- Home

- »

- Clinical Diagnostics

- »

-

COVID-19 Diagnostics Market Size & Share Report, 2030GVR Report cover

![COVID-19 Diagnostics Market Size, Share & Trends Report]()

COVID-19 Diagnostics Market Size, Share & Trends Analysis Report By Product & Service (Instruments, Reagents & Kits, Services), By Sample Type, By Test Type, By Mode, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-561-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2020 - 2023

- Forecast Period: 2021 - 2030

- Industry: Healthcare

COVID-19 Diagnostics Market Size & Trends

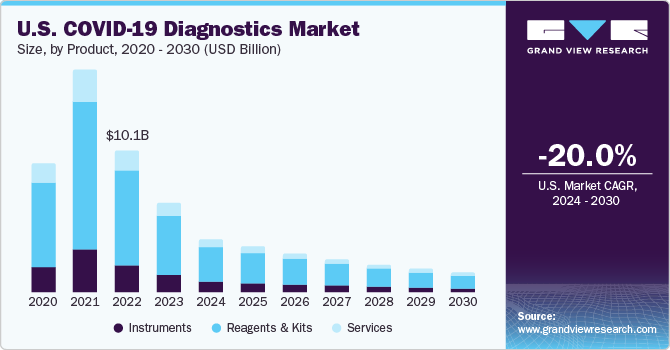

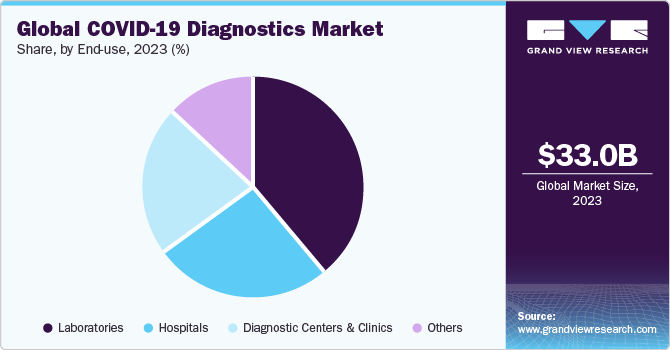

The global COVID-19 diagnostics market size was valued at USD 33.03 billion in 2023 and is expected to decline at a compound annual growth rate (CAGR) of 21.2% from 2024 to 2030. Certain factors such as rising government initiatives for COVID-19 testing and growing number of product launches are projected to accelerate the market growth during the forecast period. For instance, in September 2023, the government of U.S. awarded USD 600 million to accelerate the development and manufacturing of diagnostics tests. The government has allocated these funds to a number of research institutes and diagnostic tests manufacturers.

POC testing enables accurate real-time, lab-quality diagnostic results at patient care settings, such as urgent care centers, clinics, hospitals, and emergency rooms. In response to the pandemic, many diagnostic test developers are focusing on the development of fast and easy-to-use POC diagnostic tests to facilitate testing outside of laboratory settings. For instance, in March 2023, Lucira Health, Inc., launched its groundbreaking Lucira COVID-19 & Flu Home Test nationwide in the U.S. Additionally, this combination test has been included in Australian Register of Therapeutic Goods (ARTG), allowing healthcare professionals to use it in a point-of-care setting. Further, the health authorities are focusing on the development and supply of COVID-19 diagnostics tests, which in turn projected to have a positive impact on the market growth. In April 2021, the FDA approved an amended EUA request for various COVID-19 tests, expanding POC and OTC testing options.

Moreover, the agency mentioned that addition of PoC and OTC tests for screening will give workplaces, communities, schools, and other areas reliable & accurate options for serial screening tests. On September 23, 2020, Assure COVID-19 IgG/IgM Rapid Test Device secured reauthorization for its use as a POC antibody test for SARS-CoV-2 testing. The device was approved for emergency use by certain centers in July 2020 to aid identification of individuals with coronavirus prior to the onset of COVID-19 infection symptoms. Similarly, in September 2020, QIAGEN announced the launch of Access Anti-SARS-CoV-2 Antigen Test, a rapid portable antigen test that can provide result in less than 15 minutes and exhibits the potential to process 30 swab specimens per hour on an average. Thus, introduction of rapid POC tests has increased the efficiency as well as preference for such tests.

In addition, increase in funding and investments by various private & public organizations to boost the development of POC SARS-CoV-2 diagnostic tests is anticipated to support market growth. For instance, in March 2020, Mesa Biotech, Inc., a U.S.-based molecular diagnostic company, received USD 561,000 contract from the U.S. Department of Health and Human Services for development of a novel rapid molecular diagnostic test for COVID-19. Following this, in March 2020, Mesa Biotech received EUA for its new Accula SARS-CoV-2 Test, a POC test that gives results in minutes. On April 14, 2020, Mesa Biotech announced to ship around 10,000 Accula SARS-CoV-2 tests to enable testing outside of the clinical labs. Thus, approvals and launch of innovative POC diagnostic tests and increasing investments for development of these tests are anticipated to support market growth.

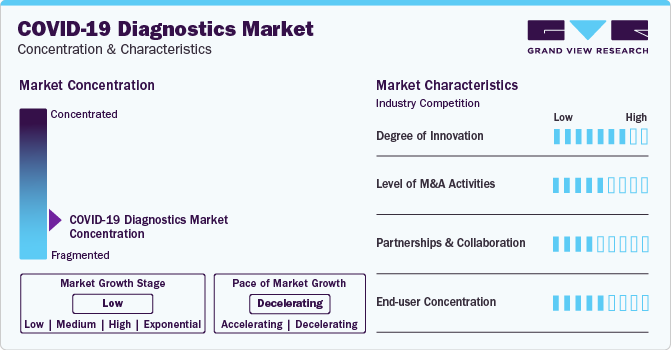

Market Concentration & Characteristics

Market growth stage is negative, and pace of the market growth is declining. The decline in COVID-19 diagnostics tests market could be attributed to factors such as decreasing infection rates, widespread vaccination efforts, and a shift in focus from diagnostic testing to preventive measures and treatments.

The SARS-CoV-2 diagnostics market is also characterized by a high level of merger and acquisition (M&A) activity by the leading players. Factors such as technology sharing and cost efficiency are playing a major role in high level of merger and acquisition (M&A) activity.

The COVID-19 diagnostics market is also witnessing considerable number of partnerships and collaborations. COVID-19 diagnostics test manufacturers are collaborating to leverage combined expertise, enhance production capabilities, and address global demand efficiently. Collaboration allows for the exchange of knowledge, resources, and technologies, accelerating the development and distribution of innovative testing solutions. Additionally, it helps meet the diverse needs of the market and navigate regulatory challenges more effectively.

Substantial end-user concentration in COVID-19 diagnostics market is likely due to centralized healthcare systems, where a limited number of healthcare providers or government agencies play a significant role in testing and decision-making.

Product & Service Insights

The services segment led the market and accounted for 47.7% of the revenue share in 2023. The surge in SARS-CoV-2 cases has proven advantageous for service providers, driven by the continuous rise in cases and an escalating demand for testing in recent years. These providers are expanding their technological capabilities by enhancing testing facilities in current labs, diagnostic centers, and launching new, high-capacity laboratories. Quest Diagnostics and Lab Corp are some of the key service providers operating in this market. These players are making ongoing attempts to keep up with the demand for testing, as the virus is spreading rapidly across the globe. For instance, in August 2020, Quest Diagnostics announced a reduction in the turnaround time for testing COVID-19 infection to 1 to 2 days.

Reagents and kits segment is projected to register substantial CAGR during the forecast period. The WHO has urged regions to ramp up early detection of disease, which consequently drives the adoption of reagents & kits on a large scale. Regulatory bodies have issued mass testing to combat the pandemic. Rising number of product approvals are projected to play considerable role in segment growth. For instance, in February 2021, Agilent announced launch of immunoassay kits for detection of COVID-19. However, some of the laboratories and hospitals are facing a shortage of reagents or kits required for large batches of testing due to disparities in supply chain and manufacturing. The CDC and FDA are continuously addressing challenges due to the shortage of reagents in the U.S. To overcome these challenges, FDA has granted Emergency Use Authorization (EUA) for several SARS-CoV-2 detection tests. This has allowed the relaxation of several stringent standards, enabling key market participants to quickly obtain FDA approval for their testing reagents and kits.

Test Type Insights

Molecular testing type segment held major market share in 2023. The utilization of RT-PCR technology in SARS-CoV-2 detection tests, measuring RNA levels in samples from exposed patients, is a key factor. The widespread adoption of PCR by the CDC, commercial labs, hospitals, and public health laboratories has notably boosted global market revenue. Additionally, the approvals for RT-PCR-based molecular diagnostic assays for early COVID-19 diagnosis contribute to the growth of this segment. Further, the market players are also taking robust efforts to introduce products in the market. For instance, in June 2022, F. Hoffmann-La Roche AG declared that the FDA approved EUA for its Cobas SARS-CoV-2 Duo for use on the Cobas 6800/8800 Systems.

The antibody testing segment is estimated to register considerable CAGR during the forecast period. Serology-based tests aid in monitoring the progress of the disease. In addition to blood serum or plasma samples, sputum, saliva, and other biological fluids are used for the detection of COVID-19 infection in individuals. Further, industrial developments are projected to offer positive environment for segment growth. For instance, in June 2022, Pictor Limited, a New Zealand-based biotech company, announced that it has achieved the CE mark for the company’s PictArray SARS-CoV-2 IgG enzyme-linked immunosorbent assay antibody test. This would further help determine whether the individual requires COVID-19 booster dose.

Sample Type Insights

Nasopharyngeal (NP) swab samples held major share in the market in 2023. This segment is expected to witness significant growth owing to the high demand for testing swabs due to increased awareness about COVID-19 testing and product availability. In addition, the introduction of various molecular diagnostic tests requiring nasopharyngeal swab samples is one of the factors contributing to the segment growth. The CDC and the U.S. FDA have recommended use of nasopharyngeal swabs as the preferred choice for swab-based diagnostic tests for the detection of SARS-CoV-2. The U.S. FDA has approved nasopharyngeal swabs manufactured by Copan Diagnostics, Puritan Medical Products, Quidel Corporation, BD, Thermo Fisher Scientific, and Hardy Diagnostics.

The blood sample testing segment is estimated to register considerable CAGR during the forecast period. With the introduction of blood-based serology tests for detection of SARS-CoV-2 infection, this segment has witnessed the fastest growth during pandemic. The potential of serology testing to identify preclinical signs of SARS-CoV-2 infection is a substantial advantage. Thus, the demand for blood-based antibody detection tests is significantly increasing in the market.

Mode Insights

The non-POC (centralized) testing segment dominated the market in 2023. Since the majority of SARS-CoV-2 tests are now performed in a lab setting, laboratory testing is currently the most adopted testing method in the market. The use of automated high throughput systems makes it possible to process many samples quickly and effectively without compromising the accuracy and reliability of the finished product. A successful COVID-19 response approach to stop the spread must include centralized testing as a key component. These factors make centralized testing an important element in a feasible COVID-19-response strategy to avoid the spread. Therefore, there is a growing demand for healthcare settings that offer decentralized services. For instance, in February 2023, Anavasi Diagnostics, which obtained the FDA's Emergency Use Authorization for their AscencioD COVID-19 Test and AscencioDx Molecular Detector. These products are portable and affordable, enabling high-quality point-of-care molecule testing in various settings, such as urgent care centers, mobile testing sites, and assisted nursing care centers.

Point-of-care testing mode segment is likely to register fastest CAGR during the study period. There is an urgent need for POC detection technologies that allow for decentralized, quick, accurate, and affordable diagnosis of COVID-19 infection. The field of COVID-19 POC diagnostics is quickly developing as a result of numerous technologies receiving commercialization approval in recent years. The first point-of-care diagnostic test for COVID-19 was approved by the U.S. FDA in March 2020 under EUA. Furthermore, several key market players are working on developing new products to achieve a significant market presence. For instance, in May 2022, LumiraDx announced that it has received a CE mark for its SARS-CoV-2 Ag Ultra test, which could provide results within 5 minutes.

End Use Insights

The laboratories end use segment dominated the market in 2023. The growth of segment is driven by various factors, including the increasing number of laboratories providing high-throughput technologies has significantly accelerated the efficiency of COVID-19 testing. For instance, in June 2020, the Indian Institute of Technology, Hyderabad, which, introduced an artificial intelligence-powered COVID-19 test designed to deliver fast and affordable testing solutions.

The diagnostic centers and clinics segment is expected to register a significant growth rate during the forecast period. According to NHS England, up to 20% of patients have hospital-acquired COVID-19 infection. This is encouraging many individuals to opt for diagnostics centers over hospitals for COVID-19 testing, which is a major factor contributing to revenue generation for this segment. Thus, the need to eliminate the risk of acquiring COVID-19 in hospitals is boosting the growth of the diagnostic centers and clinics segment.

Regional Insights

North America region dominated the market with a share of over 33.3% in 2023. The market growth is anticipated to be positively influenced over the forecast period due to various factors, including the widespread occurrence of COVID-19 infections and a well-established research and development infrastructure. Furthermore, the market growth is expected to be driven by an increase in regulatory approvals and the introduction of new diagnostic test kits and devices, which will enhance the availability of innovative solutions. This is likely to fuel the market expansion during the forecast period. For instance, in December 2022, Btnx's Rapid Response COVID-19 Antigen Self-test Kit received approval from the Government of Canada.

Asia Pacific is estimated to register fastest growth in the global COVID-19 diagnostics market during the forecast period. The increasing pool of local diagnostic reagents & kits manufacturers providing testing solutions for COVID-19 detection contributed to revenue generation in the region. Furthermore, collaborations between countries are expected to boost the adoption of COVID-19 diagnostic products in the region. Along with this, many companies in the region have entered into partnerships with international companies for developing and manufacturing COVID-19 diagnostic tests. In May 2020, Duke-NUS Medical School from Singapore collaborated with Diagnostics Development Hub & GenScript Biotech for the developing as well as manufacturing a COVID-19 detection system. India witnessed rapid growth in the global COVID-19 diagnostics market. This can be attributed to increasing testing capacity by government and new entrants in the market. The country has been expanding its testing capability for COVID-19.

COVID-19 Diagnostics Market Share Insights

Some of the key players operating in market include Hologic Inc., Thermo Fisher Scientific, Inc., F. Hoffman-La Roche Ltd., Perkin Elmer, Inc., and Abbott Laboratories. These companies focus on expanding their service portfolios, development of novel technologies, and strategic partnerships to strengthen their market presence.

In the COVID-19 testing market, emerging players are strategically involved in activities to strengthen their positions. These include research and development for innovative testing solutions, collaborations with healthcare entities for expanded reach, and the diversification of testing capabilities. By adapting to evolving market demands and technological advancements, these players aim to contribute significantly to the ongoing efforts in combating the COVID-19 pandemic.

Key COVID-19 Diagnostics Companies:

- Hologic Inc.

- Thermo Fisher Scientific, Inc.

- F. Hoffman-La Roche Ltd.

- Perkin Elmer, Inc.

- Veredus Laboratories

- 1drop Inc.

- ADT Biotech Sdn Bhd

- Laboratory Corporation of America Holdings

- bioMérieux SA

- Danaher

- Mylab Discovery Solutions Pvt. Ltd.

- Neuberg Diagnostics

- ALDATU BIOSCIENCES

- Quidel Corporation

- Quest Diagnostics

- altona Diagnostics GmbH

- Luminex Corporation

- Abbott

Recent Developments

-

In June 2022, a PerkinElmer company, EUROIMMUN, introduced CE-marked assays: Anti-SARS-CoV-2 Omicron ELISA (IgG) and Anti-SARS-CoV-2 RBD ChLIA (IgG). Both test systems detect IgG antibodies and are available in nations that accept the CE mark.

-

In May 2022, Neuberg declared that it plans to double its labs and touchpoints over the next two years. This initiative is expected to expand the company’s capacity in lab testing.

-

In November 2021, Thermo Fisher Scientific, Inc. confirmed that its PCR kit, TaqPath COVID-19 CE-IVD RT-PCR Kit, and TaqPath COVID-19 Combo Kit can detect the Omicron variant. This confirmation was expected positively impacted the company’s growth.

COVID-19 Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 20.31 billion

Revenue forecast in 2030

USD 6.25 billion

Growth Rate

CAGR of -21.2% from 2024 to 2030

Actual Years

2020 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

product & service, sample type, test type, mode, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; Sweden; Denmark; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hologic Inc.; Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Perkin Elmer, Inc.; Veredus Laboratories; 1drop Inc.; ADT Biotech SdnBhd; Laboratory Corporation of America Holdings; bioMérieux SA; Danaher; Mylab Discovery Solutions Pvt. Ltd.; Neuberg Diagnostics; ALDATU BIOSCIENCES; Quidel Corporation; Quest Diagnostics; altona Diagnostics GmbH; Luminex Corporation; Abbott

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global COVID-19 Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2020 to 2030. For the purpose of this report, Grand View Research has segmented the global COVID-19 diagnostics market on the basis of product & service, sample type, test type, mode, end-use, and region.

-

Product & Service Outlook (Revenue, USD Million, 2020 - 2030)

-

Instruments

-

Reagents & Kits

-

Services

-

-

Sample Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Nasopharyngeal (NP) swabs

-

Oropharyngeal (OP) swabs

-

Nasal swabs

-

Blood

-

Others

-

-

Test Type Outlook (Revenue, USD Million, 2020 - 2030)

-

Molecular (PCR) Testing

-

Antigen-based Testing

-

Antibody (Serology) Testing

-

Others

-

-

Mode Outlook (Revenue, USD Million, 2020 - 2030)

-

Point-of-Care (PoC)

-

Non-Point-of-Care (Non-PoC)

-

-

End-use Outlook (Revenue, USD Million, 2020 - 2030)

-

Laboratories

-

Hospitals

-

Diagnostic Centers and Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2020 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global COVID-19 diagnostics market is expected to grow at a compound annual growth rate of -21.2% from 2024 to 2030 to reach USD 6.25 billion by 2030.

b. The oropharyngeal & nasopharyngeal swabs segment is anticipated to lead the COVID-19 diagnostics market in 2023. This is attributable to the fact that nasopharyngeal swabs are the preferred choice for sample collection as recommended by the CDC.

b. Some key players in the COVID-19 diagnostics market are Thermo Fisher Scientific, Inc.; F. Hoffman-La Roche Ltd.; Perkin Elmer, Inc.; Neuberg Diagnostics; 1drop Inc.; Veredus Laboratories; ADT Biotech Sdn Bhd; altona Diagnostics GmbH; bioMérieux SA; Danaher; Mylab Discovery Solutions Pvt Ltd.; ALDATU BIOSCIENCES, and others.

b. Key factors driving the COVID-19 diagnostics market include the development of portable or an on-site diagnostic test for real-time management, robust WHO recommendations to make COVID-19 diagnostic testing a top priority, and integration of novel technologies & software solutions.

b. The global COVID-19 diagnostics market size is estimated at USD 33.03 billion in 2023 and is expected to reach USD 20.31 billion in 2024.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.2.1. Information Analysis

1.2.2. Market Formulation & Data Visualization

1.2.3. Data Validation & Publishing

1.3. Research Assumptions

1.4. Information Procurement

1.4.1. Primary Research

1.5. Information or Data Analysis

1.6. Market Formulation & Validation

1.7. Market Model

1.8. Global Market: CAGR Calculation

1.9. Objective

1.9.1. Objective 1

1.9.2. Objective2

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increase in the incidence of coronavirus globally

3.2.1.2. North America

3.2.1.3. Europe

3.2.1.4. Asia Pacific

3.2.1.5. Latin America

3.2.1.6. Middle East and Africa

3.2.1.7. Increasing product approvals by regulatory agencies

3.2.1.8. Government initiatives toward mass testing

3.2.1.9. Paradigm shift toward POC testing

3.2.2. Market Restraint Analysis

3.2.2.1. Limited testing capacity

3.2.2.2. Low demand due to supply ratio of COVID-19 reagents

3.2.3. Market opportunity analysis

3.2.3.1. Potential emerging markets

3.2.3.2. Favorable reimbursement scenario

3.2.3.3. Increasing penetration of telehealth in the diagnosis of Covid-19

3.2.4. Market Challenge analysis

3.2.4.1. Challenges pertaining to COVID-19 testing in healthcare settings

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Diagnostics: Company Position Analysis

3.3.4. COVID-19 Diagnostics: Healthcare Spending and Funding Scenario in Different Countries

3.3.4.1. U.S.

3.3.4.2. China

3.3.4.3. Brazil

3.3.4.4. Germany

3.3.4.5. Others

3.3.5. Effect on Swabs Market

3.3.5.1. Production shortage for viral transport media

3.3.5.2. Companies leading the viral transport media market

3.3.5.3. COPAN Diagnostics

3.3.5.4. PURITAN MEDICAL PRODUCTS

3.3.5.5. Becton, Dickinson and Company (BD)

3.3.5.6. Thermo Fisher Scientific

3.3.5.7. Other emerging companies

3.3.6. Pricing Analysis

Chapter 4. Product & Service Business Analysis

4.1. Segment Dashboard

4.2. COVID-19 Diagnostics Market: Product & Service Movement Analysis, USD Million, 2023 & 2030

4.3. Reagents & Kits

4.3.1. Reagents & Kits Market, 2020 - 2030 (USD Million)

4.4. Instruments

4.4.1. Instruments Market, 2020 - 2030 (USD Million)

4.5. Services

4.5.1. Services Market, 2020 - 2030 (USD Million)

Chapter 5. Sample Type Business Analysis

5.1. Segment Dashboard

5.2. COVID-19 Diagnostics Market: Sample Type Movement Analysis, USD Million, 2023 & 2030

5.3. Nasopharyngeal (NP) Swabs

5.3.1. Nasopharyngeal (NP) Swabs Tests Market, 2020 - 2030 (USD Million)

5.4. Oropharyngeal (OP) Swabs

5.4.1. Oropharyngeal (OP) Swabs Market, 2020 - 2030 (USD Million)

5.5. Nasal Swabs

5.5.1. Nasal Swabs Market, 2020 - 2030 (USD Million)

5.6. Blood

5.6.1. Blood Market, 2020 - 2030 (USD Million)

5.7. Others

5.7.1. Others Market, 2020 - 2030 (USD Million)

Chapter 6. Test Type Business Analysis

6.1. Segment Dashboard

6.2. COVID-19 Diagnostics Market: Test Type Movement Analysis, USD Million, 2023 & 2030

6.3. Molecular (PCR) Testing

6.3.1. Molecular (PCR) Testing Market, 2020 - 2030 (USD Million)

6.4. Antigen-based Testing

6.4.1. Antigen-based Testing Market, 2020 - 2030 (USD Million)

6.5. Antibody (Serology) Testing

6.5.1. Antibody (Serology) Testing Market, 2020 - 2030 (USD Million)

6.6. Others

6.6.1. Others Market, 2020 - 2030 (USD Million)

Chapter 7. Mode Business Analysis

7.1. Segment Dashboard

7.2. COVID-19 Diagnostics Market: Mode Movement Analysis, USD Million, 2023 & 2030

7.3. Point-of-Care (PoC) Testing

7.3.1. Point-of-Care (PoC) Testing Market, 2020 - 2030 (USD Million)

7.4. Non-Point-of-Care (Non-PoC) Testing

7.4.1. Non-Point-of-Care (Non-PoC) Testing Market, 2020 - 2030 (USD Million)

Chapter 8. End-use Business Analysis

8.1. Segment Dashboard

8.2. COVID-19 Diagnostics Market: End-use Movement Analysis, USD Million, 2023 & 2030

8.3. Laboratories

8.3.1. Laboratories Market, 2020 - 2030 (USD Million)

8.4. Hospitals

8.4.1. Hospitals Market, 2020 - 2030 (USD Million)

8.5. Diagnostic Centers and Clinics

8.5.1. Diagnostic Centers and Clinics Market, 2020 - 2030 (USD Million)

8.6. Others

8.6.1. Others Market, 2020 - 2030 (USD Million)

Chapter 9. Regional Business Analysis

9.1. COVID-19 Diagnostics Market Share By Region, 2023 & 2030

9.2. North America

9.2.1. SWOT Analysis

9.2.2. North America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.2.3. U.S.

9.2.3.1. Key Country Dynamics

9.2.3.2. Competitive Scenario

9.2.3.3. Regulatory Framework

9.2.3.4. U.S. COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.2.4. Canada

9.2.4.1. Key Country Dynamics

9.2.4.2. Competitive Scenario

9.2.4.3. Regulatory Framework

9.2.4.4. Canada COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3. Europe

9.3.1. SWOT Analysis

9.3.2. Europe COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.3. UK

9.3.3.1. Key Country Dynamics

9.3.3.2. Competitive Scenario

9.3.3.3. Regulatory Framework

9.3.3.4. UK COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.4. Germany

9.3.4.1. Key Country Dynamics

9.3.4.2. Competitive Scenario

9.3.4.3. Regulatory Framework

9.3.4.4. Germany COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.5. France

9.3.5.1. Key Country Dynamics

9.3.5.2. Competitive Scenario

9.3.5.3. Regulatory Framework

9.3.5.4. France COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.6. Italy

9.3.6.1. Key Country Dynamics

9.3.6.2. Competitive Scenario

9.3.6.3. Regulatory Framework

9.3.6.4. Italy COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.7. Spain

9.3.7.1. Key Country Dynamics

9.3.7.2. Competitive Scenario

9.3.7.3. Regulatory Framework

9.3.7.4. Spain COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.8. Sweden

9.3.8.1. Key Country Dynamics

9.3.8.2. Competitive Scenario

9.3.8.3. Regulatory Framework

9.3.8.4. Sweden COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.9. Norway

9.3.9.1. Key Country Dynamics

9.3.9.2. Competitive Scenario

9.3.9.3. Regulatory Framework

9.3.9.4. Norway COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.3.10. Denmark

9.3.10.1. Key Country Dynamics

9.3.10.2. Competitive Scenario

9.3.10.3. Regulatory Framework

9.3.10.4. Denmark COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4. Asia Pacific

9.4.1. SWOT Analysis

9.4.2. Asia Pacific COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.3. Japan

9.4.3.1. Key Country Dynamics

9.4.3.2. Competitive Scenario

9.4.3.3. Regulatory Framework

9.4.3.4. Japan COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.4. China

9.4.4.1. Key Country Dynamics

9.4.4.2. Competitive Scenario

9.4.4.3. Regulatory Framework

9.4.4.4. China COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.5. India

9.4.5.1. Key Country Dynamics

9.4.5.2. Competitive Scenario

9.4.5.3. Regulatory Framework

9.4.5.4. India COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.6. Australia

9.4.6.1. Key Country Dynamics

9.4.6.2. Competitive Scenario

9.4.6.3. Regulatory Framework

9.4.6.4. Australia COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.7. Thailand

9.4.7.1. Key Country Dynamics

9.4.7.2. Competitive Scenario

9.4.7.3. Regulatory Framework

9.4.7.4. Thailand COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.4.8. South Korea

9.4.8.1. Key Country Dynamics

9.4.8.2. Competitive Scenario

9.4.8.3. Regulatory Framework

9.4.8.4. South Korea COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.5. Latin America

9.5.1. SWOT Analysis

9.5.2. Latin America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.5.3. Brazil

9.5.3.1. Key Country Dynamics

9.5.3.2. Competitive Scenario

9.5.3.3. Regulatory Framework

9.5.3.4. Brazil COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.5.4. Mexico

9.5.4.1. Key Country Dynamics

9.5.4.2. Competitive Scenario

9.5.4.3. Regulatory Framework

9.5.4.4. Mexico COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.5.5. Argentina

9.5.5.1. Key Country Dynamics

9.5.5.2. Competitive Scenario

9.5.5.3. Regulatory Framework

9.5.5.4. Argentina COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.6. MEA

9.6.1. SWOT Analysis

9.6.2. MEA COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.6.3. South Africa

9.6.3.1. Key Country Dynamics

9.6.3.2. Competitive Scenario

9.6.3.3. Regulatory Framework

9.6.3.4. South Africa COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.6.4. Saudi Arabia

9.6.4.1. Key Country Dynamics

9.6.4.2. Competitive Scenario

9.6.4.3. Regulatory Framework

9.6.4.4. Saudi Arabia COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.6.5. UAE

9.6.5.1. Key Country Dynamics

9.6.5.2. Competitive Scenario

9.6.5.3. Regulatory Framework

9.6.5.4. UAE COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

9.6.6. Kuwait

9.6.6.1. Key Country Dynamics

9.6.6.2. Competitive Scenario

9.6.6.3. Regulatory Framework

9.6.6.4. Kuwait COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Chapter 10. Competitive Landscape

10.1. Company Categorization

10.2. Strategy Mapping

10.3. Company Market Share Analysis, 2023

10.4. Company Profiles/Listing

10.4.1. F. Hoffmann-La Roche AG

10.4.1.1. Overview

10.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.1.3. Product Benchmarking

10.4.1.4. Strategic Initiatives

10.4.2. Thermo Fisher Scientific, Inc.

10.4.2.1. Overview

10.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.2.3. Product Benchmarking

10.4.2.4. Strategic Initiatives

10.4.3. PerkinElmer, Inc.

10.4.3.1. Overview

10.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.3.3. Product Benchmarking

10.4.3.4. Strategic Initiatives

10.4.4. 1drop, Inc.

10.4.4.1. Overview

10.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.4.3. Product Benchmarking

10.4.4.4. Strategic Initiatives

10.4.5. Veredus Laboratories

10.4.5.1. Overview

10.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.5.3. Product Benchmarking

10.4.5.4. Strategic Initiatives

10.4.6. ADT Biotech SdnBhd

10.4.6.1. Overview

10.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.6.3. Product Benchmarking

10.4.6.4. Strategic Initiatives

10.4.7. altona Diagnostics GmbH

10.4.7.1. Overview

10.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.7.3. Product Benchmarking

10.4.7.4. Strategic Initiatives

10.4.8. bioMérieux SA

10.4.8.1. Overview

10.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.8.3. Product Benchmarking

10.4.8.4. Strategic Initiatives

10.4.9. Neuberg Diagnostics

10.4.9.1. Overview

10.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.9.3. Product Benchmarking

10.4.9.4. Strategic Initiatives

10.4.10. Abbott Laboratories

10.4.10.1. Overview

10.4.10.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.10.3. Product Benchmarking

10.4.10.4. Strategic Initiatives

10.4.11. Luminex Corporation

10.4.11.1. Overview

10.4.11.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.11.3. Product Benchmarking

10.4.11.4. Strategic Initiatives

10.4.12. Laboratory Corporation of America Holdings

10.4.12.1. Overview

10.4.12.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.12.3. Product Benchmarking

10.4.12.4. Strategic Initiatives

10.4.13. Hologic Inc.

10.4.13.1. Overview

10.4.13.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.13.3. Product Benchmarking

10.4.13.4. Strategic Initiatives

10.4.14. Quest Diagnostics, Inc.

10.4.14.1. Overview

10.4.14.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.14.3. Product Benchmarking

10.4.14.4. Strategic Initiatives

10.4.15. Quidel Corporation

10.4.15.1. Overview

10.4.15.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.15.3. Product Benchmarking

10.4.15.4. Strategic Initiatives

10.4.16. ALDATU BIOSCIENCES

10.4.16.1. Overview

10.4.16.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.16.3. Product Benchmarking

10.4.16.4. Strategic Initiatives

10.4.17. Mylab Discovery Solutions Pvt. Ltd.

10.4.17.1. Overview

10.4.17.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.17.3. Product Benchmarking

10.4.17.4. Strategic Initiatives

10.4.18. Danaher Corporation

10.4.18.1. Overview

10.4.18.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.18.3. Product Benchmarking

10.4.18.4. Strategic Initiatives

10.4.19. Cepheid

10.4.19.1. Overview

10.4.19.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.19.3. Product Benchmarking

10.4.19.4. Strategic Initiatives

10.4.20. Beckman Coulter, Inc.

10.4.20.1. Overview

10.4.20.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

10.4.20.3. Product Benchmarking

10.4.20.4. Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviation

Table 3 Incidence rate of COVID-19 in North America

Table 4 Incidence rate of COVID-19 in Europe

Table 5 Incidence rate of COVID-19 in Asia Pacific

Table 6 Incidence rate of COVID-19 in Latin America

Table 7 Incidence rate of COVID-19 in Middle East and Africa

Table 8 Specimen collection and storage for COVID-19 testing

Table 9 Different COVID-19 diagnostic tests based on different technologies

Table 10 Global COVID-19 Diagnostics Market, By region, 2020 - 2030 (USD Million)

Table 11 Global COVID-19 Diagnostics Market, By product & service, 2020 - 2030 (USD Million)

Table 12 Global COVID-19 Diagnostics Market, By sample type, 2020 - 2030 (USD Million)

Table 13 Global COVID-19 Diagnostics Market, By test type, 2020 - 2030 (USD Million)

Table 14 Global COVID-19 Diagnostics Market, By mode, 2020 - 2030 (USD Million)

Table 15 Global COVID-19 Diagnostics Market, By end use, 2020 - 2030 (USD Million)

Table 16 North America COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 17 North America COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 18 North America COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 19 North America COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 20 North America COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 21 U.S. COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 22 U.S. COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 23 U.S. COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 24 U.S. COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 25 U.S.. COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 26 Canada COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 27 Canada COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 28 Canada COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 29 Canada COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 30 Canada COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million).

Table 31 Europe America COVID-19 Diagnostics Market, by country, 2020-2030, (USD Million)

Table 32 Europe COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 33 Europe COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 34 Europe COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 35 Europe COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 36 Europe COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million))

Table 37 U.K. COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 38 U.K. COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 39 U.K. COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 40 U.K. COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 41 U.K. COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 42 Germany COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 43 Germany COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 44 Germany COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 45 Germany COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 46 Germany COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 47 France COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 48 France COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 49 France COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 50 France COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 51 France COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 52 Italy COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 53 Italy COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 54 Italy COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 55 Italy COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 56 Italy COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 57 Spain COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 58 Spain COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 59 Spain COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 60 Spain COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 61 Spain COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 62 Sweden COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 63 Sweden COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 64 Sweden COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 65 Sweden COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 66 Sweden COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 67 Norway COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 68 Norway COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 69 Norway COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 70 Norway COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 71 Norway COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 72 Denmark COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 73 Denmark COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 74 Denmark COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 75 Denmark COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 76 Denmark COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 77 Asia Pacific America COVID-19 Diagnostics Market, by country, 2020-2030, (USD Million)

Table 78 Asia Pacific COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 79 Asia Pacific COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 80 Asia Pacific COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 81 Asia Pacific COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 82 Asia Pacific COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 83 China COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 84 China COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 85 China COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 86 China COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 87 China COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 88 India COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 89 India COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 90 India COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 91 India COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 92 India COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 93 Japan COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 94 Japan COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 95 Japan COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 96 Japan COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 97 Japan COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 98 South Korea COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 99 South Korea COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 100 South Korea COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 101 South Korea COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 102 South Korea COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 103 Australia COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 104 Australia COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 105 Australia COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 106 Australia COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 107 Australia COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 108 Thailand COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 109 Thailand COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 110 Thailand COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 111 Thailand COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 112 Thailand COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 113 Latin America COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 114 Latin America COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 115 Latin America COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 116 Latin America COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 117 Latin America COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 118 Brazil COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 119 Brazil COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 120 Brazil COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 121 Brazil COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 122 Brazil COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 123 Mexico COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 124 Mexico COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 125 Mexico COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 126 Mexico COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 127 Mexico COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 128 Argentina COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 129 Argentina COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 130 Argentina COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 131 Argentina COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 132 Argentina COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 133 MEA COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 134 MEA COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 135 MEA COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 136 MEA COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 137 MEA COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 138 South Africa COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 139 South Africa COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 140 South Africa COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 141 South Africa COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 142 South Africa COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 143 Saudi Arabia COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 144 Saudi Arabia COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 145 Saudi Arabia COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 146 Saudi Arabia COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 147 Saudi Arabia COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 148 UAE COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 149 UAE COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 150 UAE COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 151 UAE COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 152 UAE COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

Table 153 Kuwait COVID-19 diagnostics market estimates and forecasts, by product & service, 2020 - 2030 (USD Million)

Table 154 Kuwait COVID-19 diagnostics market estimates and forecasts, by sample type, 2020 - 2030 (USD Million)

Table 155 Kuwait COVID-19 diagnostics market estimates and forecasts, by test type, 2020 - 2030 (USD Million)

Table 156 Kuwait COVID-19 diagnostics market estimates and forecasts, by mode, 2020 - 2030 (USD Million)

Table 157 Kuwait COVID-19 diagnostics market estimates and forecasts, by end-use, 2020 - 2030 (USD Million)

List of Figures

Fig. 1 Market Research Process

Fig. 2 Information Procurement

Fig. 3 Primary Research Pattern

Fig. 4 Market Research Approaches

Fig. 5 Value Chain-Based Sizing & Forecasting

Fig. 6 Market Formulation & Validation

Fig. 7 COVID-19 Diagnostics Market Segmentation

Fig. 8 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 9 Distribution of cases, as of 16th July 2020

Fig. 10 Distribution of cases, as of 4th June 2020

Fig. 11 Total number of cases in North America (1st March 2020-1st June 2020)

Fig. 12 Total number of cases in Europe (1st March 2020-1st June 2020)

Fig. 13 Total number of cases in Asia Pacific (excluding Oceania) (1st March 2020-1st June 2020)

Fig. 14 Total number of cases in Latin American countries (1st March 2020-1st June 2020)

Fig. 15 Total number of cases in South Africa (1st March 2020-1st June 2020)

Fig. 16 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 17 Company Position Analysis

Fig. 18 Healthcare expenditure in China, 2018-2023

Fig. 19 Healthcare expenditure in Brazil, 2018-2023

Fig. 20 Market Opportunity Relevance Analysis (Current & Future Impact)

Fig. 21 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 22 Penetration & Growth Prospect Mapping

Fig. 23 Swot Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 24 Porter’s Five Forces Analysis

Fig. 25 COVID-19 diagnostics market: Product & service outlook and key takeaways

Fig. 26 COVID-19 diagnostics market: Product & service movement analysis

Fig. 27 Global COVID-19 diagnostics reagents & kits market, 2020 - 2030 (USD Million)

Fig. 28 Global COVID-19 diagnostics instruments market, 2020 - 2030 (USD Million)

Fig. 29 Global COVID-19 diagnostic services market, 2020 - 2030 (USD Million)

Fig. 30 COVID-19 diagnostics market: Sample type outlook and key takeaways

Fig. 31 COVID-19 diagnostics market: Sample type movement analysis

Fig. 32 Global COVID-19 diagnostics nasopharyngeal swabs market, 2020 - 2030 (USD Million)

Fig. 33 Global COVID-19 diagnostics oropharyngeal swabs market, 2020 - 2030 (USD Million)

Fig. 34 Global COVID-19 diagnostics nasal swabs market, 2020 - 2030 (USD Million)

Fig. 35 Global COVID-19 diagnostics blood market, 2020 - 2030 (USD Million)

Fig. 36 Global COVID-19 diagnostics other samples market, 2020 - 2030 (USD Million)

Fig. 37 COVID-19 diagnostics market: Test type outlook and key takeaways

Fig. 38 COVID-19 diagnostics market: Test type movement analysis

Fig. 39 Global COVID-19 molecular (PCR) testing market, 2020 - 2030 (USD Million)

Fig. 40 Global COVID-19 antigen-based testing market, 2020 - 2030 (USD Million)

Fig. 41 Global COVID-19 antibody (Serology) testing market, 2020 - 2030 (USD Million)

Fig. 42 Global COVID-19 diagnostics other tests market, 2020 - 2030 (USD Million)

Fig. 43 COVID-19 diagnostics market: Mode outlook and key takeaways

Fig. 44 COVID-19 diagnostics market: Mode movement analysis

Fig. 45 Global COVID-19 Point-of-Care (PoC) testing market, 2020 - 2030 (USD Million)

Fig. 46 Global COVID-19 non-Point-of-Care (Non-PoC) testing market, 2020 - 2030 (USD Million)

Fig. 47 COVID-19 diagnostics market: End-use outlook and key takeaways

Fig. 48 COVID-19 diagnostics market: End-use movement analysis

Fig. 49 Global laboratories-based COVID-19 diagnostics market, 2020 - 2030 (USD Million)

Fig. 50 Global hospitals-based COVID-19 diagnostics market, 2020 - 2030 (USD Million)

Fig. 51 Global diagnostic centers and clinics-based COVID-19 diagnostics market, 2020 - 2030 (USD Million)

Fig. 52 Global other end-uses-based COVID-19 diagnostics market, 2020 - 2030 (USD Million)

Fig. 53 Regional Marketplace: Key Takeaways

Fig. 54 Regional Outlook, 2023 & 2030

Fig. 55 Regional Market Dashboard

Fig. 56 Regional Market Place: Key Takeaways

Fig. 57 North America

Fig. 58 North America COVID-19 Diagnostics Market Estimates and Forecast, 2020 - 2030 (USD Million)

Fig. 59 U.S. Key Country Dynamics

Fig. 60 U.S. COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 61 Canada Key Country Dynamics

Fig. 62 Canada COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 63 Europe COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 64 UK Key Country Dynamics

Fig. 65 UK COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 66 Germany Key Country Dynamics

Fig. 67 Germany COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 68 France Key Country Dynamics

Fig. 69 France COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 70 Italy Key Country Dynamics

Fig. 71 Italy COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 72 Spain Key Country Dynamics

Fig. 73 Spain COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 74 Sweden Key Country Dynamics

Fig. 75 Sweden COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 76 Norway Key Country Dynamics

Fig. 77 Norway COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 78 Denmark Key Country Dynamics

Fig. 79 Denmark COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 80 Asia Pacific COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 81 Japan Key Country Dynamics

Fig. 82 Japan COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 83 China Key Country Dynamics

Fig. 84 China COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 85 India Key Country Dynamics

Fig. 86 India COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 87 Australia Key Country Dynamics

Fig. 88 Australia COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 89 Thailand Key Country Dynamics

Fig. 90 Thailand COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 91 South Korea Key Country Dynamics

Fig. 92 South Korea COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 93 Latin America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 94 Brazil Key Country Dynamics

Fig. 95 Brazil America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 96 Mexico Key Country Dynamics

Fig. 97 Mexico America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 98 Argentina Key Country Dynamics

Fig. 99 Argentina America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 100 Middle East and Africa America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 101 South Africa Key Country Dynamics

Fig. 102 South Africa America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 103 Saudi Arabia Key Country Dynamics

Fig. 104 Saudi Arabia America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 105 UAE Key Country Dynamics

Fig. 106 UAE America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 107 Kuwait Key Country Dynamics

Fig. 108 Kuwait America COVID-19 Diagnostics Market, 2020 - 2030 (USD Million)

Fig. 109 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- COVID-19 Diagnostics Product & Service Outlook (Revenue, USD Million, 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- COVID-19 Diagnostics Sample Type Outlook (Revenue, USD Million, 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- COVID-19 Diagnostics Test Type Outlook (Revenue, USD Million, 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- COVID-19 Diagnostics Mode Outlook (Revenue, USD Million, 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- COVID-19 Diagnostics End-use Outlook (Revenue, USD Million, 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- COVID-19 Diagnostics Market: Regional Outlook (Revenue, USD Million, 2020-2030)

- North America

- North America COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- North America COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- North America COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- North America COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- North America COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- U.S.

- U.S. COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- U.S. COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- U.S. COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- U.S. COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- U.S. COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- U.S. COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Canada

- Canada COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Canada COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Canada COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Canada COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Canada COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Canada COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- North America COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Europe

- Europe COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Europe COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Europe COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Europe COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Europe COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- UK

- UK COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- UK COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- UK COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- UK COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- UK COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- UK COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Germany

- Germany COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Germany COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Germany COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Germany COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Germany COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Germany COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- France

- France COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- France COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- France COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- France COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- France COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- France COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Italy

- Italy COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Italy COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Italy COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Italy COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Italy COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Italy COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Spain

- Spain COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Spain COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Spain COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Spain COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Spain COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Spain COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Sweden

- Sweden COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Sweden COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Sweden COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Sweden COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Sweden COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Sweden COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Norway

- Norway COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Norway COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Norway COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Norway COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Norway COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Norway COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Denmark

- Denmark COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Denmark COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Denmark COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Denmark COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Denmark COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Denmark COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Europe COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Asia Pacific

- Asia Pacific COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Asia Pacific COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Asia Pacific COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Asia Pacific COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Asia Pacific COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Japan

- Japan COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- Japan COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- Japan COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- Japan COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- Japan COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- Japan COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- China

- China COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- China COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- China COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- China COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- China COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- China COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- India

- India COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)

- Instruments

- Reagents & Kits

- Services

- India COVID-19 Diagnostics Market, by Sample Type (Revenue, USD Million; 2020 - 2030)

- Nasopharyngeal (NP) swabs

- Oropharyngeal (OP) swabs

- Nasal swabs

- Blood

- Others

- India COVID-19 Diagnostics Market, by Test Type (Revenue, USD Million; 2020 - 2030)

- Molecular (PCR) Testing

- Antigen-based Testing

- Antibody (Serology) Testing

- Others

- India COVID-19 Diagnostics Market, by Mode (Revenue, USD Million; 2020 - 2030)

- Point-of-Care (PoC)

- Non-Point-of-Care (Non-PoC)

- India COVID-19 Diagnostics Market, by End Use (Revenue, USD Million; 2020 - 2030)

- Laboratories

- Hospitals

- Diagnostic Centers and Clinics

- Others

- India COVID-19 Diagnostics Market, by Product & Service (Revenue, USD Million; 2020 - 2030)