- Home

- »

- Beauty & Personal Care

- »

-

Cosmetic Oil Market Size, Share And Growth Report, 2030GVR Report cover

![Cosmetic Oil Market Size, Share & Trends Report]()

Cosmetic Oil Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Almond Oil, Olive Oil, Coconut Oil, Essential Oil, Others), By Nature (Organic, Conventional), By Application (Hair Care, Skin Care, Lip Care, Others), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-867-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cosmetic Oil Market Summary

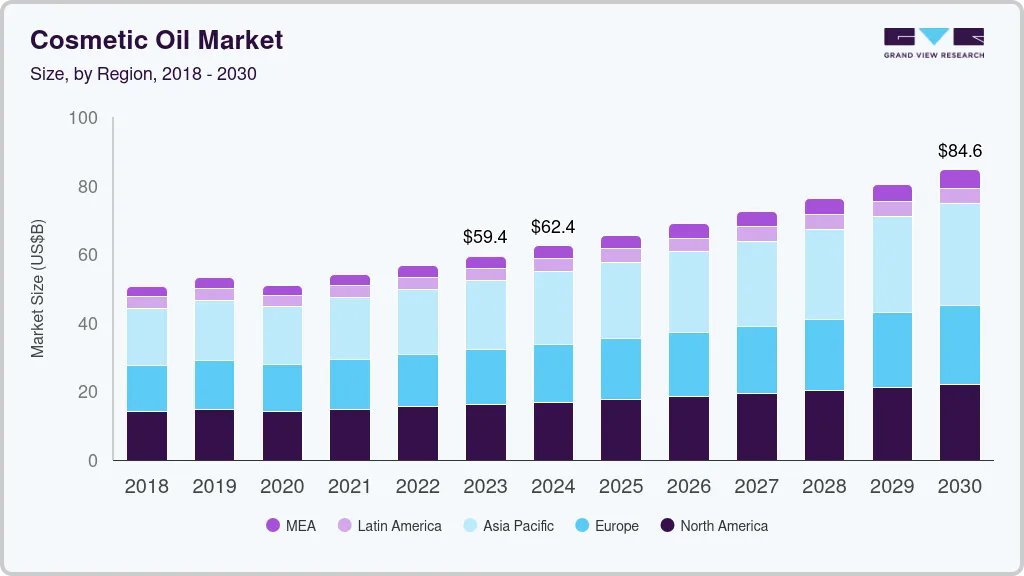

The global cosmetic oil market size was estimated at USD 59.4 billion in 2023 and is projected to reach USD 84.63 billion by 2030, growing at a CAGR of 5.2% from 2024 to 2030. Cosmetic oils include carrier oils such as coconut, almond, and essential oils.

Key Market Trends & Insights

- Asia Pacific dominated the market in 2023 accounting for a revenue share of 33.7%.

- The cosmetic oil market in South Korea's is growing significantly due to traditional hair and skin care products.

- By product, the essential oil segment dominated the market with a revenue share of 25.9% in 2023.

- By nature, the conventional segment dominated the market in 2023.

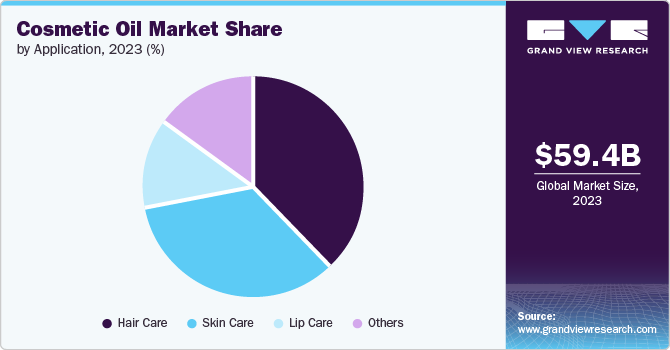

- By application, the hair care segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 59.4 Billion

- 2030 Projected Market Size: USD 84.63 Billion

- CAGR (2024-2030): 5.2%

- Asia Pacific: Largest market in 2023

The demand for cosmetic oils is growing due to diverse qualities such as antibacterial, moisturizing, and anti-inflammatory properties. Furthermore, the rising consumer preference for organic and natural cosmetic products is expected to drive market growth over the forecast period.The cosmetic oils are used in skincare and haircare products. These oils help to moisturize the skin, protect against harmful UV rays, and prevent irritation and inflammation. Initially, cosmetic oils targeted women. However, the growing influence of social media and increased beauty awareness among men are creating market opportunities. Diversifying cosmetic oils across demographics is expected to boost the cosmetic oil industry further.

The demand for cosmetic oils is anticipated to grow owing to growing awareness about the personal care routine. The increasing importance of personal appearance among consumers creates a high demand for cosmetic oils. These oils are known for their hydrating and nourishing properties and are commonly used in skin and hair care products. The inclination towards men’s beauty products and the rapid development of the gender-neutral cosmetic industry are also contributing to the market growth. Additionally, rapid innovations and R&D activities for the development of new products in cosmetic oil, as well as the presence of large cosmetic enterprises, are driving the market growth.

Product Insights

The essential oil segment dominated the market with a revenue share of 25.9% in 2023. Essential oils include lavender, rose, lemon, sandalwood, and peppermint. These oils are extracted from plants and contain a natural fragrance. Essential oils are used in cosmetic products due to their anti-inflammatory and antibacterial properties. These oils are also generally used for aromatherapy, a healing process useful for relaxation.

The olive oil segment is anticipated to grow at a significant CAGR over the forecast period. Customers are shifting towards natural and organic ingredients and choosing olive oil over synthetic oil. Olive oil is more suitable for cosmetic products because of its moisturizing and antioxidant properties. Olive oil offers various benefits for skin and hair, providing hydration, promoting healthy shine, and reducing inflammation.

Nature Insights

The conventional segment dominated the market in 2023. The cosmetics industry has long relied on traditional oils such as mineral and coconut for their affordability, availability, and established production methods. These conventional oils are cheaper than organic alternatives and offer a wide range of uses in cosmetics. Additionally, consumer familiarity with these oils has contributed to their continued market growth.

The organic segment is anticipated to grow at the fastest CAGR over the forecast period. Organic oils are perceived as natural, safe, and beneficial for skin and hair health. The beauty industry primarily emphasizes natural and organic ingredients, which increases consumer interest in organic cosmetic oils. Additionally, organic production practices in cosmetics are more sustainable and environmentally friendly. Organic products are generally costly but provide more health benefits to skin and hair, which fuels the segment’s growth.

Application Insights

The hair care segment dominated the market in 2023. Hair care is essential to people’s daily routines in various countries. Different hair oils are used for different purposes, such as almond oil for soothe and hydrate hair, grapeseed oil adds moisture, strength, and shine to the hair, and jojoba oil prevents hair loss, promotes hair growth, and strengthens hair follicles. There is a growing demand for natural and organic hair care products, and natural hair oils derived from plants are highly demanded, driving the hair oil segment to grow.

The skin care segment is expected to grow with a significant CAGR over the forecast period. Skincare oils offer a variety of benefits, such as hydration and nourishment to the skin, reducing aging signs, fine lines, and wrinkles. Various skin care oils treat specific skin concerns such as acne and eczema. Cosmetic oils are derived from plants and botanical sources such as avocado, rosehip, and jojoba, which offer natural alternatives to synthetic ingredients used in skincare.Additionally, the impact of social media and beauty influencers played an essential role in raising awareness about the specific benefits of natural cosmetic oils. A considerable number of people incorporated skin oil into their skincare routines.

Regional Insights

The North America cosmetic oil market accounted for a significant revenue share in 2023.The market in the North American region is highly mature, with a high demand for natural and organic cosmetic oils. The vast adoption of beauty and personal care routines in people’s daily lives is due to the weather and climatic conditions. The extreme geographic condition of the region demands people to have healthy body-care and haircare routines, driving the cosmetic oil market in the region.

U.S. Cosmetic Oil Market Trends

The U.S. cosmetic oil market dominated North America owing to the strong presence of cosmetic companies. This growth is attributed to the technology-driven research and development facilities. Furthermore, the introduction of herbal cosmetic oils, serums, and the incorporation of natural oils in cosmetic products.

Europe Cosmetic Oil Market Trends

Europe cosmetic oil market was identified as a lucrative region in 2023. The market's growth is attributed to the busy lifestyle, increasing demand for personal care products, and gender-neutral cosmetic solutions. The rising number of R&D activities to develop organic cosmetic oils drives market growth.

The cosmetic oil market in UK is expected to grow rapidly in the coming years due to the growing number of beauty and transformation studios. Furthermore, the demand for cosmetic oil is influenced by changing lifestyles, its application in hair treatment, and it's addressing skin issues such as acne and dry skin.

Asia Pacific Cosmetic Oil Market Trends

Asia Pacific dominated the market in 2023 accounting for a revenue share of 33.7%. The region has an emerging cosmetic oil market, with a growing disposable income of the population and increasing adoption of skincare and haircare products. The sudden upsurge in the demand for cosmetic oils is attributed to the expanding urbanization and corporate culture. Increased pollution and prevalent skin issues are the reasons for the high adopt such cosmetic products.

The cosmetic oil market in South Korea's is growing significantly due to traditional hair and skin care products. The country widely adopted cosmetic oils for their antioxidant properties. The application of oil for moisturizing the skin and for natural fragrance has been practiced for a long time.

Key Cosmetic Oil Company Insights

Some of the key companies in the cosmetic oil market include L’Oreal Group, Unilever, Coty Inc., Shiseido Co. Ltd., and others. Companies focus on increasing their customer base to gain a competitive edge in the industry. The key players focus on launching new products and providing cheaper alternatives to existing ones. Major companies are taking strategic initiatives such as mergers, acquisitions, and collaborations.

-

Coty Inc. is a beauty company with a portfolio of iconic brands in fragrance, color cosmetics, skin and body care, sun care, and hygiene products. Coty supplies its products through various distribution channels, such as specialty retailers, department stores, mass-market retailers, and duty-free shops in airports worldwide.

-

Unilever has many brands, such as Pond's, Clinic Plus, Lux, Lakmé, Kissan, Bru, Cornetto, and others, in over 190 countries. The company has different divisions, such as beauty, well-being, personal care, home care, and nutrition.

Key Cosmetic Oil Companies:

The following are the leading companies in the cosmetic oil market. These companies collectively hold the largest market share and dictate industry trends.

- L’Oreal Group

- Unilever

- Coty Inc.

- Shiseido Co. Ltd

- Innisfree Cosmetics Pvt. Ltd

- Bramble Berry

- Kao Corporation

- Uncle Harry;s Natural Products

- FARSALI

- SOPHIM IBERIA S.L.

Recent Developments

-

In December 2023, Unilever acquired the premium biotech haircare brand K18. K18 is a fast-growing brand that uses novel biotechnology to address hair damage and has been popular with professionals and consumers.

-

In August 2023, L’Oréal completed the acquisition of Aesop. The acquisition was announced on April 3, 2023, and Aesop joined L’Oréal’s Luxe Division. The integration aims to leverage Aesop’s unique brand DNA and values to expand its global presence and growth potential.

Cosmetic Oil Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 62.40 billion

Revenue forecast in 2030

USD 84.63 billion

Growth Rate

CAGR of 5.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, application, region

Regional scope

North America; Europe; Asia Pacific

Country scope

U.S.; Germany; France; South Korea; Singapore

Key companies profiled

L’Oreal Group; Unilever; Coty Inc.; Shiseido Co. Ltd.; Innisfree Cosmetics Pvt. Ltd.; Bramble Berry; Kao Corporation; Uncle Harrys Natural Products; FARSALI; SOPHIM IBERIA S.L.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cosmetic Oil Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cosmetic oil market report based on product, nature, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Almond Oil

-

Olive Oil

-

Coconut Oil

-

Essential Oil

-

Others

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair Care

-

Skin Care

-

Lip Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

-

Asia Pacific

-

South Korea

-

Singapore

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.