- Home

- »

- Medical Devices

- »

-

Coronary Stents Market Size, Share & Growth Report, 2030GVR Report cover

![Coronary Stents Market Size, Share & Trends Report]()

Coronary Stents Market Size, Share & Trends Analysis Report By Product (Bare Metal Stents (BMS), Drug Eluting Stents (DES), Bioresorbable Vascular Scaffold), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-106-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Coronary Stents Market Size & Trends

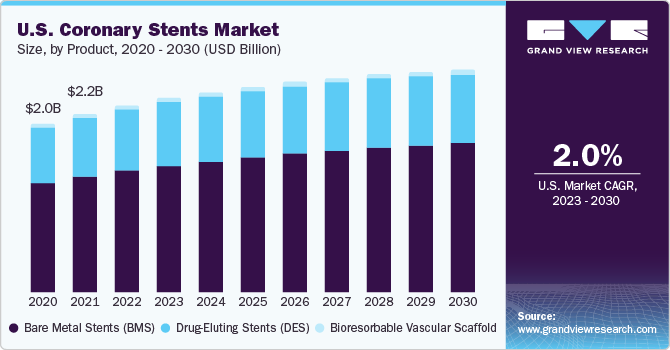

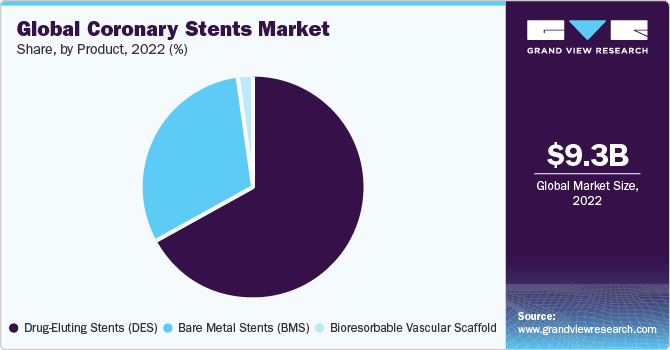

The global coronary stents market size was estimated at USD 9.32 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 3.1% from 2023 to 2030. Growing aging population and a rising prevalence of noncommunicable diseases such as cardiovascular diseases (CVDs), complex lesions, diabetes, obesity, and others are expected to drive demand for coronary stents over the forecast period. According to the World Health Organization (WHO), in 2019, CVDs were among the major causes of mortality worldwide of which ischemic heart disease (IHD) ranks as the most prevalent. In 2019, an estimated 17.9 million people died from CVDs, responsible for 32% of worldwide mortalities.

According to research published by the National Library of Medicine in June 2021, one of the CVDs, coronary artery disease (CAD), causes roughly 6,10,000 fatalities yearly (an estimated 1 in 4 deaths) and is the major cause of mortality in the U.S. As a result, the unprecedented rise in CAD incidence is predicted to boost demand for an effective coronary stent device for treatment. This factor is expected to bolster the demand throughout the forecast period. Since a coronary stent is used in most of the Percutaneous Coronary Intervention (PCI) procedures.

The rising preference for minimally invasive surgeries (MIS) is another factor expected to boost the adoption of coronary stents over the forecast period. The advantages of these procedures include small incision wounds leading to higher patient satisfaction. These procedures also provide shorter hospital stays and facilitate quick recovery. Stenting technology is increasingly preferred over the conventional balloon angioplasty owing to the introduction of advanced DES and evolving bioresorbable scaffolds. Technological advancements in coronary stents, such as the development of bifurcated stents and the use of biodegradable materials, have led to efficient and improved outcomes of CVD treatment. Companies are proactively involved in product developments and partnerships and strategic collaborations. The aforementioned factors are expected to propel market growth over the forecast period.

The impact of COVID-19 on the market for coronary stents closely tracked the impact of COVID-19 on overall PCI procedures. During the pandemic's initial outbreak and periods of high local COVID-19 case counts, several states, towns, and nations issued orders to citizens to shelter in place or minimize the potential exposure to and transmission of illness, resulting in elective surgeries being postponed. As a result, total PCI procedure volumes-and hence coronary stent unit sales and revenues-went significantly lower in 2020. These revenues are expected to rise as facility capacity usage improves and resumes all the semi-elective to non-urgent procedures.

The notable competitors in the market for coronary stents announced revenue falls in their interventional cardiology portfolios, which include coronary stent devices, in 2020, due to the impact of the COVID-19 pandemic. Boston Scientific, for instance, reported a significant decrease in annual revenues in its Interventional Cardiology segment, which includes coronary stent devices, in 2020, but the company performed relatively well in the first quarter of 2021, reporting revenue growth of approximately 7% globally compared to the first quarter of 2020. In contrast, Abbott Laboratories Laboratories was the least affected, with less impact on its entire vascular segment in 2020, which includes coronary stent devices, in its 2020 annual results.

Product Insights

The Drug-Eluting Stents (DES) segment dominated the market for coronary stents and held the largest revenue share of 66.5% in 2022. The continued advancement and launch of new devices are important factors in strengthening DES's dominance as the preferred device for PCI procedures. The competitors in the market continue to develop and launch technologically advanced DES, such as some of the notable launches are Abbott Laboratories Laboratories' XIENCE Skypoint, Medtronic's Resolute Onyx, and Boston Scientific's Synergy. In comparison to the previous generation devices, these newer-generation DES provide greater stent integrity, higher deliverability, and lower complication rates.

According to the National Library of Medicine (NLM) in February 2023,when compared to bare metal stents, drug-eluting stents (DES) displayed higher effectiveness. The design of stent platforms is continually being improved to maximize efficacy and safety, particularly due to the demand for more complicated lesions and difficult patients being treated. Constant DES development comprises the employment of novel scaffold materials, new design types, enhanced overexpansion capacities, new polymer coatings, and improved antiproliferative agents.

The bioresorbable vascular scaffold segment is expected to be the second fastest growing segment due to its several advantages in treating coronary artery disease including temporary placement in the patient heart, ease for future treatments as it degrades over 3 years, and it dissolve completely in the patient body. According to CDC analysis, the most prevalent kind of heart disease is the coronary heart disease in the U.S., claimed 375,476 lives in 2021. Such factors are expected to drive the segment growth over the forecast period.

The bare metal stents (BMS) segment is expected to have a steady growth rate over the coming year. Considering growing competition for the BRS and DES device types, the BMS has become less appealing to competitors due to low technological barriers to entry and clinical evidence demonstrating BMS's inferiority to DES. The BMS stent type managed to maintain its foothold in the market in 2022, owing to factors such as its low device cost.

Regional Insights

North America dominated the coronary stents market and accounted for the largest revenue share of 32.6% in 2022 and is anticipated to witness the same trend over the foreseeable future. A sedentary lifestyle resulting in obesity and other cardiovascular diseases such as heart attack, stroke, ischemic heart diseases (IHD), etc., are primarily driving the market in North America. Technological advancements in coronary stent technologies, such as Drug-eluting stents and the use of biodegradable materials, have further augmented the market growth. The presence of mature market players such as Medtronic, Abbott & Boston Scientific is fueling market growth in this region.

The Asia Pacific market for coronary stents is expected to exhibit the fastest growth rate in terms of revenue generation. This market is driven by some additional variables of enhanced screening for CAD, economic growth, regulatory updates, and notable beneficial reimbursement in some the countries such as Australia and South Korea. Increased government investment in healthcare and conducting new initiatives to bring in devices at affordable prices in cost constraint markets such as India and China are influencing this market as well. For instance, in China, to address inflated pricing and other issues in the delivery of expensive medical supplies, the Chinese government launched a centralized procurement scheme for high-value medical consumables in January 2021. The government aims to use this initiative to skip the associated suppliers and buy the items straight from the manufacturers, lowering the inflated pricing. As a result, the cost of coronary stents has dropped dramatically in China. The average price of coronary stents has been reduced by 93% since 2019 to grab the national tender.

Competitive Insights

Product launches, approvals, strategic acquisitions, and innovations are some of the crucial business strategies adopted by market participants to maintain and grow their global reach. Abbott Laboratories, Boston Scientific, and Medtronic accounted for a significant presence in the overall market. These companies have gained a notable presence in the market due to good strong performances in the lucrative DES market and large product portfolios spanning numerous different IC device categories. For instance, in August 2022, Medtronic launched the Onyx Frontier drug-eluting stent (DES). The new product offers advanced delivery management and improves the overall performance in the most challenging cases.

Despite the dominance of the three major manufacturers, the market for coronary stents is a blend of numerous global and local players. BIOTRONIK, for instance, has been able to establish a significant presence in the entire market by offering low pricing and new technologies that address unmet needs. Positive clinical results from BIOTRONIK's BIONYX, BIOFLOW-V, and BIOSOLVE trials, in conjunction with the use of BIOTRONIK's Orsiro DES and Magmaris BRS, have positioned the company well to compete against the market's largest players. BIOTRONIK is also one of the most competitive players in the overall BRS device market. Terumo Corporation, Biosensors International, and Cardinal Health are a few additional significant competitors in this market. Some of the prominent players in the global coronary stents market include:

-

Abbott

-

Medtronic

-

Boston Scientific Corporation

-

Terumo Corporation

-

B Braun Melsungen AG

-

Biotronik

-

Stentys SA

-

MicroPort Scientific Corporation

-

C. R. Bard, Inc.

-

Cook Medical

Coronary Stents Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.78 billion

Revenue forecast in 2030

USD 12.10 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Abbott; Medtronic; Boston Scientific Corporation; Terumo Corporation; B Braun Melsungen AG; Biotronik; Stentys SA; MicroPort Scientific Corporation; C. R. Bard, Inc.; Cook Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coronary Stents Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global coronary stents market based on product, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bare Metal Stents (BMS)

-

Drug-Eluting Stents (DES)

-

Biodegradable

-

Non-Biodegradable

-

-

Bioresorbable Vascular Scaffold

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global coronary stents market size was estimated at USD 9.32 billion in 2022 and is expected to reach USD 9.78 billion in 2023.

b. The global coronary stents market is expected to grow at a compound annual growth rate of 3.1% from 2023 to 2030 to reach USD 12.1 billion by 2030.

b. Some key players operating in the coronary stents market include Abbott, Terumo Corporation, C. R. Bard, Inc., Cook Medical, Boston Scientific, and MicroPort Scientific Corporation.

b. Key factors that are driving the coronary stents market growth include the rising prevalence of cardiovascular diseases (CVDs), such as stroke and heart attack, along with a growing geriatric population at higher risk of these cardiac diseases.

b. North America dominated the coronary stents market with a share of over 32% in 2021. This is attributable to the increasing prevalence of cardiovascular diseases such as heart attack, stroke, and ischemic heart diseases (IHD) and the increased focus of consumers on better treatment options.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."