- Home

- »

- Consumer F&B

- »

-

Craft Soda Market Size, Share, Trends, Growth Report, 2030GVR Report cover

![Craft Soda Market Size, Share & Trends Report]()

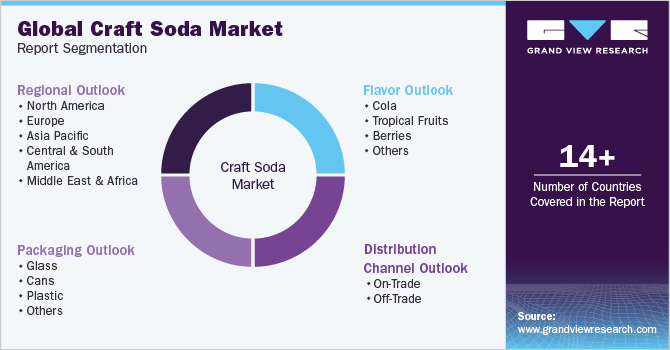

Craft Soda Market (2023 - 2030) Size, Share & Trends Analysis Report By Flavor (Cola, Tropical Fruits, Berries), By Packaging (Glass, Cans, Plastic), By Distribution Channel (On-trade, Off-trade), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-238-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Craft Soda Market Summary

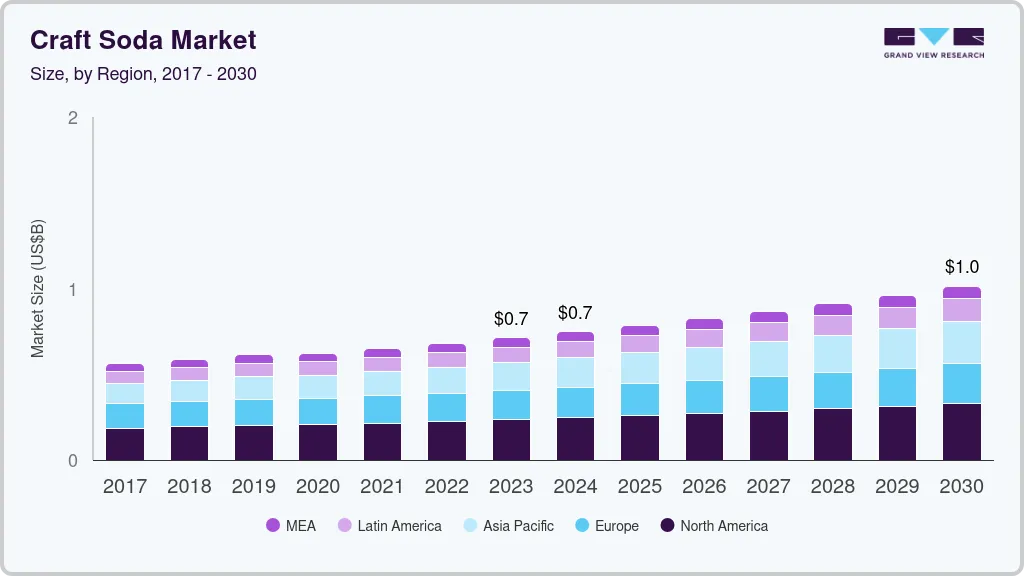

The global craft soda market size was valued at USD 681.7 million in 2022 and is projected to reach USD 1,011.8 million by 2030, growing at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. Craft sodas are increasingly viewed as a preferred substitute for conventional/traditional soft drinks and appeal to consumers who are seeking clean and healthier beverage options for consumption.

Key Market Trends & Insights

- North America emerged as the largest market in 2022 accounting for market share of 32.9%.

- Asia Pacific is expected to register the fastest CAGR during the forecast period.

- Based on flavor, the cola flavor led the market share in 2022 with a share of 50.0%.

- In terms of packaging, glass packaging led the market share in 2022 with a share of 55.1% and is expected to maintain its dominance in the coming years.

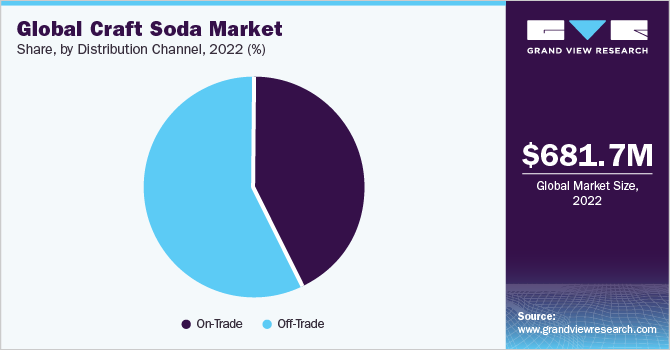

- Based on distribution channel, on-trade distribution channel captured 42.3% of the market share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 681.7 million

- 2030 Projected Market Size: USD 1,011.8 million

- CAGR (2023-2030): 5.1%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

This trend is expected to remain a prominent factor in augmenting the product demand throughout the forecast period. Furthermore, key companies have been amplifying their product portfolios by incorporating new and innovative products in the market, to gain maximum market share. An emerging trend of a healthier lifestyle and conscious eating habits during the COVID-19 pandemic has favored the growing demand and sales of craft sodas. Consumers are re-evaluating their diets by altering their choices to healthier products including beverages. Innovative product launches by brands and companies with innovative packaging were becoming popular among consumers during the pandemic.

For instance, in June 2020, Jones Soda Co., a premium craft beverage manufacturer, expanded its product portfolio with innovative descriptive packaging on its bottles during the COVID-19 pandemic, with the launch of limited-edition “Messages of Hope” cream soda labels featuring inspirational images created by consumers.

The demand for craft beverages containing natural sweeteners such as stevia, agave nectar, and honey is increasing owing to their low-calorie content. The market has witnessed key developments about new product launches containing natural sweeteners. Several brands have been capitalizing on such trends and offering healthier alternative beverages in the market. For instance, in September 2020, Sprecher Brewing-U.S.-based company launched its first zero sugar canned sodas available in flavors - Root Beer and Orange Dream. These products feature handcrafted natural ingredients-all-natural sweetener combination of monk fruit, stevia, and erythritol. Such innovations are likely to bode well with future market growth.

Additionally, increasing consumer inclination towards craft beverages infused with fruity flavors is expected to offer a plethora of lucrative opportunities to the market players and enable them to expand their product portfolio. As a result of constantly evolving consumer demand, key players are shuffling their marketing strategies and attract new customers. For instance, in June 2022, U.S.-based Utmost Brands, Inc., manufacturer of GuS - Grown-up Soda launched its new Mango Peach flavor at the Summer Fancy Food Show in New York City. The product is made of ripe mango puree, sweet peach juice, and a touch of cane sugar and is gluten-free, Kosher, and Non-GMO certified.

Consumers nowadays prefer craft beverages that are healthier and have less sugar. An increasing number of millennial consumers have been spending more on healthier products including beverages. Craft beverage is associated with higher quality natural ingredients and a quality experience, hence consumers are willing to pay more for it as a premium product. Innovative product launches and rising brand consciousness among consumers are expected to further augment product demand. For instance, in June 2021, Virgil's, a soda brand of Reed’s Inc. today launched three new Zero Sugar, Ketogenic Certified craft sodas: Grapefruit, Dr. Better and Ginger Ale.

Companies are focusing on strategic acquisitions to expand their presence and reinforce their positions in the market. In the near term, global market players are likely to acquire small- and medium-sized companies operating in the market in a bid to facilitate regional expansion. For instance, in October 2021, Sprecher Brewing Co.-Chicago, a U.S.-based brand, acquired Green River, WBC Craft Sodas, Caruso’s Italian Style Sodas, and Oak Creek Barrel Aged Root-beer from WIT Beverage company. The acquisition would further benefit the company to capture the majority of the U.S. market share and accelerate distribution, supply, and product development.

Flavor Insights

The cola flavor led the market share in 2022 with a share of 50.0%. The growth of the segment is driven by the rising demand for soda-infused soft beverages among the young generation and millennials. The cola flavor has a distinctive, original, and non-traditional taste that precisely meets consumer desire for original, innovative, and non-traditional soft drinks. Due to rising customer demand, product manufacturers are now producing different craft sodas with distinctive tastes and flavor. Many companies have begun to offer a healthier product range by switching from nutritive to organic non-nutritive sweeteners. In recent years, this has bolstered demand for cola-infused soda.

Tropical fruit flavors are estimated to register the fastest CAGR of 6.1% from 2023 to 2030 on account of the rising demand for fruit-flavored products among consumers. The global market has witnessed significant changes in terms of product advancements and services in recent years. To meet the market's expanding difficulties and dynamic consumer choices, businesses are introducing new tastes while keeping customers' health and well-being concerns in mind. Companies are focusing increasingly on product developments employing natural ingredients, such as stevia sweeteners, because of customer health awareness. This is expected to boost market growth in the coming years.

Packaging Insights

Glass packaging led the market share in 2022 with a share of 55.1%and is expected to maintain its dominance in the coming years. Glass bottles assist to preserve the carbon dioxide concentration in craft soda for a longer amount of time, guaranteeing that the flavor and quality of the product are not harmed. Glass bottles come with attractive packaging and are quite handy, resulting in consumer preference and comfort. Additionally, key companies operating in the market are launching new products with innovative packaging combining new arts and styles, and logos, thus attracting new consumers towards craft soda sold in glass bottle.

Cans are expected to grow at a CAGR of 5.0% over the forecast period on account of a rising focus on sustainable packaging and the emergence of additional small-scale independent brewers. This segment's market is also anticipated to be driven by the widespread availability and low costs of cans in grocery shops and mass merchandisers. Increased use of aluminum cans has resulted from a rise in worldwide beverage consumption combined with a spike in demand for sustainable packaging options. These cans can also be personalized in terms of colors and 3D printing, as well as embossed, to make them more attractive to buyers. This is expected to make constructive addition to the market growth.

Distribution Channel Insights

On-trade distribution channel captured 42.3% of the market share in 2022. The growth of the segment is driven by the rising consumption of such soda in pubs, restaurants, hotels, and nightclubs. According to a consumer survey conducted by The British Soft Drinks Association in 2020, consumers enjoy consuming craft sodas and other carbonated beverages at restaurants and hotels.

Since the consumption of such products at bars and cafés is mainly driven by consumer spending power, sustained increases in disposable personal income are predicted to strengthen the industry over the projection period. Many industrialized and developing nations are expected to see consistent economic development, resulting in more disposable incomes and, as a result, higher expenditure on services like bars and cafés. This is expected to contribute to market growth in the near future.

Off-trade consumption of craft soda is expected to register the fastest growth over the forecast period. Off-trade channel majorly consists of hypermarkets, supermarkets, convenience stores, grocery stores, e-commerce, and discount stores.

Some of the major retailers offering craft sodas include supermarkets such as Walmart, Carrefour, and Safeway, and are considered vital distribution channels for crafted beverage products to reach the end customers. Increasing product offerings through these channels is likely to bode well with segment growth. For instance, Amazon U.S. offers various craft soda brands including Great Value, Jones Soda, Boylan, Zenify, Dad’s Old Fashioned, and Reed’s.

Regional Insights

North America emerged as the largest market in 2022 accounting for market share of 32.9% and is also expected to maintain its dominance over the forecast period owing to an increase in the number of mainstream retailers, coupled with increasing health concerns, and shifting preferences toward healthy drinks. Increasing demand for a variety of craft sodas from these regions is anticipated to drive the regional market. A growing number of product launches and investments in packaging & labeling technology are expected to augment the demand for several types of crafted beverage products across the region. For instance, in June 2022, SkinTe-U.S. based brand, launched collagen-infused and mood-boosting sparkling wellness soda at 1,289 Walmart stores across the country, offering three of variants to consumers: Green Tea Grapefruit, White Tea Ginger, and Hibiscus Vanilla. Such innovative launches are likely to bode well with future regional growth.

On the other hand, Asia Pacific is expected to register the fastest CAGR during the forecast period. Increasing product penetration in developing countries such as India, Australia, and China is likely to bode well with regional growth. Many regional and international players are launching their products in developing countries with a larger population to generate greater revenue and increase the customer base for their products. For instance, SHUNYA Indian beverage brands offer a wide range of craft soda products available in flavors including Classic Cola, Lime, and Lemon.

Key Companies & Market Share Insights

Key players in this market face intense competition from each other as some of them are among the top manufacturers, distributors, and suppliers of craft soda in various flavors. These companies have large customer bases for their products in both, regional and international markets. Moreover, these market players have strong and vast distribution networks, which help them reach a larger customer base.

-

In June 2023, Jones Soda launched a limited-edition craft soda flavor in collaboration with Mary Jones.

-

In November 2021, Rock, Paper, Soda, a new craft soda brand launched at a pop-up food event at Yellow Cab Tavern in the U.S.

-

In January 2021, Jones Soda Co. launched its first mass-market variety of 12-packs, as well as a rotating series of special flavors that will change every six months.

-

In January 2020, Craft soda brand Soda Folk launched grape-flavored soda to its product range with naturally occurring sugars with no artificial colors.

Some of the prominent key players operating in global craft soda market include:

-

Jones Soda Co.

-

Appalachian Brewing Co.

-

Reed’s Inc.

-

PepsiCo, Inc.

-

The Original Craft Soda Company

-

The Coca-Cola Company

-

Crooked Beverage Co.

-

SIPP eco beverage co. Inc.

-

Boylan Bottling Co.

-

Wild Poppy Company

Craft Soda Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 714.2 million

Revenue forecast in 2030

USD 1,011.8 million

Growth rate

CAGR of 5.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

July 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, packaging, distribution channel, region

Regional scope

North America, Europe, Asia Pacific,Central & South America, Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; South Africa; Brazil

Key companies profiled

Jones Soda Co.; Appalachian Brewing Co.; Reed’s Inc.; PepsiCo, Inc.; The Original Craft Soda Company; The Coca-Cola Company; Crooked Beverage Co.; SIPP eco beverage co. Inc.; Boylan Bottling Co.; Wild Poppy Company

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Craft Soda Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global craft soda market report on the basis of flavor, packaging, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million; 2017 - 2030)

-

Cola

-

Tropical Fruits

-

Berries

-

Others

-

-

Packaging Outlook (Revenue, USD Million; 2017 - 2030)

-

Glass

-

Cans

-

Plastic

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

On-Trade

-

Off-Trade

-

-

Regional Outlook (Revenue, USD Million; 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global craft soda market size was estimated at USD 681.7 million in 2022 and is expected to reach USD 714.2 million in 2023.

b. The global craft soda market is expected to grow at a compound annual growth rate of 5.1% from 2023 to 2030 to reach USD 1,011.8 million by 2030.

b. North America region dominated the craft soda market with a share of more than 32% in 2022. A growing number of product launches is expected to augment the demand for several types of crafted soda products across the region.

b. Some of the key players in the craft soda market are Jones Soda Co.; Appalachian Brewing Co.; Reed’s Inc.; PepsiCo, Inc.; The Original Craft Soda Company; The Coca-Cola Company; Crooked Beverage Co.; SIPP eco beverage co. Inc.; Boylan Bottling Co.; and Wild Poppy Company

b. Key factors that are driving the craft soda market growth include an increased number of product launches in various flavors such as tropical fruits, cola, mixed, and bitter to gain maximum market share.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.