- Home

- »

- Clinical Diagnostics

- »

-

Critical Care Diagnostics Market Size, Industry Report, 2030GVR Report cover

![Critical Care Diagnostics Market Size, Share & Trends Report]()

Critical Care Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Routine & Special Chemistry, Flow Cytometry, Hematology, Immunoproteins), By End Use (Operation Room, Intensive Care Unit, Emergency Rooms), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-010-1

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Critical Care Diagnostics Market Summary

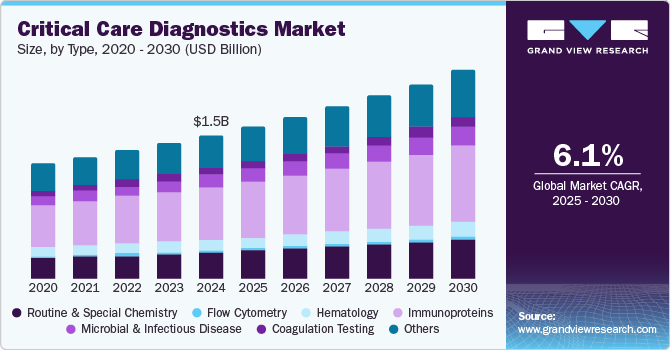

The global critical care diagnostics market size was valued at USD 1.45 billion in 2024 and is projected to reach USD 2.10 billion by 2030, growing at a CAGR of 6.11% from 2025 to 2030. The rising prevalence of chronic conditions like cardiovascular diseases, respiratory disorders, and cancer has driven the demand for critical care diagnostics.

Key Market Trends & Insights

- North America critical care diagnostics market dominated the global industry with a share of 47.97% in 2024.

- By type, the immunoproteins segment held the largest share of 36.40% in 2024.

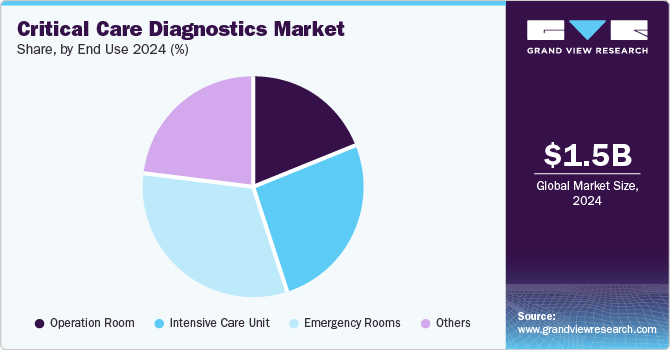

- By end use, the emergency rooms segment held the largest market share of 32.20% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.45 Billion

- 2030 Projected Market Size: USD 2.10 Billion

- CAGR (2025-2030): 6.11%

- North America: Largest market in 2024

Accurate and timely diagnosis is essential for effective treatment and patient management. Advancements in diagnostic technologies, including molecular diagnostics, next-generation sequencing, and advanced imaging modalities, have revolutionized critical care diagnostics. These innovations have significantly improved the precision, efficiency, and speed of testing, leading to enhanced patient outcomes and better healthcare delivery. The integration of these cutting-edge techniques underscores the critical role of diagnostics in managing complex and chronic diseases.

The critical care diagnostics industry has experienced significant growth and transformation, driven by several key factors, including the COVID-19 pandemic and advancements in medical technology. The pandemic placed unprecedented pressure on healthcare systems worldwide, amplifying the demand for rapid and accurate diagnostic testing in critical care settings. Early in the crisis, tests such as Polymerase Chain Reaction (PCR) and antigen diagnostics were pivotal in identifying COVID-19 infections among critically ill patients, leading to a surge in demand for diagnostic products and services. The pandemic also underscored the importance of point-of-care testing (POCT), which offers swift results and facilitates timely decision-making in critical care environments, prompting the development of innovative POCT devices.

The pandemic’s impact extended to the broader critical care market, which supplies essential equipment like ventilators, monitors, and infusion pumps for patients with life-threatening conditions. However, manufacturers faced challenges due to supply chain disruptions, lockdowns, and travel restrictions. These pressures highlighted the need for innovation and digitalization in critical care, with advancements in telemedicine, remote monitoring, and artificial intelligence offering solutions to enhance efficiency, reduce infections, and alleviate healthcare worker burnout.

Critical care diagnostics play a crucial role in intensive care units, enabling timely and accurate diagnosis of severe conditions. Tests and devices measure vital signs, blood gases, electrolytes, organ function, and infections, allowing clinicians to monitor and adjust treatments to improve patient outcomes. The growing geriatric population, highly susceptible to chronic diseases, has further fueled market growth by increasing the demand for diagnostic tests in critical care settings.

Additionally, POCT devices have gained popularity due to their convenience and rapid results, enabling bedside decision-making and reducing reliance on laboratory testing. Specialized ICUs are now equipped with advanced technologies such as bedside monitors, extracorporeal membrane oxygenation (ECMO), multifunctional respiratory therapy machines, and anesthesia systems. Hospitals with enhanced resources also utilize blood gas analyzers, hemodialysis machines, bedside X-ray units, and intra-arterial balloon counterpulsation devices. These advancements have significantly improved critical care capabilities, ensuring better outcomes for patients in intensive care units.

Type Insights

The immunoproteins segment held the largest share of 36.40% in 2024. Immunoproteins, composed of amino acids, are critical components of the immune system, which protects the body against diseases by recognizing and neutralizing pathogens such as bacteria, viruses, parasites, fungi, cancer cells, and foreign substances. They play pivotal roles in both the innate and adaptive immune responses, acting as the first line of defense and supporting long-term immunity. Immunoproteins are categorized into antibodies, cytokines, complement proteins, and major histocompatibility complex (MHC) proteins, each contributing uniquely to immune function.

The immunoproteins market is driven by the increasing prevalence of infectious and autoimmune diseases, growing awareness of immunological health, and advancements in biotechnology. Rising demand for diagnostic tools and therapeutics leveraging immunoproteins, alongside innovations in recombinant technologies, further fuels market growth.

The microbial & infectious disease segment is expected to show the fastest growth of 7.24% during the forecast period. Microbial and infectious diseases, caused by microorganisms like bacteria, viruses, parasites, and fungi, include conditions such as HIV, influenza, measles, and COVID-19. The growth of this segment is primarily fueled by advancements in diagnostic techniques, including clinical chemistry, flow cytometry, and coagulation tests. Additionally, the increasing adoption of microbiology-based diagnostics, infectious disease testing, and immunoprotein assays is expected to further propel segment expansion during the forecast period. These innovations enhance the accuracy and efficiency of disease detection, meeting the rising demand for early and precise diagnostics in managing infectious diseases.

End Use Insights

The emergency rooms segment held the largest market share of 32.20% in 2024 and is also expected to grow at the fastest CAGR over the forecast period. This growth can be attributed to the increasing prevalence of chronic diseases such as heart strokes, heart attacks, and kidney failure and the rising incidence of mental health issues, including anxiety, depression, and other related disorders. These health challenges are driving demand for advanced diagnostic tools and therapeutic interventions to improve patient outcomes and manage long-term care effectively.

The intensive care unit (ICU) segment is projected to experience robust growth during the forecast period. The intensive care unit (ICU) segment is anticipated to grow at a strong CAGR during the forecast period. Over nearly 70 years, ICUs have undergone significant advancements, becoming a cornerstone of modern healthcare systems. Multidisciplinary care in ICUs has significantly improved patient outcomes and reduced mortality rates. Factors such as early identification of severe medical and surgical conditions, advancements in prehospital care, and organized trauma centers have increased the ICU patient population.

The complexity of critical conditions often necessitates bedside diagnostics to monitor and treat patients effectively. Immediate diagnostics are crucial for managing life-threatening conditions, identifying complications early, and maintaining high standards of care. ICU management relies heavily on continuous and advanced monitoring, bedside ultrasonography, radiologic diagnostics, blood gas analysis, coagulation assessments, laboratory evaluations, and other point-of-care (POC) diagnostic methods.

During the SARS-CoV-2 pandemic, the role of POC diagnostics gained heightened importance, addressing challenges such as infection control, patient and healthcare worker safety, and minimizing risks associated with patient relocation. These dynamics have underscored the critical role of ICUs in modern healthcare.

Regional Insights

North America critical care diagnostics market dominated the global industry with a share of 47.97% in 2024, driven by the increasing prevalence of chronic diseases such as cardiovascular disorders, respiratory conditions, and sepsis. The demand for advanced diagnostic tools, including point-of-care testing (POCT), molecular diagnostics, and blood gas analyzers, is rising to support timely and accurate patient care in intensive care units. Additionally, advancements in healthcare infrastructure, coupled with increasing investments in innovative diagnostic technologies, are propelling market expansion. The impact of COVID-19 has further highlighted the importance of rapid diagnostics, driving adoption across critical care settings.

U.S. Critical Care Diagnostics Market Trends

The critical care diagnostics market in the U.S. is expanding due to the growing burden of chronic diseases such as heart failure, respiratory disorders, and kidney failure, alongside the increasing aging population. Advanced diagnostic technologies like point-of-care testing (POCT), molecular diagnostics, and blood gas analysis are in high demand to enhance patient outcomes in critical care settings. The COVID-19 pandemic underscored the need for rapid, accurate diagnostics, accelerating innovation and adoption. Investments in healthcare infrastructure and technological advancements further support market growth, emphasizing efficient and timely care for critically ill patients.

Europe Critical Care Diagnostics Market Trends

The critical care diagnostics market in Europe is witnessing strong growth due to several factors, including the increasing prevalence of chronic diseases, aging populations, and the rise in critical illnesses like cardiac disorders, respiratory diseases, and sepsis. These conditions require fast and accurate diagnostics, which has driven the demand for advanced diagnostic solutions such as point-of-care testing (POCT), molecular diagnostics, and imaging technologies. Additionally, the demand for personalized medicine, which tailors treatments based on genetic and molecular data, is expanding the role of diagnostics in critical care.

The UK critical care diagnostics market is witnessing significant growth, driven by an aging population, increased prevalence of chronic diseases, and advancements in diagnostic technology. Innovations such as molecular diagnostics and point-of-care (POC) testing are transforming the landscape, with a strong focus on enhancing the speed and accuracy of diagnoses, especially in emergency and intensive care settings. These advancements improve patient outcomes by enabling faster intervention.

The critical care diagnostics market in France is growing with an emphasis on preventive care, supported by public and private sectors. The French healthcare system, through Assurance Maladie, encourages preventive check-ups for lifestyle diseases such as cardiovascular conditions and diabetes, which are available at primary care centers. Private clinics like Institut Pasteur offer specialized screenings, including comprehensive cancer and heart health assessments. Additionally, there is rising demand for digital health platforms, as seen with Doctolib, which enables users to book medical check-ups online, promoting easy access to preventive services.

Germany critical care diagnostics market is experiencing significant growth due to factors such as an aging population, the increasing prevalence of chronic diseases, and advancements in diagnostic technologies. The demand for diagnostic tools in critical care is primarily driven by the growing incidence of conditions like cardiovascular diseases, neurological disorders, and respiratory illnesses, as well as a rise in surgical procedures.

Additionally, the market benefits from the expansion of intensive care units (ICUs) and emergency rooms, which are increasingly equipped with advanced diagnostic tools to handle critical cases. As healthcare expenditure rises and technological innovations in diagnostics, such as remote monitoring and telemedicine, gain traction, the market is expected to expand further in the coming years.

Asia Pacific Critical Care Diagnostics Market Trends

The critical care diagnostics market in Asia Pacific is expected to experience significant growth due to the region's improving healthcare infrastructure, rising medical tourism, and increased awareness about early diagnosis. Key countries driving this growth include China, India, and Japan, where government initiatives are enhancing healthcare access and quality. The region is also seeing increased healthcare expenditure and a growing demand for advanced diagnostic tools to manage chronic diseases and critical care admissions.

China critical care diagnostics market is experiencing robust growth, driven by an increase in chronic conditions like diabetes, cardiovascular diseases, and hypertension, which are prevalent in the population. These conditions often lead to critical care needs, fueling the demand for advanced diagnostic tools. Technological innovations, particularly in point-of-care testing, molecular diagnostics, and imaging, are improving diagnostic accuracy and turnaround times, which is crucial for effective management in critical care settings.

The critical care diagnostics market in Japan is expanding due to the increasing need for advanced diagnostic tools in intensive care units (ICUs) and emergency departments. This growth is driven by rising healthcare expenditures, a growing aging population, and the prevalence of chronic diseases such as cardiovascular conditions, respiratory issues, and neurological disorders. Moreover, innovations in diagnostic technologies, including the integration of telemedicine and remote diagnostics, are also playing a significant role in improving patient care and operational efficiency in hospitals.

Latin America Critical Care Diagnostics Market Trends

The critical care diagnostics market in Latin America is expected to experience significant growth, driven by the increasing need for advanced diagnostic tools due to rising chronic diseases and critical conditions. The market is evolving towards decentralized in-vitro diagnostics (IVD) and point-of-care (POC) testing solutions, which offer cost-effective, timely results for critical conditions like infectious diseases. This shift is particularly crucial as Latin America faces healthcare budget constraints and a growing demand for affordable testing methods.

Furthermore, the demand for diagnostics is being influenced by the region's focus on improving healthcare infrastructure, as seen in the growing investments in diagnostic imaging and monitoring equipment. Brazil and Mexico are expected to remain dominant players in this market, with an increasing focus on infectious disease diagnostics and hematology.

Brazil critical care diagnostics market is poised for significant growth driven by the increasing prevalence of chronic and lifestyle-related diseases, coupled with the rising need for urgent medical interventions. Key factors influencing this growth include advancements in diagnostic technologies, such as flow cytometry, hematology tests, and infectious disease diagnostics. As Brazil's healthcare system improves, especially in urban areas, the demand for diagnostics in critical care settings, including emergency and intensive care units, is increasing. The market is also expanding due to the integration of telemedicine and remote diagnostic tools, which offer efficient management of critically ill patients.

Middle East & Africa Critical Care Diagnostics Market Trends

The critical care diagnostics market in the Middle East and Africa is experiencing steady growth, driven by increasing healthcare expenditures, government support, and the adoption of advanced technologies. In particular, the United Arab Emirates (UAE) and Saudi Arabia are key players in this growth, supported by improved healthcare infrastructure and strong governmental healthcare initiatives. These countries are focusing on enhancing early disease detection and improving critical care services, with a significant focus on chronic disease management and point-of-care diagnostics.

Saudi Arabia critical care diagnostics market is experiencing significant growth, driven by increasing demand for advanced diagnostic technologies in the healthcare sector. The country's rising population, along with a growing elderly demographic, is contributing to the prevalence of chronic and lifestyle diseases, including diabetes, obesity, and hypertension, which in turn boosts the need for diagnostic services.

Key Critical Care Diagnostics Company Insights

Some of the key market players include Abbott, Danaher, F. Hoffmann-La Roche Ltd, BD, EKF Diagnostics, bioMérieux, Inc., Siemens Healthcare Private Limited, Chembio Diagnostics, Inc., Bayer AG. These players are undertaking various strategic initiatives to increase their share in the market. New product development, collaborations, and partnerships are some such endeavors.

Key Critical Care Diagnostics Companies:

The following are the leading companies in the critical care diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Danaher

- F. Hoffmann-La Roche Ltd

- BD

- EKF Diagnostics

- bioMérieux, Inc.

- Siemens Healthcare Private Limited

- Chembio Diagnostics, Inc.

- Bayer AG

Critical Care Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.54 billion

Revenue Forecast in 2030

USD 2.10 billion

Growth rate

CAGR of 6.11% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, and region

Region scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Abbott; Danaher; F. Hoffmann-La Roche Ltd; BD; EKF Diagnostics; bioMérieux, Inc.; Siemens Healthcare Private Limited; Chembio Diagnostics, Inc.; Bayer AG

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Critical Care Diagnostics Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels, and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global critical care diagnostics market report based on type, end-use, and region

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Routine & Special Chemistry

-

Flow Cytometry

-

Hematology

-

Immunoproteins

-

Microbial & Infectious Disease

-

Coagulation Testing

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Operation Room

-

Intensive Care Unit

-

Emergency Rooms

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global critical care diagnostics market size was estimated at USD 1.45 billion in 2024 and is expected to reach USD 1.54 billion in 2025.

b. The global critical care diagnostics market is expected to grow at a compound annual growth rate of 6.11% from 2025 to 2030 to reach USD 2.10 billion by 2030.

b. North America dominated the critical care diagnostics market with a share of 47.97% in 2024. This is attributable to the strong geographic presence of key players in the U.S.

b. Some key players operating in the critical care diagnostics market include Abbott Laboratories; Beckman-Coulter; Roche Diagnostics; Becton Dickinson & Co; EKF Diagnostics Holding plc; Chembio Diagnostic systems. Inc.; Bayer Healthcare AG; bioMerieux Inc; and Siemens Healthineers.

b. Key factors that are driving the critical care diagnostics market growth include the recognition and increasing awareness of targeted therapy as an alternative to unnecessary drug prescriptions, the increasing geriatric population, and telehealth and remote communications between diagnostics and laboratories.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.