- Home

- »

- Next Generation Technologies

- »

-

Data Collection And Labeling Market Size Report, 2030GVR Report cover

![Data Collection And Labeling Market Size, Share & Trends Report]()

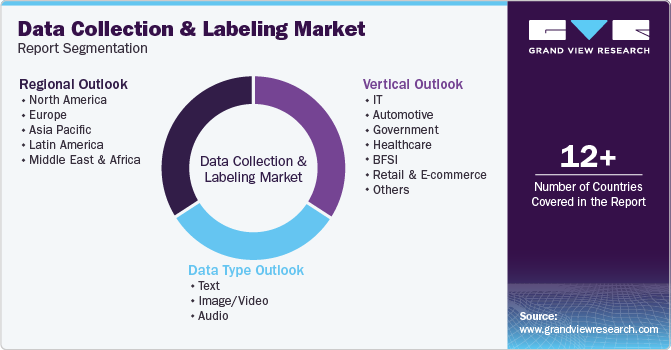

Data Collection And Labeling Market (2025 - 2030) Size, Share & Trends Analysis Report By Data Type (Text, Image/Video, Audio), By Vertical (Automotive, Government, Healthcare, BFSI, Retail & E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-406-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Collection And Labeling Market Summary

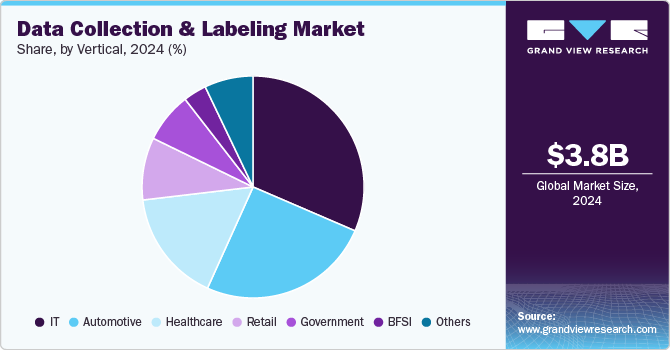

The global data collection and labeling market size was valued at USD 3.77 billion in 2024 and is expected to reach USD 17.10 billion by 2030, growing at a CAGR of 28.4% from 2025 to 2030. The industry is driven by the rising demand for high-quality data to train machine learning (ML) and artificial intelligence (AI) models.

Key Market Trends & Insights

- North America data collection and labeling market dominated the global industry with a revenue share of 35.0% in 2024.

- The data collection and labeling industry in the U.S. dominated the regional industry in 2024.

- Based on data type, the image/video segment dominated the global market and accounted for a revenue share of over 40.0% in 2024.

- Based on vertical, the IT segment held the largest revenue share of this market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.77 Billion

- 2030 Projected Market Size: USD 17.10 Billion

- CAGR (2025-2030): 28.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

It involves gathering and tagging vast amounts of data (images, videos, text, and audio) to make it understandable for algorithms. With AI applications expanding across sectors like healthcare, automotive, retail, and finance, the demand for accurate data labeling has surged. It also contributes to developing enhanced safety features in autonomous vehicles, such as terrain detection, condition monitoring, emergency vehicle detection, and wear detection. Furthermore, the rise in cloud-based services and machine learning tools is also simplifying and boosting the adoption of data labeling. Additionally, many companies now outsource labeling services to specialized providers, which is spurring the industry further.

Machine learning has been incorporated into various industries, including facial recognition on social networking websites, automated picture arrangement on visual websites, robotics, and drones. Social media monitoring is one of the most popular data collection applications, as visual analytics and visual listening are essential for digital marketing growth. Also, this technology is highly used in applications related to safety and security, such as data gathering for facial recognition used by law enforcement agencies. The need for a constant flow of data to evaluate is expanding as the importance of data-backed decisions for businesses increases. Analysts derive insights and information from data about their target clientele through data mining.

The introduction of automatic data processing technologies, such as computers and other communication devices, which process massive amounts of information rapidly and efficiently with minimal human interaction and disseminate it to a select audience, is driving the market forward. Several companies are taking strategic initiatives to build solid machine-learning models by outsourcing data collection and labeling services. AI-enabled data labeling services are rapidly gaining traction in security monitoring technology in many countries. Person/object tracking, traffic monitoring, parking occupancy detection area monitoring, and vehicle analysis are some of the primary AI applications in surveillance settings. Many companies have invested much time developing AI-based data processing technologies to maintain social isolation in open spaces, especially during the global COVID-19 epidemic.

Data Type Insights

The image/video segment dominated the global market and accounted for a revenue share of over 40.0% in 2024, primarily due to the escalating demand for high-quality labeled visual data to train AI and machine learning models. With applications spanning autonomous driving, facial recognition, and healthcare diagnostics, industries increasingly rely on annotated images and videos for accurate algorithm development. The rise of technologies like computer vision and deep learning has intensified the need for comprehensive, well-labeled visual datasets. Moreover, sectors such as retail, security, and media heavily invest in labeled data to enable features like object detection and behavior analysis, driving the revenue of this segment.

The text segment accounted for a significant share in 2024, fueled by the growing demand for natural language processing (NLP) and sentiment analysis in various industries. As businesses across finance, customer service, healthcare, and e-commerce increasingly adopt AI-driven tools, high-quality labeled text data has become essential for training models in language understanding, chatbots, translation, and voice recognition. The need for accurate, nuanced text annotation to support applications like virtual assistants and automated customer support systems contributed significantly to market growth. Additionally, advancements in AI and machine learning have driven investment in labeled text data to improve accuracy in tasks such as text classification and entity recognition.

Vertical Insights

The IT segment held the largest revenue share of this market in 2024. This is largely due to the sector's expanding use of AI and machine learning in automating and optimizing business processes. As organizations increasingly rely on AI-driven insights for decision-making, the demand for accurately labeled data essential for training algorithms has surged. The IT sector utilizes labeled data extensively for applications like predictive analytics, cybersecurity, and IT automation, necessitating high-quality data labeling to enhance algorithm performance. Furthermore, the rise in cloud computing has enabled scalable data storage and processing, allowing IT companies to handle large datasets for more efficient model training.

The automotive segment is projected to grow at the fastest CAGR during the forecast period, driven by the rapid development of autonomous driving technologies and advanced driver-assistance systems (ADAS). Automakers and tech companies require massive volumes of accurately labeled image and sensor data to train AI models for tasks such as object detection, lane recognition, and pedestrian safety in real-world driving conditions. As the industry races to achieve higher levels of autonomy, the demand for labeled data from camera footage to LiDAR and radar inputs has surged.

Regional Insights

North America data collection and labeling market dominated the global industry with a revenue share of 35.0% in 2024, driven by the region’s technological advancements and strong demand for AI and machine learning applications. Home to numerous tech giants and AI research hubs, North America has a high demand for labeled data to support innovations across industries, including automotive, healthcare, and retail. Government funding and private investments in AI and automation further propelled the growth of the data labeling market. Additionally, the region’s established infrastructure in cloud computing and data storage has enabled efficient handling of large datasets, which is critical for training complex algorithms.

U.S. Data Collection And Labeling Market Trends

The data collection and labeling industry in the U.S. dominated the regional industry in 2024. The presence of major tech companies and startups has spurred demand for high-quality labeled data essential for developing and refining AI models across various sectors, including healthcare, automotive, and finance. Furthermore, the U.S. government's support for innovation through funding and research initiatives has accelerated advancements in AI technologies. The country's well-established infrastructure for data storage and processing also facilitates the efficient handling of large datasets, further driving the need for comprehensive data collection and labeling solutions.

Europe Data Collection And Labeling Market Trends

The data collection and labeling industry in Europe is growing due to regional businesses' strong focus on innovation, robust government support, and strategic initiatives to enhance technological infrastructure. Europe's investment in AI research and development, coupled with initiatives to boost digital transformation, has driven the need for extensive datasets to train AI models. The region's robust technology infrastructure and a growing number of AI startups further contribute to this trend, establishing Europe as a significant player in the global data collection and labeling industry.

Asia Pacific Data Collection And Labeling Market Trends

The data collection and labeling industry in Asia Pacific is expected to experience the fastest CAGR during the forecast period, driven by rapid technological advancements and a booming digital economy. Additionally, countries like China and India are investing heavily in AI research and development, creating a surge in startups focused on data annotation services. The vast and diverse population in Asia Pacific also provides a rich source of data, enabling businesses to harness localized insights.

Key Data Collection And Labeling Company Insights

Some key companies in the data collection and labeling industry include Reality AI, Dobility, Inc., Trilldata Technologies Pvt Ltd, Global Technology Solutions, Globalme Localization Inc. and others.

-

Appen Limited leverages a vast crowd of skilled workers worldwide to deliver a diverse range of data services, including text, audio, image, and video annotation. The company's expertise lies in providing labeled datasets that enhance the performance of AI models across various industries, such as automotive, healthcare, finance, and technology. With a strong focus on innovation and a growing portfolio of services, Appen Limited continues to play a vital role in advancing the capabilities of AI and ML technologies globally.

-

Alegion is a prominent player in the data collection and labeling industry, specializing in providing high-quality training data for AI and machine learning applications. The company focuses on delivering scalable and accurate data annotation services tailored to the needs of various industries, including automotive, healthcare, retail, and technology. Alegion utilizes a combination of advanced technologies and a skilled workforce to efficiently label diverse data types, including images, text, and video, ensuring that AI models are trained effectively. The company's robust platform offers clients seamless project management and quality assurance, enabling them to achieve their data goals quickly and cost-effectively. With a commitment to innovation and excellence, Alegion continues to empower organizations by providing the foundational data necessary for AI-driven insights and solutions.

Key Data Collection And Labeling Companies:

The following are the leading companies in the data collection and labeling market. These companies collectively hold the largest market share and dictate industry trends.

- Reality AI

- Globalme Localization Inc.

- Global Technology Solutions

- RELX Group plc

- Labelbox, Inc

- Dobility, Inc.

- Sensata Technologies, Inc

- Trilldata Technologies Pvt Ltd

- Appen Limited

- Playment Inc

- SAS Institute Inc.

- Teledyne Technologies Incorporated

Recent Developments

-

In October 2024, Clarifai, Inc., a prominent player in computer vision and AI orchestration, formed a strategic partnership with Crimson Phoenix, a top provider of data-enabled solutions. This collaboration aims to enhance AI-driven data labeling and computer vision technologies for unstructured data, including images and videos, specifically targeting the Intelligence and Defense sectors.

-

In September 2024, The National Geospatial-Intelligence Agency (NGA) planned to launch a USD 700 million data labeling competition aimed at enhancing AI and machine learning capabilities. This initiative seeks to improve the quality and quantity of labeled data necessary for advanced geospatial intelligence applications. The NGA plans to partner with various organizations to gather high-quality labeled datasets, crucial for training AI models that support national security efforts. This competition underscores the growing importance of accurate data labeling in the defense sector.

Data Collection And Labeling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.89 billion

Revenue forecast in 2030

USD 17.10 billion

Growth Rate

CAGR of 28.4% from 2025 to 2030

Actual data

2017 - 2024

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Data type, vertical, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Reality AI; Globalme Localization Inc.; Global Technology Solutions; RELX Group plc; Labelbox, Inc; Dobility, Inc.; Sensata Technologies, Inc; Trilldata Technologies Pvt Ltd; Appen Limited; Playment Inc; SAS Institute Inc.; Teledyne Technologies Incorporated

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Collection And Labeling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global data collection and labeling market report based on data type, vertical, and region:

-

Data Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Text

-

Image/Video

-

Audio

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

IT

-

Automotive

-

Government

-

Healthcare

-

BFSI

-

Retail & E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global data collection and labeling market is expected to grow at a compound annual growth rate of 28.4% from 2025 to 2030 to reach USD 17.10 billion by 2030.

b. North America dominated the data collection and labeling market with a share of 35.8% in 2024. This is attributable to the rapid growth of cloud-based media services, as media services are one of the potential data sources for collection.

b. Some key players operating in the data collection and labeling market include Reality AI; Globalme Localization Inc.; Global Technology Solutions; RELX Group plc; Labelbox, Inc; Dobility, Inc.; Sensata Technologies, Inc; Trilldata Technologies Pvt Ltd; Appen Limited; Playment Inc; SAS Institute Inc.; Teledyne Technologies Incorporated

b. Key factors that are driving the data collection and labeling market growth include the growing need to make text/image more interactive and engaging, growing R&D spending on the development of self-driving vehicles, and rapid penetration of AI and machine learning across the world.

b. The global data collection and labeling market size was estimated at USD 3.77 billion in 2024 and is expected to reach USD 4.89 billion in 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.