Data Resiliency Market Size & Trends

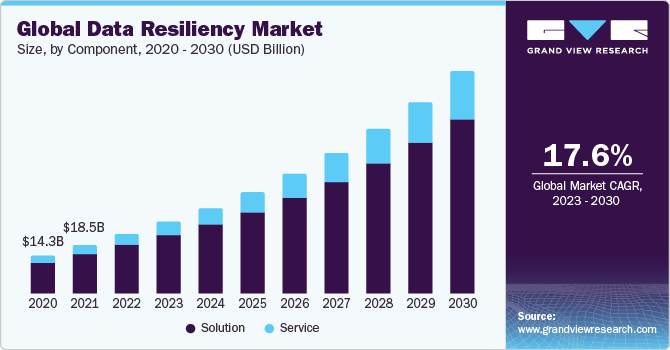

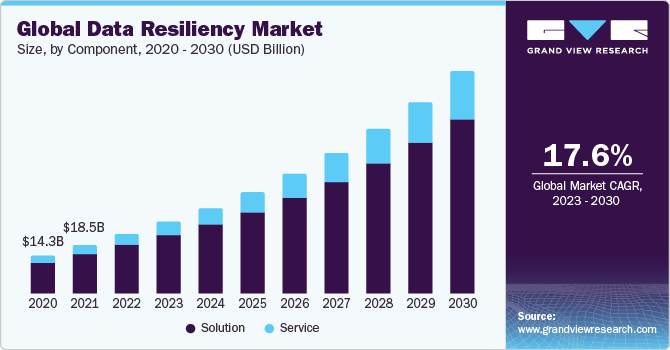

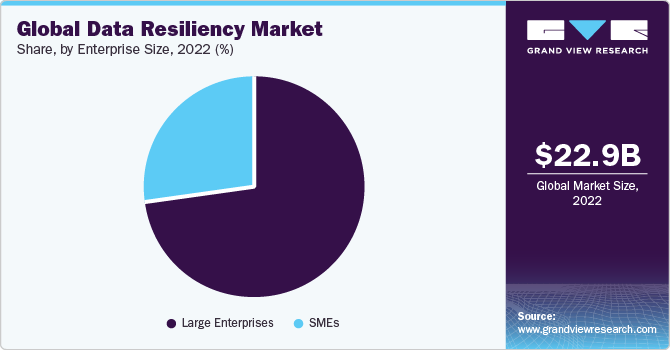

The global data resiliency market size was valued at USD 22.87 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 17.6% from 2023 to 2030. Data resiliency plays a critical role in ensuring the seamless operation of organizations, even in adverse situations like power failures or equipment malfunctions. This capability allows data centers, storage systems, and servers to swiftly recover data, enabling the organization to maintain its operational continuity. The increasing volume of data generated from diverse sources is driving the adoption of data resiliency systems. This surge in demand is expected to contribute to the market growth over the forecast period.

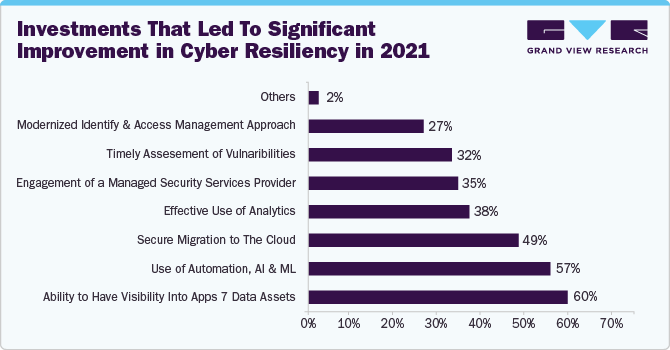

The global data resiliency market is experiencing growth driven by several factors. The increasing concerns regarding data safety and security, coupled with the adoption of cloud-based data backup and recovery solutions, are primary contributors to this growth. Additionally, enterprises are emphasizing achieving operational excellence and implementing data quality management solutions. The substantial growth in data generation from various sources further boosts the market. The adoption of blockchain solutions by various enterprises presents a significant opportunity for the global data resiliency market to expand.

Enterprises and government organizations worldwide are shifting from using cloud environments solely for testing purposes to deploying a larger portion of their mission-critical workloads and compute instances in the cloud. This transition is driven by the escalating adoption of IoT (Internet of Things), cloud computing, and big data analytics. These technologies are integral components of many organizations' digital transformation strategies. Consequently, the demand for data centers is rising as they play a crucial role in supporting these technological advancements, contributing significantly to the growth of the market.

Component Insights

Based on the component, the data resiliency market is segmented into solutions and services. The solution segment held the largest market share in 2022. This dominance of the segment can be attributed to the increasing investment by numerous companies in data resilience solutions, aiming to protect crucial corporate data from sophisticated cyber-attacks.

These solutions ensure that operations can swiftly resume after a catastrophic event by providing redundant systems and data recovery capabilities.

Deployment Insights

On the basis of deployment, the market is segmented into on-premises and cloud. The on-premises segment held the largest market share in 2022. On-premises data resiliency solutions stand out for their speed and lower latency, facilitated by reliable networking communications. Organizations seeking high performance across diverse workloads prefer on-premises deployment. Verticals such as defense, BFSI, and government prefer the on-premises deployment, as they cannot afford to lose financial records, sensitive data, money transactions, and customer data.

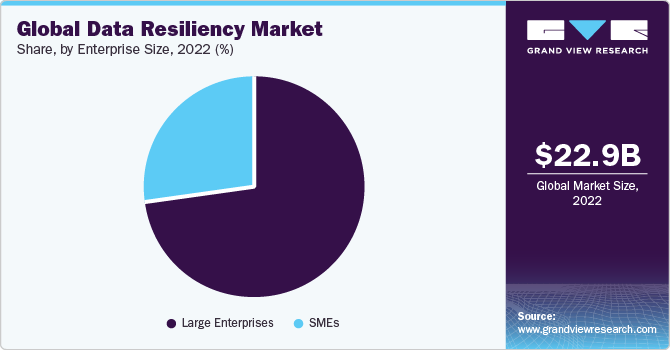

Enterprise Size Insights

On the basis of enterprise size, the market is segmented into large enterprises and SMEs. The large enterprises segment held the largest market share in 2022. Large enterprises typically have more substantial budgets dedicated to IT infrastructure, security, and data management. This financial capacity allows them to invest in advanced data resiliency solutions that cater to the complexities of their operations.

Furthermore, large enterprises often have complex and expansive IT infrastructures, including multiple servers, databases, and applications. Implementing comprehensive data resiliency solutions becomes imperative to safeguard the integrity and availability of diverse data types.

Vertical Insights

On the basis of vertical, the market is segmented into BFSI, IT and telecom, retail & consumer goods, government, public goods, healthcare, media & entertainment, manufacturing, and others. The BFSI sector deals with substantial daily data generation and processing. This data includes important information like account numbers, transaction passwords, and credit/debit card details, demanding both high security and effective backup measures. Data resiliency solution providers play a crucial role in facilitating BFSI enterprises to back up and recover data, ensuring the uninterrupted flow of business operations. Consequently, the BFSI segment is projected to take the lead in adopting data resiliency solutions, driven by the growing apprehensions among customers regarding the security of their essential data.

Regional Insights

North America dominated the market in 2022. The region is home to numerous large enterprises with expansive IT infrastructures. These organizations, along with government agencies, demand robust data resiliency solutions to ensure the security and continuity of their operations. Furthermore, the region faces significant cybersecurity challenges due to its high reliance on digital technologies. This has propelled organizations to invest in advanced data resiliency solutions to protect against cyber threats and data breaches.

Key Companies & Market Share Insights

Key players operating in the market areAcronis International GmbH; Asigra Inc.;Open Text Corporation; CenturyLink; Commvault; IBM; Microsoft; NetApp; Quest Software Inc.; and Unitrends. Vendors in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including mergers & acquisitions, partnerships, collaborations, and new product/ technology development. The following are some instances of such initiatives.

-

In March 2023, IBM and Cohesity, Inc. unveiled a collaborative effort to tackle the pressing demand among organizations for heightened data security and resilience in hybrid cloud settings. By integrating data protection, cyber resilience, and data management features from both entities, IBM is set to introduce the IBM Storage Defender solution. This solution incorporates Cohesity's data protection capabilities as a fundamental component of the offering.

-

In October 2023, Pure Storage, Inc., a pioneer in IT providing cutting-edge data storage technology and services, enhanced its Evergreen portfolio by introducing a commitment. This commitment involves covering the power and rack space expenses for customers utilizing the Evergreen//OneTM Storage as a Service (STaaS) and Evergreen//FlexTM subscriptions. Additionally, Pure Storage has announced novel guarantees, including power & space efficiency, zero data loss, and no data migration, along with offering flexible upgrades and financing options across its comprehensive Evergreen portfolio.