- Home

- »

- Biotechnology

- »

-

COVID-19 Detection PoC Kits Market Size Report, 2030GVR Report cover

![COVID-19 Detection PoC Kits Market Size, Share & Trends Report]()

COVID-19 Detection PoC Kits Market Size, Share & Trends Analysis Report By Sample Handling {RNA Extraction System (Rapid Testing Kits, RT-PCR Testing)}, By Sample Type, By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-958-5

- Number of Report Pages: 168

- Format: PDF, Horizon Databook

- Historical Range: 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global COVID-19 detection PoC kits market size was valued at USD 3.517 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of -3.9% from 2023 to 2030. The major factor for driving the market growth includes the increasing product approval by regulatory bodies, the immense need for rapid diagnostics, and government testing for coronavirus. Since the breakout of the novel coronavirus infection, there has been an increase in demand for diagnostic solutions. Confirmatory tests allow rapid detection of viruses and help in preventing the transmission by isolating a patient. As of July 2022, the WHO has approved more than 400 tests and collection kits, including 235 molecular, 88 antibodies, and 34 antigen tests.

Furthermore, a paradigm shift towards PoC testing is also expected to propel the growth of the market for COVID-19 detection PoC kits. PoC testing allows precise real-time, and lab-quality diagnostic results in patient care settings, such as hospitals, urgent care centers, clinics, and emergency rooms. In response to the SARS-CoV-2 pandemic, several diagnostic test developers have been engaged in the development of simple and rapid PoC COVID-19 diagnostic tests to facilitate testing outside of laboratory settings.

In April 2021, IIT Kharagpur launched COVIRAP - a nucleic acid-based PoC diagnostic device - for infectious disorders, including SARS-CoV-2. This PoC device, developed by lead researcher Dr. Arindam Mondal, prof. Suman Chakraborty and their research team, has been licensed for commercialization by Bramerton Holdings LLC, U.S., and the Rapid Diagnostic Group of Companies, India. This device gives results using saliva/nasal swab samples in 45 minutes.

An increasing number of COVID-19 cases even after vaccination is expected to boost the growth of the market for COVID-19 detection PoC kits in the coming year. According to the ICMR, around 86% of vaccinated individuals in India contracted SARS-CoV-2 Delta variant infection. Moreover, an ICMR study found that most COVID-19 patients had received at least one vaccine dose before contracting the infection. A study published by the Health Ministry in August 2021 stated that around 2.6 lakh individuals (O.048%) have received at least one dose of the vaccine.

In addition, an increase in funding and investments by various private and public organizations to boost the development of POC SARS-CoV-2 diagnostic tests is anticipated to support the growth of the market for COVID-19 detection PoC kits. For instance, various organizations came together to assist Africa in its fight against COVID-19. In April 2021, the World Bank announced its plan to provide USD 39 billion in financial assistance to African countries. Moreover, it also announced a commitment of USD 2.9 billion for the procurement and deployment of mRNA vaccines in 41 African countries.

Sample Handling Insights

The RT-PCR testing segment dominated the market for COVID-19 detection PoC kits and held the largest revenue share of 39.02% in 2022. This is because a majority of the SARS-CoV-2 detection tests are based on RT-PCR technology for the quantification of RNA in the samples of patients infected with the coronavirus. Large-scale adoption of PCR across commercial laboratories, government bodies, hospitals, and public health laboratories has resulted in significant revenue growth for this segment in the global market.

Point of Care (PoC), on the other hand, is anticipated to expand at the fastest rate during the projected period. Advancements in PoC technology for the diagnosis of SARS-CoV-2 virus infection are aimed at minimizing assay duration and enhancing testing capacity to prevent further transmission of the disease. The first PoC diagnostic test for COVID-19 was approved by the U.S. FDA in March 2020 under Emergency Use Authorization (EUA). Since then, key players in this market have been engaged in developing and manufacturing of such tests.

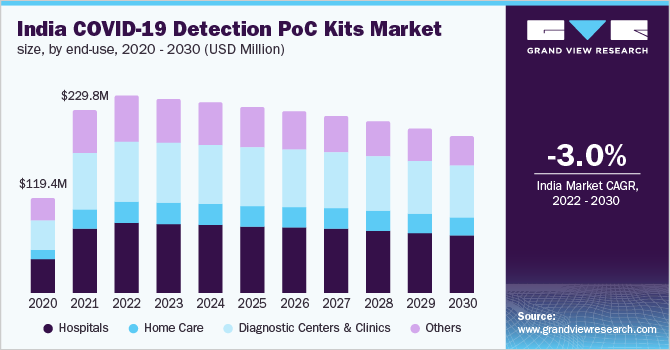

End-use Insights

The hospitals segment accounted for the maximum revenue share of 35.3% in 2022 and is expected to dominate the market for COVID-19 detection PoC kits during the forecast years. This can be attributed to the increasing number of COVID-19 tests being conducted to prevent the transmission of infection. In February 2020, the U.S. FDA permitted hospitals to use their own tests for rapid detection of SARS-CoV-2 infection. Since then, many hospitals across the globe have started developing their own COVID-19 tests to obtain rapid results.

In India, private hospitals are performing COVID-19 tests before admitting patients for any other medical conditions. As the number of healthcare workers contracting the infection is increasing, hospitals are insisting on conducting coronavirus tests. Furthermore, Max Healthcare, a private hospital network, started testing all its patients and healthcare workers for COVID-19 infection. Such initiatives are expected to drive COVID-19 testing to stop further transmission of infection, which is likely to impel the segment growth.

Sample Type Insights

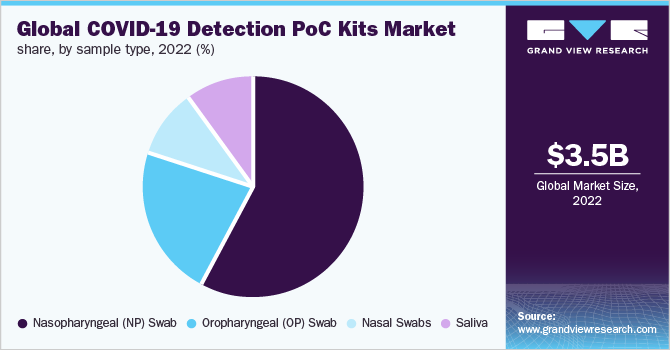

The nasopharyngeal swabs segment dominated the market for COVID-19 detection PoC kits and accounted for the largest revenue share of 58.0% in 2022 owing to the higher acceptance for COVID-19 testing. Moreover, it is anticipated to be the fastest-growing segment owing to the high demand for testing swabs for COVID-19 detection. In addition, the introduction of various molecular diagnostic tests requiring nasopharyngeal swab samples is expected to further boost segment growth.

Nasopharyngeal swabs have been found to show a notably higher SARS-CoV-2 sensitivity, viral load, and detection rate when compared to other swab types. Thus, nasopharyngeal swab type is majorly recommended across various geographies for testing of SARS-CoV-2 virus. This factor is also estimated to drive segment growth during the forecast period.

Oropharyngeal (OP) swabs samples are observed to be less sensitive compared to nasopharyngeal samples; however, utilizing multiple types of specimens helps attain the highest sensitivity during infection screening. This has enhanced the use of OP swabs for SARS-CoV-2 virus diagnosis. Hence, the usage of OP swab specimens alongside a nasopharyngeal swab enhances the detection of COVID-19 viral illnesses in clinical settings and/or allows a thorough study of the etiology of lower respiratory tract infection.

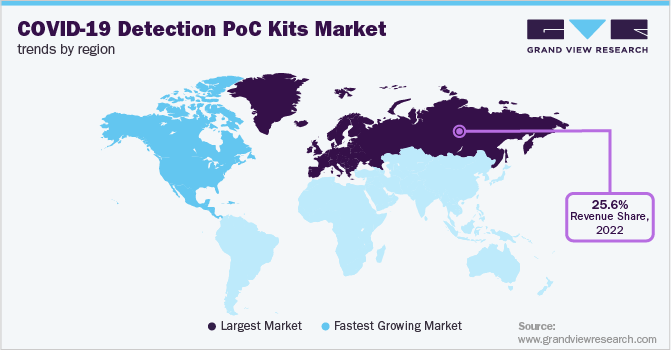

Regional Insights

Europe accounted for a major revenue share of 25.6% in the market in 2022. This can be attributed to the high number of COVID-19 cases coupled with the rapid scaling of COVID-19 testing in the region. According to data published in June 2022, the WHO stated that there has been a 6% rise in the number of daily COVID-19 cases in the region. The European Centre for Disease Prevention and Control anticipates a new wave of omicron infection that would become dominant throughout the EU. As with the previous waves, the growing cases of coronavirus could increase hospitalizations and deaths. This would further increase the testing in the region, which would boost the demand for COVID-19 diagnostic technology.

North America's COVID-19 detection PoC Kits market is estimated to show a declining growth rate of 3.3% during the forecast period. The rise of COVID-19 cases and the local presence of major players involved in the research and manufacture of diagnostic tests, utilizing various technologies, can be attributed to the market's growth. Furthermore, the presence of key laboratories, such as Laboratory Corporation of America (LabCorp) and Quest Diagnostics, has strengthened the COVID-19 diagnostics market. As of June 2021, Quest Diagnostics performed around 41.8 million COVID-19 molecular diagnostic tests and nearly 6.2 million SARS-CoV-2 antibody tests.

Key Companies & Market Share Insights

Key entities in the market for COVID-19 detection PoC kits are implementing several strategies such as geographical expansion, strategic collaborations, and mergers and acquisitions to expand their market presence. For instance, in May 2021, Cerba HealthCare, IFC, and Proparco entered into a strategic partnership to expand diagnostic capacity and support response to the pandemic in Africa. Similarly, in August 2021, Mylab Discovery Solutions entered into a technology partnership with U.S.-based Hemex Health for POC diagnostics. under this initiative, the company will develop test assays, and Hemex will offer its expertise and Gazelle POC testing platform. Some of the prominent players in the COVID-19 detection PoC kits market include:

-

Abbott Laboratories

-

Mylab Discovery Solutions Pvt. Ltd.

-

Convergent Technologies

-

Thermo Fisher Scientific, Inc.

-

F. Hoffmann-La Roche

-

Cepheid

-

BGI

-

Cue health Inc.

-

SD Biosensor Inc.

-

Quest Diagnostics

COVID-19 Detection PoC Kits Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.516 billion

Revenue forecast in 2030

USD 2.67 billion

Growth rate

CAGR of -3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Sample handling, sample type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; India; Bangladesh; Sri Lanka; South Korea, Brazil; Mexico, South Africa; Kenya; Tanzania; Uganda; Ethiopia; Nigeria

Key companies profiled

Abbott Laboratories; Mylab Discovery Solutions Pvt. Ltd.; Convergent Technologies; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche; Cepheid; BGI; Cue health Inc.; SD Biosensor Inc.; Quest Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global COVID-19 Detection PoC Kits Market Segmentation

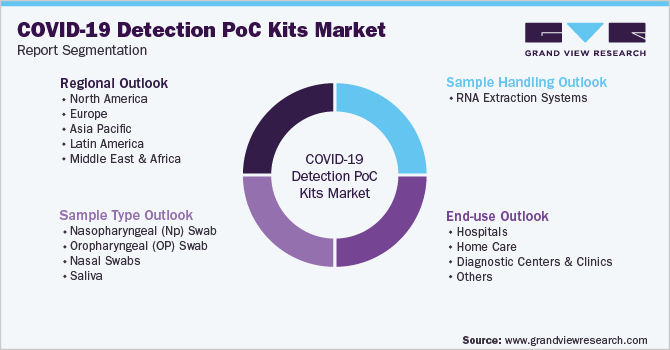

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2030. For the purpose of this study, Grand View Research has segmented the global COVID-19 detection PoC kits market report on the basis of sample handling, sample type, end-use, and region:

-

Sample Handling Outlook (Revenue, USD Million, 2020 - 2030)

-

RNA extraction systems

-

Rapid Testing Kits

-

Point-Of-Care Testing Devices

-

RT-PCR testing

-

-

-

Sample Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Nasopharyngeal (NP) swab

-

Oropharyngeal (OP) swab

-

Nasal Swabs

-

Saliva

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2030)

-

Hospitals

-

Home Care

-

Diagnostic Centers and Clinics

-

Others

-

Government Settings

-

NGOs

-

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

South Korea

-

Bangladesh

-

Sri Lanka

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Kenya

-

Tanzania

-

Uganda

-

Ethiopia

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 Detection PoC Kits market size was estimated at USD 3.517 billion in 2022 and is expected to reach USD 3.516 billion in 2023.

b. The global COVID-19 Detection PoC Kits market is expected to grow at a compound annual growth rate of -3.9% from 2023 to 2030 to reach USD 2.67 billion by 2030.

b. Nasopharyngeal (NP) swab is segment is likely to dominate the forecast period. Higher rate of COVID-19 detection is projected to accelerate segment growth.

b. Some key players operating in the COVID-19 Detection PoC Kits market include Hologic Inc.; Thermo Fisher Scientific, Inc; F. Hoffman-La Roche Ltd; MyLab Discovery Solutions Pvt Ltd.; Convergent Technologies; BGI; Danaher; SD Biosensor Inc.; Quest Diagnostics; and Perkin Elmer, Inc.

b. A robust focus on mass testing of COVID-19 in emerging countries coupled with the risk of new variants is projected to drive the COVID-19 Detection PoC Kits market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."