- Home

- »

- Alcohol & Tobacco

- »

-

Craft Beer Market Size, Share, Global Industry Trends Report, 2025GVR Report cover

![Craft Beer Market Size, Share & Trends Report]()

Craft Beer Market Size, Share & Trends Analysis Report By Type (Ale, Lager, Pilsner, Others (Sour, Fruit, and Specialty)), By Distributional Channel (On Trade, Off Trade), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-783-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Report Coverage

The global craft beer market size was valued at USD 92.18 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 10.0% from 2024 to 2030. The craft beer market is experiencing growth due to increasing demand for unique craft beer flavors, and rising interest in health-conscious options such as low-alcohol and non-alcoholic beers. Technological advancements in brewing techniques and supply chain management are resulting in better quality and more creative flavors, helping the market to grow further. The continuous increase in the range of flavors and designs attracts a wider audience, particularly adults. Adaptation of digital tools for marketing and distribution of beer is making a significant growth in national and international market.

The increasing awareness of the advantages of craft beer is propelling the market growth. The preferences of consumers are changing, as they are opting for low-alcohol-by-volume (ABV) beer, as these innovations in beers are allowing health-conscious consumers to enjoy beer without the high amount of alcohol content in it. Additionally, the income level of customers is rising allowing them to spend more on experiences rather than necessities.

Millennials and Gen Z are the most targeted customers of the craft beers market. Adults are legally allowed to drink and are the most inclined to consume craft beer. The generations show a greater interest in experimenting with new experiences and backing small, local brewing establishments are driving the market.

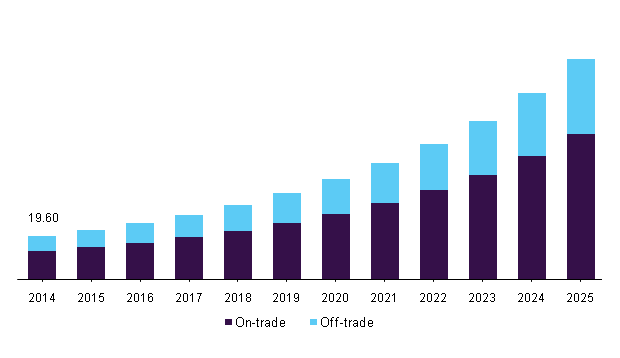

Distribution Channel Insights

The on trade segment dominated the market and accounted for a share of 57.4% in 2023. The on trade distribution channel includes clubs, pubs, bars, restaurants, hotels, and coffee shops. On trade channel provides a unique customer experience. The on-trade distributions of craft beer focus more on direct sales of beers and alcoholic beverages within the establishments. The beer sold through on trade channel is much costlier than that of offline channel distribution. Craft beer is gaining more popularity in hotels, and bars owing to the rising socializing trends in clubs and bars. These social venues are great places for celebrations, socializing, and relaxation which attracts large number of adults due to the dominance of on trade channel.

The off trade distribution channel such as liquor stores and supermarkets, has a more market reach and they serve a large consumer base. They also offer a broader selection of products. They provide convenience for customers to drink for future consumption. Off-trade channels are usually driven by consumer preferences.

Type Insights &Trends

The lager segment dominated the market with a significant revenue share in 2023. Lagers are known for being refreshing and crisp, they contain a lower alcohol content and are perfect for warm weather and causal occasional drinking. Craft brewers are making high quality lager using premium ingredients and advance brewing processes. Craft brewers are innovating and moving beyond their traditional lager by introducing unique ingredients, and flavors. This innovation appeals to a broader range of people. Additionally, lager can be produced throughout the year and easily transported anywhere without loss of taste, making it more convenient to use.

The ale segment is expected to grow at a significant CAGR over the forecast period. Ale is more of a traditional beer, consumed widely as it provides calories and vitamins and has some other nutritional properties. Ale has a wide variety of flavors as compared to other beers. Ale is a social drink, served at restaurants, pubs, and gatherings. It has a strong and bitter taste, which gives a traditional feel to its consumers; people drink it for its taste, social aspect, and some health benefits.

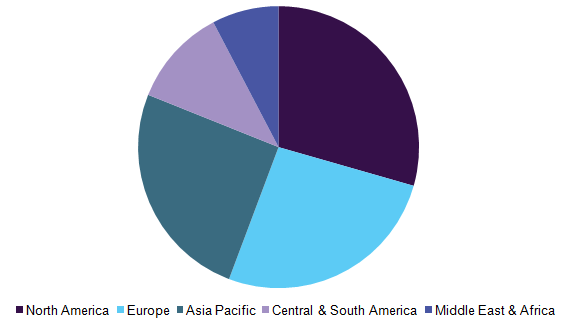

Regional Insights & Trends

Asia Pacific dominated the market with a revenue share of 31.9% in 2023. The younger generation in the Asia Pacific region is increasingly enjoying a wide variety of flavorful beers. Craft beers provide a greater selection of styles and ingredients, to cater to the changing taste preferences of the customers.

Craft brewers in the Asia-Pacific region are experimenting with different flavors and ingredients, drawing inspiration from local customs and meeting the demand for distinct experiences. Also, the international players recognize the potential of Asia Pacific region and set up industries in the region, further fueling the growth.

Europe Craft Beer Market Trends

The Europe craft beer market is anticipated to witness significant growth over the forecast period. Europe has a long and rich history in brewing, it establishes the brewing tradition in the world therefore the foundation for beer market is very strong in the region. The consumers have a strong appreciation of quality beer and are very receptive to innovation and variety craft brewers bring. Europe is a financially strong region, and millennials are willing to spend more on premium beers and the experience craft brewers offer. Europe has a strong foothold in the craft beer market and demands a wide variety of craft beers, which are some key reasons for the growth of the market

Key Companies & Market Share & Insights

Some of the key companies in the craft beer market include D.G. Yuengling and Son, Inc.; Pottsville; The Boston Beer Company; The Gambrinus Company; Lagunitas Brewing Company; Sierra Nevada Brewing Co. Market players in the industry are emphasizing more on innovation and exploring a variety of ingredients to produce distinct flavors. Craft beer companies majorly focus on packaging and innovative branding of their products to give a premium feel to their customers.

-

The Boston Beer Company is among the top beer companies in the U.S., with products available worldwide.

-

D.G. Yuengling and Son, Inc. Pottsville is America’s oldest brewery that manufactures beverages such as alcohol and beer. Its craft beers consist of light and premium beer, lager, light lager, and porter, along with seasonal offerings like bock.

Key Craft Beer Companies:

The following are the leading companies in the craft beer market. These companies collectively hold the largest market share and dictate industry trends.

- D.G. Yuengling and Son, Inc. Pottsville

- The Boston Beer Company

- The Gambrinus Company

- Lagunitas Brewing Company

- Sierra Nevada Brewing Co.

- New Belgium Brewing Company

- DeschutesBrewery

- Minhas Brewery

- Chimay Beers And Cheeses

- Omer Vander Ghinste

Recent Developments

-

In August 2024, Tilray Brands Inc. announced that it has entered into an agreement with Molson Coors Beverage Co. to acquire its 4 craft breweries including., Georgia-based Terrapin Beer Co., Oregon-based Hop Valley Brewing Co, Michigan-based Atwater Brewery, and Texas-based Revolver Brewing. This acquisition will bring the organization’s beverage footprint to 18 brands.

-

In April 2024, New Belgium Brewing, partnered with India’s Bira 91 to introduce Tamarind Chutney Dubbel. It is a unique and limited-release beer, crafted with specialty malts in Bengaluru, Delhi National Capital Region (NCR) in India.

- In February 2024, American Brew Crafts Pvt Ltd. (ABCL) announced the launch of a Belgian style craft beer, Flying Monkey, in Hyderabad. This new variant is expected to redefine the landscape in Hyderabad, adding adventurous dimension to the city’s beer culture.

- In August 2023, Lone Wolf expanded its portfolio and unveiled its 2 new beer variants Mavrick (100% malt lager) and Alpha (Belgium Wit bier) in an event of the launch of Ambiance Mall in New Delhi on July 30. Both the products are crafted with alcohol by volume of less than 5%.

Craft Beer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.73 billion

Revenue forecast in 2030

USD 178.57 billion

Growth Rate

CAGR of 10.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 – 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution Channel, Type, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South[IG5] Korea, Australia, Brazil, KSA, UAE, and South Africa

Key companies profiled

D.G. Yuengling and Son, Inc. Pottsville; The Boston Beer Company; The Gambrinus Company; Lagunitas Brewing Company; Sierra Nevada Brewing Co.; New Belgium Brewing Company; Deschutes Brewery; Minhas Brewery; Omer Vander Ghinste

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Craft Beer Market Report Segmentation

This report forecasts revenue & volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global craft beer market report based on type, distributional channel, and region:

-

Type Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

Ale

-

Lager

-

Pilsner

-

Others (Sour, fruit and specialty)

-

-

Distributional Channel Outlook (Volume, Million Liters; Revenue, USD Million, 2018 – 2030)

-

On Trade

-

Off Trade

-

-

Regional Outlook (Volume, Million Liters; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."