- Home

- »

- HVAC & Construction

- »

-

Data Center Cooling Market Size, Industry Report, 2033GVR Report cover

![Data Center Cooling Market Size, Share & Trends Report]()

Data Center Cooling Market (2026 - 2033) Size, Share & Trends Analysis Report By Component (Solution, Services), By Type (Raised Floors, Non-raised Floors), By Containment, By Structure, By Application (Telecom, IT, Retail, Healthcare, BFSI, Energy), By Region, And Segment Forecasts

- Report ID: 978-1-68038-652-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Cooling Market Summary

The global data center cooling market size was valued at USD 26.31 billion in 2025 and is anticipated to reach USD 128.31 billion by 2033, growing at a CAGR of 22.3% from 2026 to 2033. The growth is attributed to the rapid expansion of hyperscale and colocation data centers worldwide.

Key Market Trends & Insights

- Asia Pacific data center cooling dominated the global market with the largest revenue share of 36.9% in 2025.

- The data center cooling industry in the U.S. is expected to grow significantly over the forecast period.

- By component, the solution segment led the market and held the largest revenue share of 74.7% in 2025.

- By containment, the raised floor without containment segment led the market and held the largest revenue share in 2025.

- By application, the telecom segment is expected to expand significantly over the forecast period.

Market Size & Forecast

- 2025 Market Size: USD 26.31 Billion

- 2033 Projected Market Size: USD 128.31 Billion

- CAGR (2026-2033): 22.3%

- Asia Pacific: Largest market in 2025

Cloud service providers, social media platforms, and digital service enterprises continue to invest heavily in large-scale data center infrastructure to support growing data traffic and storage requirements. These facilities operate at high utilization levels and require advanced, reliable cooling systems to maintain uptime, improve energy efficiency, and comply with stringent service-level agreements.The increasing adoption of high-density computing driven by artificial intelligence (AI), machine learning (ML), high-performance computing (HPC), and advanced analytics workloads significantly contributes to the growth of the data center cooling industry. These applications generate significantly higher heat loads compared to traditional IT workloads, often exceeding the cooling capacity of conventional air-based systems. As a result, data center operators are increasingly investing in advanced cooling technologies such as liquid cooling, direct-to-chip cooling, rear-door heat exchangers, and immersion cooling systems to manage higher rack densities and ensure thermal stability.

A data center comprises networked computers and storage equipment for organizing, storing, processing, and disseminating data that is crucial for the functioning of a business organization. Improved network connectivity and the proliferation of smart devices are leading to an exponential increase in the volume of data generated daily. The global installed base of connected IoT devices continues to expand steadily, despite short-term macroeconomic headwinds. Total active IoT connections reached approximately 18.5 billion in 2024, representing a year-over-year increase of around 12% compared to 2023. Based on connection trends observed in the first half of 2025, the number of connected IoT devices is projected to rise by roughly 14% during the year, reaching an estimated 21.1 billion by the end of 2025.

Energy efficiency and sustainability requirements are also major contributors to market growth. Data centers are among the most energy-intensive facilities, and cooling systems account for a substantial share of total power consumption. Operators are under increasing pressure from regulators, investors, and customers to reduce carbon emissions, improve power usage effectiveness (PUE), and meet environmental, social, and governance (ESG) targets. This is accelerating the adoption of energy-efficient cooling solutions, including free cooling, evaporative cooling, adiabatic systems, and AI-driven thermal management software that optimizes cooling performance while lowering operating costs.

Component Insights

The solution segment dominated the market and accounted for the revenue share of over 74.4% in 2025. The surge in data traffic is due to the rapid increase in high-density computing workloads, particularly AI training, inference, HPC, and advanced analytics. These workloads generate significantly higher heat loads than traditional enterprise IT, rendering legacy air-based cooling architectures inefficient. As a result, data center operators are adopting integrated cooling solutions such as liquid cooling systems, rear-door heat exchangers, direct-to-chip cooling, and immersion cooling designed as end-to-end deployments rather than standalone components.

The services segment is expected to register a significant CAGR over the forecast period due to the rising complexity of modern data centers, particularly with the proliferation of high-density computing, AI workloads, and hyperscale facilities. As organizations increasingly adopt advanced cooling technologies, such as liquid cooling and modular architectures, they require specialized services to ensure optimal performance, minimize downtime, and maintain energy efficiency.

Solution Insights

The air conditioners dominated the market in 2025 due to the growth in data center densities, driven by the need for reliable and scalable thermal management in high-density computing environments. Traditional air-cooled systems remain widely deployed due to their ease of integration, lower upfront costs compared to liquid cooling, and proven operational reliability. As data centers continue to expand to support cloud services, hyperscale computing, and AI workloads, the demand for efficient air conditioning solutions that can maintain optimal server temperatures while minimizing energy consumption is increasing significantly.

The precision air conditioners segment is expected to grow at a significant CAGR over the forecast period, driven by the increasing density of IT equipment and the rising demand for high-performance computing (HPC) and AI workloads. As modern data centers deploy more powerful servers, GPUs, and storage systems, heat generation has increased substantially, necessitating the need for precise and reliable cooling solutions.

Services Insights

The installation & deployment dominated the market in 2025 due to the rising complexity of modern data centers. As organizations increasingly adopt high-density, AI-driven, and hyperscale computing environments, the deployment of advanced cooling solutions such as liquid cooling, in-row cooling, and immersive cooling systems requires specialized expertise.

The maintenance service segment is expected to grow at a significant CAGR over the forecast period. The shift toward outsourcing the management of data center operations has driven the growth of the maintenance services market. Many organizations, particularly those without in-house technical expertise, rely on specialized service providers for routine inspections, troubleshooting, and upgrades. This outsourcing trend not only drives recurring revenue for service providers but also encourages the adoption of comprehensive maintenance contracts, including performance optimization and lifecycle management.

Type Insights

The non-raised floor dominated the market in 2025. The non-raised floor segment plays a crucial role in integrating modern thermal assessment and surveillance systems. It provides real-time monitoring of temperature fluctuations across the data center, allowing service providers to identify and address any issues before they occur.

The raised floor segment is expected to grow at a significant CAGR over the forecast period. Raised floors facilitate the management of airflow patterns within data centers. Containment techniques, such as cool aisle and hot aisle combinations, are being implemented using the underfloor chamber. The strategic airflow control improves cooling efficiency by avoiding the mixing of hot and cold air, thus boosting the cooling system's overall effectiveness.

Containment Insights

The containment segment is further segregated into raised floor with containment and raised floor without containment. The raised floor with containment segment is further segregated into Hot Aisle Containment (HAC) and Cold Aisle Containment (CAC). The raised floors with containment dominated the market in 2025. Raised floors with containment help save operating costs by improving energy efficiency and lowering the total cooling expenses. With reliable airflow management and containment measures, data center operators can achieve significant cost savings in their operational budgets, boosting the economic viability of their facilities. AI algorithms are being used to analyze sensor data and historical performance to identify potential errors, enabling data center managers to schedule maintenance proactively, minimize disruptions, and extend the service life of critical systems.

The raised floor without containment segment is expected to grow at a significant CAGR from 2026 to 2033. The growth of the raised floor without containment segment is driven by the legacy infrastructure present in many older data centers. Numerous facilities were originally designed with raised-floor cooling in mind and continue to rely on this method due to the high costs associated with retrofitting to newer containment solutions. As these data centers undergo incremental upgrades, they often retain raised-floor cooling due to its familiarity and compatibility with existing equipment.

Structure Insights

The room based cooling dominated the market and accounted for the revenue share of over 47.0% in 2025. Room-based cooling systems are widely used with cloud-based management platforms. The integration with cloud solutions enables remote surveillance, analysis of data, and effective control of the cooling system. Cloud-based technology allows data center managers to oversee the cooling equipment from any location, thus increasing operational efficiency. Room-based cooling systems address issues associated with Indoor Air Quality (IAQ).

The row-based cooling segment is expected to grow at a significant CAGR over the forecast period. Row-based cooling systems have witnessed advancements in circulation management and the modular and scalable nature of row-based cooling solutions. Unlike centralized cooling systems, row-based units can be deployed incrementally, allowing data center operators to align cooling capacity with IT load growth. This flexibility is especially beneficial for cloud providers and colocation facilities, where rapid scalability is essential.

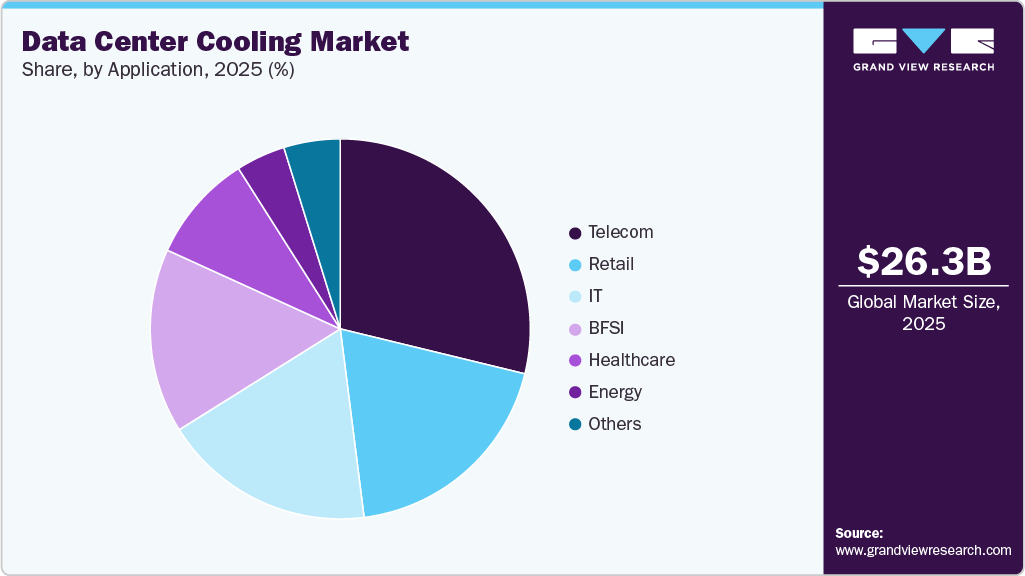

Application Insights

The telecom segment dominated the market and accounted for the revenue share of nearly 29.0% in 2025. Telecom firms are becoming increasingly conscious of the need for cost reduction and the utilization of sustainable resources. Modular and scalable data center cooling technologies provide adaptability to shifting demand patterns. The telecom industry is experiencing a rapid increase in demand for data-intensive services, which is being pushed by technologies such as IoT, 5G, and edge computing.

The retail segment is expected to grow at a significant CAGR over the forecast period, driven by the rapid expansion of e-commerce and digital retail platforms, which require robust data center infrastructure to handle increasing online transactions, customer data processing, and real-time analytics.

Regional Insights

The North America data center cooling market held a significant market share of 31.4% in 2025, due to the rapid scale-up of hyperscale campuses supporting cloud computing, generative AI, and large language model training. Operators are deploying ultra-large facilities with extremely high aggregate power loads, which necessitates advanced cooling architectures capable of operating efficiently at scale.

U.S. Data Center Cooling Market Trends

The data center cooling market in the U.S. is expected to grow significantly at a CAGR of 16.7% from 2026 to 2033 due to the explosive expansion of AI-focused data centers and GPU-intensive workloads concentrated in technology hubs such as Northern Virginia, Texas, Arizona, and the Midwest. These facilities are pushing rack power densities far beyond traditional limits, accelerating demand for liquid cooling, rear-door heat exchangers, and hybrid cooling systems.

Europe Data Center Cooling Market Trends

The data center cooling market in Europe is anticipated to register a considerable growth from 2026 to 2033 owing to stringent sustainability mandates and regulatory pressure to reduce carbon emissions and energy consumption. Cooling solutions are increasingly designed to align with circular economy principles, including waste heat reuse for district heating and low-impact refrigerants.

The UK data center cooling market is expected to grow rapidly in the coming years, fueled by capacity constraints in and around London, where limited space and power availability are forcing data centers to operate at higher densities within smaller footprints. This has increased reliance on advanced airflow management, containment systems, and space-efficient cooling solutions.

The Germany data center cooling market held a substantial market share in 2025, driven by industrial digitalization and the expansion of enterprise and edge data centers supporting manufacturing, automotive, and Industry 4.0 applications. High emphasis on energy efficiency and engineering precision is encouraging adoption of technically advanced cooling systems with fine-grained thermal control.

Asia Pacific Data Center Cooling Market Trends

Asia Pacific data center cooling market held a significant share of over 36.9% in 2025 due to rapid digital transformation, expanding internet penetration, and large-scale investments in new data center capacity across emerging and mature economies. The region’s diverse climatic conditions are accelerating demand for climate-adaptive cooling solutions that can perform efficiently in hot, humid, or variable environments.

The Japan data center cooling market is expected to grow rapidly in the coming years owing to the need for highly reliable, disaster-resilient infrastructure in a seismically active environment. Cooling solutions must meet strict reliability, redundancy, and precision requirements to support mission-critical workloads in finance, telecommunications, and government sectors.

The China data center cooling market held a substantial market share in 2025 due to government-led data center expansion initiatives and the rapid build-out of large-scale facilities in designated data center clusters. These projects are focused on supporting cloud services, AI development, and digital public services, which require high-capacity and cost-efficient cooling solutions.

Key Data Center Cooling Company Insights

Key players operating in the data center cooling industry are Vertiv Group Corp. and Schneider Electric, STULZ GmbH, and Rittal GmBH & Co. KG. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In December 2025, ABB announced a strategic partnership with OctaiPipe aimed at accelerating the adoption of AI-optimized cooling solutions in data centers. The collaboration leverages ABB’s global expertise and OctaiPipe’s on-premise, privacy-first AI platform to enhance energy efficiency, potentially reducing cooling energy consumption by up to 30 percent. The initiative is designed to help data center operators achieve rapid ROI while addressing regulatory, security, and operational requirements.

-

In December 2025, Vertiv Group Corp. completed its acquisition of PurgeRite Intermediate LLC, a U.S.-based provider of mechanical purging, flushing, and filtration services for data centers and other critical facilities. This acquisition strengthens Vertiv’s thermal management services portfolio and reinforces its leadership in advanced liquid cooling and ne22xt-generation thermal chain solutions globally.

-

In November 2025, Schneider Electric broadened its EcoStruxure Data Center Solutions portfolio with new solutions aimed at addressing the elevated power and cooling demands of advanced AI and HPC environments. The update includes a prefabricated modular EcoStruxure Pod Data Center that brings together high-power busway, liquid cooling capabilities, and high-density NetShelter racks, along with upgraded EcoStruxure Rack Solutions designed to speed the deployment of AI and high-performance computing infrastructure.

Key Data Center Cooling Companies:

The following are the leading companies in the data center cooling market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- Air Enterprises

- Asetek, Inc.

- Climaveneta Climate Technologies PVT. LTD.

- Coolcentric

- Dell Inc.

- Fujitsu

- Hitachi Ltd.

- Johnson Controls

- Mitsubishi Electric Corporation

- Nortek Air Solutions, LLC

- NTT Ltd.

- Rittal GmBH & Co. KG

- Schneider Electric

- STULZ GMBH

- Vertiv Group Corp.

Data Center Cooling Market Report Scope

Report Attribute

Details

Market size in 2026

USD 31.39 billion

Revenue forecast in 2033

USD 128.31 billion

Growth rate

CAGR of 22.3% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Component, solution, services, type, containment, structure, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ABB; Air Enterprises; Asetek, Inc.; Climaveneta ClimateTechnologies PVT. LTD.; Coolcentric. Dell Inc.; Fujitsu; Hitachi, Ltd.; Johnson Controls; Mitsubishi Electric Corporation; Nortek Air Solutions, LLC; NTT Ltd.; Rittal GmBH & Co. KG.; Schneider Electric; STULZ GMBH; Vertiv Group Corp

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Cooling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data center cooling market report based on component, solution, services, type, containment, structure, application, and region.

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Billion, 2021 - 2033)

-

Air Conditioners

-

Precision Air Conditioners

-

Chillers

-

Air Handling Units

-

Others

-

-

Services Outlook (Revenue, USD Billion, 2021 - 2033)

-

Installation & Deployment

-

Support & Consulting

-

Maintenance Services

-

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Raised Floors

-

Non-Raised Floors

-

-

Containment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Raised Floor with Containment

-

Hot Aisle Containment (HAC)

-

Cold Aisle Containment (CAC)

-

-

Raised Floor without Containment

-

-

Structure Outlook (Revenue, USD Billion, 2021 - 2033)

-

Rack-Based Cooling

-

Row-Based Cooling

-

Room-Based Cooling

-

-

Application Outlook (Revenue, USD Billion, 2021 - 2033)

-

Telecom

-

IT

-

Retail

-

Healthcare

-

BFSI

-

Energy

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The growth is attributed to the rapid expansion of hyperscale and colocation data centers worldwide. Cloud service providers, social media platforms, and digital service enterprises continue to invest heavily in large-scale data center infrastructure to support growing data traffic and storage requirements. These facilities operate at high utilization levels and require advanced, reliable cooling systems to maintain uptime, improve energy efficiency, and comply with stringent service-level agreements.

b. The global data center cooling market size was estimated at USD 26.31 billion in 2025 and is expected to reach USD 31.39 billion in 2026.

b. The data center cooling market in North America held a significant market share of 31.4% in 2025 due to the rapid scale-up of hyperscale campuses supporting cloud computing, generative AI, and large language model training. Operators are deploying ultra-large facilities with extremely high aggregate power loads, which necessitates advanced cooling architectures capable of operating efficiently at scale.

b. Key players operating in the data center cooling industry are Vertiv Group Corp. and Schneider Electric, STULZ GmbH, and Rittal GmBH & Co. KG

b. The global data center cooling market is expected to grow at a compound annual growth rate of 22.3% from 2026 to 2033 to reach USD 128.31 billion by 2033.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.