Cutter Stapler Market Size & Trends

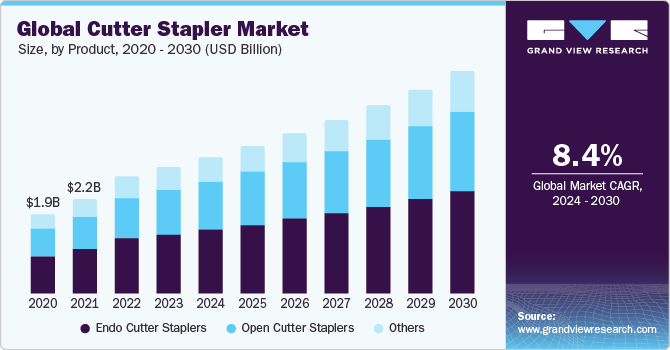

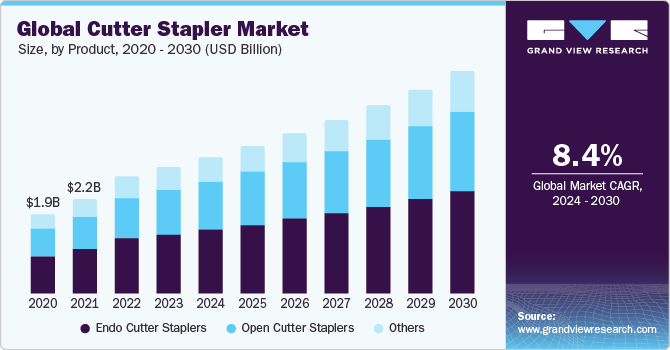

The global cutter stapler market size was valued at USD 2.93 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.36% from 2024 to 2030. The growth of the cutter staplers market is expected to be driven by factors such as a rise in surgical procedures, the growing use of surgical cutter staplers in minimally invasive surgery, and the launch of technologically advanced products.

The cutter staplers market has witnessed significant growth in recent years, majorly driven by the increasing adoption of minimally invasive surgical techniques. The benefits associated with minimally invasive surgeries are largely recognized by patients and healthcare providers as well. These benefits include reduced post-operative pain, shorter hospital stays, quicker recovery times, and improved cosmetic outcomes due to smaller incisions. As a result, there is a growing preference for minimally invasive procedures among patients seeking less invasive and more comfortable treatment options.

Moreover, advancements in surgical technology have significantly enhanced the precision and efficiency of minimally invasive procedures. Cutter staplers have evolved to meet the specific needs of these surgeries, offering better control, reduced risk of complications, and improved patient outcomes. Surgeons are now able to perform a broader range of procedures using minimally invasive techniques, including laparoscopic and robotic-assisted surgeries, which rely on cutter staplers for tissue management and hemostasis. Additionally, research and development efforts in the healthcare industry also contribute to the growth of the cutter staplers market. Manufacturers are continually improving the design, functionality, and safety features of these devices, making them more user-friendly and effective for surgeons.

Product Type Insights

Based on the product type, the cutter staplers market is segmented into endo cutter staplers, open cutter staplers, and others. The endo cutter staplers captured the largest market share in 2023. The factors contributing to the growth of endo-cutter staplers include lesser risk for complications such as tissue leakage and bleeding, continuous technological advancements, and product affordability. Endo staplers are currently widely employed to create resections, anastomoses, and transactions in gastrointestinal, thoracic, gynecological, and pediatric procedures. Continuous advancements in technology, safety features, and surgeon training contribute to their growing adoption, thereby strengthening their position in the market.

Application Insights

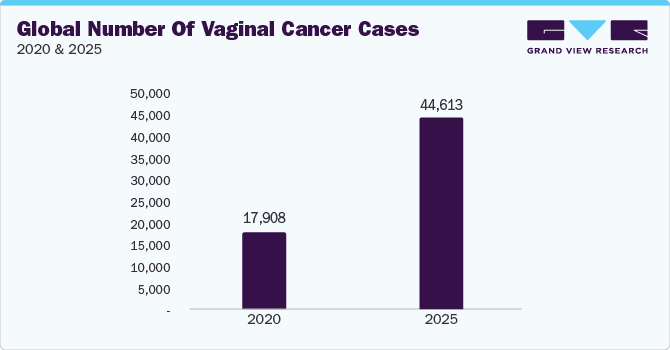

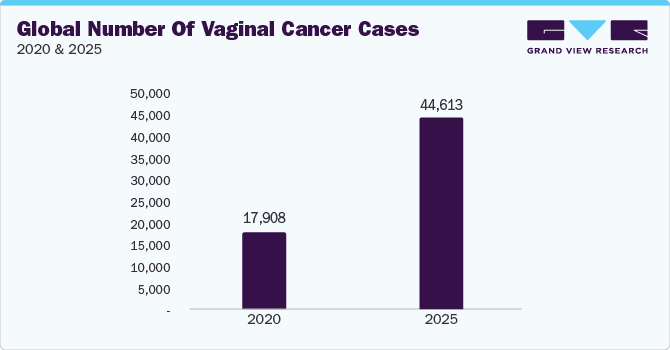

On the basis of application, the market is segmented into abdominal surgery, obstetrics and gynecological surgeries, cardiac and thoracic surgeries, orthopedic surgery, and others. The obstetrics and gynecology surgery segment captured the largest market share in 2023 due to factors such as the increasing number of births, cesarean section operations, and technical advancements in cutter staplers. The number of cesarean sections performed worldwide has increased and now accounts for more than one in five (21%) deliveries, according to the new data released by the World Health Organization (WHO) in 2021. According to the study, this number is expected to rise over the next ten years, with nearly a third (29%) of all newborns projected to be delivered via cesarean section by 2030.

Usage Insights

Based on usage, the market is segmented into disposable and reusable. The disposable cutter staplers held the majority of the market share in 2023 since the demand for disposable cutter staplers is exceptionally high due to their convenience, safety, and cost-effectiveness. These devices eliminate the need for time-consuming sterilization, ensuring consistent performance and reducing the risk of infections.

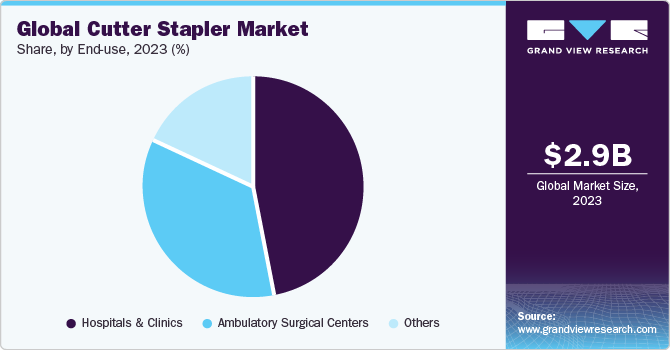

End-use Insights

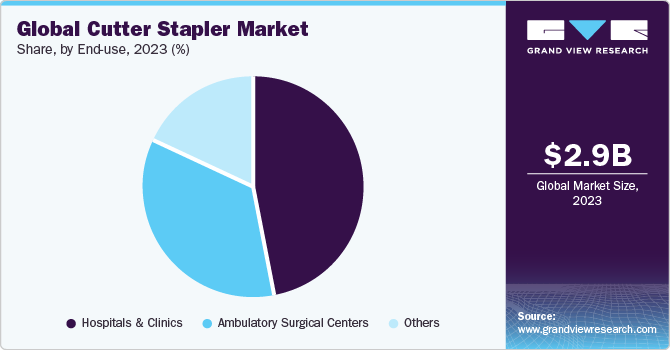

Based on end use, the cutter staplers market is segmented into hospitals & clinics, ambulatory surgical centers, and others. The hospitals segment was identified as the largest end-use segment in the year 2023, whereas the ambulatory surgery centers segment is anticipated to display the highest growth over the forecast period. It has been reported that every year, ambulatory surgery centers (ASCs) carry out around 22.5 million procedures in over 5,900 Medicare-certified facilities across the United States. Additionally, Medicare's participation in the ASC industry results in significant cost savings exceeding USD 4.2 billion per annum, primarily for the procedures that are performed in these centers.

Regional Insights

North America dominated the market in 2023 owing to factors such as high healthcare expenditure and the presence of well-established hospitals and major players operating in the U.S. are contributing to the growth of the market in the region. In addition, technological advancements and rising demand for minimally invasive surgeries are anticipated to drive the regional market over the forecast period. Asia Pacific is anticipated to become the fastest-growing regional market over the forecast period. Rising disposable income in countries such as India and China is expected to boost the growth of the other surgery segment, thereby contributing to the regional market growth. The rising geriatric population in the region is expected to lead to a rise in the number of orthopedic and cardiovascular procedure volumes. While the COVID-19 pandemic had a significant negative impact on Asian countries in 2020 and the first half of 2021, the market already began to recover in the second half. The presence of huge backlogs and postponement of certain elective surgeries due to the pandemic has resulted in the ever-rising demand for surgical equipment in this region.

Key Companies & Market Share Insights

Key players operating in the market are Medtronic, Johnson & Johnson, Locamed, Infiniti Medical, Reach Surgical, Purple Surgical, Meril Life, Victor Medical, XNY Medical, Grena, Frankenman International Ltd., and Golden Stapler. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

-

In February 2023, OSSIO, Inc. announced the launch of the new OSSIOfiber Compression Staple. The OSSIOfiber Compression Staples is OSSIO's fifth product family, enabling surgeons to advance to more powerful, bio-integrative compression.

-

In June 2022, Ethicon (Part of Johnson & Johnson MedTech) announced the launch of the ECHELON 3000 Stapler in the U.S. ECHELON 3000 stapler is a digital device that offers simple, one-handed powered articulation to the surgeons to help address the unique needs of their patients.