- Home

- »

- Next Generation Technologies

- »

-

Data Center Virtualization Market Size, Industry Report, 2033GVR Report cover

![Data Center Virtualization Market Size, Share & Trends Report]()

Data Center Virtualization Market (2025 - 2033) Size, Share & Trends Analysis By Type (Server, Storage), By Component (Software, Services), By Service, By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-988-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Center Virtualization Market Summary

The global data center virtualization market size was estimated at USD 9.08 billion in 2024 and is projected to reach USD 48.32 billion by 2033, growing at a CAGR of 21.1% from 2025 to 2033. The increasing demand for cost-effective and scalable IT infrastructure drives the growth. Data center virtualization allows organizations to reduce hardware dependencies, improve server utilization rates, and cut down operational costs.

Key Market Trends & Insights

- North America data center virtualization dominated the global market with the largest revenue share of 45.1% in 2024.

- The data center virtualization industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the server segment led the market with the largest revenue share of 38.2% in 2024.

- By component, the software segment held the dominant market position with the largest revenue share in 2024..

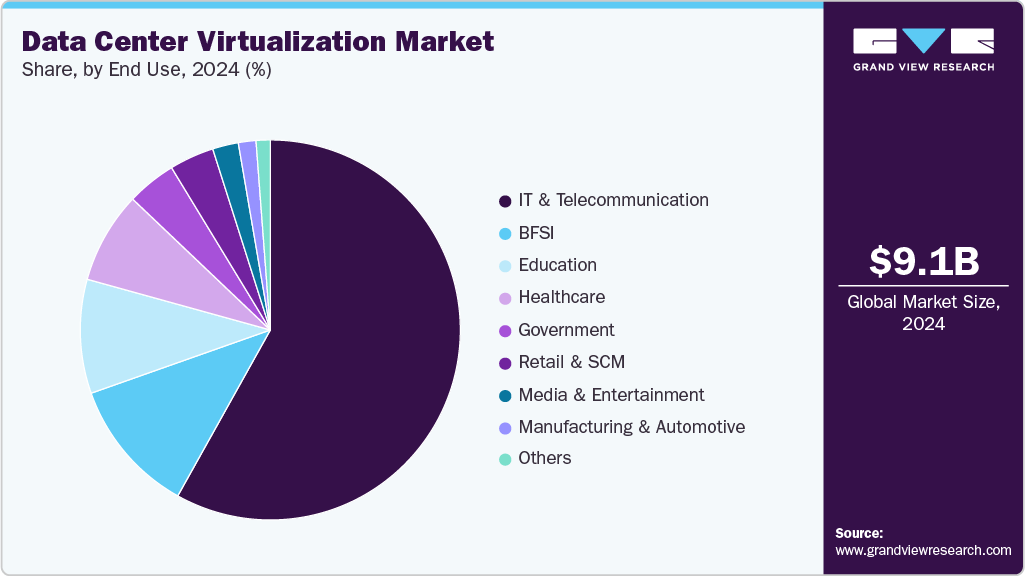

- By end use, the IT & telecommunication segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 7.10 Billion

- 2033 Projected Market Size: USD 11.92 Billion

- CAGR (2025-2033): 5.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

By consolidating workloads on fewer physical machines, companies can significantly reduce capital and energy expenditures, making virtualization an attractive solution for businesses of all sizes, especially small and medium enterprises (SMEs). The rising adoption of cloud computing and hybrid cloud environments also contributes to the growth of the data center virtualization industry. As enterprises migrate their workloads to cloud platforms, virtualization plays a crucial role in enabling seamless integration, scalability, and agility across on-premise and cloud environments. Virtualization technologies, such as hypervisors and virtual machine managers, help organizations build flexible IT environments that support dynamic workload distribution and disaster recovery solutions. According to studies conducted by Amazon Web Services (AWS) in collaboration with Telecom Advisory Services, cloud computing had a significant economic impact in 2023, contributing over USD 1 trillion to the global gross domestic product (GDP). The reports also highlight the growing role of cloud-enabled artificial intelligence (AI), which accounted for more than USD 98 billion of that contribution.Enhanced security and data protection features also contribute to the market's expansion. Virtualized environments support rapid patch management, isolated virtual machines, and centralized control, improving security posture while minimizing the risk of breaches or downtime. With growing concerns around data privacy and regulatory compliance, especially in highly regulated sectors like finance and healthcare, virtualization offers a more secure framework for managing sensitive information.

The increasing need for digital transformation across industries is accelerating the demand for modern, agile data center solutions. Virtualization supports automation, orchestration, and remote management capabilities, which are vital for businesses embracing DevOps practices, edge computing, and AI-driven analytics. This trend is further supported by the proliferation of Internet of Things (IoT) devices, which require efficient backend infrastructure to process vast volumes of data in real time.

Type Insights

The server segment dominated the data center virtualization market and accounted for the revenue share of 38.2% in 2024, driven by the increasing demand for efficient resource utilization and cost-effective infrastructure. Virtualization enables multiple virtual machines to run on a single physical server, reducing hardware costs and improving server efficiency. The rise in cloud computing, edge deployments, and AI workloads is pushing enterprises to adopt high-performance, virtualized servers to support dynamic and scalable operations.

The network segment is anticipated to grow at the fastest CAGR during the forecast period due to the rising adoption of software-defined networking (SDN) and network function virtualization (NFV), which allow more agile, programmable, and efficient network management within virtualized data centers. These technologies decouple network control from hardware, enabling centralized management, automation, and rapid provisioning of network resources, which is crucial for supporting dynamic workloads and multi-tenant environments.

Component Insights

The software segment dominated the data center virtualization industry with the largest revenue share in 2024. This can be attributed to the growing need for centralized management, orchestration tools, and automation platforms that streamline virtual infrastructure operations. As virtual environments become more complex, enterprises are increasingly adopting virtualization software for tasks such as workload balancing, real-time monitoring, and automated provisioning to enhance operational efficiency. The rise of containerization and microservices architecture is also fueling demand for software solutions such as Kubernetes and OpenShift that manage containerized applications within virtualized environments.

The service segment is expected to grow at a significant CAGR during the forecast period due to the increasing demand for consulting, integration, migration, and managed services as organizations navigate complex virtualization deployments. Many enterprises, especially those with legacy infrastructure, rely on third-party expertise to design and implement tailored virtualization strategies that align with their business goals. The rapid pace of technological change and the shortage of in-house IT skills further drive the need for professional services to ensure smooth transitions and minimal disruption.

Service Insights

The advisory & implementation services segment dominated the data center virtualization market with the largest revenue share in 2024, driven by the increasing complexity of IT environments and the strategic need for customized virtualization roadmaps that align with digital transformation goals. Organizations are seeking expert guidance to assess virtualization readiness, plan phased implementations, and ensure alignment with compliance, governance, and business continuity frameworks.

The optimization services segment is expected to grow at a significant CAGR during the forecast period, as businesses focus on maximizing the ROI of their virtualized infrastructure through performance tuning, workload redistribution, and capacity planning. These services help identify underutilized resources, eliminate performance bottlenecks, and ensure that virtual environments operate at peak efficiency. With growing requirements to meet SLAs, improve application responsiveness, and reduce downtime, optimization services are becoming essential for sustaining long-term operational excellence in increasingly dynamic and resource-intensive data center environments.

Enterprise Size Insights

The large enterprise segment dominated the data center virtualization industry with the largest revenue share in 2024, fueled by digital resilience, global scalability, and seamless integration across diverse IT environments. With operations spanning multiple geographies and complex application ecosystems, these organizations are adopting virtualization to support unified infrastructure management, enable faster deployment of enterprise applications, and enhance business agility during periods of expansion or restructuring.

The SMEs segment is expected to grow at a significant CAGR during the forecast period as SMEs increasingly turn to virtualization to overcome limited IT budgets and physical infrastructure constraints. For SMEs, virtualization offers a cost-efficient pathway to access enterprise-grade computing capabilities, reduce hardware dependency, and support business continuity planning without the need for large-scale data center investments.

End Use Insights

The IT and telecommunication segment dominated the market and accounted for the largest revenue share in 2024, driven by the need for high availability, rapid service delivery, and dynamic network management. Virtualization enables telcos and IT service providers to efficiently manage large volumes of data, deploy new services quickly, and reduce time-to-market for applications and platforms. As telecom operators transition to 5G and edge computing, virtualization plays a critical role in supporting virtual network functions (VNFs) and enabling flexible, software-driven infrastructure.

The healthcare segment is expected to grow at a significant CAGR over the forecast period owing to the rising demand for secure, scalable, and interoperable systems that can handle electronic health records (EHRs), telemedicine, and AI-powered diagnostics. Virtualization helps healthcare providers improve data accessibility, ensure disaster recovery, and meet regulatory compliance (such as HIPAA), all while supporting seamless integration across various medical applications and systems in a cost-effective and secure environment.

Regional Insights

North America dominated the global data center virtualization market with the largest revenue share of 45.1% in 2024, driven by the increasing penetration of advanced technologies such as AI, IoT, and big data analytics, which demand scalable and flexible computing environments. The region's mature IT infrastructure, strong presence of cloud service providers, and early adoption of virtualization across sectors such as BFSI, retail, and government further drive market growth.

U.S. Data Center Virtualization Market Trends

The data center virtualization industry in the U.S. is expected to grow significantly at a CAGR of 21.2% from 2025 to 2033, due to the accelerated pace of digital transformation among companies and federal agencies. A strong emphasis on modernizing legacy systems within defense, education, and public sector organizations has led to increased demand for virtual infrastructure. Furthermore, robust investments in hyperscale data centers and federal initiatives like the Cloud Smart strategy are fueling adoption of virtualization platforms nationwide.

Europe Data Center Virtualization Market Trends

The data center virtualization industry in Europe is anticipated to register considerable growth from 2025 to 2033, due to sustainability mandates and green data center initiatives. Virtualization plays a central role in reducing the carbon footprint of data centers by enabling workload consolidation and improving energy efficiency. Moreover, the push for digital sovereignty and local data processing in line with GDPR compliance is encouraging European businesses to invest in secure, virtualized data center environments.

The UK data center virtualization market is expected to grow rapidly in the coming years, owing to organizations revamping digital operations to remain competitive in global markets. The fintech and legal tech sectors, coupled with rising cybersecurity concerns, are prompting increased adoption of virtualization for secure, agile, and compliant data management and service delivery frameworks.

The data center virtualization market in Germany held a substantial revenue share in 2024 due to its industrial digitalization (Industrie 4.0) push, especially among automotive and manufacturing firms. These sectors are leveraging virtualization to support smart factory operations, real-time data analytics, and remote equipment management. In addition, Germany’s strong regulatory focus on data localization and resilience is leading to more virtualized private data centers.

Asia Pacific Data Center Virtualization Market Trends

Asia Pacific data center virtualization industry is expected to witness the fastest growth from 2025 to 2033, due to digitally driven economic development and large-scale cloud adoption by government and enterprises alike. Regional initiatives such as Digital India, China’s New Infrastructure Plan, and Southeast Asia’s e-governance projects are contributing to widespread virtualization. The need for agile, scalable infrastructure across fast-growing economies is making virtualization essential for both public and private sector modernization.

The Japan data center virtualization market is expected to grow rapidly in the coming years, driven by the aging workforce and labor shortages, prompting businesses to automate and virtualize IT operations for higher efficiency. The country’s aggressive move toward digital government (Digital Agency reforms) and the digital twin infrastructure development for manufacturing and urban planning are pushing demand for high-performance, virtualized environments.

The data center virtualization market in China held a substantial market share in 2024, due to the government’s New Infrastructure strategy, which promotes 5G, AI, and data center development. Rapid expansion of internet services, smart city projects, and cloud-native platforms among local tech giants is accelerating virtualization. Additionally, strong demand for sovereign cloud solutions and domestic virtualization software vendors is shaping a robust, localized virtualization ecosystem.

Key Data Center Virtualization Company Insights

Key players operating in the data center virtualization industry are VMware, Inc.; Microsoft; IBM Corporation; Cisco Systems, Inc.; Hewlett-Packard Enterprise Development LP; and Dell Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, Hewlett Packard Enterprise Development LP expanded its HPE Aruba Networking portfolio with new wired and wireless solutions, including the HPE Aruba Networking CX 10K distributed services switches. In collaboration with AMD, HPE aims to deliver secure, scalable, and cost-effective data center and colocation networking solutions designed to meet the demands of large-scale enterprise deployments.

-

In February 2025, Cisco Systems, Inc. expanded its partnership with NVIDIA Corporation to offer AI solutions that support high-performance, low-latency, and energy-efficient connectivity across data centers and cloud platforms, helping enterprises build scalable AI-ready infrastructure.

-

In July 2024, Digital Realty Trust introduced a new Microsoft Azure ExpressRoute peering point at its Dallas data center campus in the U.S., enabling customers to access Azure services through a single cross-connect. The company also joined as a launch partner for Microsoft’s Azure ExpressRoute Metro service in Zurich and Amsterdam, offering secure, low-latency, and private connectivity to Azure from its facilities. This enhances support for hybrid IT and cloud-adjacent architectures.

Key Data Center Virtualization Companies:

The following are the leading companies in the data center virtualization market. These companies collectively hold the largest market share and dictate industry trends.

- ATTO Technology

- AT&T

- Cisco Systems, Inc.

- Dell Inc.

- Fujitsu

- HCL Technologies Limited

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- IBM Corporation

- Konverge

- Microsoft

- Oracle

- Rahi

- Veritis Group Inc.

- VMware, Inc.

Data Center Virtualization Market Report Scope

Report Attribute

Details

Market size in 2025

USD 10.46 billion

Revenue forecast in 2033

USD 48.32 billion

Growth rate

CAGR of 21.1% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, component, service, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ATTO Technology; AT&T; Cisco Systems, Inc.; Dell Inc.; Fujitsu; HCL Technologies Limited; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; IBM Corporation; Konverge; Microsoft; Oracle; Rahi; Veritis Group Inc.; VMware, Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Center Virtualization Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the data center virtualization market report based on type, component, service, enterprise size, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Server

-

Storage

-

Network

-

Desktop

-

Application

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2021 - 2033)

-

Services

-

Software

-

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Advisory & Implementation Services

-

Optimization Services

-

Managed Services

-

Technical Support Services

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecommunication

-

Manufacturing & Automotive

-

Government

-

Healthcare

-

Education

-

Retail & SCM

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data center virtualization market size was estimated at USD 9.08 billion in 2024 and is expected to reach USD 10.46 billion in 2025.

b. The global data center virtualization market is expected to grow at a compound annual growth rate of 21.1% from 2025 to 2033 to reach USD 48.32 billion by 2033.

b. North America dominated the global market with the largest revenue share of 45.1% in 2024, driven by the increasing penetration of advanced technologies such as AI, IoT, and big data analytics, which demand scalable and flexible computing environments.

b. Some key players operating in the data center virtualization market include ATTO Technology, AT&T, Cisco Systems, Inc., Dell Inc., Fujitsu, HCL Technologies Limited, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., IBM Corporation, Konverge, Microsoft, Oracle, Rahi, Veritis Group Inc., VMware, Inc.

b. Key factors driving the data center virtualization market growth include increasing demand for cost-effective and scalable IT infrastructure. Data center virtualization allows organizations to reduce hardware dependencies, improve server utilization rates, and cut down operational costs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.