- Home

- »

- Medical Devices

- »

-

Craniomaxillofacial Devices Market Size & Share Report, 2030GVR Report cover

![Craniomaxillofacial Devices Market Size, Share & Trends Report]()

Craniomaxillofacial Devices Market (2024 - 2030) Size, Share & Trends Analysis Report, By Product (Cranial Flap Fixation, CMF Distraction, Temporomandibular), By Material, By Application, By Region, And Segment Forecasts

- Report ID: 978-1-68038-468-0

- Number of Report Pages: 128

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Craniomaxillofacial Devices Market Summary

The global craniomaxillofacial devices market size was estimated at USD 1.8 billion in 2023 and is projected to reach USD 3.5 billion by 2030, growing at a CAGR of 9.5% from 2024 to 2030. The shift in preference towards minimally invasive surgeries, owing to the availability of technologically advanced products, is one of the key factors expected to support the market growth.

Key Market Trends & Insights

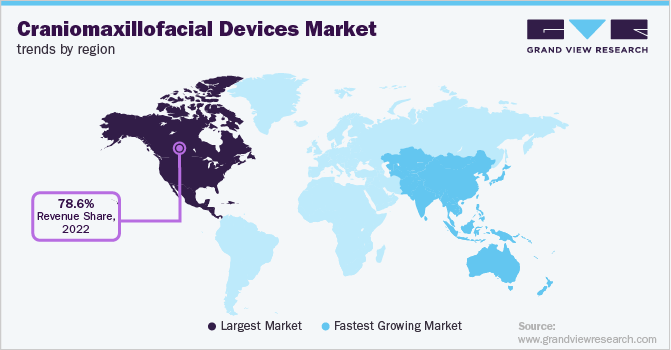

- North America led with a market share of more than 78.6% in terms of revenue in 2022, owing to the availability of technologically advanced implants and increased volume of Craniomaxillofacial (CMF) procedures.

- Supportive government initiatives, such as the establishment of the American Society of Craniofacial Surgery (ASCFS), for creating awareness about CMF surgeries, are likely to boost the regional growth.

- Based on product, the CMF plate and screw fixation segment held the largest market share of over 72.9% in 2022.

- In terms of material, metallic implants led the overall material market with a share of more than 70.2% in 2022.

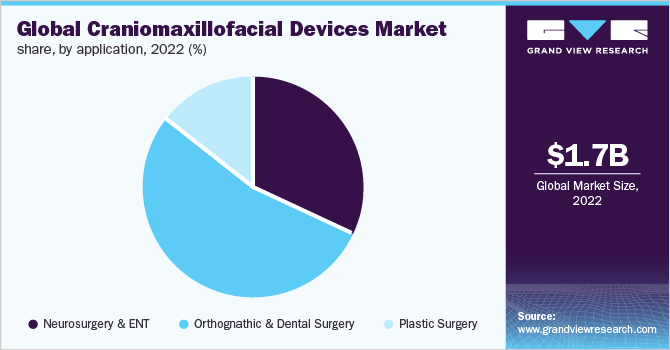

- On the basis of application, the orthognathic & dental surgery application segment held the largest revenue with a share of more than 53.5% in 2022.

Market Size & Forecast

- 2023 Market Size: USD 1.8 billion

- 2030 Projected Market Size: USD 3.5 billion

- CAGR (2024-2030): 9.5%

- North America: Largest market in 2022

For instance, leading player Zimmer Biomet offers ROSA ONE Brain, a robotic platform that aids in performing complex neurosurgical procedures to be performed minimally invasive, often without needing to shave the entire head. Thus, companies coming up with innovative devices are expected to drive the market.

The onset of COVID-19 led many elective procedures to halt as the healthcare facilities were burdened with COVID-19-affected patients. According to the American Society of Plastic Surgeons reported that reconstructive surgical procedures which also included Maxillofacial Surgery witnessed a decrease.

The rise in the number of facial and head injuries caused due to the sports-related injuries is also expected to boost demand for the craniomaxillofacial devices. According to the Centers for Disease Control and Prevention (CDC), an estimated 1.7 to 3.8 million traumatic brain injuries are reported each year in the U.S., of these, 10.0% arise due to the sports and recreational activities.

Furthermore, the U.S. Consumer Product Safety Commission (CPSC) data stated that, in 2018, 454,407 sports-related head injuries were treated at U.S. hospital emergency rooms. This highlights the high growth prospects that lie ahead for the craniomaxillofacial device manufacturers in the country.

Rising incidents of road accidents are also expected to increase the demand for craniomaxillofacial devices. According to Columbia University (Department of Neurology), motor vehicle accidents are one of the most common causes of Traumatic Brain Injury (TBI) among children and adults in the U.S. On a global note as well, a rise in the number of road accidents is expected to boost demand for the craniomaxillofacial devices, especially from the developing countries.

According to the American Society of Plastic Surgeons in 2020 around 256,085 maxillofacial reconstructive surgery procedures were carried out in the U.S. The procedure is also among the top five most carried out plastic surgery procedures in the country. As per John Hopkins Medicine, around more than 3.5 million injuries from the sports are reported each year in the U.S and almost one-third of all injuries incurred in childhood are sports-related injuries.

The COVID-19 significantly affected the craniomaxillofacial devices market. It had led to the cancellation and rescheduling of surgical procedures at a global level. For surgeons working in the craniomaxillofacial (CMF) field, surgical procedures are limited to urgent or emergent cases. Medartis AG, a key manufacturer of craniomaxillofacial implants reported that the company’s products witnessed a decline as elective procedures were halted resulting in production stoppages and supply chain bottlenecks.

Reni Shaw Plc., a major player in CMF implants in Europe stated in its annual report that its medical dental line had lower sales than in 2020, as demand for additively manufactured CMF implants and dental structures was affected by the pandemic due to the reduction in non-essential operations.

However, the market has witnessed a positive recovery in 2021 and many competitors in the market experienced growth in sales of CMF products as medical surgeries resumed with strict Covid-19 protocols in place.

Product Insights

Amongst the product segment, the CMF plate and screw fixation segment held the largest market share of over 72.9% in 2022. This dominance is attributed to its wide usage in various surgical procedures such as deformity correction, orthognathic surgery, tumor removal, and pediatric surgeries. Bone graft substitute, on the other hand, is projected to be the fastest-growing during the forecast period. BGSs are used in the reconstruction of bone defects and in the case of spine fusion. Limited availability of donors has led to a shortage of natural bone grafts creating a demand for the bone graft substitutes.

Some of the popularly used synthetic bone substitutes include calcium sulfate, calcium phosphate ceramics, and bioactive glass ceramics. France-based Biomatlante offers MBCP biphasic calcium phosphate synthetic bone graft substitute. It closely resembles the architecture of natural human bone and gradually dissolves in the body, promoting new bone formation through the release of calcium and phosphate ions.

Material Insights

Metallic implants led the overall material market with a share of more than 70.2% in 2022. Features such as lower corrosiveness, ability to provide rigid support to the fractures, comparatively cheaper price than bio absorbable counterparts, and higher market penetration than other materials, support the market growth. Metals are used in CMF surgery because they are less corrosive and physiologically support the fractures.

Titanium and its alloy are the most commonly used metals for CMF surgery due to the advantage associated with it, such as lightweight, inert metallic properties, the strength provided to implants, high tissue acceptance, and corrosion resistance. It is used in mandibular reconstruction.

Bio absorbable materials are expected to be the fastest-growing during the forecast period, as the usage of these implants nullifies the chances of a second surgery, required in the case of metallic implants and easy assimilation in the body system. Technological advancements in CMF surgery, for example, self-enforced technology and advantages associated with it such as biocompatible, easily handled, degradable property, and reliability are the factors expected to propel the market growth.

Application Insights

The orthognathic & dental surgery application segment held the largest revenue with a share of more than 53.5% in 2022. Based on the application, the market is segmented into neurosurgery & ENT, orthognathic & dental surgery, and plastic surgery. Orthognathic and dental surgery held the largest revenue with a share in 2022 owing to its wide usage to correct a variety of minor and major skeletal and dental deformities.

Neurosurgery & ENT was the fastest growing owing to the increasing incidence of trauma and spinal disorders requiring Cerebrospinal Fluid (CSF) management during surgery. Surgeons perform craniotomies to gain greater access to the brain during neurosurgery. Craniotomies are done to treat trauma, infection in the brain, skull fractures, aneurysms, epilepsy, Parkinson’s disease, pressure in the brain after a stroke or an injury, and to remove blood clots from a head injury.

Moreover, the adoption of deep brain stimulation procedures is one of the key contributing factors to this segment's growth. In deep brain stimulation, the implants are used to cover the skull after inserting the electrode. Neurosurgical application of cranial implants consists of surgery of the skull and otolaryngology procedures.

These devices assist in treating neuro-oncology, neurovascular diseases, spinal disorders, dura mater repair, trans nasal skull-based surgery, deep brain stimulation, pelvic or cranial trauma, and CSF management. Medpor bio-absorbable implants are most commonly used for neurosurgery.

Also, the introduction of surgical navigation technology for ENT procedures is expected to fuel growth of the craniomaxillofacial devices market during the forecast period. Advantages associated with this technology, such as ease of use, 3D display, and real-time virtual anatomy updates are anticipated to boost its adoption in near future.

Regional Insights

North America led with a market share of more than 78.6% in terms of revenue in 2022, owing to the availability of technologically advanced implants and increased volume of Craniomaxillofacial (CMF) procedures. In addition, factors such as the increase in awareness about deformity correction surgeries and the presence of established healthcare facilities are the factors that contributed to the impressive growth.

Apart from this, supportive government initiatives, such as the establishment of the American Society of Craniofacial Surgery (ASCFS), for creating awareness about CMF surgeries and their associated advantages are likely to boost the demand for CMF devices during the forecast period.

Asia Pacific is estimated to be the fastest-growing during the forecast period. The presence of untapped opportunities, constantly improving healthcare infrastructure, economic development, and rising patient awareness is the key impact rendering drivers, accounting for the lucrative growth of the craniomaxillofacial industry in Asia Pacific.

As per Research Gate, Asia has the highest percentage of traumatic brain-related injuries as a result of falls (77.0%), unintentional injuries (57.0%), and road traffic accidents (48.0%). This will act as a driving factor for the key players to expand its product portfolio in Asia Pacific.

Key Companies & Market Share Insights

The market is highly competitive and dominated by a limited number of players. Key companies have a strong footprint in the U.S. market owing to their extensive advanced product offerings. New product launches and expansions are some of the key strategies adopted by these players to increase market share.

DePuy Synthes, a subsidiary of Johnson & Johnson remains a frontrunner name in the craniomaxillofacial device market. The company is proactively involved in launching innovative products and acquisitions. These companies face tough competition from small medical device manufacturers that are involved in the development of technologically advanced products with greater efficiency.

Also in November 2021, DePuy Synthes launched the UNIUM System as a next-generation power tools system for trauma and small bone procedures. This system can also be used across, sports medicine, spine and thorax procedures. Some of the key companies in global craniomaxillofacial devices market include:

-

DePuy Synthes (J&J),

-

Stryker

-

Medtronic

-

B. Braun Melsungen AG

-

Reni Shaw plc.

-

Medartis AG

-

KLS Martin Group

-

Xilloc Medical B. V

-

Synimed

- Zimmer-Biomet

Craniomaxillofacial Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.0 billion

Revenue forecast in 2030

USD 3.5 billion

Growth rate

CAGR of 9.5% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historic data

2018 - 2022

Forecast period

2024 - 2030

Market representation

Revenue in USD million, CAGR from 2024 to 2030

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; India; China; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

DePuy Synthes (J&J); Stryker; Medtronic; B. Braun Melsungen AG; Reni Shaw plc.; Medartis AG; KLS Martin Group; Xilloc Medical B. V; Synimed; Zimmer-Biomet

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

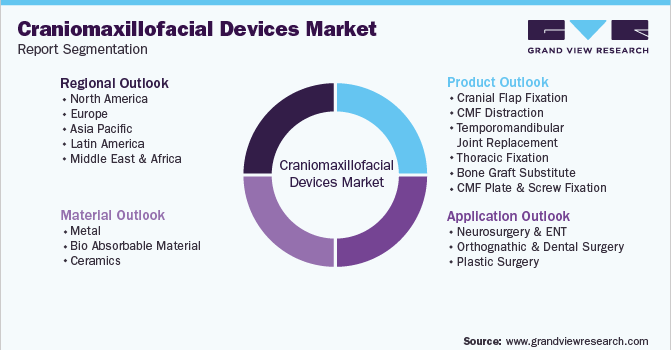

Global Craniomaxillofacial Devices Market Segmentation

This report forecasts revenue growth at global, regional, & country levels along with provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Craniomaxillofacial Device Market based on the product, material, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cranial Flap Fixation

-

CMF Distraction

-

Temporomandibular Joint Replacement

-

Thoracic Fixation

-

Bone Graft Substitute

-

CMF Plate and Screw Fixation

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Metal

-

Bio absorbable material

-

Ceramics

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurosurgery & ENT

-

Orthognathic and Dental Surgery

-

Plastic surgery

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global craniomaxillofacial devices market size was estimated at USD 1.7 billion in 2022 and is expected to reach USD 1.8 billion in 2023.

b. The global craniomaxillofacial devices market is expected to grow at a compound annual growth rate of 9.5% from 2023 to 2030 to reach USD 3.5 billion by 2030.

b. North America dominated the craniomaxillofacial devices market with a share of 78.6% in 2022. This is attributable to the introduction of technologically advanced cranial implants, rising demand for minimally invasive surgeries, availability of sophisticated healthcare infrastructure, and high patient awareness levels.

b. Some key players operating in the craniomaxillofacial devices market include DePuy Synthes (J&J), Stryker, Medtronic, B. Braun Melsungen AG, Renishaw Plc, Medartis AG, KLS Martin Group, Xilloc Medical B. V, Synimed and Zimmer-Biomet.

b. Key factors that are driving the craniomaxillofacial devices market growth include the rising incidence of road accidents due to urbanization and industrialization coupled with the rising demand for effective reconstructive surgeries.

b. The CMF plate and screw fixation segment accounted for the largest market share of over 73.0% in 2022, in the craniomaxillofacial devices market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.