- Home

- »

- Medical Devices

- »

-

Cryoablation Devices Market Size, Industry Report, 2030GVR Report cover

![Cryoablation Devices Market Size, Share & Trends Report]()

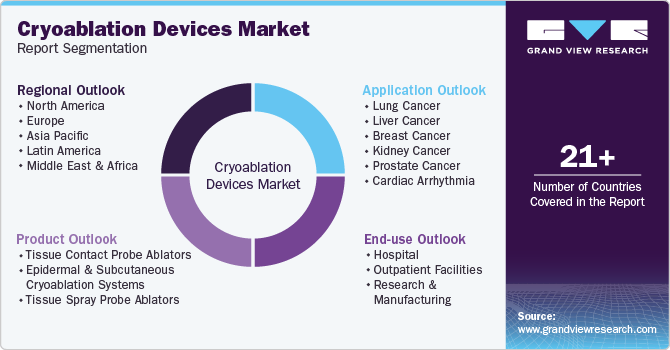

Cryoablation Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Tissue Contact Probe Ablators, Tissue Spray Probe Ablators), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-040-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Cryoablation Devices Market Summary

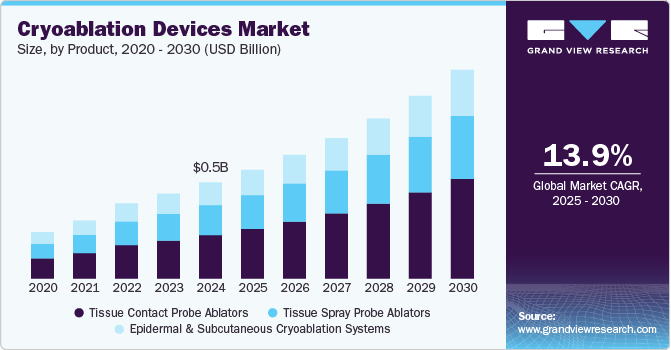

The global cryoablation devices market size was valued at USD 477.1 million in 2024 and is projected to reach USD 1,036.7 million by 2030, growing at a CAGR of 13.9% from 2025 to 2030. Growth is driven by rising cancer prevalence, increasing adoption of minimally invasive procedures, and advancements in cryoablation technology. The expanding geriatric population and growing preference for targeted tumor therapies further boost demand.

Key Market Trends & Insights

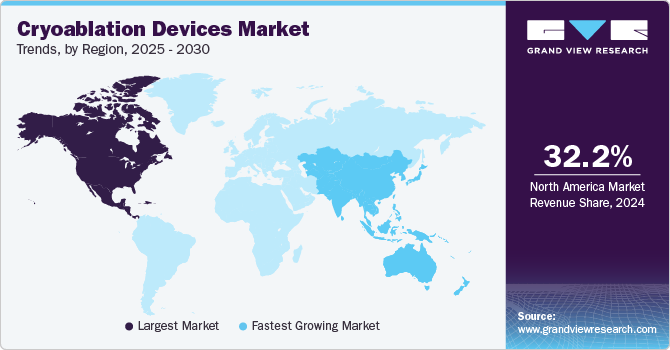

- North America cryoablation devices market led the global industry in 2024, capturing the largest revenue share of 32.2%

- The cryoablation devices industry in the U.S. held a significant share of the North America region in 2024.

- By product, The tissue contact probe ablators segment dominated the market with a revenue share of 45.2% in 2024.

- By application, The cardiac arrhythmia segment dominated the market with a share of 37.8% in 2024.

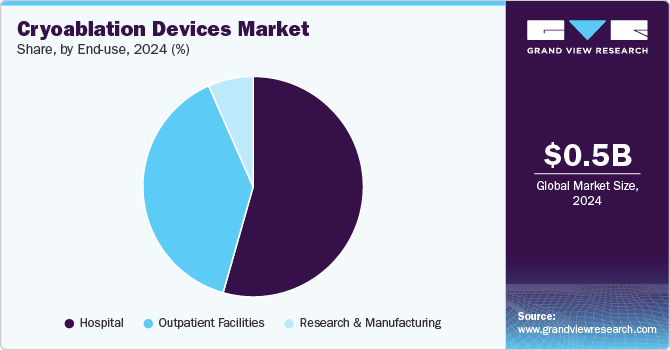

- By end use, The hospital segment dominated the market with the largest share of 54.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 477.1 Million

- 2030 Projected Market Size: USD 1,036.7 Million

- CAGR (2025-2030): 13.9%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, regulatory approvals and strategic collaborations among key players enhance market expansion. Increasing applications in cardiology, dermatology, and pain management contribute to market growth. Increasing inclination of the patients and surgeons towards non-invasion or minimal invasion treatment procedures due to the advantages such as patient comfort, speedy recovery, and minimized turnaround time are a few of the factors which are anticipated to fuel demand for cryoablation devices during the forecast period.

Advanced cancer ablation procedures are mostly performed on an outpatient basis and do not require any hospital admission as compared to conventional therapies, resulting in a significant reduction in total healthcare expenses. Ablation therapy is the preferred surgery for cancer of small sizes. Hence, the procedural volume is indirectly reliant on the yearly tumor screening tests.

According to the CDC in October 2022, approximately 12 million U.S. individuals suffered from atrial fibrillation by 2030. Moreover, in 2019, around 183,321 deaths were caused in the U.S. Furthermore, approximately 450,000 hospitalizations were recorded with atrial fibrillation as the key diagnosis every year in the U.S. The rising prevalence of atrial fibrillation is predicted to enhance demand for the cryoablation devices industry during the forecast period.

A rise in the prevalence of tumors such as lung cancer, prostate cancer, breast cancer, and many more in several countries across the globe is anticipated to fuel the cryoablation devices industry growth. As per an article published by CDC in June 2022, nearly 221,097 new lung cancer cases were reported in the U.S., and 139,601 deaths were caused due to lung cancer. Furthermore, every year, in the U.S., approximately 25,000 men and 11,000 women get liver cancer, and around 9,000 women and 19,000 men die due to the same.

According to the survey conducted by NCI's Surveillance, Epidemiology, and End Results (SEER) Program, conducted in March 2021, the most common age for getting a tumor diagnosis is 66 years, that is, half of the tumor cases occur in individuals under this age. The geriatric population is held as the main target population for minimally invasive or noninvasive cryoablation techniques, due to the compromised body’s biological functions. Thus, the rising geriatric population base is expected to augment demand for cryoablation devices during the forecast period.

Market Concentration & Characteristics

The cryoablation devices industry is moderately concentrated, with key players like Medtronic, Boston Scientific, and IceCure Medical driving innovation. It is characterized by rapid technological advancements, increasing regulatory approvals, and expanding applications in oncology, cardiology, and dermatology. Market growth is fueled by rising demand for minimally invasive procedures and improved patient outcomes. The industry features strong R&D investments, strategic partnerships, and geographic expansions to enhance market presence. In addition, increasing awareness and favorable reimbursement policies support adoption. While barriers to entry include high development costs and regulatory hurdles, innovation and clinical efficacy continue to shape the competitive landscape.

The cryoablation devices industry has experienced significant advancements with AtriCure, Inc.'s announcement on October 2024 regarding the launch of its cryoSPHERE MAX cryoablation probe. This new probe features a larger ball tip to improve cryo nerve block therapy (cryoNB). It reduces freezing time by 50% compared to the original cryoSPHERE probe and over 30% compared to the cryoSPHERE+ probe.

Regulations in the cryoablation devices industry are critical in ensuring patient safety and device efficacy. Regulatory bodies like the FDA and EMA oversee the approval and monitoring of cryoablation technologies, requiring rigorous clinical trials and safety testing before products reach the market. These regulations set standards for device performance, labeling, and post-market surveillance. In addition, regulatory frameworks help streamline the introduction of advanced devices while safeguarding public health.

Mergers and acquisitions (M&A) in the cryoablation devices industry are growing swiftly as companies seek to enhance their technological expertise and expand their market presence. A notable example is Boston Scientific Corporation's acquisition in July 2018 of the remaining 65% of Cryterion Medical Inc., a private firm developing a single shot cryoablation platform for atrial fibrillation (AF) treatment, for USD 202 million.

In the cryoablation devices industry, product substitutes include alternative treatment options for conditions like atrial fibrillation (AF) and chronic pain. Radiofrequency (RF) ablation is a common substitute, using heat to destroy tissue, offering a similar approach to cryoablation. Other alternatives are laser ablation, which employs light energy for tissue removal, and surgical procedures, such as catheter ablation, which can also target heart arrhythmias. In addition, pharmacological treatments and non-invasive therapies, like pharmaceutical drug management or electrical cardioversion, may act as substitutes in certain cases, depending on the patient’s condition and the physician's recommendations.

The cryoablation devices industry is experiencing notable regional expansion, driven by increasing demand for minimally invasive treatments for conditions like atrial fibrillation and chronic pain. Key markets such as North America and Europe are leading growth due to advanced healthcare infrastructure, rising patient awareness, and technological innovations. Meanwhile, emerging markets in Asia-Pacific and Latin America are seeing accelerated adoption of cryoablation therapies as healthcare systems improve and the demand for cost-effective treatments rises. This regional growth is supported by expanding clinical applications and regulatory approvals, fostering innovation and making cryoablation devices more accessible globally.

Product Insights

The tissue contact probe ablators segment dominated the market with a revenue share of 45.2% in 2024 and is anticipated to register the fastest CAGR during the forecast period. It is due to the developing healthcare infrastructure, adoption of changing trends in the healthcare system, and consumption patterns. The increasing focus of manufacturers in developing advanced cryoablation devices is expected to contribute towards market growth.

The ablation probe upon contacting the target, the tumor cells, uses freezing technology to destroy the abnormal tissues. For instance, cryoFORM Cryoablation Probe, a product of AtriCure, is among the latest generation, which features a thermal capacity to remove heat and increase the flexibility for various ablation treatments. The recent advancements in probe nanotechnologies assists healthcare professionals to detect and treat cancer. Nanoprobe biotechnology thus helps in discovering new cancer biomarkers, which have become a key part in early cancer diagnosis.

Tissue spray probe ablators held a considerable revenue share in 2024. Increasing preference and demand for tissue spray probes owing to their increasing advantages are anticipated to foster segment growth. The rising focus of manufacturers on developing advanced tissue probe ablators is estimated to contribute toward segment progression.

Application Insights

The cardiac arrhythmia segment dominated the market with a share of 37.8% in 2024 owing to the rising cardiovascular disorders that are anticipated to increase the risk of developing heart damage such as abnormal heart valves, cardiomyopathy, narrowed heart arteries, and many more. According to a WHO report of 2021, globally 17.9 million deaths occurred due to CVD annually. Moreover, it is anticipated that more than 3.6 million people will die from CVD, mainly from heart disease and stroke by 2030. The prevalence of getting cardiac arrhythmia is estimated to be between 1.5% to 5.0% in general. Thus, the increasing prevalence of cardiovascular disorders globally is expected to strengthen segment growth.

The breast cancer segment is estimated to expand at the fastest CAGR over the forecast period. According to the American Cancer Society article, published in January 2023, nearly 297,790 and 55,720 novel breast cancer cases and ductal carcinoma in situ (DCIS) cases, respectively, will be reported this year. Approximately, 43,000 deaths due to breast cancer in women are projected in the year 2023.

Furthermore, the median age estimated by the American Cancer Society is 62 years at which most women are most likely to be diagnosed with breast cancer. Although, breast cancer is mostly diagnosed in women, however, men get diagnosed too with breast cancer. According to a CDC article, published in September 2022, every 1 man out of 100 gets diagnosed with breast cancer. Moreover, according to the American Cancer Society, in 2023, around 2,800 novel breast cancer cases are expected to be diagnosed in men, and in that, 530 men are expected to die from cancer. The growing cases of individuals diagnosed with breast cancer are anticipated to propel the growth of the market for cryoablation devices.

End Use Insights

The hospital segment dominated the market with the largest share of 54.4% in 2024. This is attributed to an increase in patients diagnosed with cardiovascular diseases leading to the increased number of cardiac arrhythmia surgeries performed, which is among the most common surgeries performed in hospitals worldwide. This type of surgery accounts for more resources used in the cardiovascular domain than any other procedure. In developed countries, insurance companies pay for medical expenditures that include ligature costs. Thus, an increase in the number of cancer cases contributes to the rising demand for cryoablation devices in this segment, which is expected to strengthen growth in future years.

Outpatient facilities are expected to register the fastest CAGR during the forecast period. According to Definitive Healthcare’s platform, in 2022, there were over 11,815 active ambulatory surgical centers present in the U.S. and the number is most likely to rise in the coming years. This rapid growth trend reflects a rising preference for outpatient procedures. The kind of procedures performed in ambulatory centers have undergone substantial changes in recent years. Technological advancements in minimally invasive surgeries are contributing to the growing demand for ambulatory surgical centers.

Regional Insights

North America cryoablation devices market held a dominant position, capturing 32.2% in terms of revenue owing to the rising prevalence of cancer, better healthcare infrastructure, availability of reimbursement, and growing geriatric population. These factors are driving the cryoablation devices industry growth in the region. For instance, the Patient Protection and Affordable Care Act (PPACA), a law passed by the U.S. government, promotes affordability along with the quality of healthcare through various health coverage policies, which helps in reducing the expenses of healthcare for individuals and governments.

U.S. Cryoablation Devices Market Trends

The cryoablation devices industry in the U.S. held a significant share of the North America region in 2024. The U.S. is home to key players and research institutions that drive innovation in cryoablation devices technology. The U.S. Food and Drug Administration (FDA) recently recalled catheters associated with Boston Scientific's POLARx Cryoablation System due to a higher risk of esophageal injury, which has been linked to seven patient injuries and four deaths. Approved by the FDA in August 2023, the POLARx Cryoablation System is used to treat recurrent symptomatic atrial fibrillation unresponsive to medical therapy contributing to the growth of the U.S. market.

Europe Cryoablation Devices Market Trends

The Europe cryoablation devices industry was the second largest globally in 2024, owing to the rising public funding in Europe’s healthcare infrastructure. Moreover, the growing geriatric population and growing number of initiatives by government to increase awareness for prevention of tumors is expected to propel market growth. For instance, the European Cancer Observatory aims to spread awareness about the various options available for treatments of tumor, such as advanced minimal invasive surgeries and early diagnostic techniques.

The cryoablation devices industryin the UK is witnessing significant growth due to the rising incidence of chronic diseases such as cancer and the rising elderly population. For instance, according to the Department of Health & Social Care in the UK, the population aged 85 and older is expected to increase by one million between 2021 and 2036.

France cryoablation devices industry is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. According to World Bank data, in 2021, France allocated approximately 12.31% of its GDP to healthcare. Its robust healthcare infrastructure promotes the adoption of minimally invasive surgical instruments and devices.

The cryoablation devices industry in Germany is primarily fueled by advancements in medical procedures, such as the first intranasal cryotherapy performed at Landstuhl Regional Medical Center (LRMC) in April 2021. This procedure, a first in Germany, uses cryoablation to freeze nasal nerves, treating chronic rhinitis. U.S. Army Lt. Col. Jessica Peck highlighted its significance in addressing both allergic and non-allergic rhinitis. Previously performed in the U.S. for two years, it was only recently approved in Germany. With at least 20% of German adults suffering from allergies, this innovation offers new treatment options for long-term nasal inflammation relief.

Asia Pacific Cryoablation Devices Market Trends

The Asia Pacific cryoablation devices industry is anticipated to register the fastest CAGR over the forecast period. The growing presence of many healthcare providers and the rising patient population in developing countries such as India, Thailand, and China are the major factors estimated to foster market growth. Furthermore, with government assistance, the utilization of healthcare infrastructure in the region is expanding. For instance, the Indian government provides financial support for poor individuals suffering from tumors under the Health Minister Cancer Patient Fund (HMCPF) scheme. These government initiatives and other various factors are anticipated to boost the cryoablation device industry in the Asia Pacific during the period.

The cryoablation devices industry in Japan is growing, primarily driven by the country’s aging population, with approximately 30% aged 65 and older in 2023, according to World Bank data. Growth is further fueled by the introduction of advanced surgical tools and frequent product launches. Manufacturers are heavily investing in R&D to develop innovative instruments that enhance precision, efficiency, and patient care.

China cryoablation devices market held the largest revenue share in Asia Pacific in 2024. China's swiftly changing healthcare landscape and patient needs significantly contribute to the growth of the cryoablation devices industry. The country faces a rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and autoimmune disorders. For instance, the International Diabetes Federation (IDF) reported that in 2021, 537 million people globally had diabetes, with 206 million in the Western Pacific Region; this number is projected to increase to 260 million by 2045.

The cryoablation devices market in India is set for significant growth, driven by the increasing prevalence of gastrointestinal disorders and colorectal cancer. With colorectal cancer cases rising at an estimated 5% annually, the demand for minimally invasive procedures has increased. India's aging population, projected to reach 20% by 2050, further fuels this demand. Government initiatives, such as the Ayushman Bharat scheme, are enhancing access to advanced healthcare, boosting cryoablation devices.

Latin America Cryoablation Devices Market Trends

The Latin American cryoablation devices industry is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Cryoablation Devices Market Trends

The Middle East and Africa cryoablation devices industry is growing due to advancements in healthcare infrastructure, rising awareness of minimally invasive procedures, and the increasing prevalence of chronic conditions like atrial fibrillation and cancer. The adoption of cryoablation therapies is being driven by the growing demand for cost-effective, less invasive treatment options. In addition, improvements in medical technology, along with regulatory approvals for cryoablation devices, are fueling market expansion.

The cryoablation devices industry in Saudi Arabia is anticipated to grow over the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, as per Saudi Arabian Monetary Agency (SAMA), the proportion of the Saudi Arabian population aged 60 and above is estimated to reach 25% by the end of 2050.

Key Cryoablation Devices Company Insights

Companies are aiming at manufacturing new medical devices, developments, and technological advancements. Moreover, acquisitions and mergers for novel product development and solidification of the supply chain webs constitute some of the initiatives implemented by the major players. For instance, in August 2022, Medtronic plc announced the acquisition of Affera, Inc., which is a medical technology manufacturer. This acquisition helped Medtronic in expanding the company’s ablation portfolio by comprising the first cardiac navigation and mapping platform, thus introducing one of the most effective cryoablation technologies in the market.

Key Cryoablation Devices Companies:

The following are the leading companies in the cryoablation devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Micro Port Scientific Corporation.

- Medtronic

- COOPERSURGICAL, INC.

- ATRICURE, INC.

- BVM Medical Limited

- CPSI Biotech

- Ice Cure Medical

- METRUM CRYOFLEX Sp. z o.

Recent Developments

-

In December 2024, Boston Scientific revises usage guidelines for POLARx and POLARx FIT Cryoablation Balloon Catheters following an unexpectedly high number of atrio-esophageal fistula reports.

-

In November 2024, IceCure Medical has received a Notice of Allowance from Japan's Patent Office for its 'Cryogenic System with Multiple Submerged Pumps'. This innovation enables independent control of multiple cryoprobes, enhancing the treatment of larger tumors. The patent strengthens IceCure's intellectual property and product portfolio in cryoablation technology.

Cryoablation Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 540.3 million

Revenue forecast in 2030

USD 1,036.7 million

Growth rate

CAGR of 13.9% from 2025 to 2030

Actual Data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Boston Scientific Corporation; Micro Port Scientific Corporation.; Medtronic; COOPERSURGICAL, INC.; ATRICURE, INC.; BVM Medical Limited; CPSI Biotech; Ice Cure Medical; METRUM CRYOFLEX Sp. z o.

Customization scope

Free report customization (equivalent upto 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Cryoablation Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global cryoablation devices market report based on product, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Tissue Contact Probe Ablators

-

Epidermal and Subcutaneous Cryoablation Systems

-

Tissue Spray Probe Ablators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Lung Cancer

-

Liver Cancer

-

Breast Cancer

-

Kidney Cancer

-

Prostate Cancer

-

Cardiac Arrhythmia

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Outpatient Facilities

-

Research & Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global market for cryoablation devices was estimated at USD 477.1 million in 2024 and is expected to reach USD 540.3 million in 2025.

b. The global cryoablation devices market is expected to grow at a compound annual growth rate of 13.9% from 2025 to 2030 to reach USD 1,036.7 million by 2030.

b. North America dominated the cryoablation devices market with a share of 32.2% in 2024. This is attributable to the increasing prevalence of cancer such as lung and prostrate cancer and cardiac arrhythmia in North America.

b. Some key players operating in the cryoablation devices market include Boston Scientific Corporation, MicroPort Scientific Corporation, Medtronic, COOPERSURGICAL, INC., ATRICURE, INC., BVM Medical Limited, CPSI Biotech, and IceCure Medical.

b. Key factors that are driving the market growth include Increasing preference for minimally invasive surgeries, new product launches, and rising prevalence of cancer.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.