- Home

- »

- Pharmaceuticals

- »

-

Critical Limb Ischemia Treatment Market Size Report, 2030GVR Report cover

![Critical Limb Ischemia Treatment Market Size, Share & Trends Report]()

Critical Limb Ischemia Treatment Market Size, Share & Trends Analysis Report By Treatment (Devices, Drugs, Surgery), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-172-7

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

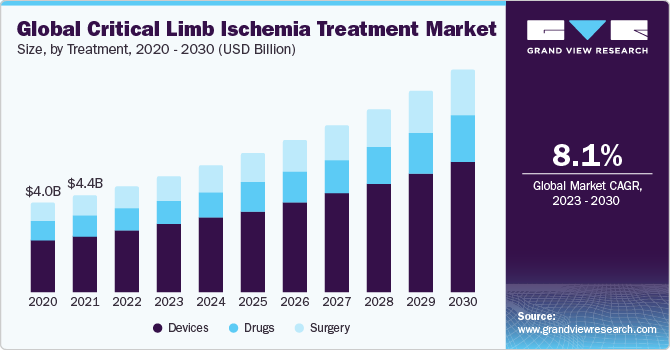

The global critical limb ischemia treatment market size was valued at USD 4.90 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.12% from 2023 to 2030.The aging population continues to grow, and the prevalence of critical limb ischemia, a condition characterized by poor blood circulation in the limbs, is increasing. This trend drives the demand for critical limb ischemia treatment options. According to the WHO, there is an anticipated doubling of the global population's proportion aged 60 years and older from 12% in 2015 to 22% by 2050.

The COVID-19 pandemic caused major disruptions to healthcare systems, leading to the cancellation of diagnostic and treatment procedures. Hospitals postponed venous surgeries, elective treatments, and the intervention for asymptomatic illnesses, affecting the growth of the market, as reported in the Internal Journal of Surgery Case Reports in March 2021. Furthermore, an increased risk of thrombotic consequences, such as limb ischemia, has been associated with SARS-CoV-2 infection, according to a report published in the Journal of Vascular Surgery in August 2021. Limb ischemia related to COVID-19 was linked to a higher risk of mortality and amputation and was manifested in people with a low incidence of comorbidities.

Additionally, it is anticipated that the market will expand at a faster rate due to the increasing prevalence of risk factors that raise the incidence of critical limb ischemia. The WHO European Region's 2022 report on obesity and overweight states that these conditions have attained epidemic proportions, affecting almost 60% of the population. Children are also impacted; one in three school-aged children and 7.9% of children under the age of five are overweight or obese.

Treatment Insights

Based on the treatment, the critical limb ischemia treatment market is segmented into devices, drugs, and surgery. The device segment held the largest market share in 2022. Dilation devices and stents play a role in opening up narrow arteries while also safeguarding their walls.

They are commonly used in treating limb ischemia. Known for their low complication rates and high technical success, they ultimately improve patients' quality of life. These advantages are anticipated to propel the growth of the devices segment throughout the forecast period.

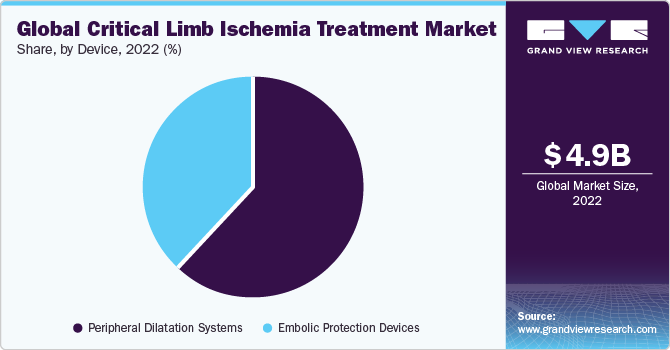

Device Insights

On the basis of the device, the market is segmented into embolic protection devices and peripheral dilatation systems. The peripheral dilatation systems segment dominated the market in 2022. The rise in the utilization of critical limb ischemia vascular surgery and balloon dilators is expected to support the growth of this segment.

Key players in the limb ischemia treatment sector are prioritizing the creation and introduction of new peripheral dilatation devices with advanced technology. In June 2022, Cordis, a company specializing in technologies, revealed that the company started human testing of its Radianz Radial Peripheral System.

Regional Insights

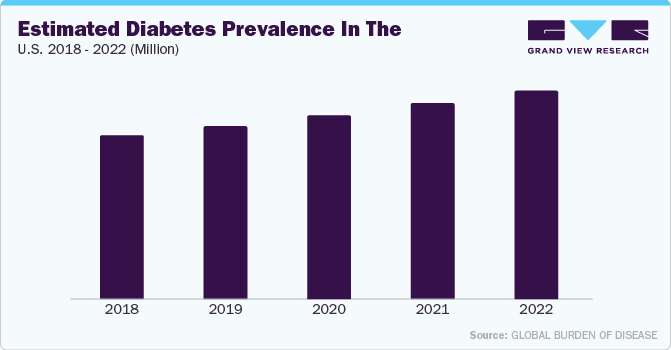

North America dominated the market in 2022. Large patient pool and presence of established manufacturers are anticipated to strengthen market growth in this region. The primary driver of demand for the market over the forecast period is the growing prevalence of critical limb ischemia, combined with risk factors such as hypertension, diabetes, obesity, and hyperlipidemia among the population. Peripheral vascular disease affects patients with diabetes at risk for chronic limb-threatening ischemia; hence, rising diabetes incidence is anticipated to fuel market expansion. For instance, according to statistics released by the International Diabetes Federation 2022, 32 million Americans were estimated to have diabetes in the 10th edition of 2021, and this number is expected to rise to 34 million by 2030 and 36 million by 2050.

Key Companies & Market Share Insights

Key players operating in the market are Medtronic plc, Cynata Therapeutics Ltd, LimFlow SA, Cardiovascular Systems, Inc., Abbott Laboratories, Eli Lilly and Company, Rexgenero Ltd., Teva Pharmaceuticals, Cesca Therapeutics, Boston scientific corporation, Micro Medical Solutions. These industry players are consistently engaged in initiatives such as new product development, strategic mergers and acquisitions, and other collaborative efforts to explore and secure new avenues in the market.

The following are some instances of strategic initiatives:

-

In June 2022, Koninklijke Philips N.V. announced that the U.S. FDA approved the device named Philips endovascular system, Tack (4F). It provides a long-lasting therapeutic impact and enhanced quality of life for patients suffering from critical limb ischemia.

-

In March 2022, LimFlow registration enrollment of patients in the PROMISE II U.S. pivotal trial for a novel device intended to save amputations in patients who have no other options with chronic limb-threatening ischemia.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."