- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Corrosion Protective Coatings Market Size Report, 2030GVR Report cover

![Corrosion Protective Coatings Market Size, Share & Trends Report]()

Corrosion Protective Coatings Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Solvent-borne, Water-borne and Powder Coatings), By Material, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-964-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Corrosion Protective Coatings Market Summary

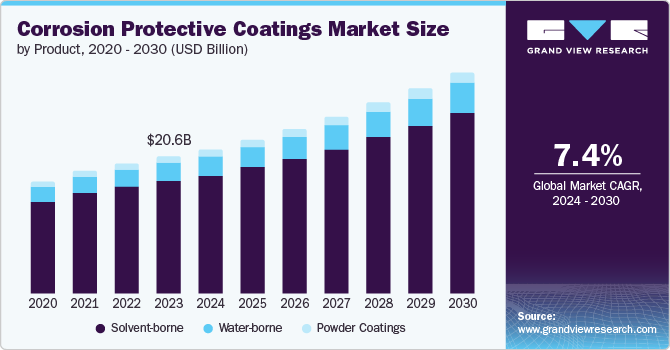

The global corrosion protective coatings market size was valued at USD 20.59 billion in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. The booming industrialization and infrastructure projects across the globe are driving significant demand for corrosion protective coatings.

Key Market Trends & Insights

- Asia Pacific market dominated the market with a revenue share of 45.2% in 2023.

- By product, the solvent-borne segment dominated the market with 82.1% of revenue share in 2023.

- By material, the epoxy segment dominated the market with 39.9% of revenue share in 2023.

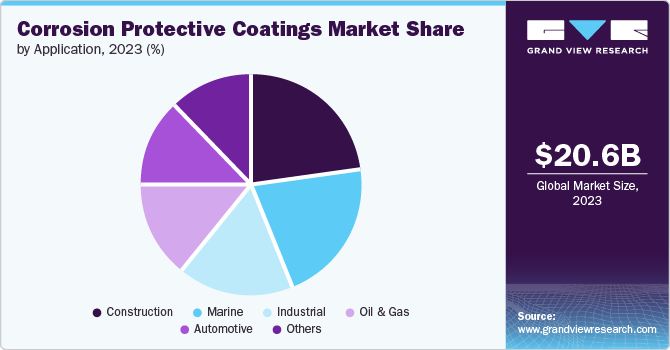

- By application, the construction segment accounted for the largest revenue share of 22.9% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 20.59 Billion

- 2030 Projected Market Size: USD 33.28 Billion

- CAGR (2024-2030): 7.4%

- Asia Pacific: Largest market in 2023

Rising concerns about asset lifespan, increasing focus on safety and asset protection across various industries, driven by regulatory compliance, are further stimulating market demand.

The oil and gas industry is one of the largest consumers of corrosion protective coatings due to the harsh environments in which equipment operates. With rising global energy demands and increased investments in oil exploration, particularly offshore, there is a significant need for effective corrosion protection to ensure the longevity and reliability of infrastructure. The global focus on infrastructure development, including bridges, dams, pipelines, and buildings, drives the need for durable and protective coatings.

Rapid urbanization leads to higher construction activities and infrastructure requirements in urban areas. This trend necessitates robust protective measures against corrosion for buildings and other structures exposed to various environmental conditions. Protective coatings offer a long-term solution, reducing maintenance costs and extending asset life.

Product Insights

The solvent-borne segment dominated the market with 82.1% of revenue share in 2023. This is due to its superior performance characteristics, including excellent adhesion, durability, and chemical resistance. It offers exceptional protection against harsh environments, making them ideal for applications in industries such as oil & gas, marine, and infrastructure. Furthermore, advancements in formulation technologies have led to the development of low-VOC (volatile organic compound) solvent-borne products that comply with stringent environmental regulations while maintaining high performance standards. This combination of effectiveness and regulatory compliance is driving the growth of solvent-borne coatings in various industries.

The powder coatings segment is anticipated to witness a significant CAGR of 8.0% over the forecast period. This upward trend is due to its environmentally friendly nature, high transfer efficiency, and excellent corrosion resistance. The absence of volatile organic compounds (VOCs) makes them compliant with stringent environmental regulations, while their ability to create thick, uniform coatings enhances protection against corrosion. In addition, powder coatings offer cost-effective application processes, reduced material waste, and durable finishes, driving their adoption across various industries, including automotive, appliances, and construction.

Material Insights

The epoxy segment dominated the market with 39.9% of revenue share in 2023. This is due to their exceptional corrosion resistance, durability, and versatility. These coatings offer excellent adhesion to various substrates, forming a protective barrier against harsh environments. Additionally, epoxy coatings exhibit superior chemical resistance, making them ideal for applications in industries such as oil & gas, chemical processing, and marine. The increasing demand for robust and long-lasting coatings is driving the expansion of the epoxy coatings segment.

The zinc segment is anticipated to witness significant CAGR of 8.4% over the forecast period. These coatings provide excellent corrosion resistance by acting as sacrificial anodes, protecting the underlying metal from corrosion. Zinc-rich coatings are widely used in industries exposed to harsh environments, such as infrastructure, marine, and oil & gas. The growing emphasis on asset protection and the need for cost-effective corrosion prevention solutions are contributing to the increasing demand for zinc-based coatings.

Application Insights

The construction segment accounted for the largest market revenue share of 22.9% in 2023. The increasing emphasis on infrastructure development and building restoration are significant factors driving the growth of corrosion protective coatings in the construction sector. The need to protect concrete, steel, and other building materials from the harsh effects of weather, pollution, and chemical exposure is driving demand for coatings that offer durability, aesthetics, and long-term protection.

The industrial segment is projected to grow at a CAGR of 4.6% over the forecast period. This is due to the exposure of industrial equipment and machinery to harsh operating conditions. Industries such as oil & gas, chemical processing, and manufacturing rely heavily on these coatings to protect assets from corrosion, extend equipment life, and ensure safety. Moreover, stringent environmental regulations and the increasing cost of equipment replacement are driving the adoption of advanced corrosion protection solutions in the industrial sector.

Regional Insights

The North America corrosion protective coatings market is anticipated to grow at a CAGR of 4.1% during the forecast period. It is attributable to robust industrialization, extensive infrastructure, and stringent environmental regulations. The presence of key industries such as oil & gas, automotive, and construction, coupled with a growing emphasis on asset protection and maintenance, fuels the demand for corrosion-resistant coatings.

U.S. Corrosion Protective Coatings Market Trends

The U.S. corrosion protective coatings market held a dominant position in 2023. The country's focus on infrastructure, coupled with the growing demand for corrosion protection in the oil & gas, automotive, and construction sectors, is propelling market expansion.

Asia Pacific Corrosion Protective Coatings Market Trends

Asia Pacific market dominated the market with a revenue share of 45.2% in 2023. The market is expected to grow during the forecast period due to the rapid industrialization and urbanization and a surge in construction activities. The region's burgeoning economies, coupled with increasing investments in oil & gas, shipbuilding, and automotive sectors, are fuelling demand for corrosion protection.

Europe Corrosion Protective Coatings Market Trends

The Europe corrosion protective coatings market was identified as a lucrative region in 2023driven by robust industrial base and extensive infrastructure. The region's focus on infrastructure renewal, coupled with the growing demand for corrosion protection in the oil & gas, marine, and automotive sectors, is propelling market expansion. The UK corrosion protection coatings market held a substantial market share in 2023 driven by its industrial heritage, maritime activities, and a focus on infrastructure maintenance.

Key Corrosion Protective Coatings Company Insights

Some key companies in the corrosion protective coatings market include Akzo Nobel N.V., PPG Industries, Inc., Jotun, Sherwin Williams Co., Kansai Paint Co. Ltd., 3M and others.

-

Akzo Nobel N.V. specializes in the production of paints, coatings, and specialty chemicals. Company operates through two primary segments i.e. decorative paints and performance coatings.

Key Corrosion Protective Coatings Companies:

The following are the leading companies in the corrosion protective coatings market. These companies collectively hold the largest market share and dictate industry trends.

- Akzo Nobel N.V.

- PPG Industries, Inc.

- Jotun

- Sherwin Williams Co.

- Kansai Paint Co., Ltd.

- 3M

- Sika AG

- Axalta Coating Systems Ltd.

- BASF SE

- Nippon Paint Holdings Co., Ltd.

- NYCOTE

- Hempel A/S

Recent Developments

-

In June 2023, AkzoNobel’s Powder Coatings business announced the launch of Interpon Redox portfolio to offer corrosion protection, especially within regions with high humidity and coastal areas.

-

In April 2023, PETRONAS announced the launch of ProShield+, a corrosion protection technology. It is an advanced based technology to protect assets from corrosion, which has been tested in company’s units operating in downstream and upstream sectors.

Corrosion Protective Coatings Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 21.62 billion

Revenue forecast in 2030

USD 33.28 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilo Tons, Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Indonesia, Malaysia, Thailand, Australia, Argentina, Brazil, Saudi Arabia, UAE, Qatar, Oman, South Africa

Key companies profiled

Akzo Nobel N.V., PPG Industries, Inc., Jotun, Sherwin Williams Co., Kansai Paint Co., Ltd., 3M, Sika AG, Axalta Coating Systems Ltd., BASF SE, Nippon Paint Holdings Co., Ltd., NYCOTE, Hempel A/S

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Corrosion Protective Coatings Market Report Segmentation

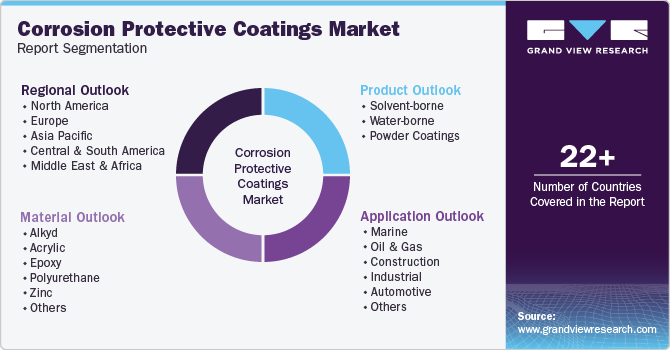

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global corrosion protective coatings market report based on product, material, application, and region:

-

Product Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Solvent-borne

-

Water-borne

-

Powder Coatings

-

-

Material Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Alkyd

-

Acrylic

-

Epoxy

-

Polyurethane

-

Zinc

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

Marine

-

Oil & Gas

-

Construction

-

Industrial

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume in Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Qatar

-

Oman

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.