- Home

- »

- Pharmaceuticals

- »

-

Crohn's Disease Therapeutics Market Size Report, 2030GVR Report cover

![Crohn's Disease Therapeutics Market Size, Share & Trends Report]()

Crohn's Disease Therapeutics Market Size, Share & Trends Analysis Report By Type, By Route of Administration (Injectable, Oral), By Distribution Channel (Hospital Pharmacies), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-424-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Crohn's Disease Therapeutics Market Trends

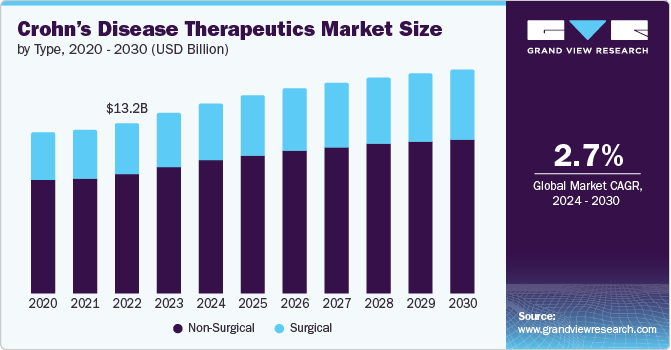

The global crohn's disease therapeutics market size was valued at USD 13.20 billion in 2023 and is projected to grow at a CAGR of 2.7% from 2024 to 2030. The increased incidence of Crohn’s disease in patients in several countries has triggered the need for therapeutics. Furthermore, the drug discovery process, including more specific therapies, has resulted in better quality of patient lives and treatment choices. In addition, increasing awareness of Crohn’s disease and initiatives towards enhancing diagnostic rates have resulted in an increasing number of patients receiving early treatments is anticipated to drive market growth.

The emergence of biologics and targeted therapies makes treatment cost-effective. The rise in accessibility for these drugs is expected to propel market developments, especially in regions with limited healthcare budgets. This is also empowering pharmaceutical companies to invest in research in therapies for Crohn’s which in turn drives the competition in the market. In gastroenterology, there is a growing interest in personalized medicine that customizes treatment plans to individual patients' genetics and diseases. This approach aims at identifying the most effective drug based on patient profile with a minimal side effect.

Developing complementary diagnostics and tests that guide treatment decisions and targeted therapies impacts the Crohn's disease market. This personalized approach not only improves patient outcomes but also optimizes the cost of care, which can lead to a sustainable market in the long term. The growing use of stem cells in the treatment of diseases and the development of new biologics and anti-cytokine agents with diverse activities are expected to drive the industry in the future. For instance, Infliximab and Adalimumab are effective in treating moderate to severe symptoms.

Type Insights

Non-surgical dominated the market and accounted for a share of 70.3% in 2023 owing to the advancements in medication and the development of powerful biological therapies and biosimilars that effectively manage Crohn's disease. These medications also offer improved control and better treatment outcomes compared to traditional options.

The surgical segment is expected to grow at a CAGR of 3.4% during the forecast period. This is driven by the need for surgery in severe cases with complications, and the ongoing development of minimally invasive surgical techniques that offer faster recovery and less discomfort for patients. Additionally, the development of procedures in surgery, including robotic surgery, helps patients to be discharged from the hospital quickly. This makes surgery a more suitable option in complicated cases.

Route of Administration Insights

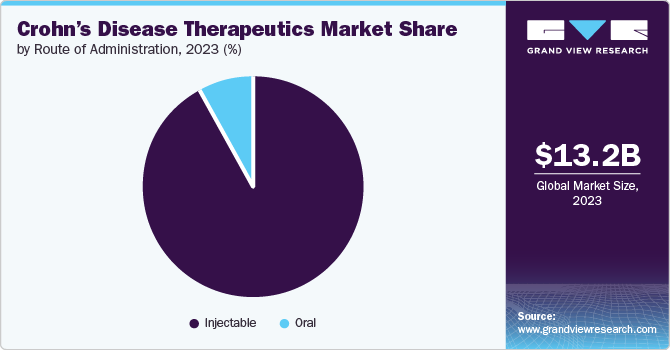

The injectable segment dominated the market in 2023 due to the use of biologics which are markedly potent drugs administered through injections. Several biologic injections are used in the treatment of Crohn’s that alleviate the severity, and the frequency of flare-ups. The FDA has approved Adalimumab (Humira), Adalimumab-adbm, Certolizumab, Infliximab, and others with the ultimate objective of preventing severity. For instance, Adalimumab (Humira), Adalimumab-adbm helps in easing the symptoms and prevents remission in patients.

The oral segment is projected to grow at a CAGR of 7.1% over the forecast period. This is due to the discovery of new and effective oral drugs that deal with mild to moderate Crohn’s condition and offer customized treatment options to patients. Additionally, the factors contributing towards patient compliance have also shifted the demand towards oral medications over injections suitable for the long term.

Distribution Channels Insights

The hospital pharmacies segment dominated the market in 2023. This is due to the potent biologics used at the start of the supervised treatment. Hospitals offer integrated care settings that provide access to medications, surgery, dietary management, and psychological support to manage Crohn's disease. Besides, a severe flare with symptoms such as pain, dehydration, and extreme inflammation is a major cause for patients seeking hospitalization.

The online pharmacies segment is projected to grow at a CAGR of 4.8% over the forecast period. This is mainly due to the technological advancements and availability of Internet bandwidth. Online pharmacies play a crucial role in patient awareness and education. As Crohn’s commonly falls under inflammatory bowel disease (IBD) and gastrointestinal disease, online pharmacies have emerged as a prominent tool for online consultation.

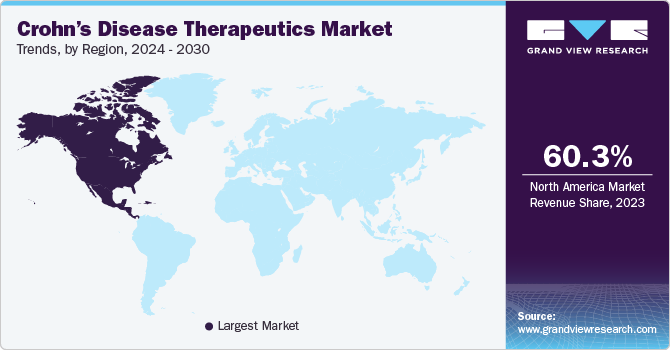

Regional Insights

North America Crohn’s disease therapeutics dominated the market in 60.25% of the global revenue in 2023. High incidences of Chron’s in patients are one of the major growth drivers. In addition, these countries have an established health systems with well-affiliated insurance infrastructure for better access to novel therapies for Crohn’s disease. Furthermore, North America is one of the principal regions for pharmaceutical innovation, with a quick implementation of new and possibly more effective therapies for Crohn’s disease.

U.S. Crohn's Disease Therapeutics Market Trends

The U.S. Crohn’s disease therapeutics market dominated in North America with a share of 73.8% in 2023 due to the high probability of patients in the U.S. developing Crohn’s disease. The percentage is relatively higher as compared with other regions. Additionally, the American healthcare system provides a pool of diverse insurance plans for patients that address many specialists, which is helpful in the diagnosis at an early stage and treatment with the help of innovative methods.

Europe Crohn's Disease Therapeutics Market Trends

Europe Crohn’s disease therapeutics market grew high in 2023. This is because Europe witnessed a rising rate of the condition in the population. Additionally, the government and healthcare systems ensure patients gain access to the treatments required. This has resulted in a huge demand for clinical products from a treatment aspect.

UK Crohn’s disease therapeutics market is expected to grow higher in the coming years due to the increasing number of patients and the emphasis of the National Health Service (NHS) on early diagnosis and easy access to treatment. This is anticipated to drive demand for therapeutics and drugs. Also, the research initiatives in the UK lead to the development of new therapies, which propel the market growth.

Asia Pacific Crohn's Disease Therapeutics Market Trends

Asia Pacific Crohn’s disease therapeutics market is anticipated to witness significant growth. This is due to the advances in diagnostic imaging technology and the rising prevalence of the condition in the population. Furthermore, inflating healthcare costs, and reimbursement scenarios have fueled the need for therapies and therapeutics.

China Crohn’s disease therapeutics market held a substantial share in 2023 owing to a large population and increasing awareness and diagnostic tools. Furthermore, the country’s economic development has triggered the expansion of healthcare expenditure and insurance.

Key Crohn's Disease Therapeutics Company Insights

Some key companies in the global Crohn’s disease therapeutic market include Takeda Pharmaceutical Company Limited, AbbVie Inc., Pfizer Inc., Ferring B.V., and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Pfizer, Inc. is an international pharmaceutical company focusing on advancing health through innovation and producing prescription and over-the-counter products in several therapeutic categories.

-

Takeda Pharmaceutical Company Limited undertakes research, production, and sales of a wide portfolio of prescription medicines for different illnesses, specializing in gastroenterology, and oncology.

Key Crohn's Disease Therapeutics Companies:

The following are the leading companies in the crohn’s disease therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Takeda Pharmaceutical Company Limited

- AbbVie Inc.

- Perrigo Company plc

- Pfizer Inc.

- Johnson & Johnson Services Inc.

- Ferring B.V.

- Bristol-Myers Squibb Company (Celgene Corporation)

- F. Hoffmann-La Roche Ltd (Genentech, Inc.)

- UCB S.A.

- Salix Pharmaceuticals

- Gilead Sciences Inc.

Recent Developments

-

In June 2024, AbbVie bought biotechnology firm Celsius Therapeutics for USD 250 million. The company is currently working on therapies for inflammatory bowel disease (IBD). The key to this acquisition is Celsius’ drug CEL383 has the potential to become the first of its kind for IBD patients. CEL383, has the potential to impact more patients as AbbVie aims to get more patients into remission.

-

In June 2024, Johnson & Johnson applied for the FDA approval of TREMFYA for the Crohn’s disease treatment. This drug is already approved for use in patients with psoriasis and psoriatic arthritis. The outcome of the trials demonstrated that TREMFYA was successful in managing Crohn’s disease symptoms and might offer new treatment method for patients.

Crohn's Disease Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.85 billion

Revenue Forecast in 2030

USD 16.28 billion

Growth rate

CAGR of 2.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, route of administration, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Takeda Pharmaceutical Company Limited, AbbVie Inc., Perrigo Company plc, Pfizer Inc., Johnson & Johnson Services Inc., Ferring B.V., Bristol-Myers Squibb Company (Celgene Corporation), F. Hoffmann-La Roche Ltd (Genentech, Inc.), UCB S.A., Salix Pharmaceuticals, Gilead Sciences Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Crohn's Disease Therapeutics Market Report Segmentation

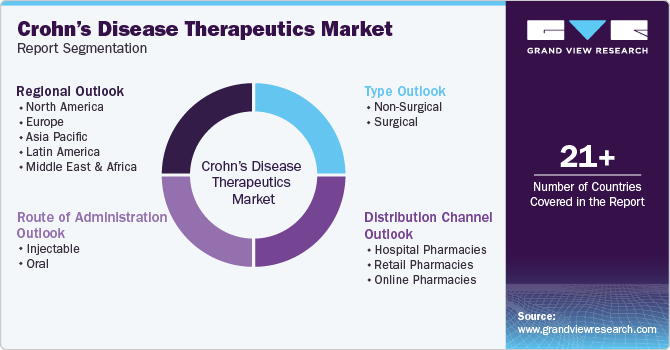

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Crohn’s disease therapeutics market report based on type, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-Surgical

-

Anti-Inflammatory

-

Immune system suppressors

-

Antibiotics

-

Others

-

-

Surgical

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Oral

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."