- Home

- »

- Next Generation Technologies

- »

-

Data Protection As A Service Market, Industry Report, 2033GVR Report cover

![Data Protection As A Service Market Size, Share & Trends Report]()

Data Protection As A Service Market (2026 - 2033) Size, Share & Trends Analysis By Service (DRaaS, BaaS, STaaS), By Deployment (Public Cloud, Private Cloud), By Enterprise Size, By End Use (Healthcare, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-207-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Data Protection As A Service Market Summary

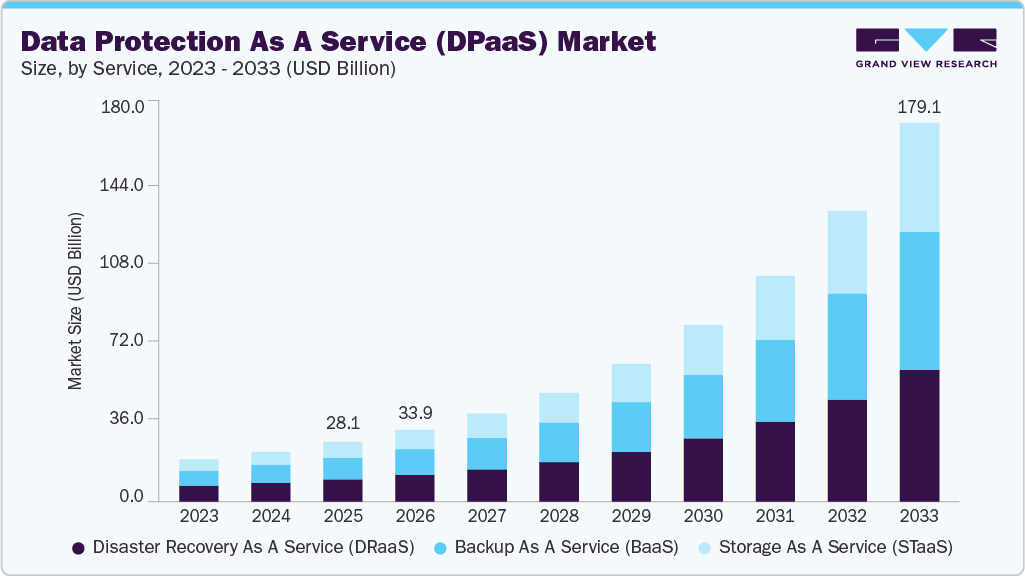

The global data protection as a service market size was estimated at USD 28.07 billion in 2025 and is projected to reach USD 179.06 billion by 2033, growing at a CAGR of 26.8% from 2026 to 2033 due to the increasing volume of data generated across enterprises and the rising incidence of cyber threats such as ransomware, phishing, and data breaches. As organizations transition to hybrid and multi-cloud environments, the need for scalable, cloud-based backup, recovery, and storage solutions has become critical to ensure business continuity and compliance with evolving data privacy regulations like GDPR and CCPA.

Key Market Trends & Insights

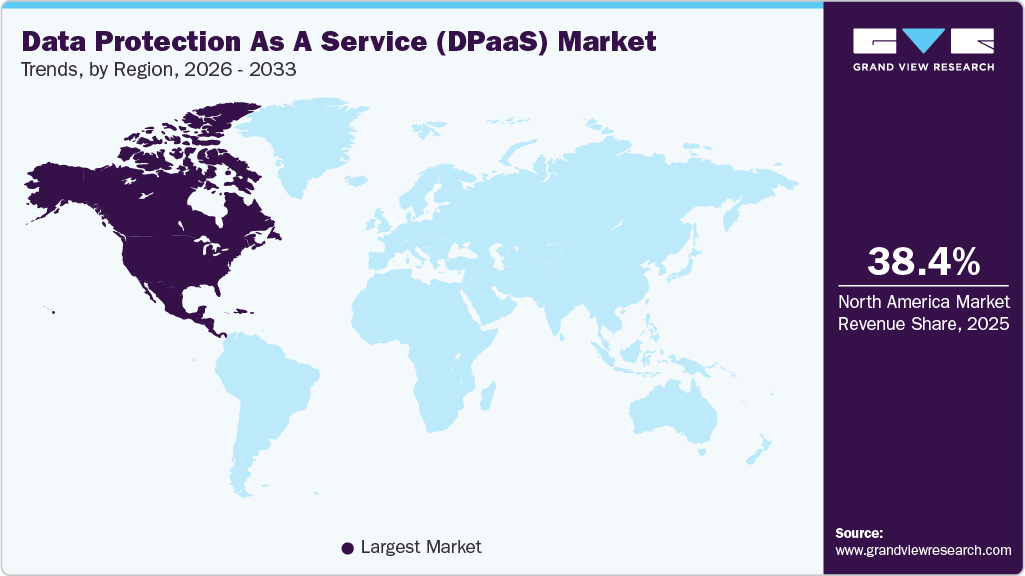

- North America data protection as a service dominated the global market with the largest revenue share of 38.4% in 2025.

- The data protection as a service industry in the U.S. is expected to grow significantly over the forecast period.

- By service, disaster recovery as a service (DRaaS) led the market and held the largest revenue share of 37.6% in 2025.

- By deployment, the private cloud segment held the dominant position in the market and accounted for the largest revenue share in 2025.

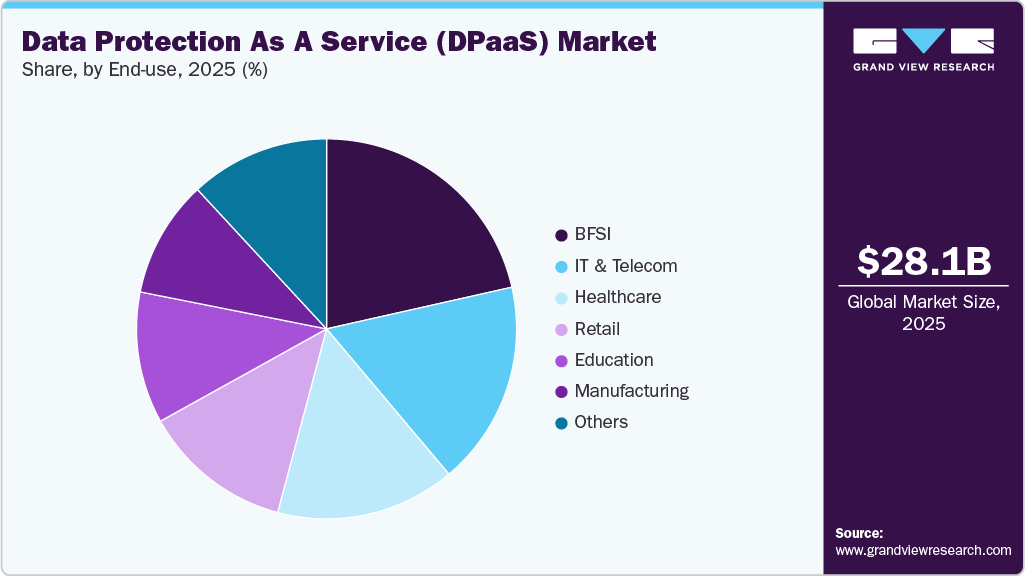

- By end use, the manufacturing segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2025 Market Size: USD 28.07 Billion

- 2033 Projected Market Size: USD 179.06 Billion

- CAGR (2026-2033): 26.8%

- North America: Largest market in 2025

Modern cyberattacks have shifted from merely stealing data to holding it hostage through encryption. This malicious evolution has rendered traditional, infrequent backup methods obsolete. Organizations now recognize that data is a critical asset whose integrity and availability are paramount to business continuity. DPaaS solutions directly address this by offering robust, automated, and immutable backups that cannot be altered or deleted by attackers. Moreover, leading DPaaS providers integrate advanced security features like AI-driven anomaly detection to identify suspicious activity before a full-scale attack occurs, and streamlined disaster recovery orchestration that allows businesses to restore operations from a clean copy of their data in minutes or hours, rather than days. This transition from a reactive to a proactive and resilient data protection posture is a powerful driver compelling enterprises to adopt cloud-based data protection services.

The increasingly stringent global regulatory landscape for data privacy and compliance is a significant compliance-driven growth factor. Regulations such as the General Data Protection Regulation (GDPR) in Europe, the California Consumer Privacy Act (CCPA), and various industry-specific mandates such as HIPAA for healthcare and PCI-DSS for payment data, impose strict requirements on how data is stored, processed, and protected. Non-compliance can result in devastating financial penalties and reputational damage.

In the second quarter of 2025, global regulators significantly intensified privacy and data protection enforcement, collectively issuing fines exceeding €800 million. Authorities across various regions introduced landmark rulings and enforcement actions that are set to redefine corporate compliance practices. The Q2 2025 Privacy & Data Protection Regulatory Enforcement Report provides an in-depth analysis of these key developments, highlighting major penalties, evolving regulatory trends, and the strategic impacts organizations must consider to strengthen their data protection frameworks moving forward.

Service Insights

The disaster recovery as a service (DRaaS) segment dominated the market and accounted for a revenue share of 37.6% in 2025, driven by the critical need for robust business continuity in an era of escalating cyber threats, particularly ransomware. Traditional disaster recovery (DR) plans, often reliant on physical hardware in a secondary data center, are notoriously complex, expensive, and slow to execute. In the face of a ransomware attack that can encrypt an entire network, the speed of recovery is paramount to survival. DRaaS directly addresses this vulnerability by offering a cloud-based recovery site that is on standby. Modern DRaaS solutions provide automated failover and failback processes, allowing businesses to redirect users to replicated workloads in the cloud within minutes or hours, rather than the days or weeks typical of traditional DR.

The storage as a service (STaaS) segment is anticipated to grow at the fastest CAGR during the forecast period due to the strategic shift from capital-intensive storage procurement to a flexible, operational expenditure model. Traditional storage infrastructure requires significant upfront capital expenditure (CapEx) for hardware, leading to challenges in capacity forecasting, frequent over-provisioning, and rigid refresh cycles. STaaS disrupts this model by offering a subscription-based, pay-as-you-go model. This provides organizations with predictable operating expenses (OpEx), direct cost alignment with actual storage consumption, and the ability to elastically scale capacity on-demand.

Deployment Insights

The private cloud segment dominated the market and accounted for the largest revenue share in 2025. The demand for predictable performance and granular control over IT resources continues to fuel private cloud deployment. Organizations with latency-sensitive applications or large, steady-state workloads often find that a private cloud offers more consistent performance without the potential variability associated with shared public cloud resources. Moreover, the private cloud model provides unparalleled administrative control, allowing IT teams to customize hardware, software, and management protocols to meet precise operational needs.

The public cloud segment is expected to grow at a significant CAGR during the forecast period. Small and medium-sized businesses (SMBs) historically lacked the capital and expertise to implement and manage sophisticated disaster recovery (DR) and data backup solutions comparable to those of large enterprises. Public Cloud DPaaS has fundamentally leveled the playing field. SMBs can now access the same underlying, globally resilient infrastructure and advanced software capabilities as large corporations, but through a simple, subscription-based portal.

Enterprise Size Insights

The large enterprises segment dominated the market and accounted for the largest revenue share in 2025. Traditional data protection infrastructure requires heavy capital expenditure and maintenance resources. DPaaS enables large enterprises to transition to an operational expenditure (OPEX) model with predictable subscription costs. This shift reduces hardware dependency, simplifies scalability, and allows IT teams to focus on strategic initiatives instead of backup administration.

The small and medium-sized enterprises (SMEs) segment is expected to grow at a significant CAGR during the forecast period. SMEs often lack redundant infrastructure for disaster recovery. DPaaS provides cloud-based replication, quick restore options, and reliable data continuity, enabling SMEs to maintain operations during disruptions without significant capital investment. SMEs in regulated sectors must comply with data protection and privacy regulations. DPaaS simplifies compliance by offering automated policy enforcement, audit trails, and secure storage that meets regulatory standards.

End Use Insights

The BFSI segment dominated the market and accounted for the largest revenue share in 2025. BFSI firms generate enormous volumes of transactional, customer, and market data daily. DPaaS enables efficient backup, deduplication, and long-term retention at scale, allowing institutions to manage and protect large datasets without expanding on-premises infrastructure. Moreover, with the rise of digital banking, online insurance platforms, and fintech services, BFSI organizations are migrating workloads to cloud environments. DPaaS provides seamless protection across hybrid and multi-cloud deployments, safeguarding mission-critical applications and customer data in real time.

The manufacturing segment is expected to grow at a significant CAGR over the forecast period. Manufacturing firms rely heavily on production data, supply chain information, and industrial control systems. DPaaS ensures that this operational data is securely backed up and recoverable in case of system failures, cyberattacks, or human errors, minimizing downtime and production losses. Moreover, with the adoption of smart factories, connected machines, and IoT-enabled sensors, manufacturing data volumes are increasing exponentially. DPaaS provides scalable, automated backup and recovery for these diverse and high-volume datasets, ensuring continuous protection across the digital manufacturing ecosystem.

Regional Insights

North America Data Protection as a Service Industry Trends

North Americadata protection as a service industry dominated the global market with the largest revenue share of 38.4% in 2025, driven by stringent cybersecurity standards across industries, with enterprises increasingly adopting cloud-native solutions to meet federal guidelines such as the Cybersecurity Maturity Model Certification (CMMC) and NIST frameworks. This regulatory pressure, combined with a high rate of digital transformation initiatives, propels demand for advanced, automated, and compliant data protection services.

U.S. Data Protection as a Service Market Trends

The data protection as a service industry in the U.S. is expected to grow significantly at a CAGR of 25.6% from 2025 to 2033, due to large-scale adoption of multi-cloud architectures and SaaS platforms across enterprises. Organizations seek centralized backup and recovery solutions to ensure seamless data protection across hybrid IT environments while maintaining compliance with sector-specific regulations such as HIPAA and GLBA.

Europe Data Protection as a Market Trends

The data protection as a service industry in Europe is anticipated to register considerable growth from 2025 to 2033 due to strong emphasis on data privacy and GDPR enforcement. Companies are investing in cloud-based backup and recovery services that offer robust data governance, cross-border compliance, and encrypted storage to adhere to strict European privacy standards.

The UK data protection as a service industry is expected to grow rapidly in the coming years, owing to financial services and insurance sectors, which require high levels of resilience and disaster recovery capabilities. DPaaS adoption is rising as banks and insurers seek to protect mission-critical data while reducing capital-intensive backup infrastructure.

The Germany data protection as a service industry held a substantial market share in 2025 due to the industrial and manufacturing sectors’ shift toward Industry 4.0. Enterprises are increasingly adopting automated backup and recovery solutions to safeguard operational technology (OT) and production data while ensuring business continuity across digitalized factories.

Asia Pacific Data Protection as a Service Market Trends

Asia Pacific data protection as a service industry held a significant share in the global market in 2025, due to rapid digital adoption among SMEs and large enterprises is a key growth driver. The region’s expanding e-commerce, fintech, and telecommunication sectors are increasingly leveraging DPaaS to secure cloud workloads and distributed data across multiple countries with varying compliance requirements.

The Japan data protection as a service industry is expected to grow rapidly in the coming years, driven by enterprises modernizing legacy IT systems and integrating hybrid cloud architectures. Businesses seek reliable, managed data protection services to reduce operational complexity while supporting advanced analytics and AI-driven workloads in mission-critical environments.

The China data protection as a service industry held a substantial market share in 2025, due to the strict local data sovereignty laws and the increasing volume of data generated by government, fintech, and technology sectors. Organizations are adopting localized, compliant cloud-based backup solutions to ensure secure storage, cross-region replication, and adherence to cybersecurity mandates.

Key Data Protection As A Service Company Insights

Key players operating in the data protection as a service industry are Amazon Web Services, Inc., Microsoft, IBM Corporation, Dell Inc., and Broadcom.The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In August 2025, Microsoft unveiled Windows Backup for Organizations, a new cloud-based enterprise backup solution designed to streamline device migration and safeguard system settings and user preferences. The service provides encrypted, regionally stored backups and supports Windows 10 and Windows 11 devices connected through Microsoft Entra. This launch underscores Microsoft’s commitment to enhancing data protection and business continuity across enterprise environments through secure and scalable cloud infrastructure.

-

In February 2025, IBM Corporation released updates for its Guardium Database Protection Service (DPS), introducing versions 11.x and 12.x with expanded capabilities. The new releases feature enhanced vulnerability assessments, updated security policies, and improved reporting tools designed to strengthen customers’ database protection and compliance management. These upgrades help organizations maintain a robust security posture across hybrid and cloud environments.

-

In April 2024, Dell Inc. expanded its data protection portfolio with the introduction of new PowerProtect Data Domain appliances delivering enhanced performance and security, alongside the launch of Dell APEX Backup Services AI. The AI-driven solution is designed to boost operational efficiency and productivity while providing comprehensive protection and recovery across hybrid, multi-cloud, and SaaS environments. This expansion reinforces Dell’s focus on delivering intelligent, scalable data protection for modern enterprise workloads.

Key Data Protection As A Service Companies:

The following are the leading companies in the data protection as a service (DPaaS) market. These companies collectively hold the largest market share and dictate industry trends.

- Amazon Web Services, Inc.

- Asigra Inc.

- Broadcom

- Cisco Systems, Inc.

- Commvault

- Cyfuture

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Huawei

- IBM Corporation

- Microsoft

- Oracle

- Quantum Corporation

- Quest Software Inc.

- Veritas Technologies LLC

Data Protection as a Service (DPaaS) Market Report Scope

Report Attribute

Details

Market size in 2026

USD 33.91 billion

Revenue forecast in 2033

USD 179.06 billion

Growth Rate

CAGR of 26.8% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2026 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, deployment, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

Amazon Web Services, Inc.; Asigra Inc.; Broadcom; Cisco Systems, Inc.; Commvault; Cyfuture; Dell Inc.; Hewlett Packard Enterprise Development LP; Huawei; IBM Corporation; Microsoft; Oracle; Quantum Corporation; Quest Software Inc.; Veritas Technologies LLC

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Data Protection as a Service (DPaaS) Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global data protection as a service (DPaaS)market report based on service, deployment, enterprise size, end use, and region.

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Disaster Recovery as a Service (DRaaS)

-

Backup as a Service (BaaS)

-

Storage as a Service (STaaS)

-

-

Deployment Outlook (Revenue, USD Billion, 2021 - 2033)

-

Public Cloud

-

Private Cloud

-

Hybrid Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

Small and Medium-sized Enterprises (SMEs)

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

Healthcare

-

IT and Telecom

-

Retail

-

Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global DPaaS market size was estimated at USD 28.07 billion in 2025 and is expected to reach USD 33.91 billion in 2026.

b. The global DPaaS market is expected to grow at a compound annual growth rate of 26.8% from 2026 to 2033 to reach USD 179.06 billion by 2033.

b. The private cloud segment dominated the market and accounted for the largest revenue share of 57.5% in 2025. The demand for predictable performance and granular control over IT resources continues to fuel private cloud deployment. Organizations with latency-sensitive applications or large, steady-state workloads often find that a private cloud offers more consistent performance without the potential variability associated with shared public cloud resources. Moreover, the private cloud model provides unparalleled administrative control, allowing IT teams to customize hardware, software, and management protocols to meet precise operational needs.

b. Key players operating in the data protection as a service industry are Amazon Web Services, Inc., Microsoft, IBM Corporation, Dell Inc., and Broadcom.

b. As organizations transition to hybrid and multi-cloud environments, the need for scalable, cloud-based backup, recovery, and storage solutions has become critical to ensure business continuity and compliance with evolving data privacy regulations like GDPR and CCPA

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.