- Home

- »

- Communications Infrastructure

- »

-

Coworking Spaces Market Size, Share, Growth Report, 2030GVR Report cover

![Coworking Spaces Market Size, Share & Trends Report]()

Coworking Spaces Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Corporate /Professional), By Application, By Industry Vertical, By Region And Segment Forecasts

- Report ID: GVR-4-68040-164-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Coworking Spaces Market Summary

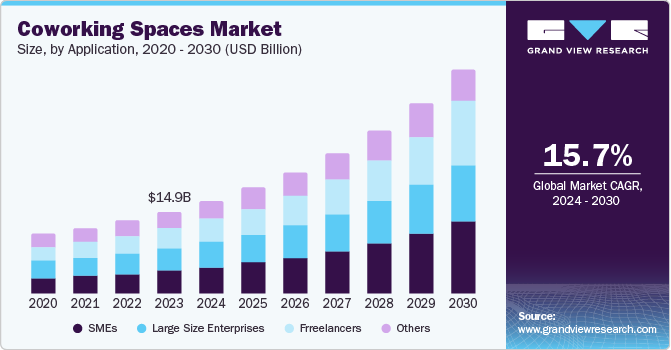

The global coworking spaces market size was estimated at USD 14.91 billion in 2023 and is projected to reach USD 40.47 billion by 2030, growing at a CAGR of 15.7%% from 2024 to 2030. Coworking spaces are gaining significant growth due to technological improvements and the expansion of the freelance economy.

Key Market Trends & Insights

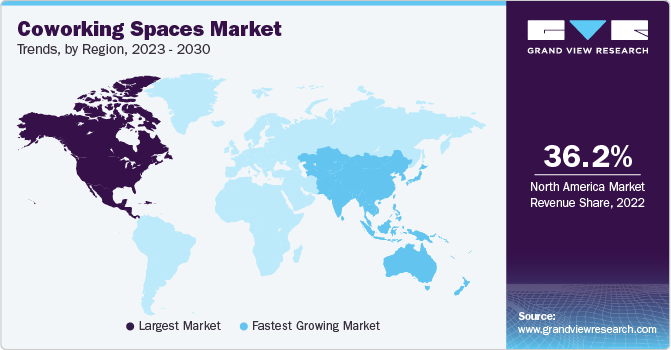

- North America dominated the global market for coworking spaces, accounting for 34.6% in 2023.

- The U.S. coworking spaces market held the regional industry's largest revenue share, accounting for 68.0% in 2023.

- By type, the corporate /professional segment dominated the global industry for coworking spaces and accounted for a revenue share of 27.6% in 2023.

- By application, the SMEs segment held the largest coworking spaces market revenue share in 2023.

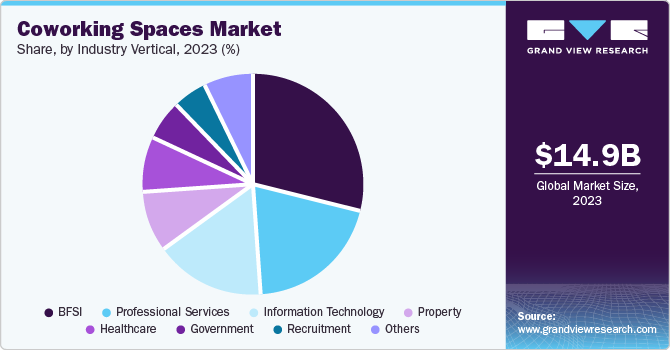

- By industry vertical, the BFSI segment dominated the global coworking spaces market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 14.91 Billion

- 2030 Projected Market Size: USD 40.47 Billion

- CAGR (2024-2030): 15.7%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

This tendency affects the real estate sector, including landlords, developers, and real estate brokers, as well as how individuals interact and collaborate. Tenants are in greater competition than ever, and many are looking to the coworking concept and business model as an appealing, cost-effective, and adaptable replacement for traditional office space.

The traditional lease and rental office premises have radically transformed with coworking spaces' emergence. Landlords and service providers are capitalizing on the coworking concept to present a more appealing, flexible, and cost-effective alternative to traditional office space as the market for office space rents gets more competitive. The rise of remote work, a burgeoning startup culture, and a growing need for flexible office spaces augment market growth. The number of people working from home or remotely, as well as the creation of sustainable coworking spaces, are the key reasons driving the expansion of the market.

Furthermore, the growing number of freelancers and entrepreneurs is a major driver of the coworking spaces industry. Coworking revolves around communication and connectivity. Managing coworking spaces enables you to connect with nearby companies and financiers. This raises the bar for membership plans and service quality. Effective teamwork and investment generate more revenue, add value for members, and generate new leads. Collaborations frequently prove to be cost-effective tactics that boost revenue as well.

Type Insights

The corporate /professional segment dominated the global industry for coworking spaces and accounted for a revenue share of 27.6% in 2023. Corporate and professional spaces offer dedicated desks, private offices, meeting rooms, top-notch furniture, cutting-edge technology, and other amenities to suit the needs of professionals and established businesses seeking a structured work environment. These spaces offer a more structured environment for companies that need privacy and confidentiality, making them perfect for focus-driven settings such as those required by legal firms or financial consultants. Enhanced productivity is among the principal advantages of business coworking spaces. Compared to traditional workplaces, collaborative workspaces encourage more inventive and creative surroundings, which boosts productivity. Workers can use shared resources that are only sometimes available in conventional office locations, such as equipment and conference rooms. Coworking environments provide more flexibility, which raises employee satisfaction and retention rates.

The open/ conventional coworking spaces segment is expected to experience the fastest CAGR during the forecast period. Open coworking spaces provide a flexible setting that promotes networking among professionals, freelancers, entrepreneurs, and small businesses. Common features of these workspaces include open floor plans with shared workstations or tables next to lounges or cafeterias. Conventional office owners are incorporating coworking spaces into their developments through partnerships with well-known coworking space providers or by entering the market and starting their brand.

Application Insights

The SMEs segment held the largest coworking spaces market revenue share in 2023. The rise of coworking spaces coincides with the arrival of millennials into the labor force. People beginning their enterprises, launching startups, and combining smaller firms needed a suitable yet affordable workplace to collaborate, team up, and work. Coworking spaces can check all these boxes and more. The benefit of renting a shared workplace is that employees can rent desk space for as long or as little as they require. Workers can use shared workspaces on their terms, while businesses save money on commercial leases. Because SMEs are not tied down to office space, with leased offices, their office can also expand.

The freelancers segment is projected to experience significant growth from 2024 to 2030. This is attributed to changing company resource management preferences, a large number of freelancers seeking services such as established infrastructure supported by interrupted high-speed internet connection and increasing engagement of businesses with individual professionals for IT, data, networking, and infrastructure-related projects.

Industry Vertical Insights

The BFSI segment dominated the global coworking spaces market in 2023. For example, the Royal Bank of Scotland, a prominent organization in the BFSI industry, has chosen coworking space. Some of the banks' employees use the workspaces at Edinburgh's Square, in a specially designed open-plan working space. It is designed for entrepreneurs, startups, freelancers, other professionals, and RBS employees. Similarly, in May 2024, Santander Holdings USA, Inc. announced an addition to its Work Café coworking space and bank locations. It unveiled its location in Miami, Florida, 3036 Grand Avenue, in the heart of Coconut Grove. [KA1] The adoption of modern customer experience enhancement strategies, the embracement of advanced technology assistance, and the availability of secured devices and connections supported by cutting-edge technology are expected to generate greater demand in this market.

The information technology segment is expected to hold a significant CAGR over the forecast period. Coworking spaces provide flexible terms and procedures that enable IT firms to scale their operations as needed. They allow for easy office space expansion and contraction as projects and team sizes change, making them ideal for IT firms with dynamic and evolving needs. Coworking spaces offer a cost-effective option by allowing IT firms to share the costs of facilities and amenities such as conference rooms, high-speed internet, and common areas with other businesses. This reduces overhead expenses and allows IT firms to devote more resources to key business activities.

Regional Insights

North America dominated the global market for coworking spaces, accounting for 34.6% in 2023. The region has a large number of coworking spaces. The growing acceptance of flexible work techniques, service offices, and remote teams is driving the demand for coworking spaces, with the presence of coworking behemoths like WeWork and Regus. Freelancers, startups searching for well-managed working spaces, and larger organizations seeking to develop their businesses in a controlled and cost-effective manner drive expansion for this market.

U.S. Coworking Spaces Market Trends

The U.S. coworking spaces market held the regional industry's largest revenue share, accounting for 68.0% in 2023. This market is primarily driven by factors such as technology startups' increasing demand for enhanced infrastructure and coworking environments, the effective implementation of modern technologies enabling remote working, and businesses seeking to reduce operational costs.

Europe Coworking Spaces Market Trends

Europe is identified as a significant region for the global coworking spaces market in 2023. It is attributed to factors such as the large number of startups in the area, the presence of multiple companies providing flexible coworking spaces, increasing advancements in technology capabilities and digital transformations leading to a rise in remote working roles, and the availability of numerous services such as internet accessibility, meeting rooms, team suits, and more.

Asia Pacific Coworking Spaces Market Trends

Asia Pacific coworking spaces market is expected to experience the fastest CAGR from 2024 to 2030. This market is mainly influenced by the offshore offices of startups and SMEs operating in the information technology industry of North America, Europe, and other parts, the growing availability of coworking spaces in countries such as India, China, and others, rapid rate of digitization in the region, and infrastructural enhancements in the multiple economies.

India coworking spaces market held a significant revenue share of the regional industry in 2023. This is attributed to the rising availability and accessibility of the Internet, the rapid pace of developments and improvements in infrastructure capabilities, the increasing number of new entrants offering competitive services, and the large number of startups seeking cost-effective coworking spaces.

Key Coworking Spaces Company Insights

Some of the key companies involved in the global coworking spaces market include WeWork Companies Inc., The Executive Centre, Impact Hub GmbH, International Workplace Group plc and others. To address growing competition and increasing demand, companies in the market are adopting strategies such as technology advancements, enhanced digital footprint for effective customer engagements, portfolio expansions, service differentiations, and more.

-

WeWork Companies Inc., one of the prominent organizations in the coworking space industry, offers a wide range of services, including prepaid monthly memberships for global location access, pay-per-use services, on-demand day passes, WeWork labs, on-demand meeting rooms, and more.

-

International Workplace Group plc, a major market participant in office space and coworking business, offers products and services from office spaces to coworking spaces, virtual offices, and workplace recovery replacements. Its coworking portfolio provides shared amenities, stylish space, storage, dedicated desks, and access to coworking locations worldwide.

Key Coworking Spaces Companies:

The following are the leading companies in the coworking spaces market. These companies collectively hold the largest market share and dictate industry trends.

- WeWork

- International Workplace Group plc

- THE JUST GROUP

- The Work Project Management Pte Ltd.,

- The Executive Centre

- Servecorp

- THE GREAT ROOM

- Newmark

- Impact Hub GmbH

- Techspace Group Ltd.

Recent Developments

-

In March 2023, The Great Room, one of the key players in the coworking space market, launched its sixth coworking space offering in Singapore. This marks the latest addition to its portfolio of multiple spaces across significant locations such as Singapore, Bangkok, and Hong Kong.

Coworking Spaces Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.88 billion

Revenue Forecast in 2030

USD 40.47 billion

Growth rate

CAGR of 15.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

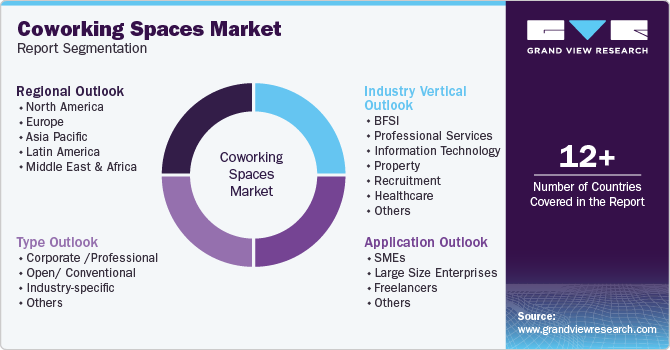

Segments Covered

Type, application, industry vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Japan,China, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE

Key companies profiled

WeWork; International Workplace Group plc; THE JUST GROUP; The Work Project Management Pte Ltd.; The Executive Centre; Servecorp; THE GREAT ROOM; Newmark; Impact Hub GmbH; Techspace Group Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Coworking Spaces Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the coworking spaces market report based on type, application, industry vertical, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate /Professional

-

Open/ Conventional

-

Industry-specific

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Size Enterprises

-

Freelancers

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Professional Services

-

Information Technology

-

Property

-

Recruitment

-

Healthcare

-

Government

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.