- Home

- »

- Medical Devices

- »

-

Cranial Clamps Market Size Report, 2030GVR Report cover

![Cranial Clamps Market Size, Share & Trends Report]()

Cranial Clamps Market Size, Share & Trends Analysis Report, By Application (Surgery, Imaging), By Patient (Adult, Pediatric), By End Use (Diagnostics Imaging Laboratories), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-079-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Report Overview

The global cranial clamps market size was valued at USD 277.1 million in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. The increasing incidence of Traumatic Brain Injuries (TBIs), Central Nervous System (CNS), and brain tumors has driven the market growth. According to a Centers for Disease Control and Prevention (CDC) estimate, there are approximately 586 hospitalizations and 190 deaths every day associated with traumatic brain injuries (TBIs).

During skull procedures using medical imaging technologies such as Computed Tomography (CT), Magnetic Resonance Imaging (MRI), and skull radiography, the head is stabilized using devices called cranial clamps. These are utilized in several operations, including those for aneurysms and neurodegenerative conditions, including epilepsy and Parkinson's disease.

Moreover, technological advancements in cranial clamps have significantly expedited market growth. Major companies have invested heavily in research and development to improve the precision and compatibility with other equipment. Innovations in cranial clamp design, such as developing radiolucent and sterilizable clamps, enhance surgical precision and patient safety. These advancements enable neurosurgeons to perform complex procedures more accurately, reducing the risk of complications and improving patient outcomes. In addition, the increasing preference for minimally invasive neurosurgical procedures has driven the demand for specialized cranial clamps that offer precise fixation and stability while minimizing tissue damage.

Furthermore, the growing healthcare infrastructure and increased healthcare spending in emerging economies have contributed to the market expansion. Governments and private sectors in these regions have invested heavily in healthcare facilities and advanced medical equipment, including cranial clamps. This investment is driven by the need to provide better healthcare services and improve patient care, fueling the demand for cranial stabilization devices.

Application Insights

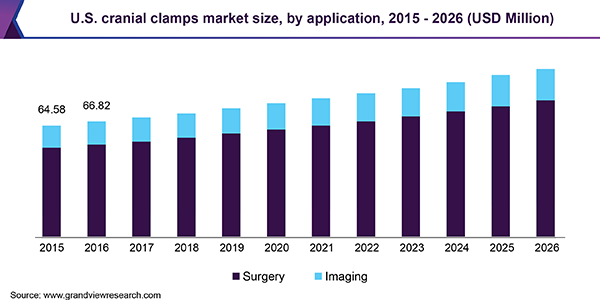

Surgeries dominated the market and accounted for a revenue share of 82.9% in 2023 credited to an increasing number of patients suffering from head trauma injuries or TBI, pediatric disorders, and cerebrovascular disorders. According to the International Brain Injury Association, nearly one million Americans are treated in hospital emergency departments due to TBIs. Furthermore, the growing healthcare sector and the increase in the availability of surgeries for TBIs and cerebral disorders among the aging population have led to significant growth in this segment.

The imaging segment is expected to grow considerably at a CAGR of 4.0% over the forecast period owing to the rising prevalence of neurological disorders and increased demand for neurosurgeries. An increase in the usage of imaging techniques such as Positron Emission Tomography (PET), CT scans, and MRI aid in the market growth. They have enhanced the accuracy and reliability of diagnostic imaging. These advancements necessitate the use of specialized cranial clamps that can provide stable and precise head fixation during imaging procedures, ensuring high-quality images and accurate diagnoses. The development of radiolucent cranial clamps, which do not interfere with imaging results, has particularly gained traction in this context.

Patient Insights

The adult segment dominated the market and accounted for the largest revenue share of 91.3% 2023 attributed to the rising prevalence of neurological disorders among adults, including brain tumors, aneurysms, and neurodegenerative diseases such as Parkinson’s and Alzheimer’s. These conditions often necessitate precise cranial stabilization during surgery, boosting the demand for cranial clamps. In addition, the growing incidence of traumatic brain injuries (TBIs) due to road accidents, falls, and sports-related injuries among adults has further driven the need for effective cranial stabilization devices.

The pediatric segment is projected to grow at a CAGR of 3.5% over the forecast period. The rising prevalence of neurological conditions such as brain tumors, hydrocephalus, and congenital anomalies among children has resulted in market growth. This has led to widespread awareness regarding neurological disorders, consequently to a rise in early diagnosis and treatment of the patients. Major companies have launched cranial clamps that are smaller in size to improve surgical precision while treating younger patients, reducing the risk of complications and improving patient outcomes.

End Use Insights

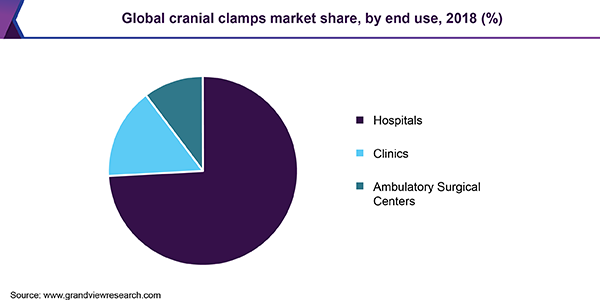

Hospitals dominated the market and accounted for the largest revenue share of 74.3% in 2023. Hospitals admit patients with neurological issues, including trauma, critical sickness, and brain injury. The availability of cutting-edge technology and knowledgeable neurosurgeons contribute to successfully treating illnesses. Patients receive many advantages from hospitals, including access to Neurological Intensive Care Units (NICUs), which are primarily focused on intracranial pressure (ICP), ventilator and autonomic nervous system control, and the effects of severe neuromuscular weakness. Moreover, the expansion of the healthcare industry and rising disposable income have led to a rise in the demand for expensive neurological procedures that are frequently carried out in hospitals.

Ambulatory surgical centers (ASCs) are expected to grow substantially during the forecast period. The rising number of car accidents and traumatic brain injuries, for which major surgery is the first line of therapy, are contributing to the market expansion. Ambulatory surgery centers offer cost-effective and efficient diagnostic and treatment services. Furthermore, the rise in global government activities is anticipated to spur additional growth.

Regional Insights

The North America cranial clamps market dominated the global market and accounted for the largest revenue share of 38.0% in 2023. Increased surgical procedures for tumor removal and an increase in individuals with neurological diseases such as epilepsy and Parkinson's disease are the main causes of this development. Furthermore, the expansion is expected to be further stimulated by the swift technological advancements in the gadgets utilized during neurological surgical procedures.

U.S. Cranial Clamps Market Trends

The cranial cramps market in the U.S. is expected to grow substantially over the forecast period owing to the frequency of neurological conditions such as brain cancer, Parkinson's disease, and Alzheimer's disease. These illnesses' main effects have been raising demand for imaging technology and neurological treatments. Furthermore, the availability of cutting-edge neurological treatments and favorable government reimbursement policies contribute to the market's growth.

Europe Cranial Clamps Market Trends

The Europe cranial clamps market accounted for a significant revenue share in 2023. The growing number of neurological disease cases and the expanding healthcare industry propelled the market. As the number of neurological patients rises, hospitals are adopting more and more state-of-the-art neurological treatment technology and procedures.

Asia Pacific Cranial Clamps Market Trends

The cranial clamps market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period, owing to favorable government policies, rising healthcare costs, and an increase in the number of highly qualified neurosurgeons. Brain Tumor Day is marked annually on June 8 in India, according to the National Health Portal of India. This day is specifically devoted to raising awareness about brain tumors and the surgical treatments available for them. These kinds of projects are

Key Company & Market Share Insights

Some of the major companies in the cranial clamps market are PRO-MED Instrumente GmbH, INTEGRA LIFESCIENCES, Hillrom, B. Braun SE, and more. These key players have increasingly focused on launching innovative cranial clamps, investing in growth strategies, and promoting technological advancements. For instance, Allen Medical includes a C-Flex Head Positioning System in its spine system that can be used with cranial clamps or headrests. This technology has precise and easy readjustments for carrying out spine surgical procedures.

-

INTEGRA LIFESCIENCES is a global medical device manufacturing company specializing in neurosurgery, wound reconstruction, and surgical reconstruction products. The company’s portfolio includes solutions for dural access, cerebral spinal fluid management, soft tissue reconstruction, and nerve and tendon repair.

-

Hillrom, a global medical technology company, provides products and therapies across various care settings. The company’s offerings include smart beds, patient monitoring systems, and clinical communication apps. The company collaborates with Baxter International, focusing on connected care and medical innovation.

Key Cranial Clamps Companies:

The following are the leading companies in the cranial clamps market. These companies collectively hold the largest market share and dictate industry trends.

- PRO-MED Instrumente GmbH

- Integra Lifesciences

- Hillrom

- B. Braun SE

- Vernacare Ltd.

- Micromar Ind. e Com. LTDA

- STERIS

- IMRIS Inc.

- Zimmer Biomet

- J&J MedTech

- Medtronic

Recent Development

-

In October 2023, IMRIS Inc. and Black Forest Medical Group introduced the DORO LUCENT IMRI set, also known as IMRIS, for intraoperative MRI during neurosurgical procedures. This cranial stabilization set is designed to be compatible with all leading image-guided surgery (IGS) systems, offering flexibility and interoperability. In addition, the system is lightweight, slim, and user-friendly, ensuring ease of management during procedures and providing superior patient positioning.

Cranial Clamps Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 290.2 million

Revenue forecast in 2030

USD 382.2 million

Growth Rate

CAGR of 4.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, patient, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

PRO-MED Instrumente GmbH; Integra Lifesciences; Hillrom; B. Braun SE; Vernacare Ltd.; Micromar Ind. e Com. LTDA; STERIS; IMRIS Inc.; Zimmer Biomet; J&J MedTech; Medtronic

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cranial Clamps Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cranial clamps market report based on application, patient, end use, and region.

-

Application Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgery

-

Imaging

-

-

Patient Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Pediatric

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Ambulatory Surgical Centers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."