- Home

- »

- Next Generation Technologies

- »

-

Customer Information System Market, Industry Report, 2030GVR Report cover

![Customer Information System Market Size, Share & Trends Report]()

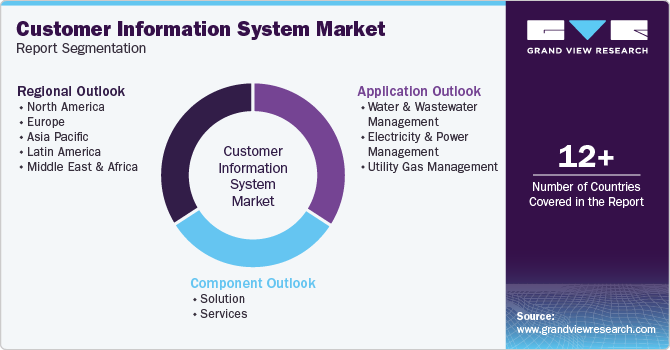

Customer Information System Market (2025 - 2030) Size, Share & Trends Analysis Report, By Component (Solution, Services), By Application (Water and Wastewater Management, Electricity and Power Management, Utility Gas Management), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-432-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Customer Information System Market Summary

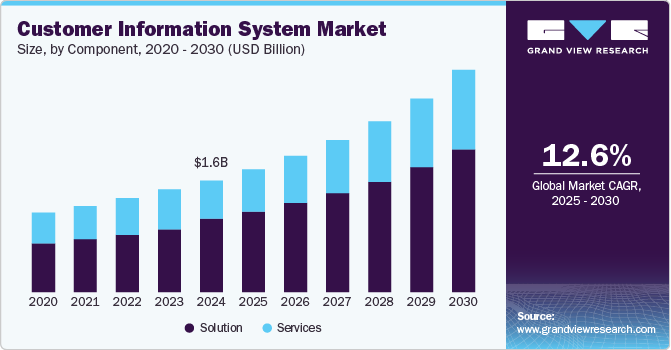

The global customer information system market size was estimated at USD 1,558.4 million in 2024 and is projected to reach USD 3,104.2 million by 2030, growing at a CAGR of 12.6% from 2025 to 2030. Cloud solutions are becoming popular in the CIS market.

Key Market Trends & Insights

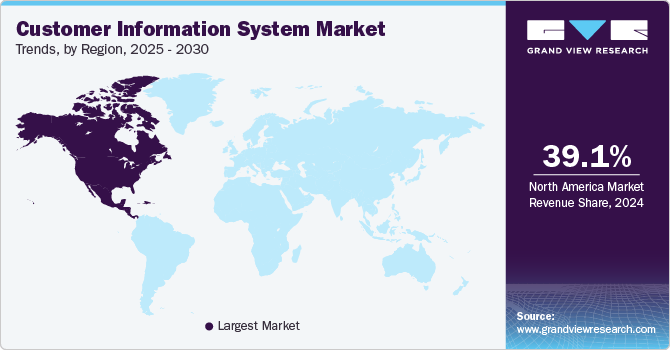

- The North America region dominated the customer information system industry in 2024 and accounted for a 39.1% share of the global market.

- The Asia Pacific region is expected to grow at the highest CAGR of 15.3% from 2025 to 2030.

- Based on component, the solution segment dominated the market in 2024 and accounted for a 65.8% share of the global revenue.

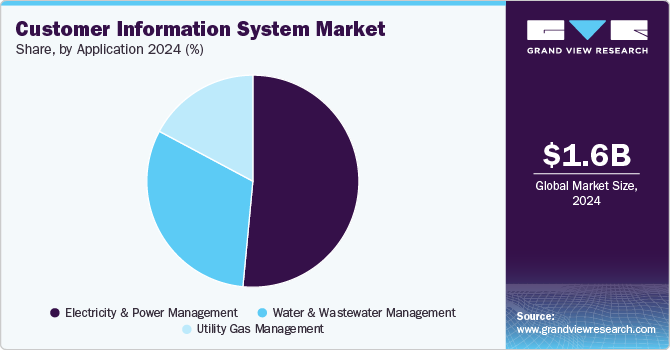

- In terms of application, the electricity and power management segment dominated the customer information system industry in 2024 and accounted for a revenue share of over 51.0%.

Market Size & Forecast

- 2024 Market Size: USD 1,558.4 Million

- 2030 Projected Market Size: USD 3,104.2 Million

- CAGR (2025-2030): 12.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Due to the desire of organizations to minimize the costs of IT infrastructure and improve the availability of data, cloud-based CIS platforms are widely used. In addition, the combination of CIS with the help of such tools as analytics and artificial intelligence is gradually becoming a trend. This integration helps companies to get a better understanding of customers’ behavior, needs, and wants, which in turn will help them to deliver better services.

The other emerging trend is the increasing concern of organizations towards the protection of data and information. The adoption of the GDPR in Europe and the CCPA in the U.S. means that organizations are under pressure to make sure that their customer information system platforms meet the highest standards of data protection. This has made organizations adopt CIS solutions that have better encryption, data security, and strict access controls to prevent customer data from being hacked or accessed by unauthorized persons.

Businesses in different sectors are integrating digital technologies into their operations to optimize processes, interact with customers, and operate more effectively. The change in the market has led to the need to adopt complex CIS solutions that can manage a vast amount of customer data, offer real-time analytics, and facilitate multi-channel interaction. Also, the growing usage of smart meters and IoT devices in the utility industry is driving the CIS market. These technologies produce a lot of data that need efficient systems to manage and analyze them in order to be useful.

Technology is, therefore, a major determinant of the customer information system market as it continues to evolve. Another important trend in the field of technology is the application of artificial intelligence and machine learning in customer information system platforms. AI and ML can analyze large volumes of customer data in real-time to provide insights into the business. For instance, through the use of predictive analytics that has been enhanced by artificial intelligence, organizations can be in a position to predict the needs and preferences of customers so that they can deliver services before they are requested.

Another important technology trend is the use of blockchain for the secure storage and sharing of data. Blockchain technology can provide a decentralized and secure environment for storing customer data and avoid data breaches and non-compliance with data protection laws. Also, the usage of Robotic Process Automation (RPA) in customer information systems is gradually increasing. RPA can help in automating processes like data entry, and this can help minimize errors that are likely to occur when the work is being done manually and, at the same time, create time for other important tasks.

Component Insights

The solution segment dominated the market in 2024 and accounted for a 65.8% share of the global revenue due to the shift towards integrated platforms that offer end-to-end functionalities. Contemporary CIS solutions are intended to handle various customer contacts, billing procedures, and data analysis functions. The major factors that are driving this segment are the need to better manage the relationship with the customers and the need to enhance the efficiency of the operations. Due to the constant attempts of businesses to individualize their services and optimize their processes, there is a growing need for advanced CIS solutions that offer real-time analytics and automated processes. The demand for digital transformation in every industry is also driving the increased use of sophisticated CIS solutions.

The services segment is projected to witness significant growth from 2025 to 2030 due to the focus on specialized offerings that cater to the unique needs of different sectors. The services segment includes a range of specific activities aimed at the implementation, maintenance, and enhancement of CIS solutions for customers. This segment is very important in the sense that it enables organizations to be in a position to harness CIS technologies for their operations and strategies. Services in this domain include consulting on legacy extensions, customer information systems, and the provision of support for the same.

Application Insights

The electricity and power management segment dominated the customer information system industry in 2024 and accounted for a revenue share of over 51.0%.The electricity and power management industry is experiencing the transition to smart grids and digitalization. Sophisticated CIS solutions are being applied to control electricity distribution, analyze the grid condition, and incorporate renewable power. The use of RTM and data analytics is enabling utilities to manage energy consumption, improve the stability of the grid, and satisfy consumers. Other drivers include increased regulatory requirements and the development of new technologies that are also pushing the adoption of smart grid technologies and advanced CIS solutions.

The utility gas management segment is projected to witness significant growth from 2025 to 2030 as there is an increasing focus on enhancing safety and efficiency through advanced CIS solutions. Technologies like remote monitoring and predictive maintenance are being used to deal with gas distribution networks and possible problems that may arise. Smart meters and real-time data analysis have enhanced the efficiency of billing and the reduction of operational costs.

Regional Insights

The North America region dominated the customer information system industry in 2024 and accounted for a 39.1% share of the global market. In North America, the CIS market is driven by advanced infrastructure and high technology adoption rates. The region is characterized by a strong presence of leading CIS vendors and a focus on integrating innovative technologies such as AI and cloud computing. The U.S., in particular, is a major contributor to this growth due to its large number of enterprises investing in digital transformation and customer data management solutions.

U.S. Customer Information System Market Trends

The customer information system industry in the U.S. is expected to grow at a significant CAGR from 2025 to 2030. The U.S. leads the CIS market with significant investments in modernizing infrastructure and adopting new technologies. The country’s focus on regulatory compliance and customer-centric services drives demand for advanced CIS solutions. According to the U.S. Census Bureau, the market for customer data management technologies, including CIS, is expected to grow by 7.5% annually through 2028 as businesses across various sectors increasingly prioritize data-driven strategies.

Europe Customer Information System Market Trends

The customer information system industry in Europe is expected to witness notable growth from 2025 to 2030 owing to stringent data privacy regulations, particularly the General Data Protection Regulation (GDPR). These regulations have made organizations consider CIS solutions that have enhanced data protection solutions such as encryption and secure storage. Another trend is the use of the latest technologies such as artificial intelligence (AI) and machine learning (ML) to provide further insights into the customers and serve them better. The European market is more concerned with innovation and compliance with regulations, which has led to increased demand for advanced CIS platforms that improve data management and operational flexibility.

The UK customer information system industry held a substantial market share in 2024. The rising adoption of cloud-based CIS solutions is fueling market growth in the UK Cloud-based systems offer scalability, flexibility, and cost-effectiveness, making them an attractive option for businesses looking to modernize their customer information management processes. These solutions enable remote access, seamless integration with other enterprise systems, and real-time data updates, enhancing efficiency and agility. As more organizations migrate to cloud infrastructure, the demand for cloud-enabled CIS solutions is expected to increase.

The Germany customer information system industry is expected to grow rapidly during the forecast period. The growing adoption of automation and artificial intelligence in customer service is contributing to CIS market expansion in Germany. Businesses are implementing AI-powered chatbots, virtual assistants, and automated response systems to improve customer service efficiency. CIS solutions equipped with AI capabilities help organizations manage large volumes of customer interactions, automate routine processes, and enhance service quality. As companies seek to reduce operational costs while improving customer engagement, AI-integrated CIS platforms are becoming increasingly prevalent.

Asia Pacific Customer Information System Market Trends

The Asia Pacific region is expected to grow at the highest CAGR of 15.3% from 2025 to 2030, driven by rapid digital transformation and a surge in smart utility projects. There is a growing popularity of cloud-based CIS solutions in the region, as such solutions are more scalable and more flexible in terms of the amount of data they can handle. This change is driven by the increasing emphasis on the development of smart cities and the implementation of IoT solutions that improve real-time data processing and customer engagement. Also, utility companies are upgrading their infrastructure to incorporate renewable energy and efficient resource management, which is a trend toward efficiency and sustainability.

The China customer information system industry held a substantial market share in 2024. China's booming e-commerce and digital payments industry is a key factor driving CIS adoption. With leading e-commerce giants such as Alibaba, JD.com, and Pinduoduo processing millions of transactions daily, businesses need efficient CIS solutions to manage customer interactions, track purchase histories, and provide personalized recommendations. The rise of digital wallets and mobile payments, such as Alipay and WeChat Pay, further emphasizes the need for integrated CIS platforms that facilitate secure and seamless customer transactions. As the e-commerce sector continues to expand, demand for CIS solutions that enhance customer experience and retention will grow.

The India customer information system market is expected to grow rapidly during the forecast period. The rapid expansion of India’s utilities sector, particularly in electricity, water, and gas distribution, is a key factor fueling CIS market growth. The government’s focus on smart metering and grid modernization has led utility companies to adopt CIS platforms to manage customer data, track energy consumption, and enhance billing accuracy. With large-scale smart meter deployments under initiatives such as the Revamped Distribution Sector Scheme (RDSS), utility providers require CIS solutions that can handle vast amounts of customer data while ensuring efficient service delivery. As India transitions toward smarter energy management, the need for advanced CIS platforms is expected to increase.

Key Customer Information System Company Insights

Some of the key players operating in the market include Oracle Corporation, SAP SE and IBM Corporation, among others.

-

SAP SE is a global company specializing in enterprise software solutions, offering advanced tools for business process management, cloud computing, and digital transformation. SAP’s key offering in the customer data management space is its Customer Information System (CIS) (CIS), which enables businesses to efficiently collect, manage, and analyze customer-related data. SAP’s CIS solutions are integrated into platforms like SAP S/4HANA for Customer Management and SAP Customer Data Cloud, allowing organizations to centralize customer profiles, track interactions, and enhance customer engagement. With features such as real-time data synchronization, AI-driven insights, and automated customer support workflows, businesses can improve customer service efficiency and make data-driven decisions.

Itineris and Fluentgrid Limited are some of the emerging market participants in the target market.

-

Fluentgrid Limited is a global provider of smart utility and city management solutions, specializing in customer information systems (CIS), smart grid technologies, and digital transformation solutions for the energy, water, and utility sectors. The company’s flagship offering is its Fluentgrid Customer Information System (CIS) (CIS), a software solution designed to manage customer data, billing, metering, and service requests for utility providers. This CIS platform enables real-time customer data tracking, automated billing processes, and seamless integration with smart metering systems, helping utilities improve operational efficiency and customer satisfaction.

Key Customer Information System Companies:

The following are the leading companies in the customer information system market. These companies collectively hold the largest market share and dictate industry trends.

- Oracle Corporation

- SAP SE

- IBM Corporation

- Advanced Utility Systems

- Cayenta

- Fluentgrid Limited

- Gentrack

- Hansen Technologies

- Itineris

- Milestone Utility Services

Recent Developments

-

In September 2024, KUBRA partnered with Advanced Utility Systems to enhance the utility customer experience. This partnership integrates KUBRA’s customer experience management solutions with the features of Advanced Utility Systems’ Infinity Customer Information System (CIS). By combining these technologies, the collaboration seeks to optimize the efficiency and effectiveness of utility customer service operations. This initiative reflects a shared dedication to innovation and excellence in customer engagement, ensuring a seamless and user-centric experience.

-

In April 2024, Hansen Technologies announced a strategic collaboration with AWS to integrate its customer management solutions with AWS’s cloud infrastructure. This partnership aims to enhance scalability and performance, enabling utilities to benefit from advanced cloud technologies and services.

-

In August 2023, IBM acquired Apptio, a leader in technology business management software. This acquisition aims to strengthen IBM’s capabilities in providing comprehensive IT financial management solutions, which include advanced analytics and financial planning tools for enterprise clients, enhancing its offerings in the CIS market.

Customer Information System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.72 billion

Revenue forecast in 2030

USD 3.10 billion

Growth rate

CAGR of 12.6% from 2025 to 2030

Actual data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Oracle; SAP SE; Itineris; Hansen Technologies; Fluentgrid Limited; Advanced Utility Systems; Gentrack; Cayenta; IBM; Milestone Utility Services

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Customer Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the customer information system market report based on component, application, and region.

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

Legacy Extension Consulting Service

-

Customer Information System (CIS) Implementation Service

-

Support Service

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Water and Wastewater Management

-

Electricity and Power Management

-

Utility Gas Management

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global customer information system market size was estimated at USD 1.56 billion in 2024 and is expected to reach USD 1.72 billion in 2025.

b. The global customer information system market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 3.10 billion by 2030.

b. The customer information system implementation service segment dominated the market in 2023 and accounted for a 45% share of the global revenue. The application of agile methodologies in CIS implementation projects is becoming increasingly popular. Agile approaches offer more flexibility and multiple cycles of development, which can help organizations respond to changes and solve problems during the implementation phase.

b. Some key players operating in the customer information system market include Oracle, SAP SE, Itineris, Hansen Technologies, Fluentgrid Limited, Advanced Utility Systems, Gentrack, Cayenta, IBM, and Milestone Utility Services.

b. Owing to the growing need among organizations to minimize the costs of IT infrastructure and improve data availability, cloud-based CIS platforms are widely used. In addition, the combination of CIS with tools such as analytics and artificial intelligence is gradually becoming a trend. This integration helps companies better understand customers’ behavior, needs, and wants, which in turn will help them deliver better services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.