- Home

- »

- Pharmaceuticals

- »

-

Cytomegalovirus Treatment Market Size Report, 2030GVR Report cover

![Cytomegalovirus Treatment Market Size, Share & Trends Report]()

Cytomegalovirus Treatment Market Size, Share & Trends Analysis Report, By Application, By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, E-Commerce), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-186-5

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2018 - 2021

- Industry: Healthcare

Cytomegalovirus Treatment Market Trends

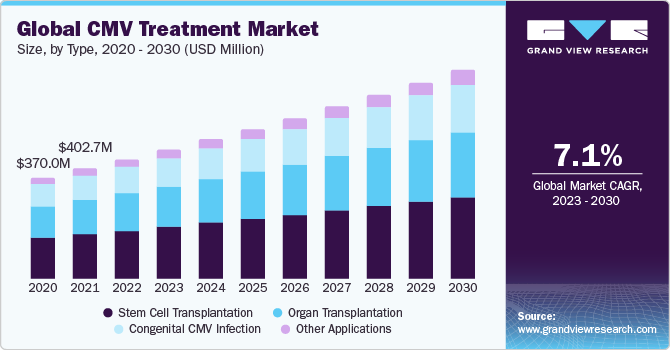

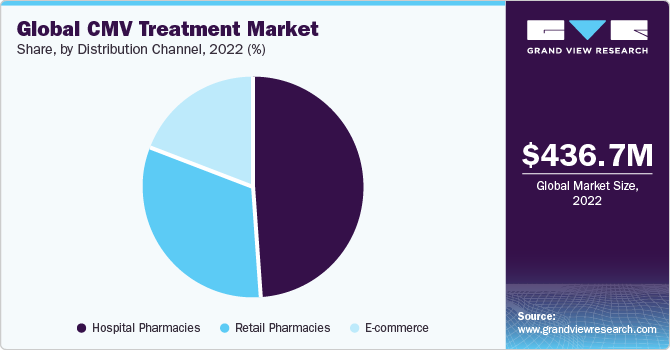

The global cytomegalovirus (CMV) treatment market was valued at USD 436.7 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.09% over the forecast period. The CMV treatment market is driven by the increasing prevalence of CMV infection, rising awareness of CMV infection, and the development of new and more effective CMV treatments. Some of the most common CMV treatments include antiviral medications, immunoglobulin therapy, and stem cell transplantation. The CMV treatment market is driven by the increasing prevalence of chronic diseases, the growing demand for personalized medicine, and the increasing availability of CMV treatments in developing countries.

The CMV treatment market is driven by numerous factors. For instance, according to the National Library of Medicine article published in August 2023, around 59% of individuals above six years old have encountered CMV, and seroprevalence rises with age. CMV infection can personify as a primary infection, reinfection, or reactivation, occurring through various modes such as blood products, breastfeeding, close-contact settings, perinatal transmission, and sexual transmission. Reactivation, particularly in immunocompromised patients, is linked to increased morbidity and mortality.

According to the National Library of Medicine article published in August 2023, for individuals with intact immunity, CMV rarely contributes to mortality. However, in immunocompromised patients undergoing chemotherapy or using corticosteroids, CMV can result in significant morbidity and mortality. Following bone marrow transplants, reported mortality rates vary between 10% and 75%, thereby boosting the CMV treatment market. Moreover, CMV infects approximately 60% to 70% of adults in industrialized countries and nearly 100% in emerging countries. Among herpes viruses, CMV possesses the highest number of genes specifically designed to evade both innate and adaptive immunity in the host. CMV imposes a burden of T-cell antigenic surveillance and contributes to immune dysfunction. Additionally, congenital CMV stands as a primary infectious cause of conditions such as learning disabilities, deafness, and intellectual disability. It serves as a significant driver for the CMV treatment market.

Application Insights

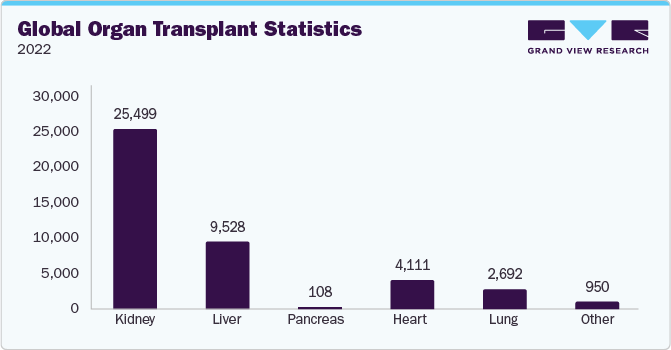

On the basis of application, the CMV treatment market is segmented into stem cell transplantation, organ transplantation, congenital cmv infection, and other applications. The stem cell transplantation segment gained a maximum market share in the CMV treatment market, in 2022. However, the organ transplantation segment is expected to grow at a fastest CAGR for the forecast period. The organ transplantation application growth is attributed to the heightened risk of CMV infection in individuals undergoing organ transplantation. Organ transplant recipients often receive immunosuppressive therapy to prevent organ rejection, making them more susceptible to CMV reactivation. Effectively managing CMV in this patient population is crucial for preventing complications and improving transplant outcomes, driving the demand for CMV treatment in the context of organ transplantation.

Distribution Channel Insights

Based on the distribution channel, the CMV treatment market is segmented into hospital pharmacy, retail pharmacy, and E-Commerce. Hospital pharmacy segment captured the largest market share in the global market. The large market share is attributed to several factors. Hospitals are key healthcare institutions where patients, especially those with compromised immune systems or undergoing organ transplantation, receive specialized care. The availability of a variety of CMV drugs and antiviral therapies in hospital pharmacies ensures timely and appropriate treatment for patients. Additionally, hospital pharmacies are equipped to handle the complexities of managing CMV infections in diverse patient populations, making them a central hub for CMV treatment. The collaborative nature of healthcare teams within hospitals also facilitates effective communication and coordination in managing CMV cases.

Regional Insights

Asia Pacific is expected to grow at the fastest CAGR for the forecast period. Whereas, North America dominated the market with the largest share in 2022. According to the Cleveland Clinic article published in October 2022, the prevalence of CMV infection in the U.S. and Canada is substantial, with an estimated:

-

Half of the population experiencing a CMV infection by the age of 40.

-

Up to 90% of individuals are infected by the age of 80.

-

Approximately 1 in 200 babies are born with CMV annually, but only 10% (1 in 10) manifest symptoms at birth.

Competitive Insights

Key players operating in the market are Gilead Sciences, Chimerix, Clinigen Group PLC, Merck & Co. Inc, F. Hoffmann-La Roche Ltd, Fresenius Kabi, Genentech Inc., Teva Pharmaceuticals Inc, Mylan N.V, Thermo Fisher Scientific, Takeda Pharmaceuticals, and Pfizer. The market participants are constantly working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. The following are some instances of such initiatives.

In September 2022, ProBioGen and City of Hope, a cancer research and treatment institution in the U.S., entered into a non-exclusive commercial license agreement. This agreement grants the City of Hope the capability to produce its groundbreaking synthetic MVA-based CMV vaccine utilizing ProBioGen's scalable viral manufacturing platform, AGE1.CR.pIX.

In June 2022, Synklino successfully concluded a Series A funding round, securing EUR 29.8 million to drive the clinical trials of its drug candidate aimed at treating CMV.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."