- Home

- »

- Alcohol & Tobacco

- »

-

Craft Rum Market Size And Share, Industry Report, 2030GVR Report cover

![Craft Rum Market Size, Share & Trends Report]()

Craft Rum Market (2025 - 2030) Size, Share & Trends Analysis Report By Distribution Channel (On-trade, Off-trade), By Region (North America, Europe, Asia Pacific, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-4-68039-200-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Craft Rum Market Size & Trends

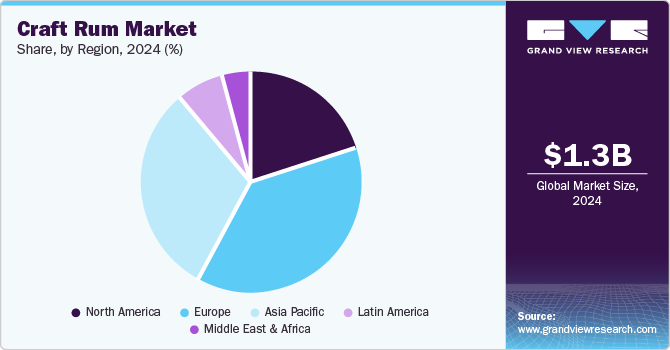

The global craft rum market size was valued at USD 1.35 billion in 2024 and is projected to grow at a CAGR of 5.9% from 2025 to 2030. The growing inclination of millennial consumers towards the authenticity and quality of ingredients used in alcoholic drinks has been the major driving factor for the craft spirits market, including craft rum. The consistently growing popularity of cocktail culture and the use of rum as a versatile spirit for making cocktails is also promoting the demand for craft rum. The introduction of craft rum in different flavors and product promotions through social media and print media are also positively impacting the craft rum industry at the global level.

Over the past two decades, the spirits industry has undergone significant changes, marked by increased alcohol consumption and a growing demand for high-quality spirits. Consumers worldwide are willing to pay more for high-quality products with a distinct taste and experience. Craft spirits, a unique niche, offer distinct flavors and stand apart from mass-produced liquors. Craft rum, typically made from high-quality molasses or sugarcane juice, is aged in various types of barrels to develop complex flavor profiles. The use of local ingredients, small-batch production, and a focus on sustainability are key factors driving the popularity of craft rum.

Consumers prefer craft rum over commercial rum due to its smooth taste, high quality, and authentic flavor. According to the Bacardi Global Brand Ambassador Survey 2022, 32% of bartenders expect to witness increased premiumization in aged rums over the coming years. Manufacturers have continuously improved their craftsmanship and quality to cater to evolving tastes. Distilleries such as Puget Sound Rum Company and Plank Road Distillery offer flavored craft rum, promoting their use in cocktails. Craft rum is a versatile spirit, serving as a base for various cocktail recipes. Industry professionals, including bartenders and sommeliers, frequently share craft rum cocktail recipes on social media, showcasing their skills and educating consumers about cocktail mixing. This has consistently boosted the demand for craft rum-based cocktails, ranging from simple to complex and premium mixes

As the craft rum industry grows, distilleries and liquor companies seek to innovate and shape the market. Major players are expanding their presence into new markets, driven by increasing global demand for craft rum from regions like the Caribbean, Latin America, and Asia. In response to growing consumer environmental consciousness, companies are prioritizing sustainability. Practices such as waste reduction, responsible packaging, and using renewable energy in distillation processes are becoming increasingly common. Additionally, distilleries are adopting advanced technologies like AI and IoT to optimize production processes and create unique, high-quality spirits.

Distribution Channel Insights

The on-trade segment dominated the market with more than 62.2% share of the global revenue in 2024. Bars, pubs, and restaurants are the key distribution channels of the product. Distilleries often introduce their unique and niche products at high-end bars and restaurants before launching them on other retail channels. These channels encourage consumers to try new products for direct consumption or in the form of cocktails and have been focusing on improving the cocktail experience. This boosts the sales of craft rum-based cocktails from the on-trade platform. Furthermore, willingness to try an innovative drink and luxury alcoholic beverages and share on social media are also driving the on-trade sales of the product. According to the Bacardi Consumer Survey 2022, six out of ten consumers believed that trying something new and different is important in choosing a cocktail at a bar, club, or restaurant.

The off-trade segment is expected to expand at the fastest CAGR of 6.1% from 2025 to 2030. The increasing availability of drinks in supermarkets, liquor shops, and online retail stores has fueled the growth of the off-trade segment. Post-COVID-19 pandemic, consumers are more inclined to buy their preferred spirit and enjoy it in the comfort of their homes. Recently, a surge in the cost of on-trade drinking has diverted some budget-sensitive consumers towards off-trade drinking. The consumption of specialty and high-quality spirits via ordering through online portals or consuming in the form of ready-to-drink has further boosted the growth of the off-trade segment within the craft spirit industry, including rum. Besides, the growing sense among consumers to support local breweries and distilleries further complements the growth of the craft rum industry. According to a survey conducted by LendingTree, 50% of shoppers in the U.S. are willing to spend more to support local businesses. Buyers also seek craft distilleries and local producers fueled by the stories and authenticity behind small-batch production.

Regional Insights

Europe craft rum market held the largest revenue share of more than 38.3% in 2024. The U.K., Germany, and France are the region's major markets. European consumers are some of the most aware consumers with respect to Rum’s diversity. The European rum market recovered relatively faster to register sales of 24.6 million cases in 2021. The sales grew by 6% to reach 26 million cases in 2022. Growing cocktail culture also positively impacts premium rum sales, including craft rum in the region. Furthermore, the increasing number of micro distillers producing craft spirits in Germany has been gaining traction over the years.

Italy craft rum market is projected to experience the fastest growth in the regional market over the forecast period. Italy is one of the largest rum exporters in the world. The country exported USD 226 million worth of rum globally in 2022, claiming 11.2% of the global market share. However, consumer in Italy consumes considerable amounts of premium rum. In 2022, Italy imported USD 125 million in Rum and tafia, majorly from the U.S., Venezuela, the Netherlands, and France, becoming the 6th largest importer of Rum and tafia in the world.

Asia Pacific Craft Rum Market Trends

Asia Pacific craft rum market is expected to expand at the fastest CAGR of 6.2% from 2025 to 2030. Several major countries, including Indonesia, India, Philippines, and Japan, have a rich history of regular and craft rum. These countries are undertaking serious innovation in distilling rums and are receiving acclamation for their flavors and fresh, tropical appeal.This has boosted the sales of craft rum in the region. The growing trend of the Tiki cocktail culture in Asian countries is also expected to fuel the product's consumption in the upcoming years.

India emerged as the dominant country in the regional craft rum market. The country has celebrated the history of consuming rum from its colonial era. Factors including rapid urbanization, increasing purchasing power, and growing pub and bar culture are the key factors boosting the growth of craft rum industry in the country. Additionally, the rise of craft cocktails and mixology among Gen Z and millennials is further encouraging the consumption of craft rum.

Key Craft Rum Company Insights

Some of the key companies operating in the global craft rum industry are Bacardi Limited, Suntory Holdings Limited, Diageo, Maine Craft Distilling, LLC, Charles Merser & Co., Drum & Black Rum Company, Wicked Dolphin Rum, Domaines Ellam and Arizona Craft Beverage, Rockstar Spirits Ltd., Belize Spirits Marketing, Inc. and others. The introduction of a new product is the key strategy adopted by almost all major players in the market. Additionally, the incorporation of advanced technologies, including AI, is further helping the distilleries to improve the quality of their products.

-

Bacardi Limited, a global leader in the spirits industry, has embraced the growing trend of craft rum. To capitalize on the increasing consumer demand for high-quality, artisanal spirits, Bacardi has invested in acquiring and developing craft rum brands.

Key Craft Rum Companies:

The following are the leading companies in the craft rum market. These companies collectively hold the largest market share and dictate industry trends.

- Bacardi Limited

- Suntory Holdings Limited

- Diageo

- Maine Craft Distilling, LLC

- Charles Merser & Co.

- Drum & Black Rum Company

- Wicked Dolphin Rum

- Domaines Ellam and Arizona Craft Beverage

- Rockstar Spirits Ltd.

- Belize Spirits Marketing, Inc.

Recent Developments

-

In September 2024, the Good Craft Co., a division of Diageo India, opened its first sensorial experience home in Bengaluru, India, named The Flavour Lab. The experience home was built to initiate a direct-to-consumer experiential ecosystem to promote craft spirit in India.

-

In June 2024, Tidal Rum, a premium craft rum brand in the U.K., achieved its goal of raising approximately USD 315 thousand through crowdfunding.

-

In January 2023, Diageo, a British liquor giant, announced the acquisition of Filipino rum brand Don Papa. Don Papa was founded in 2012 in the Philippines and made their rum in Negros Occidental using local sugarcane and aged in American oak barrels, which provided a rich taste and texture to the craft.

Craft Rum Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.42 billion

Revenue forecast in 2030

USD 1.89 billion

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, Brazil, Argentina, South Africa, UAE

Key companies profiled

Bacardi Limited, Suntory Holdings Limited, Diageo, Maine Craft Distilling, LLC, Charles Merser & Co., Drum & Black Rum Company, Wicked Dolphin Rum, Domaines Ellam and Arizona Craft Beverage, Rockstar Spirits Ltd., Belize Spirits Marketing, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Craft Rum Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global craft rum market report based on distribution channel, and region.

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-trade

-

Off-trade

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.