- Home

- »

- Next Generation Technologies

- »

-

Customer Data Platform Market Size, Industry Report, 2033GVR Report cover

![Customer Data Platform Market Size, Share & Trends Report]()

Customer Data Platform Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Enterprise Size (SMEs, Large Enterprises), By Deployment (Public, Private), By Type (Analytics, Campaign), By End Use (Retail, BFSI), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-594-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Data Platform Market Summary

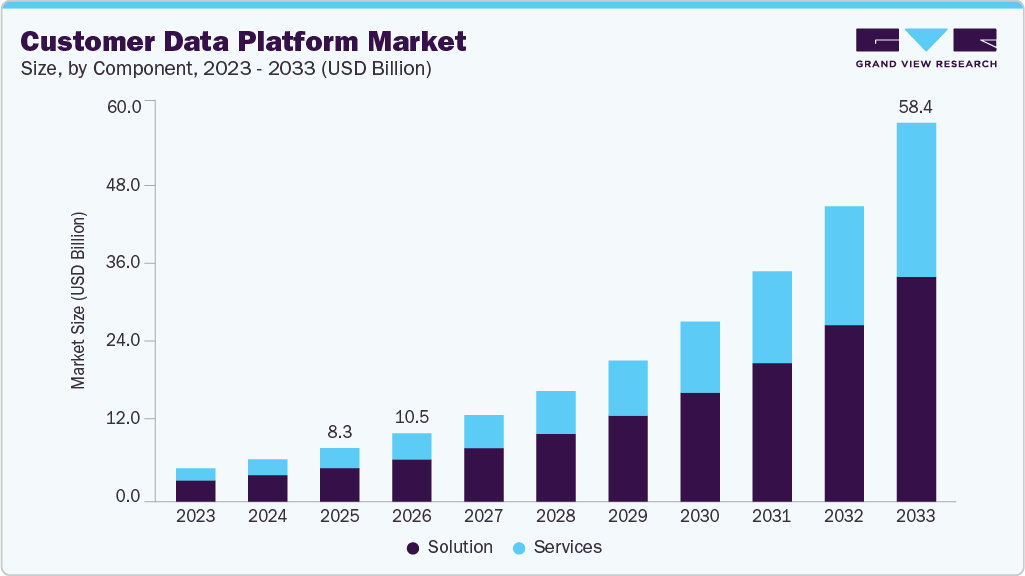

The global customer data platform market size was estimated at USD 8.26 billion in 2025 and is projected to reach USD 58.41 billion by 2033, growing at a CAGR of 27.8% from 2026 to 2033. The market growth is driven by the increasing need for unified customer data management to deliver personalized and consistent omnichannel experiences.

Key Market Trends & Insights

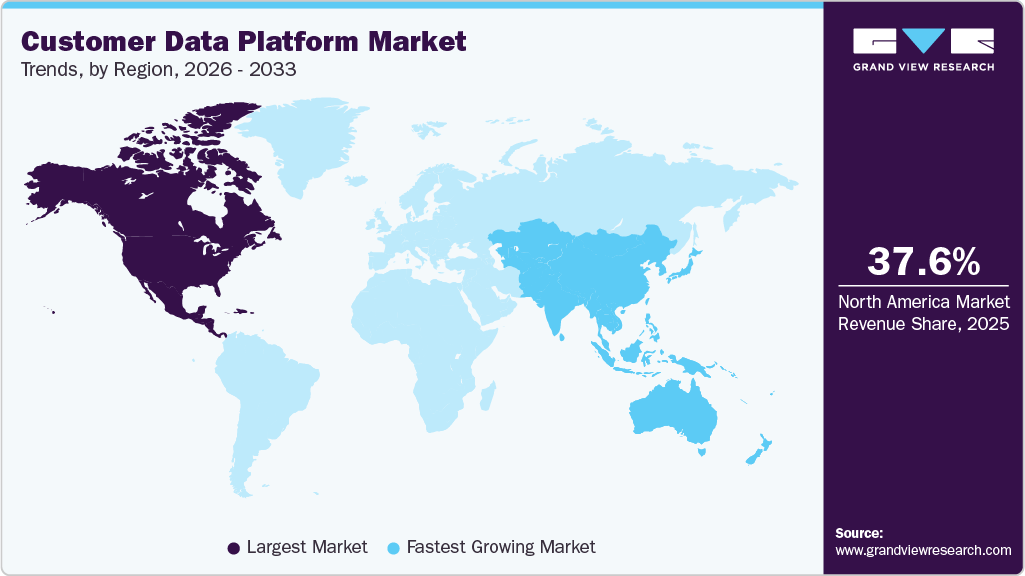

- North America customer data platform dominated the global market with the largest revenue share of 37.6% in 2025.

- The customer data platform industry in U.S. is expected to grow significantly over the forecast period.

- By component, solution segment led the market and held the largest revenue share of 62.5% in 2025.

- By enterprise size, the large enterprises segment held the dominant position with the largest revenue share in 2025.

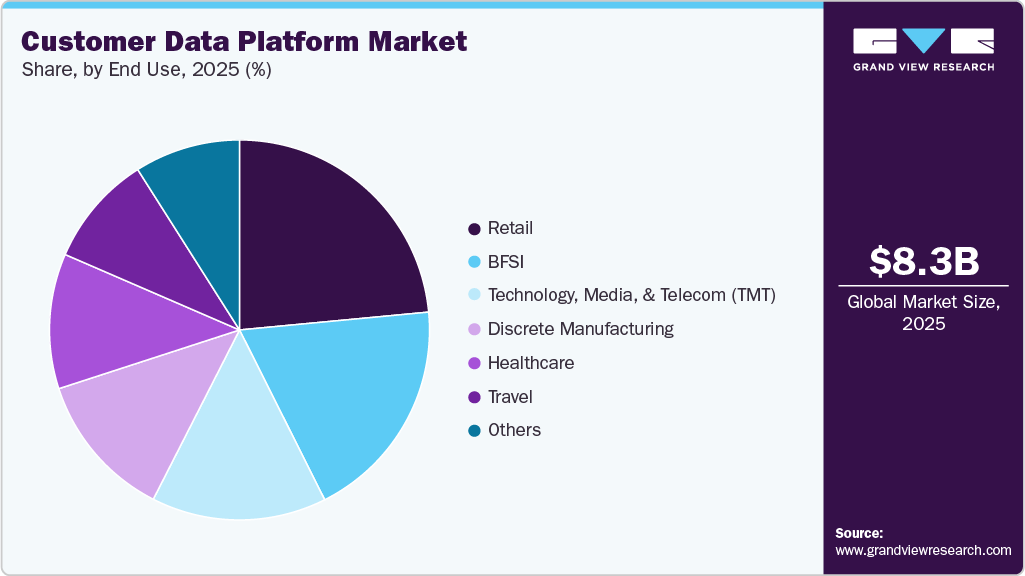

- By end use, the travel segment is expected to grow at the fastest CAGR from 2026 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 8.26 Billion

- 2033 Projected Market Size: USD 58.41 Billion

- CAGR (2026-2033): 27.8%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

As organizations handle massive volumes of customer information from diverse touchpoints, such as social media, e-commerce, mobile apps, and CRM systems, there is a rising demand for platforms that can consolidate, clean, and analyze this data in real time.The growing emphasis on delivering hyper-personalized customer experiences is one of the strongest drivers of the global customer data platform industry. Businesses are increasingly leveraging customer data platform (CDP) to unify customer data from multiple touchpoints and create a 360-degree view of each customer. This unified data enables real-time personalization across marketing, sales, and customer support channels. As consumers now expect brands to understand their preferences and anticipate their needs, companies in retail, BFSI, healthcare, and travel sectors are rapidly adopting CDPs to enhance engagement and loyalty.

The exponential growth of digital channels, such as e-commerce platforms, mobile apps, social media, IoT devices, and CRM systems, has led to a surge in fragmented customer data. Organizations face challenges in integrating and analyzing this data effectively. CDPs provide a centralized platform to collect, cleanse, and harmonize data from multiple sources, offering actionable insights that drive marketing automation and data-driven decision-making. This growing data complexity is propelling the demand for CDP solutions globally.

Modern marketing relies heavily on real-time data analytics and insights for campaign optimization, customer segmentation, and predictive analysis. CDPs enable marketers to harness first-party data to create targeted campaigns and measure their performance effectively. As companies shift from traditional marketing to data-driven strategies to maximize ROI and reduce customer acquisition costs, the demand for CDPs that provide accurate, compliant, and actionable data continues to accelerate. For instance, in March 2025, 6sense, a U.S.-based provider ofa predictive intelligence engine for B2B sales and marketing, launched 6sense Intelligent Workflows. It is a solution designed to streamline marketing and sales operations by centralizing audience engagement and data management. The platform combines audience and data workflows, enabling go-to-market teams to optimize campaigns at scale through a unified, data-driven approach.

Component Insights

The solution segment dominated the market and accounted for the revenue share of 62.5% in 2025, fueled by the integration of CDPs with advanced analytics, AI, and machine learning technologies. These integrations enable predictive analytics, customer segmentation, recommendation engines, and churn prediction. Organizations are increasingly seeking solutions that go beyond data storage to extract actionable insights that inform marketing, sales, and customer service strategies. AI-enabled CDP solutions are particularly attractive as they enable businesses optimize campaign targeting and improve return on investment.

The service segment is anticipated to grow at the fastest CAGR during the forecast period, due to the rising complexity of implementing and integrating CDPs into existing IT and marketing ecosystems. Organizations often require expert guidance for deployment, configuration, and integration with CRM, ERP, analytics, and marketing automation platforms. Professional services, including consulting and system integration, help businesses accelerate adoption, reduce errors, and ensure that the CDP aligns with organizational goals, thereby driving growth in the service segment. The segment is further bifurcated into integration & deployment, support & maintenance, and training & consulting.

Enterprise Size Insights

The large enterprise segment dominated the market and accounted for the largest revenue share in 2025. Large enterprises implement omnichannel strategies, requiring consistent messaging and engagement across digital and physical channels. CDPs support these strategies by unifying online and offline customer interactions, providing real-time insights for coordinated campaigns, and enabling seamless customer experiences. The growing emphasis on delivering cohesive, cross-channel experiences is driving CDP demand in the large enterprise segment. For instance, in August 2025, FirstHive, an AI-driven Customer Data Platform provider, partnered with Infogain, a digital customer experience engineering provider, to co-develop advanced CX solutions. The collaboration combines Infogain’s digital transformation expertise with FirstHive’s AI-powered CDP technology to assist large enterprises use unified customer data for more personalized and seamless buyer experiences.

The SMEs segment is expected to grow at a significant CAGR during the forecast period. The rapid expansion of digital commerce and online channels among SMEs has increased the demand for tools that can manage multi-channel customer interactions effectively. CDPs allow SMEs to integrate online sales, social media, email marketing, and other digital touchpoints into a single platform, enabling consistent engagement and improving conversion rates. The need to compete effectively in digital marketplaces accelerates the adoption of CDPs in this segment.

Deployment Insights

The cloud segment dominated the market and accounted for the largest revenue share in 2025, driven by the widespread adoption of cloud computing across industries. Organizations prefer cloud-based CDPs due to their flexibility, scalability, and lower upfront costs compared to on-premises solutions. Cloud CDPs allow businesses to quickly deploy, access, and manage customer data from anywhere, which is especially beneficial for enterprises with multiple locations or remote teams. The convenience and efficiency of cloud deployment continue to accelerate its adoption in the CDP market.

The on-premises segment is expected to grow at a significant CAGR during the forecast period, driven by the organizations that require maximum control over their sensitive customer data. By hosting CDPs on their own infrastructure, companies can implement strict security policies, monitor access, and manage data internally without relying on third-party cloud providers. This is particularly important for highly regulated industries such as banking, healthcare, and government, where data privacy and compliance are critical.

Type Insights

The analytics segment dominated the market and accounted for the largest revenue share in 2025. CDP analytics enable enterprises to deliver personalized experiences at scale by analyzing individual customer data and segmenting audiences effectively. Marketers use analytics to understand preferences, predict future behavior, and tailor content, offers, and recommendations. The growing emphasis on enhancing customer experience through personalization is a major driver of the analytics segment, as businesses seek to differentiate themselves in competitive markets.

The access segment is expected to grow at a significant CAGR during the forecast period. The increasing need for self-service capabilities within CDPs drives the access type segment. Organizations want marketing, sales, and analytics teams to directly access customer data without depending on IT or data specialists. Moreover, businesses increasingly require granular, role-based access controls to ensure that sensitive customer information is only accessible to authorized personnel. Advanced access management in CDPs allows organizations to assign permissions at the user or team level, maintaining data security and compliance while enabling broad usability.

End Use Insights

The retail segment dominated the market and accounted for the largest revenue share in 2025. The rapid growth of e-commerce and m-commerce has increased the volume and complexity of retail customer data. CDPs enable retailers to collect and analyze this data to understand shopping behavior, identify trends, and predict future purchase patterns. The rise of online and mobile shopping drives demand for CDPs that support real-time insights and targeted marketing in the fast-paced digital retail environment.

The travel segment is expected to grow at a significant CAGR over the forecast period. Travel companies are increasingly focusing on personalized experiences to attract and retain customers. CDPs enable airlines, hotels, and travel agencies to unify customer data from booking engines, loyalty programs, mobile apps, and social media. By analyzing this data, travel organizations can deliver tailored offers, personalized itineraries, and targeted promotions, improving customer satisfaction and loyalty, which drives the adoption of CDPs in the travel segment.

Regional Insights

North America customer data platform market dominated the global industry with the largest revenue share of 37.6% in 2025, driven bythe rapid adoption of AI and machine learning in marketing and analytics. Companies in the U.S. and Canada increasingly rely on AI-powered CDPs to enhance customer segmentation, predictive modeling, and personalized campaigns. The region’s technological maturity, high digital penetration, and focus on maximizing marketing ROI accelerate CDP adoption.

U.S. Customer Data Platform Market Trends

The customer data platform market in the U.S. is expected to grow significantly at a CAGR of 26.1% from 2025 to 2033, due tothe expansion of omnichannel retail and e-commerce, with businesses seeking unified platforms to manage customer interactions across in-store, online, and mobile channels. CDPs enable seamless cross-channel analytics and personalized campaigns, helping U.S. companies deliver superior customer experiences and improve engagement.

Europe Customer Data Platform Market Trends

The customer data platform market in Europe is anticipated to register considerable growth from 2025 to 2033, driven by stringent data privacy and regulatory compliance requirements such as GDPR. Organizations are adopting CDPs to ensure secure data management, consent tracking, and compliance across multiple countries, while still leveraging customer data for personalized marketing and operational efficiency.

The UK customer data platform market is expected to grow rapidly in the coming years, owing to the increasing demand for predictive analytics in marketing and customer lifecycle management. Businesses use CDPs to forecast customer behavior, optimize campaigns, and improve retention, helping organizations remain competitive in a highly digitized market.

The customer data platform market in Germany held a substantial market share in 2025 due to the manufacturing and industrial sector’s push for data-driven customer insights. German companies leverage CDPs to integrate B2B and B2C data, optimize marketing strategies, and enhance product personalization, reflecting a growing trend of customer-centric industrial marketing.

Asia Pacific Customer Data Platform Market Trends

Asia Pacific customer data platform held a significant share in the global market in 2025 due to rapid digitalization and mobile commerce adoption. Countries such as India, Singapore, and Australia are witnessing an explosion of online consumer behavior, prompting businesses to invest in CDPs to unify mobile, web, and social data for personalized marketing at scale.

Japan customer data platform market is expected to grow rapidly in the coming years, driven by advanced customer analytics and loyalty program integration. Japanese enterprises, particularly in retail and travel, adopt CDPs to track detailed customer behavior, implement sophisticated loyalty schemes, and enhance personalization across high-value customer segments.

The customer data platform market in China held a substantial market share in 2025, due to the rise of social commerce and digital ecosystem integration. With platforms such as WeChat, Taobao, and Douyin, companies are adopting CDPs to consolidate social, e-commerce, and mobile data, enabling real-time engagement and targeted marketing in a highly competitive digital landscape.

Key Customer Data Platform Company Insights

Key players operating in the customer data platform industry are Salesforce, Inc., OracleAdobe, TEALIUM, andSAP SE. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Customer Data Platform Companies:

The following are the leading companies in the customer data platform market. These companies collectively hold the largest market share and dictate industry trends.

- Acquia, Inc.

- Adobe

- Ascent360

- BlueConic

- CHEQ AI Technologies Ltd.

- Cloudera

- Lytics, Inc.

- mParticle, Inc.

- NGDATA N.V.

- Oracle

- Salesforce, Inc.

- SAP SE

- TEALIUM

- Twilio Inc.

- Uniphore

Recent Developments

-

In October 2025, SAP SE unveiled a new integration approach for its Business Suite, combining AI, data, and enterprise applications to drive next-generation digital transformation. Leveraging zero-copy sharing, customer data remains securely within SAP systems while staying instantly accessible across existing data platforms. This approach preserves critical business context without the need for costly data duplication, reducing silos, simplifying pipelines, and delivering trusted, ready-to-use data products exactly where and when they are needed.

-

In June 2025, Tealium introduced CloudStream, a cutting-edge solution that combines zero-copy segment building with real-time data activation. This platform allows enterprises to seamlessly integrate real-time data collection, cloud storage, and activation within a single system, moving beyond traditional warehouse-only approaches. CloudStream transforms data clouds into fully functional activation engines, removing the need for manual data transfers or duplication, and enabling organizations to leverage edge data instantly for customer engagement, enhancing flexibility, performance, and regulatory compliance.

-

In March 2025, Adobe introduced Brand Concierge, the first brand-centric agent app designed to evolve traditional chatbots and web agents into rich, brand-driven experiences. By leveraging a company’s unique brand attributes and customer data, Brand Concierge delivers personalized interactions for every customer. Additionally, Adobe launched a suite of Experience Platform Agents built on the Adobe Experience Platform Agent Orchestrator, which integrates seamlessly with enterprise applications such as Adobe Real-Time CDP, Experience Manager, Journey Optimizer, and Customer Journey Analytics, enhancing team capacity and strengthening the capabilities of Adobe’s category-leading solutions.

Customer Data Platform Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 10.49 billion

Revenue forecast in 2033

USD 58.41 billion

Growth rate

CAGR of 27.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Acquia, Inc.; Adobe; Ascent360; BlueConic; CHEQ AI Technologies Ltd.; Cloudera; Lytics, Inc.; mParticle Inc.; NGDATA N.V.; Oracle; Salesforce, Inc.; SAP SE; TEALIUM; Twilio Inc.; Uniphore

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Data Platform Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global customer data platform market report based on component, type, deployment, enterprise size, end use, and region:

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public

-

Private

-

Hybrid

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Analytics

-

Campaign

-

Access

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Retail

-

BFSI

-

Technology, Media, & Telecom (TMT)

-

Travel

-

Healthcare

-

Discrete Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer data platform market size was estimated at USD 8.26 billion in 2025 and is expected to reach USD 10.49 billion in 2026.

b. The global customer data platform market is expected to grow at a compound annual growth rate of 27.8% from 2026 to 2033 to reach USD 58.41 billion by 2033.

b. North America dominated the global market with the largest revenue share of 37.6% in 2025, driven by the rapid adoption of AI and machine learning in marketing and analytics. Companies in the U.S. and Canada increasingly rely on AI-powered CDPs to enhance customer segmentation, predictive modeling, and personalized campaigns. The region’s technological maturity, high digital penetration, and focus on maximizing marketing ROI accelerate CDP adoption.

b. Key players operating in the customer data platform industry are Salesforce, Inc., Oracle Adobe, TEALIUM, and SAP SE.

b. As organizations handle massive volumes of customer information from diverse touchpoints, such as social media, e-commerce, mobile apps, and CRM systems, there is a rising demand for platforms that can consolidate, clean, and analyze this data in real time.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.