- Home

- »

- Clinical Diagnostics

- »

-

COVID-19 Antigen Test Market Size Report, 2021-2027GVR Report cover

![COVID-19 Antigen Test Market Size, Share & Trends Report]()

COVID-19 Antigen Test Market Size, Share & Trends Analysis Report By Product & Service (Reagents & Kits, Platforms), By End Use (Clinics & Hospitals, Home Care), By Region, And Segment Forecasts, 2021 - 2027

- Report ID: GVR-4-68039-389-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2020

- Forecast Period: 2021 - 2027

- Industry: Healthcare

Report Overview

The global COVID-19 antigen test market size was valued at USD 5.3 billion in 2020 and is expected to expand at a compound annual growth rate (CAGR) of 6.7% from 2021 to 2027. The COVID-19 antigen tests are gaining traction in the current scenario, as it is easy to use, patient-friendly, and has a shorter test-to result timeline. Timeline and scalability challenges pertaining to SARS-CoV-2 PCR testing are the primary factors that are increasing the uptake of antigen-based test approaches in turn driving the growth of the market. The emergence of COVID-19 variants in the U.K., South Africa, and Brazil, which are found to be more transmissible than the original strain, intensified the need for rapid tests. Rising concern over the spread and frequency of these variants is expected to fuel the demand for widespread testing. Owing to this, the market for COVID-19 antigen tests is expected to witness lucrative growth in the near future.

There is a high demand for low-cost rapid-testing kits for large-scale testing to help manage the spikes in incidence of COVID-19, particularly in countries with underdeveloped healthcare systems, such as India. Currently, India, along with the U.S., are the top contributors of total COVID-19 cases across the world. The spike in the incidence of COVID-19 can also be attributed to the evolution of the virus into newer variants. These factors drive the need for rapid mass testing in various settings.

The increasing number of companies entering this space coupled with increasing product approvals by the regulatory bodies across the globe. As of June 16, 2021, 28 antigen diagnostic tests for COVID-19 diagnosis have been authorized by the U.S. FDA. Thus, regulatory bodies play a vital role in augmenting market growth. For instance, In April 2021, the CE mark was granted to Vatic Health – a U.K.-based firm for its COVID-19 virus on-the-spot’ saliva antigen test.

A large number of operating entities shifted their focus from conventional PCR-based testing to antigen-based testing, considering it a lucrative source of revenue in the coming years. Other factors driving the market include the shortage of molecular testing materials, the lesser need for supplies, and the rising demand for mass testing to contain the spread of SARS-CoV-2 across the globe.

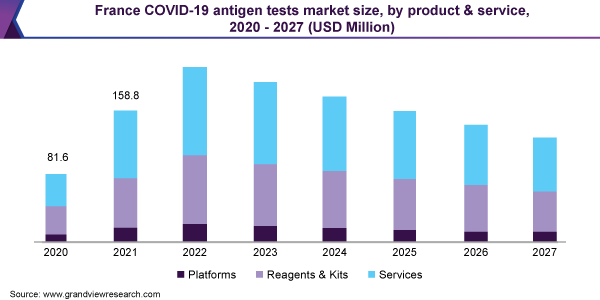

Product & Service Insights

The services segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49% in 2020. This can be attributed to the widespread utilization of rapid antigen tests at various end-use settings such as clinical laboratories, hospitals, and home care. With the growing need to curb the COVID-19 virus, various service providers started offering rapid antigen testing services.

For instance, the Boots Company PLC offers an in-store COVID-19 rapid antigen testing service in the U.K. This service is available for adults and children above five years and offers quick results required for reassurance. In addition, several CLIA-certified laboratories such as Accel Diagnostics offer these services in turn supporting segment growth.

Given the rising popularity of self-administered test kits, the reagents and kits segment is projected to grow at a significant rate throughout the forecast period. In June 2021, Roche received a CE mark for its at-home SARS-CoV-2 Antigen Self-Test Nasal. An earlier version of this home test is available in the European market since February 2021. Such approvals are expected to propel the segment's growth.

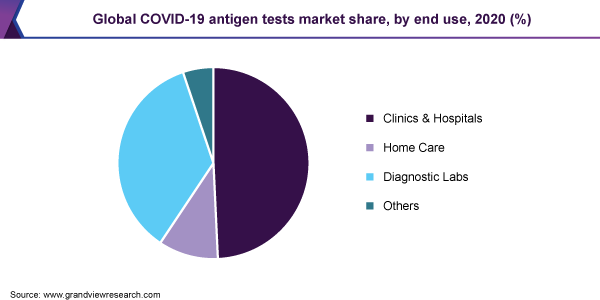

End-use Insights

The clinics and hospitals segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49.3% in 2020. This end-use segment witnessed the highest penetration of rapid antigen tests thus, contributing to the largest revenue share. The U.S. FDA has recognized the antigen tests as suitable for POC diagnosis, aimed at scaling up testing capacity, especially in the U.S.

Acceptance of the vital role of COVID-19 antigen tests by the U.S. FDA has provided lucrative opportunities for the expansion of the COVID-19 antigen testing business across various end-use settings. Thus, these tests have widespread applications across various locations for the testing of individuals for COVID-19 infection.

The home care segment is expected to contribute significant revenue in the coming years. The rising number of over-the-counter test kits is the major factor in driving the segment growth. Abbott BinaxNOW COVID-19 Antigen Self-Test, Ellume COVID-19 Home Test Kit, and Pixel by LabCorp Home Collection Kit are some commercially available OTC COVID-19 rapid antigen tests.

Regional Insights

Asia Pacific dominated the COVID-19 antigen test market and accounted for the largest revenue share of 37.0% in 2020. The presence of home-grown key players, actively developing SARS-CoV-2 antigen tests, and the introduction of several new products by emerging start-ups have contributed to the region's dominance.

For instance, in May 2021, Pune-based Mylab Discovery Solutions Ltd. received approval from the Indian Council of Medical Research (ICMR) for its rapid antigen test kit. This kit delivers results within 15 minutes. Furthermore, in February 2021, the Ministry of Health, Indonesia announced the use of rapid antigen tests for the screening of SARS-CoV-2 infections. Such initiatives are expected to accelerate the usage of antigen tests in Asia Pacific.

On the other hand, given the increasing number of SARS-CoV-2 cases in the country, the U.S. has undertaken several initiatives related to antigen testing. For instance, in May 2021, the Centers for Disease Control and Prevention (CDC) allowed the use of at-home SARS-CoV-2 antigen tests for international travelers arriving in the U.S. Such factors are expected to increase the use of antigen tests in turn supplementing the revenue generation.

Key Companies & Market Share Insights

The market is expected to witness tremendous growth in the near future. The increasing number of emergency use authorizations and product approvals by regulatory bodies and technological collaborations between operating entities are factors that have intensified market competition.

In June 2021, the U.S. FDA granted Emergency Use Authorization (EUA) for OraSure Technologies, Inc.’s InteliSwab -SARS-CoV-2 rapid antigen tests. The approval includes Over-the-Counter (OTC) use without a prescription, prescription home use, and professional use in point of care (POC) CLIA-waived settings. Thus, increasing approvals are expected to boost the market growth. Some of the prominent players in the COVID-19 antigen test market include:

-

Abbott

-

SD Biosensor Inc.

-

Mylab Discovery Solutions Pvt. Ltd

-

GenBody Inc.

-

F. Hoffmann-La Roche AG

-

Access Bio., Inc.

-

ADS biotech Inc.

-

PerkinElmer, Inc.

-

Princeton BioMeditech Corporation

-

Becton, Dickinson, and Company

-

Diasorin S.P.A

-

Quidel Corporation

-

Laboratory Corporation of America

COVID-19 Antigen Test Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 8.8 billion

Revenue forecast in 2027

USD 8.3 billion

Growth Rate

CAGR of 6.7% from 2021 to 2027

Base year for estimation

2020

Historical data

2020

Forecast period

2021 - 2027

Quantitative units

Revenue in USD Million and CAGR from 2021 to 2027

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segment coverage

Product and service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East Africa

Country scope

U.S.; Canada; Germany; U.K.; Italy; France; Spain; Russia; China; India; South Korea; Australia; Japan; Brazil; Mexico; South Africa; Saudi Arabia

Companies profiled

Abbott; SD Biosensor Inc.; Mylab Discovery Solutions Pvt. Ltd.; GenBody Inc.; F. Hoffmann-La Roche AG; SD Biosensor Inc.; Access Bio., Inc.; ADS biotech Inc.; PerkinElmer, Inc.; Princeton BioMeditech Corporation; Becton; Dickinson and Company; Diasorin S.P.A; Quidel Corporation; Laboratory Corporation Of America

Customization scope

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of the customization

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2027. For the purpose of this study, Grand View Research has segmented the global COVID-19 antigen test market report on the basis of product and service, end use, and region:

-

Product & Service Outlook (Revenue, USD Million, 2020 - 2027)

-

Platforms

-

Reagents & Kits

-

Services

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2027)

-

Clinics & Hospitals

-

Home Care

-

Diagnostic Labs

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2027)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Italy

-

France

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Australia

-

Japan

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The clinics and hospitals segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49.3% in 2020.

b. Asia Pacific dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 37.0% in 2020.

b. The global COVID-19 antigen tests market size was estimated at USD 5.3 billion in 2020 and is expected to reach USD 8.8 billion in 2021.

b. The global COVID-19 antigen tests market is expected to grow at a compound annual growth rate of 6.7% from 2021 to 2027 to reach USD 8.3 billion by 2027.

b. The services segment dominated the market for COVID-19 antigen tests and accounted for the largest revenue share of 49% in 2020.

b. Some key players operating in the COVID-19 antigen tests market include Abbott, SD Biosensor, Mylab Discovery Solutions Pvt Ltd, Quidel Corporation, Laboratory Corporation Of America, PerkinElmer, F. Hoffmann-La Roche AG, and Becton, Dickinson and Company.

b. Key factors driving the COVID-19 antigen tests market growth include a rise in product approvals by regulatory bodies, rising cases coupled with the emergence of novel COVID-19 strains, and the key role of COVID tests in vaccine R&D and a paradigm shift towards Point-of-Care (POC) testing.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."