- Home

- »

- Digital Media

- »

-

Corporate E-learning Market Size, Industry Report, 2030GVR Report cover

![Corporate E-learning Market Size, Share & Trends Report]()

Corporate E-learning Market (2025 - 2030) Size, Share & Trends Analysis Report By Learning Type (Distance Learning, Instructor-led Training, Blended Learning), By Organization Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-507-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Corporate E-learning Market Summary

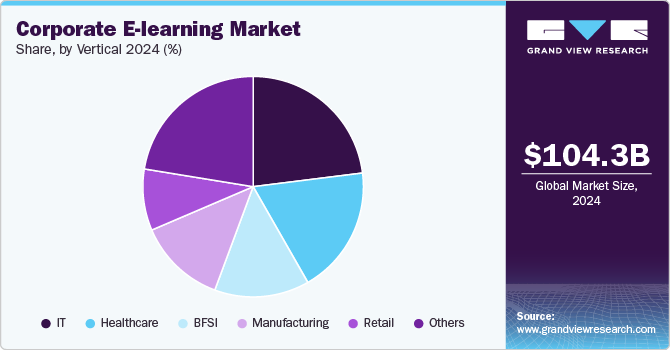

The global corporate e-learning market size was estimated at USD 104.32 billion in 2024 and is projected to reach USD 334.96 billion by 2030, growing at a CAGR of 21.7% from 2025 to 2030. The corporate e-learning market has experienced significant growth, driven by digital transformation and the increasing need for upskilling in a rapidly evolving business landscape.

Key Market Trends & Insights

- North America dominated with a revenue share of over 35.0% in 2024.

- The U.S. corporate e-learning industry is expected to grow at a significant CAGR from 2025 to 2030.

- By learning type, the distance learning segment led the market in 2024, accounting for over 40% share of the global revenue.

- By organization size, the large enterprises segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 104.32 Billion

- 2030 Projected Market Size: USD 334.96 Billion

- CAGR (2025-2030): 21.7%

- North America: Largest market in 2024

Organizations worldwide are adopting e-learning solutions to enhance workforce training, improve productivity, and reduce costs associated with traditional in-person training. Factors fueling this growth include the proliferation of mobile devices, advancements in artificial intelligence (AI) and augmented reality (AR), and the rising demand for personalized learning experiences.

Cloud-based e-learning platforms have further expanded accessibility, enabling employees to learn at their own pace from any location. For instance, in October 2024, LinkedIn Corporation launched an AI based personalized learning platform. AI-powered learning plans offer more tailored content by taking into account industry, experience, and career objectives. These plans are also more flexible, enabling learners to adjust them according to their individual timelines and customize them to align with the organization's talent architecture.

The growing emphasis on employee engagement and retention also drives the corporate e-learning market’s expansion. As organizations recognize the correlation between professional development opportunities and job satisfaction, e-learning platforms have become essential in talent management strategies. Innovations such as VR simulations and AI-driven adaptive learning ensure that training is both immersive and tailored to individual needs, increasing effectiveness. Moreover, globalization has heightened the need for consistent training across geographically dispersed teams, making scalable e-learning solutions indispensable. With sustainability gaining prominence, e-learning reduces the environmental impact of training programs by minimizing travel and resource consumption, further solidifying its long-term adoption. For instance, in October 2024, D2L Corporation launched the all-new Creator+, integrated with H5P Group. Creator+ offers a comprehensive all-in-one solution for creating engaging courses, incorporating interactive content, video tools, dynamic analytics, and generative AI.

Industries such as IT, healthcare, and manufacturing are leading the adoption due to their need for continual skill development and regulatory compliance training. Furthermore, the COVID-19 pandemic accelerated the transition to remote work, amplifying reliance on e-learning systems. Companies are now leveraging gamification, microlearning, and data analytics to boost engagement and measure training outcomes. As businesses prioritize reskilling to remain competitive, the corporate e-learning market is poised to become an indispensable component of modern workforce development strategies.

Learning Type Insights

The distance learning segment led the market in 2024, accounting for over 40% share of the global revenue. This growth is driven by the increasing demand for flexible learning solutions that cater to the diverse and dispersed workforce of modern organizations. Distance learning offers the advantage of accessibility, allowing employees to engage in training from anywhere, at any time, without the need for physical presence. This is mainly valuable for multinational companies and remote teams who require a consistent and scalable training solution. The rise of mobile learning and cloud-based platforms has further enhanced the reach and effectiveness of distance education, ensuring that employees can access training materials on the go. For instance, in September 2024, Skillsoft launched a suite of advanced features aimed at making learning more impactful. These enhancements simplify the certification process for learners while utilizing generative AI technologies to provide a highly personalized and adaptive learning experience, accelerating the acquisition of essential, in-demand skills.

The instructor-led training segment is anticipated to witness significant growth in the coming years. The sustained relevance of instructor-led training is driven by its ability to deliver personalized, interactive learning experiences, especially for complex and highly technical topics. Instructor-led training provides real-time feedback, fostering a deeper understanding and immediate problem-solving. This model is increasingly being enhanced with digital tools such as virtual classrooms, video conferencing, and interactive whiteboards, making it more accessible to geographically dispersed teams.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2024. This growth is driven by the increasing focus of large organizations on workforce development to remain competitive in a rapidly evolving global economy. Large enterprises often have diverse and geographically dispersed teams, making e-learning a cost-effective and scalable solution for employee training. These organizations are leveraging e-learning platforms to deliver consistent training programs in areas such as leadership, compliance, digital transformation, and specialized technical skills. For instance, in September, Oracle announced a new open skills architecture within Oracle Dynamic Skills empowering organizations to design, manage, and execute a holistic, organization-wide skills-based talent strategy. Oracle Dynamic Skills, a component of Oracle Fusion Cloud Human Capital Management (HCM), enables organizations at any stage of their skills journey to gain deeper insights into their employees' capabilities, enhance talent access, and make more informed workforce decisions.

The SMEs segment is anticipated to witness significant growth in the coming years. This growth reflects the increasing recognition among small and medium-sized enterprises of the strategic importance of employee training to compete in a dynamic business environment. SMEs often operate with limited budgets and resources, making cost-effective e-learning solutions a practical choice for skill enhancement and compliance training. The adoption of cloud-based e-learning platforms allows SMEs to access scalable and customizable training programs without significant upfront investments. Moreover, government initiatives and subsidies to promote digital learning among SMEs are driving market expansion.

Vertical Insights

The IT segment accounted for the largest market revenue share in 2024. This growth is primarily driven by the rapid pace of technological innovation, which demands constant upskilling and reskilling of IT professionals. E-learning platforms provide cost-effective and scalable solutions for training employees on emerging technologies such as cloud computing, artificial intelligence, blockchain, and cybersecurity. The flexibility of these platforms allows organizations to train their workforce efficiently, ensuring that teams remain updated on the latest tools and programming languages.

The BFSI segment is likely to show notable growth over the forecast period. This rapid growth is driven by the BFSI sector's increasing reliance on digital transformation, necessitating the upskilling and reskilling of employees to handle emerging technologies such as blockchain, artificial intelligence, and cybersecurity. Financial institutions are adopting e-learning platforms to ensure compliance with regulatory standards, provide ongoing professional development, and enhance customer service capabilities. The flexibility of e-learning allows BFSI firms to train their workforce cost-effectively. In contrast, AI-powered modules deliver personalized learning experiences based on employee roles and skill gaps.

Regional Insights

North America dominated with a revenue share of over 35.0% in 2024. The corporate e-learning market in North America is experiencing significant growth due to various factors, such as advancements in technology, workforce dynamics, and evolving corporate training needs. The rise of remote and hybrid work environments has increased the need for online corporate training programs. Thus, organizations are investing in e-learning to keep employees updated with emerging technologies, such as AI, big data, and cybersecurity.

U.S. Corporate E-learning Market Trends

The U.S. corporate e-learning industry is expected to grow at a significant CAGR from 2025 to 2030. Increasing demand for continuous learning and upskilling, and technological advancements and the growth of learning platforms are primarily driving the growth of the U.S. corporate e-learning market. According to the 2023 LinkedIn Learning Report, 94% of employees in the U.S. say they would stay at a company longer if it invested in their learning and development. This reflects a growing recognition of the importance of ongoing employee education.

Europe Corporate E-learning Market Trends

The corporate e-learning industry in the Europe region is expected to witness significant growth over the forecast period. The European Union introduced various funding programs and initiatives to support digital education and the development of e-learning infrastructure. Programs such as the Erasmus+ initiative promote lifelong learning and the integration of digital solutions in workforce development. European countries have policies promoting continuous professional development. For instance, regulations requiring companies to meet training requirements for compliance, safety, or skill development further boost the demand for corporate e-learning solutions.

Asia Pacific Corporate E-learning Market Trends

The corporate e-learning industry in the Asia Pacific region is expected to witness significant growth over the forecast period. Companies across Asia-Pacific are leveraging e-learning to train employees on new technologies and digital tools, aligning with their digital transformation strategies. The Asia-Pacific region, particularly in countries such as, India, China, and Southeast Asia, is witnessing an increase in SMEs and startups, driving demand for cost-effective employee training solutions. The region boasts a large, youthful workforce that is more inclined toward digital learning platforms.

Key Corporate E-learning Company Insights

Some key players in the corporate e-learning industry, such as Adobe and Allen Communication Learning Services.

-

Adobe is a global technology company that designs and develops digital marketing and creative software. The company operates through three main segments, namely Digital Media, Digital Experience, and Publishing and Advertising. Adobe leads the way in integrating artificial intelligence into video editing through its Creative Cloud suite. In the corporate e-learning market, Adobe offers a range of products and services, such as: Adobe Captivate, Adobe Learning Manager, and Adobe Connect.

-

Allen Communication Learning Services provides custom learning and development solutions tailored to organizational needs. The company’s corporate e-learning service offerings are broadly classified into four categories such as: Advisory, Design, Tech, and Talent. The company provides various corporate e-learning services such as: Custom Training Development, eLearning Design and Development, and Learning Strategy and Consulting, among others. The company provides corporate e-learning services to various industries such as healthcare, retail, manufacturing, and others.

Key Corporate E-learning Companies:

The following are the leading companies in the corporate e-learning market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Allen Communication Learning Services

- City & Guilds Group

- D2L Corporation

- Designing Digitally

- Docebo

- Microsoft

- Oracle

- SAP SE

- Skillsoft

Recent Developments

-

In September 2024, Adobe launched Adobe Captivate 12.4, a tool for creating interactive, device-independent eLearning content. Version 12.4 delivers advanced enhancements, including question pools, improved padding controls, upgraded simulations, direct publishing to Adobe Learning Manager, customizable project dimensions, file hyperlinking, and resizable hotspots.

-

In September 2024, City & Guilds collaborated with hundo, employability skills platform provider, to deliver a new employability skills pilot programme. This initiative would bridge the gap between employment and education by equipping young people with the crucial skills needed to thrive in today’s workforce.

-

In April 2024, D2L Corporation partnered with Atomic Jolt, Inc., LMS solutions provider, to aid in delivering user-friendly search and assessment software. The partnership aims to enhance assessments and streamline search functionality within D2L Brightspace, enabling teachers to save time and better prepare learners for the future.

Corporate E-learning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 125.61 billion

Revenue forecast in 2030

USD 334.96 billion

Growth rate

CAGR of 21.7% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Learning type, organization size, vertical, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Adobe, Allen Communication Learning Services, City & Guilds Group, D2L Corporation, Designing Digitally, Docebo, Microsoft, Oracle, SAP SE, Skillsoft

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corporate E-learning Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global corporate e-learning market report based on learning type, organization size, vertical, and region.

-

Learning Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Distance Learning

-

Instructor-led Training

-

Blended Learning

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT

-

Healthcare

-

BFSI

-

Retail

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global corporate e-learning market size was estimated at USD 104.32 billion in 2024 and is expected to reach USD 125.61 billion in 2025.

b. The global corporate e-learning market is expected to grow at a compound annual growth rate of 21.7% from 2025 to 2030 to reach USD 334.96 billion by 2030.

b. North America dominated the corporate e-learning market with a share of 36.1% in 2024. The corporate e-learning market in North America is experiencing significant growth due to various factors, such as advancements in technology, workforce dynamics, and evolving corporate training needs. The rise of remote and hybrid work environments has increased the need for online corporate training programs.

b. Some key players operating in the corporate e-learning market include Adobe, Allen Communication Learning Services, City & Guilds Group, D2L Corporation, Designing Digitally, Docebo, Microsoft, Oracle, SAP SE, Skillsoft

b. The corporate e-learning market has experienced significant growth, driven by digital transformation and the increasing need for upskilling in a rapidly evolving business landscape. Organizations worldwide are adopting e-learning solutions to enhance workforce training, improve productivity, and reduce costs associated with traditional in-person training.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.