- Home

- »

- Medical Devices

- »

-

Cranial Fixation And Stabilization Devices Market Report, 2030GVR Report cover

![Cranial Fixation And Stabilization Devices Market Size, Share & Trends Report]()

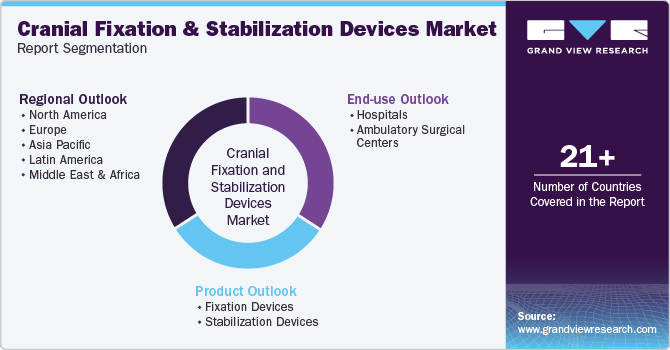

Cranial Fixation And Stabilization Devices Market Size, Share & Trends Analysis Report By Product (Fixation Devices, Stabilization Devices), By End Use (Hospitals, Ambulatory Surgical Centers), By Region And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-542-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

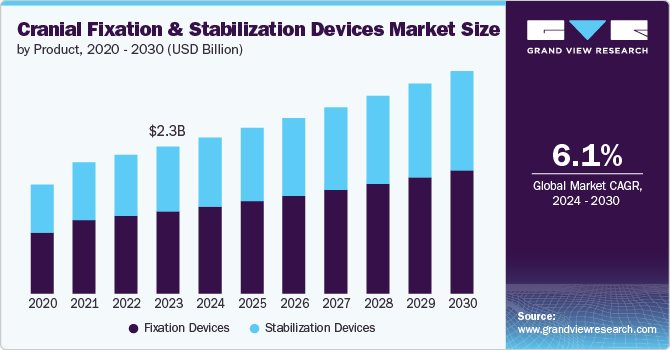

The global cranial fixation and stabilization devices market size was estimated at USD 2.3 billion in 2023 and is projected to grow at a CAGR of 6.1% from 2024 to 2030. This growth can be attributed due to factors such as increasing incidence of neurological disorders such as, Traumatic Brain Injuries (TBIs), brain tumors, and congenital anomalies which require cranial fixation and stabilization devices. According to a report from the National Brain Tumor Society, in U.S. approximately 94,390 individu als are expected to receive a new primary brain tumor diagnosis in 2023. Thus, the rising prevalence of these disorders propel market growth over the forecast period.

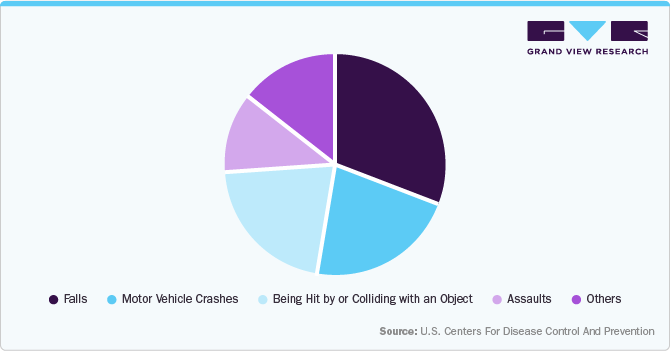

The growing number of road accidents, falls, and other traumatic brain injuries (TBIs) is leading to an increased need for cranial fixation devices to properly address and treat cranial injuries. For instance, as per a report by WHO, in December 2023, each year, about 1.19 million people die due to road traffic accidents. These injuries are the leading cause of death for children and young adults aged 5 to 29 years. These factors are driving the demand for cranial fixation devices. As per the Center for Disease Control and Prevention (CDC), the leading causes of TBI are:

Moreover, the market is strongly influenced by the expanding field of neurosurgery and orthopedic surgery, which is driving demand for more advanced and effective solutions. With the increasing volume of procedures in these practices, there is a need for specialized devices to address complex cases. The demand for cutting-edge cranial fixation solutions is growing alongside advances in surgical techniques and technology to ensure precise and successful outcomes. In addition, increasing occurrences of spinal disorders and trauma that necessitate cranial fixation during surgeries are additional factors contributing to the market's growth. Moreover, the increasing use of deep brain stimulation procedures is expected to further drive market expansion. These devices play a crucial role in treating a range of conditions including neuro-oncology, spinal disorders, dura mater repair, pelvic & trauma, neurovascular diseases, transnasal skull-based surgery, and CSF management.

The market for cranial fixation and stabilization devices is being driven by advancements in medical technology, by introducing innovative solutions that improve the precision, effectiveness, and safety of treatments. Enhanced materials, advanced imaging techniques, and cutting-edge surgical tools are among the developments that enable better management of cranial injuries and disorders. These technological advancements are leading to the creation of more reliable, customizable, and minimally invasive devices, improving patient outcomes and increasing the appeal of these products to healthcare providers. Thus, the market is experiencing growth due to the adoption of these advanced technologies and their positive impact on clinical practices.

Market Concentration & Characteristics

The market for cranial fixation and stabilization devices is advancing significantly with innovations in materials, design, and technology. Notable progress includes the utilization of lightweight, biocompatible materials, the creation of patient-specific devices using 3D printing, and the introduction of minimally invasive techniques that improve surgical precision and shorten recovery periods.

The level of mergers and acquisitions (M&A) activities in the global market is relatively high, driven by the need for companies to expand their product portfolios, access new technologies, and enter emerging markets. Strategic acquisitions allow firms to integrate advanced technologies, enhance their competitive edge, and achieve economies of scale.

Regulatory requirements in the breast lesion localization methods are crucial for maintaining patient safety and the effectiveness of products. However, compliance requirements, such as FDA approval in the US or CE marking in Europe, demand significant investment in research and development, clinical trials, and quality assurance processes. While regulatory requirements can create barriers to entry and increase costs, they also drive companies to maintain high standards, ultimately enhancing product reliability and patient safety in the market.

Alternative treatments and technologies that serve as substitutes for cranial fixation and stabilization devices include a range of options. These alternatives may consist of non-invasive solutions like external brace systems and advanced imaging-guided therapies, as well as different types of internal fixation methods such as bioresorbable implants and traditional metal plates and screws.

The focus of end-user demand in the market for cranial fixation and stabilization devices is on hospitals and specialized surgical centers. These facilities contribute to the majority of demand due to the high volume of cranial surgeries and trauma cases they handle. They have a need for advanced fixation solutions for complex procedures and often play a key role in driving innovation and the adoption of new technologies.

Product Insights

The fixation devices segment led the market with the largest revenue share of 55.93% in 2023. This growth can be attributed to its vital function in ensuring the precise and stable positioning of cranial structures during surgical procedures. This category encompasses a range of devices, including skull clamps, fixation pins, and plates, all of which are crucial for maintaining proper alignment and stability of the cranium. The rising incidence of neurological disorders and the increasing incidence of cranial surgeries have fueled the need for these devices.

The stabilization devices segment is anticipated to grow at the fastest CAGR over the forecast period. Advances in technology are leading to the development of more sophisticated and reliable stabilization devices that offer enhanced precision and safety for cranial surgeries. Growing instances of neurological disorders, such as traumatic brain injuries and brain tumors, are fueling the need for reliable stabilization solutions to guarantee successful surgical outcomes. Furthermore, the increasing emphasis on minimally invasive surgical methods, which demand advanced stabilization systems to aid delicate procedures, is expected to further boost the segment's growth.

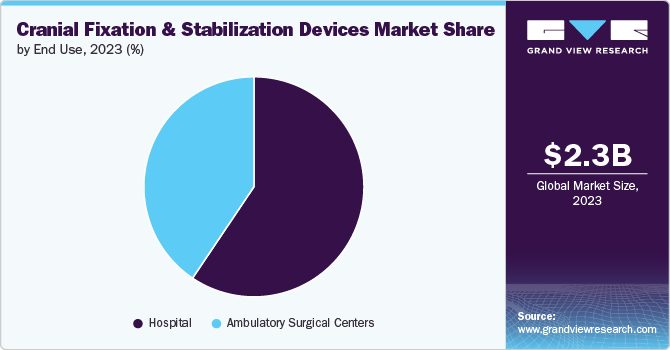

End Use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 59.42% in 2023. Hospitals are the primary settings for advanced surgical procedures, including those requiring these devices. Handling a high volume of complex neurosurgical cases and emergency procedures drives substantial demand for these devices in hospitals. Moreover, hospitals often have the resources to invest in cutting-edge technology and high-quality equipment, resulting in increased expenditure on cranial fixation and stabilization. In addition, the structured procurement processes followed by hospitals lead to bulk purchases and long-term contracts with medical device manufacturers, contributing to a significant revenue flow from hospitals to the market. The ongoing expansion of healthcare infrastructure and the increasing number of surgical procedures performed in hospitals continue to strengthen their dominant role as revenue contributors in this sector.

The ambulatory surgical centers segment is anticipated to grow at the fastest CAGR over the forecast period. The growing favor for outpatient surgical procedures and the cost-efficiency of ambulatory surgery centers (ASCs) in comparison to traditional hospitals are on the rise. Developments in minimally invasive techniques and technologies are enabling the feasibility of intricate cranial surgeries in these environments, leading to increased patient numbers and a heightened need for specialized fixation and stabilization devices. Furthermore, the expansion of ASC networks and their capacity to provide top-notch care at reduced expenses are contributing to the rapid growth in this segment.

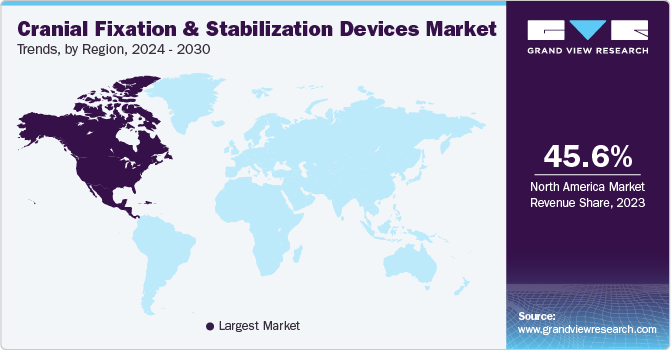

Regional Insights

North America dominated the cranial fixation and stabilization devices market with the revenue share of 45.64% in 2023. The presence of well-established healthcare infrastructure and key manufacturers in the U.S. is projected to augment the regional growth. Technological advancements coupled with high economic development in this region are also likely to drive the market. Furthermore, various activities by government and private firms to increase awareness are expected to boost the region’s development.

U.S. Cranial Fixation And Stabilization Devices Market Trends

The cranial fixation and stabilization devices market in U.S. held the largest share in North America in 2023. Increased healthcare spending and a focus on improving patient outcomes and safety are also key factors contributing to the market’s expansion. In addition, evolving regulatory and reimbursement dynamics are shaping market trends by influencing access and affordability. Moreover, the rising prevalence of neurological disorders in U.S. drives the market. For instance, according to estimates from the American Cancer Society for 2023, approximately 25,400 malignant tumors of the brain or spinal cord are expected to be diagnosed in the U.S., with 14,420 cases in males and 10,980 cases in females.

Europe Cranial Fixation And Stabilization Devices Market Trends

The cranial fixation and stabilization devices market in Europe is driven by the factors, such as the rising prevalence of neurological disorders and an aging population that increases the demand for neurosurgical interventions. Advances in technology, such as the development of innovative fixation devices and materials, are enhancing surgical outcomes and boosting market growth.

The UK cranial fixation and stabilization devices market is driven by factors such as the UK’s emphasis on minimally invasive procedures is fostering the adoption of sophisticated cranial stabilization technologies. The expansion of healthcare facilities and investment in modern surgical equipment are also supporting market trends.

The cranial fixation and stabilization devices market in France is anticipated to witness at a significant CAGR the forecast period owing to technological innovations, such as the integration of smart technologies and the development of high-precision, customizable devices, are enhancing surgical outcomes and contributing to market growth. In addition, the French healthcare system's focus on improving patient care and supporting minimally invasive surgical techniques is fostering the adoption of cutting-edge cranial devices. The expansion of specialized neurosurgical centers and increased investment in healthcare infrastructure further bolster market dynamics.

The Germany cranial fixation and stabilization devices market is driven by the factors, such as, Germany’s strong healthcare system and substantial investment in medical technology are propelling the adoption of advanced cranial fixation and stabilization solutions. A major driver is the increasing prevalence of neurological disorders and a growing elderly population, which heighten the need for effective surgical interventions.

Asia Pacific Cranial Fixation And Stabilization Devices Market Trends

The cranial fixation and stabilization devices market in Asia Pacific is anticipated to witness at a significant CAGR during the forecast period. This is due to the growing prevalence of neurological disorders and a swiftly aging population driving the demand for advanced cranial surgical solutions. In addition, substantial investments in healthcare infrastructure and the expansion of specialized neurosurgery centers are facilitating market growth.

The China cranial fixation and stabilization devices market is experiencing significant growth driven by factors such as increasing healthcare expenditures and a commitment to enhancing patient care and safety are driving the market's expansion. In addition, favorable regulatory policies and heightened awareness of advanced treatment options are further fueling market growth in China.

The cranial fixation and stabilization devices market in Japan is experiencing significant growth due to the increasing preference for outpatient surgical procedures and the rising cost efficiency of ambulatory surgery centers (ASCs) compared to traditional hospitals. The advancements in minimally invasive techniques and technologies have made it feasible to perform intricate cranial surgeries in these settings, leading to a surge in patient numbers and a heightened demand for specialized fixation and stabilization devices.

Latin America Cranial Fixation And Stabilization Devices Market Trends

The cranial fixation and stabilization devices market in Latin America is driven due to the region's rising prevalence of neurological disorders and a rising elderly population are driving demand for advanced cranial surgical solutions. Investments in healthcare infrastructure and the expansion of specialized neurosurgery centers are supporting market development across the region.

Middle East & Africa Cranial Fixation And Stabilization Devices Market Trends

The cranial fixation and stabilization devices market in the MEA region is expected to witness at a significant CAGR during the forecast period, due to various factors, such as rising investments in healthcare infrastructure and the expansion of specialized neurosurgery centers are enhancing market development in the region. The Saudi Arabia market accounted for the largest share of the MEA market.

Key Cranial Fixation And Stabilization Devices Company Insights

Top manufacturers are adapting the shift towards user comfort through technological advancements, and innovative products. These innovative products are driving the market growth positively over the forecast period. Moreover, the market is experiencing significant growth, driven by a rising incidence of neurological disorders. Emerging players in this market are contributing to its dynamic landscape through innovation and strategic expansions.

Key emerging companies in the market include:

-

Brainlab: Specializes in software and hardware solutions for neurosurgery, including cranial fixation and stabilization technologies

-

Orthofix: Focuses on musculoskeletal products and is expanding its offerings in cranial fixation and stabilization

-

NeuroBlate (Monteris Medical): Known for its innovative approaches in neurosurgery, including techniques that may intersect with cranial fixation and stabilization

Cranial Fixation And Stabilization Devices Companies:

Key Cranial Fixation And Stabilization Devices Companies:

The following are the leading companies in the cranial fixation and stabilization devices market. These companies collectively hold the largest market share and dictate industry trends.

- Integra LifeSciences Corporation

- Stryker

- KLS Martin Group

- B. Braun SE

- Johnson & Johnson

- Medtronic

- evonos GmbH & Co. KG

- Zimmer Biomet Holdings, Inc.

- Colson Medical, Inc. (Acumed LLC)

- Medicon eG

Recent Developments

-

In April 2024, Kelyniam Global and Fin-ceramica, Faenza S.p.a., manufacturers of custom cranial implants, have announced that the NEOS Surgery Cranial LOOP fixation system has received FDA 510(k) clearance. This system is approved for use with Finceramica's CustomizedBone hydroxyapatite cranial implant

-

In April 2024, 3D Systems announced that the Food and Drug Administration (FDA) has granted 510(k) clearance for its VSP PEEK Cranial Implant, a patient-specific cranial implant solution that is 3D-printed

-

In February 2023, Stryker received 510(k) clearance from the U.S. Food and Drug Administration for its Q Guidance System with Cranial Guidance Software. This image-based planning and intraoperative guidance system is designed to assist in cranial surgeries. This approval reinforced Stryker's neurotechnology portfolio in the U.S.

Cranial Fixation And Stabilization Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.48 billion

Revenue forecast in 2030

USD 3.50 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Integra LifeSciences Corporation; Stryker; KLS Martin Group; B. Braun SE; Johnson & Johnson; Medtronic; evonos GmbH & Co. KG; Zimmer Biomet Holdings, Inc.; Colson Medical, Inc. (Acumed LLC); Medicon eG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cranial Fixation And Stabilization Devices Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the cranial fixation and stabilization devices market based on product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixation Devices

-

Stabilization Devices

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."