eluting Coronary Stent System in India, enhancing treatment options for patients with blocked coronary arteries. This latest generation stent offers improved safety for complex cases and is part of Abbott's ongoing efforts to advance the angioplasty procedure, a minimally invasive method to restore blood flow to the heart using stents.

-

In March 2024, Silk Road Medical, Inc., launched Tapered ENROUE Transcartoid Stent System in the U.S, primarily for the hospitals. Furthermore, the company’s CEO stated, “New tapered configurations for our ENROUTE Transcarotid Stent System build upon the robust portfolio of Silk Road’s carotid solutions. We are pleased to bring this portfolio expansion to market as part of our commitment to offering a diverse toolkit for physicians, allowing them to address individual patient anatomy

Coronary Stents Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.5 billion

Revenue forecast in 2030

USD 9.7 billion

Growth Rate

CAGR of 2.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD Billion/Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; Medtronic; Boston Scientific Corporation; Terumo Corporation; B Braun SE; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coronary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global coronary stents market report based on product, end use and region.

-

Coronary Stents Product Outlook (Revenue, USD Million, 2018-2030)

-

Bare Metal Stents

-

Drug Eluting Stents

-

Bioresorbable Vascular Scaffolds (BVS)/Bioresorbable Coronary Stents

-

-

Coronary Stents End Use Outlook (Revenue, USD Million, 2018-2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global coronary stents market size was estimated at USD 8.3 billion in 2024 and is expected to reach USD 8.5 billion in 2025.

b. The global coronary stents market is expected to grow at a compound annual growth rate of 2.6% from 2025 to 2030 to reach USD 9.7 billion by 2030.

b. Some key players operating in the coronary stents market include Abbott, Terumo Corporation, C. R. Bard, Inc., Cook Medical, Boston Scientific, and MicroPort Scientific Corporation.

b. Key factors that are driving the coronary stents market growth include the rising prevalence of cardiovascular diseases (CVDs), such as stroke and heart attack, along with a growing geriatric population at higher risk of these cardiac diseases.

b. North America dominated the coronary stents market with a share of over 43.6% in 2024. This is attributable to the increasing prevalence of cardiovascular diseases such as heart attack, stroke, and ischemic heart diseases (IHD) and the increased focus of consumers on better treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.