- Home

- »

- Pharmaceuticals

- »

-

Crocin Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Crocin Market Size, Share & Trends Report]()

Crocin Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Food, Drug), Purity (Purity >98%, Purity <98%), Indication (Pain), Distribution Channel (Hospital Pharmacy), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-056-7

- Number of Report Pages: 134

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Crocin Market Size & Trends

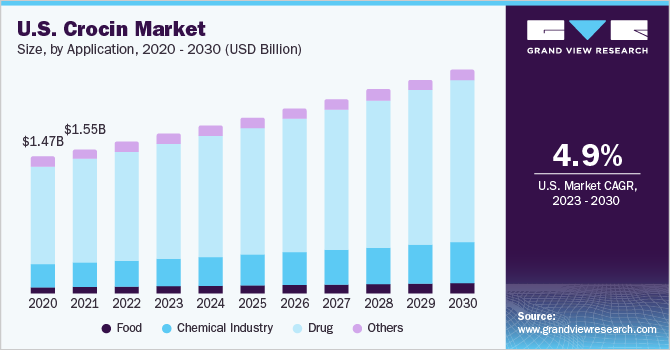

The global crocin market size was estimated at USD 4.54 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.14% from 2023 to 2030. Some of the major factors driving the market are the rising prevalence of conditions like headaches, flu, & other pains, increasing demand for pain management drugs, and increased production of paracetamol. Oral diseases affect approximately 3.55 billion people, causing pain and discomfort, according to WHO. Moreover, according to WHO, there were 1 billion people in the world aged 60 and above in 2020, and the number is expected to increase to 1.4 billion by 2050. Paracetamol is an effective antipyretic used to reduce fever and the rising prevalence of flu and the increased use of OTC products are propelling the market growth.

The growing prevalence of chronic pain diseases and the rising prevalence of cancer pain worldwide are driving the demand for pain management drugs. The rising population, with a high geriatric population in several developing countries, is expected to drive market growth. The pandemic had a combined impact on pain management drugs by severely disrupting the drug supply chain, causing delays in the production and sale of opioids, the most significant pain management drug in the market.

Furthermore, increased paracetamol production by local market players and initiatives to increase availability is expected to drive the market over the forecast period. For example, in June 2021, with funding from the France Relance program, SEQENS in collaboration with Sanofi and UPSA launched a project to build a new paracetamol production unit. The unit will also be able to produce 10,000 tons of paracetamol per year, according to reports.

China and India, the primary API suppliers of paracetamol drugs, were incapable of supplying APIs due to COVID-19 restrictions, which resulted in manufacturing shortages and restrains in many European countries. Acetaminophen is one of the most regularly used OTC pain relievers available in the U.S. without a prescription and is frequently consumed in combination with other OTC and prescription medications, both generic & branded. In the U.S., a bottle of 500 mg acetaminophen tablets generally costs between USD 2.00 and USD 5.00.

Application Insights

The drug segment is anticipated to dominate the crocin industry with a revenue share of 71.8% in 2022 owing to the increasing production of paracetamol to be used for relieving pain and fever. People suffering from high fevers and flu-related aches & pains commonly used paracetamol. Moreover, the market growth can be attributed to a variety of factors.

Some of the major ones are the increasing prevalence of conditions like headaches & flu and the increasing demand for pain management drugs. Paracetamol is commonly used to treat minor to moderate pains such as headaches, toothaches, osteoarthritis, menstrual periods, backaches, and flu or cold symptoms. It is also used to reduce fever as an effective antipyretic. The increasing burden of indicative conditions and over-the-counter (OTC) use of the products is propelling the market.

The chemical industry segment is expected to grow at the fastest rate during the forecast period. The chemical works in the crocin market by supporting the production of key raw materials and chemicals for acetaminophen, i.e. paracetamol. Commercially, phenol, ortho-, and para-nitrotoluene are majorly made available to the pharmaceutical industry by the chemical industry, which drives the growth of the chemical industry as a major supplier.

Purity Insights

The purity >98% segment held the largest share of 95.4% of the market in 2022 and is also expected to show the fastest growth in the forecast period owing to the high purity associated with the formulation made from this formulation. The dominance of this segment can be attributed to the increasing number of surgeries carried out in Purity >98% owing to the presence of qualified and specialized healthcare professionals. The need for rapid relief from postoperative pain is further driving the market growth. Purity >98% are equipped with surgical equipment that makes accepting patients easier. Moreover, the rising concerns to treat acute and mild postoperative pain are leading the overall market growth.

The purity <98% segment held the second-largest revenue share of the crocin market and is expected to maintain its dominance over the forecast period. The use of purity >98% is higher than that of <98% purity, this can be attributed to the overall growth.

Indication Insights

The pain indication segment dominated the market with a revenue share of 58.4% in 2022 owing to the increased acceptability and tolerability associated with paracetamol for relieving pain. Paracetamol is administered through the oral or Intravenous (IV) route. However, the IV route of administration is widely adopted for relieving pain owing to its effectiveness and rapid action. A single dose of crocin given intravenously is effective in relieving pain for around 4 hours for about 37% of patients with acute postoperative pain.

Pyrexia segment is expected to grow at the fastest rate in the forecast period as paracetamol is one of the most commonly used legal drugs for treating pyrexia and lowering fever. The medication is widely available on prescription & over the counter and is extensively used due to the low side effects. During the COVID-19 pandemic, paracetamol was commonly used and consumed by the population for relieving fever, which was associated with the infection. Several brands of paracetamol are available in the market, enhancing the buyers' acceptability. Fever is associated with many diseases and disorders, which increases the need for regulation of body temperature so that treatment for the underlying condition can be managed more precisely.

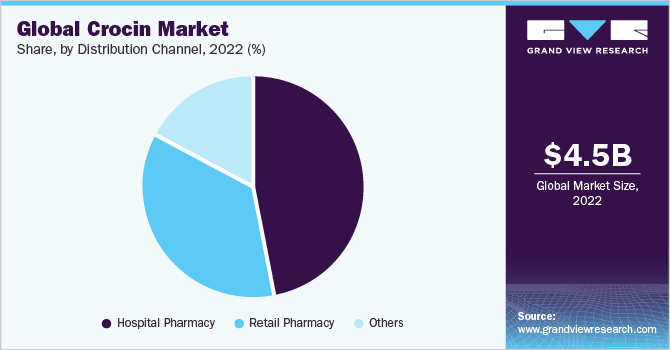

Distribution Channel Insights

Hospital pharmacies led the distribution channel segment in 2022 with a share of 47.2% as they are the key stakeholders in the market handling medications in a crucial hospital environment that requires immediate access to medicine & products. Moreover, these pharmacies cover outpatient and inpatient services, facilitating easy treatment of gastrointestinal diseases in patients. The dominance of this segment can be attributed to the increasing number of surgeries carried out in hospitals owing to the presence of qualified and specialized healthcare professionals.

The retail pharmacies segment is expected to show the fastest growth over the forecast period. The retail pharmacy segment is moving toward consolidation, and pharmacies are forming groups & pharmacy chains. This horizontal integration is projected to lead to market consolidation and create a dominance of prominent players. The pharmacists’ experience & physical presence and proximity in these pharmacies provide the segment a competitive edge over online pharmacies.

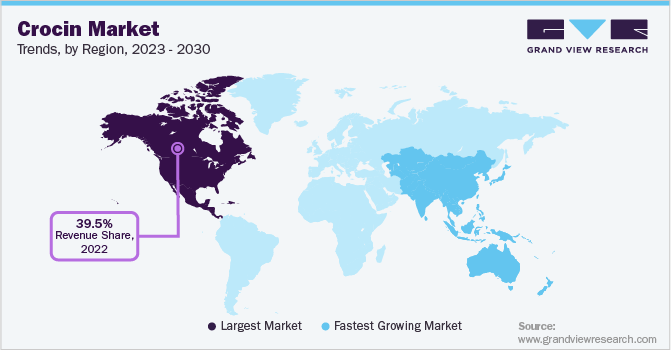

Regional Insights

North America emerged as one of the prominent regional markets in 2022 with a revenue share of 39.51%. The growth in the region can be attributed to the increasing need for pain management drugs among the population in the region. The market growth can be attributed to the increasing prevalence of headaches and migraine in the region. According to an article published in January 2021 by the American Migraine Foundation, more than 4 million adults in the U.S. suffer from chronic daily migraine, with a minimum of 15 headache days per month. The increasing disposable income and expanding patient pool in the region are expected to drive market growth.

Asia Pacific is expected to expand at a CAGR of 5.57% from 2023 to 2030. The growth in the region can be attributed to the presence of China and India in the region with these countries being the world’s two largest API producers responsible for supplying around 80% of the global paracetamol, making Asia the largest source of paracetamol. Moreover, its massive population makes it the world’s largest consumer market.

Key Companies & Market Share Insights

The key players operating in the market are increasingly focusing on acquiring specialized capacities that are highly capital-intensive to develop. For Instance, in April 2022, Genexa, Inc. launched Genexa Acetaminophen Extra Strength and Genexa Acetaminophen PM with the same efficacy as that of its counterparts available in the market but without the use of artificial preservatives, dyes, or synthetic fillers. The products were available as OTC pain relievers. Some of the key players in the global crocin market include:

-

TCI Chemicals Pvt. Ltd.

-

Merck KGaA

-

GSK plc.

-

Cayman Chemical

-

APExBIO Technology

-

Wilshire Technologies

-

Biosynth

-

Cipla, Inc.

-

Novartis AG

-

Sanofi

-

Aurobindo Pharma

-

Teva Pharmaceutical Industries Ltd.

-

Mallinckrodt

Crocin Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.79 billion

Revenue forecast in 2030

USD 6.79 billion

Growth rate

CAGR of 5.14% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in (USD million) and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, purity, indication, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

TCI Chemicals Pvt. Ltd.; Merck KGaA; GSK plc.; Cayman Chemical; APExBIO Technology; Wilshire Technologies; Biosynth, Cipla, Inc.; Novartis AG; Sanofi; Aurobindo Pharma; Teva Pharmaceutical Industries Ltd.; Mallinckrodt

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crocin Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the crocin market on the application, purity, indication, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food

-

Chemical Industry

-

Drug

-

Others

-

-

Purity Outlook (Revenue, USD Million, 2018 - 2030)

-

Purity >98%

-

Purity <98%

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Pain

-

Pyrexia (Fever)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global crocin market size was estimated at USD 4,546.82 million in 2022 and is expected to reach USD 4,791.89 million in 2023.

b. The global crocin market is expected to grow at a compound annual growth rate of 5.14% from 2023 to 2030 to reach USD 6.79 billion by 2030.

b. Pain dominated the crocin market with a share of 58.35% in 2022. This is attributable to the increasing usage of paracetamol as an Over-The-Counter (OTC) analgesic with lesser side effects as compared to other painkillers available in the market.

b. Some key players operating in the crocin market include Cipla, Sanofi, Sun Pharmaceutical Industries Ltd., Mallinckrodt, Teva Pharmaceuticals USA, Aurobindo Pharma, Biological E Limited, Genesis Biotec, Geno, and GSK.

b. Key factors that are driving the market growth include the rising prevalence of conditions like headaches, flu, & other pains, increasing demand for pain management drugs, and increased production of paracetamol.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.