- Home

- »

- Next Generation Technologies

- »

-

Decentralized Identity Market Size And Share Report, 2030GVR Report cover

![Decentralized Identity Market Size, Share & Trends Report]()

Decentralized Identity Market (2023 - 2030) Size, Share & Trends Analysis Report By Identity Type (Biometrics, Non-biometrics), By End-user (Individual, Enterprises), By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-979-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2019 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Decentralized Identity Market Summary

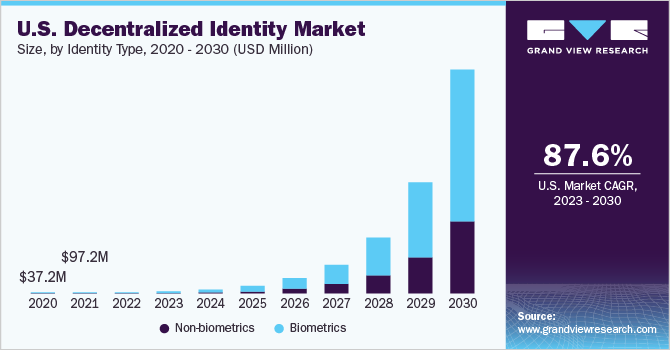

The global decentralized identity market size was estimated at USD 647.80 million in 2022 and is projected to reach USD 10200 million by 2030, growing at a CAGR of 90.3% from 2023 to 2030. Privacy and security concerns have become increasingly prominent in today's digital landscape.

Key Market Trends & Insights

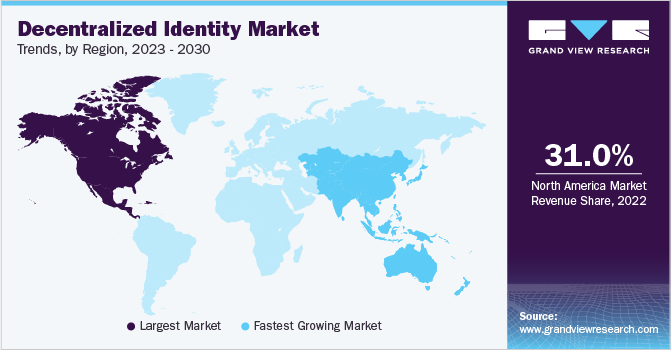

- North America dominated the global decentralized identity market with the largest revenue share of 34.6% in 2022.

- By identity type, the biometric segment led the market, holding the largest revenue share of 64.0% in 2022.

- By end user, the enterprises segment held the dominant position in the market and accounted for the leading revenue share of 65.0% in 2022.

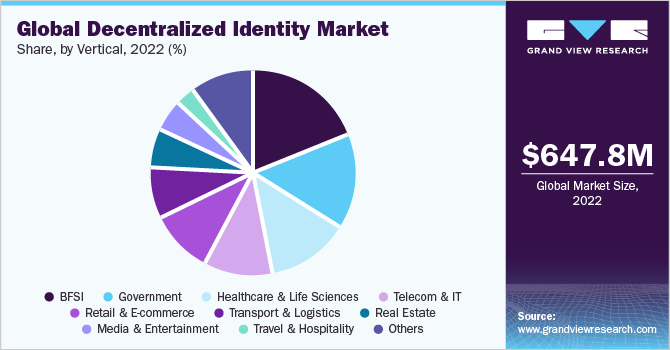

- By vertical, the BFSI segment held the dominant position in the market and accounted for the leading revenue share of 19.0% in 2022.

- By end user, an individual segment is expected to grow at the fastest CAGR of 91.6% from 2023 to 2033.

Market Size & Forecast

- 2022 Market Size: USD 647.80 Million

- 2030 Projected Market Size: USD 102000 Million

- CAGR (2023-2030): 90.3%

- North America: Largest market in 2022

With traditional centralized identity systems, individuals have limited control over their data, which raises concerns about data breaches and unauthorized access. Decentralized identity (ID) solutions offer a more secure and privacy-centric approach by enabling individuals to own and control their digital identities.

The rise of blockchain technology has paved the way for decentralized identity solutions. Blockchain provides a transparent and immutable ledger that can securely store and verify identity information. This eliminates the requirement for intermediaries and creates a trustless environment where identity verification can be done directly between parties, reducing costs and improving efficiency. Moreover, increasing demand for frictionless and seamless user experiences is accentuating the acceptance of decentralized ID worldwide.

Traditional identity verification processes can be cumbersome, involving multiple usernames, passwords, and authentication methods. Decentralized identity solutions offer a single, portable digital identity that can be easily verified across different platforms and services, simplifying the user experience. Furthermore, regulatory requirements and compliance standards are expected to push organizations to adopt decentralized identity solutions. Regulations such as the California Consumer Privacy Act (CCPA) and General Data Protection Regulation (GDPR) in Europe require businesses to handle personal data responsibly and provide individuals with greater control over their data. Decentralized identity solutions align with these regulations by giving individuals ownership and control over their personal information.

Increasing digitalization of various industries, such as finance, healthcare, and e-commerce, is fueling demand for decentralized identity. These sectors require robust identity verification processes to ensure secure transactions and protect sensitive data. Decentralized identity solutions offer a reliable and tamper-proof method of identity verification. As a result, it mitigates risks associated with identity theft and fraud.

However, the challenge of widespread adoption and interoperability is restraining market growth. While decentralized identity solutions offer numerous benefits, transitioning from traditional identity systems to decentralized models can be complex and require a significant shift in infrastructure and user behavior. In addition, different decentralized identity platforms may also use different standards and protocols, leading to interoperability issues between systems. To overcome this restraint, industry collaboration and the development of open standards are essential. Stakeholders, including technology providers, industry associations, and regulatory bodies, need to work in unison to establish common frameworks and interoperability standards for decentralized identity.

COVID-19 Impact Analysis

The COVID-19 pandemic has played a crucial role in driving market growth. The pandemic boosted digitalization in almost all industries globally. Due to the COVID-19 outbreak, decentralized identification technology has made significant advances in processing digital identity verifications. Due to increasing concerns about identity theft among online users, several companies have begun integrating blockchain technology into digital identity platforms to remove middleware entities to enhance security and reduce identity fraud. This is further expected to fuel the growth of the decentralized identity industry globally.

Market Dynamics

Distributed ledger technology, also known as the blockchain, forms the basis of technology used in decentralized identity management. Blockchain enables peer-to-peer data sharing and makes data private and secure using encryption. Cryptographic algorithms enable the creation of unique identifiers, using public and private keys that encrypt data, secure it, and minimize exposure to risks and vulnerabilities such as identity theft and cybercrime. Digital wallets are utilized to store and manage personal data, while smart contracts, a pre-defined set of software instructions, are leveraged to create agreements and execute transactions between involved parties. Users can use their digital wallet to generate a verifiable credential containing necessary information when they want to share their personal information with another party. The verifiable credential is then sent to the receiving party, who can use the public key in the user's DID document to verify the credential's authenticity.

Identity Type Insights

In terms of identity type, the biometric segment dominated the market in 2022 with a revenue share of more than 64.0%. Biometric identifiers, such as fingerprints, facial recognition, iris scans, and voice recognition, provide a high level of precision and security in authenticating an individual's identity. This type of identity verification offers a strong level of verification and is difficult to forge or replicate, making it highly reliable for forming trust in digital interactions. Biometric identity also offers convenience and ease of use for users. With biometric authentication, individuals can confirm their identity quickly and seamlessly by solely using their distinctive biological traits. This excludes the necessity for passwords or other traditional forms of authentication, which can be easily forgotten, stolen, or compromised.

Non-biometrics segment is anticipated to grow substantially over the forecast period. Growing demand for non-biometric identity among consumers owing to easy portability and convenience is expected to drive the segment's growth. Moreover, non-biometric authentication is typically used as a backup for biometric password-less security. Such factors are anticipated to contribute to segment growth over the forecast period.

End-user Insights

In terms of end-user, the enterprises segment dominated the market in 2022 with a revenue share of more than 65.0%. Growing concern for reducing business risk is a significant factor driving segment growth. Moreover, a decentralized identity framework enables enterprises to control users’ identities independently of the identity issuer. Furthermore, a decentralized identity eliminates the initial need for organizations to gather and store personal data.

An individual segment is expected to register the fastest CAGR of 91.6% over the forecast period. The growth of individual segment can be attributed to the increasing adoption of decentralized identity solutions by individuals for creating and maintaining their identities. Furthermore, decentralized identity solutions help individuals verify and authenticate themselves in various identification processes for different use cases, such as loan sanctioning, bank account opening, and other KYC processes, among others. Thus, such wide use cases of decentralized identity to individual users are further expected to drive growth of the segment over the forecast period.

Enterprise Size Insights

In terms of enterprise size, the large enterprises segment dominated the market in 2022 with a revenue share of over 67.0%. Demand for decentralized identity is rising among large enterprises as these enterprises are trying aggressively to avoid identity risk. For instance, in August 2022, Litentry, a multi-chain identity protocol, announced a partnership with Node Real, a blockchain infrastructure solution provider. Through the partnership, Litentry can incorporate NodeReal's MegaNode, which offers powerful real-time and historical data indexing on the Ethereum and Binance Chain networks.

The small & medium enterprises (SMEs) segment is anticipated to register the fastest CAGR of 90.8% over the forecast period. Small enterprises typically try to digitalize their services and enhance customer experience. Furthermore, the application of blockchain technology-based identity management can be widely adopted as a means of guaranteeing the protection of private information and improving accountability and trust between parties. In addition, SMEs also benefit from increased product and service efficiency and quality, improved supply chain management, and blockchain-driven business model innovation.

Vertical Insights

In terms of vertical, the BFSI segment dominated the market in 2022 with a revenue share of over 19.0%. Banks are required to conduct KYC checks to confirm customers' identity and ensure they are not involved in any illegal activity, such as bribery or money laundering. In addition, the U.S. spends USD 25 billion on Anti Money Laundering (AML) compliances. Moreover, according to Forbes, in April 2019, major banks spent up to USD 500 million annually on cybersecurity.

The telecom & IT segment is anticipated to grow at the fastest CAGR of 92.1% over the forecast period. With increasing digitization of communication and growing demand for secure and seamless identity verification, the telecom & IT segment is actively exploring decentralized identity solutions to enhance user experiences and ensure robust security. Telecom and IT companies often handle a vast amount of sensitive customer data, including personal information and authentication credentials. By adopting decentralized identity solutions, they can provide their customers with greater control and ownership over their identity information while also enhancing data privacy and protection.

Regional Insights

In terms of region, North America dominated the market in 2022 with a revenue share of more than 31.0%. North America region has a varied range of industries and sectors that can benefit from decentralized identity solutions. These comprise financial services, healthcare, government, and e-commerce, among others. The need for secure and effectual identity authentication, data sharing, and user verification in these sectors has driven the adoption of decentralized identity technologies. In addition, it has a huge and tech-savvy population that is progressively more aware of the significance of data privacy and digital security, which is also accentuating the market growth in the region.

Asia Pacific is anticipated to grow at the fastest CAGR of 91.9% over the forecast period. The regional market's growth can be attributed to growing awareness of cybersecurity in nations such as India, China, and Japan. Aggressive efforts are being pursued by various organizations across the Asia Pacific to safeguard consumer identity, which is also expected to contribute to the regional market’s growth. For instance, in April 2021, Affinidi, a Tamsek identity startup, and The Commons Project Foundation, a global nonprofit tech firm, formed a collaboration. The main aim of this collaboration was to integrate digital credentials for secure international travel.

Key Companies & Market Share Insights

The decentralized identity industry can be described as a highly competitive market due to the presence of several prominent market players. In efforts to improve their offerings, market firms pursue strategies such as new alliances, strategic agreements, and others. For instance, in January 2023, Quadrata, a Web3 identity solution, focused on enhancing compliance and reputation within public blockchains and established partnerships with nine prominent DeFi protocols. These protocols include Archblock, TrueFi, BSOS, Cred Protocol, Frigg.Eco, Chelo Finance, Chee Finance, CR Square, and SPACE. Through Quadrata's passport network, users of each protocol will have access to robust identity verification services, ensuring a crucial layer of safety and security for their activities. This collaboration reinforces the commitment of Quadrata and partnered protocols to prioritize user protection and establish a trusted ecosystem within the decentralized finance space.

Players operating in the market are aggressively involved in emerging standards, protocols, and frameworks to allow interoperability and seamless integration of decentralized identity systems. Market players are also dedicated to augmenting user privacy, data security, and user-centric control over personal information. With continuous improvements in blockchain technology and growing requirements for secure digital identity solutions, competition among these players is expected to intensify as they strive to capture an important share of a growing market. Some prominent players in the global decentralized identity market include:

-

Microsoft Corporation

-

Accenture plc

-

Wipro Limited

-

SecureKey Technologies Inc.

-

Persistent Systems Limited

-

Avast Software s.r.o.

-

Civic Technologies, Inc.

-

R3

-

Validated ID, SL

-

Dragonchain

-

Nuggets

-

1Kosmos Inc.

Decentralized Identity Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.13 billion

Revenue forecast in 2030

USD 102.00 billion

Growth rate

CAGR of 90.3% from 2023 to 2030

Base year of estimation

2022

Historical data

2019 - 2021

Forecast period

2023 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Identity type, end-user, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Microsoft Corporation; Accenture plc; Wipro Limited and Subsidiaries; Secure Technologies Inc.; Persistent Systems Limited; Avast Software s.r.o.; Civic Technologies, Inc.; R3; Validated ID, SL; Dragonchain; Nuggets; 1Kosmos Inc

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decentralized Identity Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For this study, Grand View Research has segmented the global decentralized identitymarket report based on identity type, end-user, enterprise size, vertical, and region:

-

Identity Type Outlook (Revenue, USD Million, 2019 - 2030)

-

Biometrics

-

Non-biometrics

-

-

End-user Outlook (Revenue, USD Million, 2019 - 2030)

-

Individual

-

Enterprises

-

-

Enterprise Size Outlook (Revenue, USD Million, 2019 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises

-

-

Vertical Outlook (Revenue, USD Million, 2019 - 2030)

-

BFSI

-

Government

-

Healthcare & Life Sciences

-

Telecom & IT

-

Retail & E-commerce

-

Transport & Logistics

-

Real Estate

-

Media & Entertainment

-

Travel & Hospitality

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global decentralized identity market size was estimated at USD 0.65 billion in 2022 and is expected to reach USD 1.13 billion in 2023.

b. The global decentralized identity market is expected to grow at a compound annual growth rate of 90.3% from 2023 to 2030 to reach USD 102.0 billion by 2030.

b. North America dominated the decentralized identity market with a share of 31.8% in 2022. The growing preference to protect against identity thefts across North America is anticipated to propel regional market growth over the forecast period.

b. Some key players operating in the decentralized Identity market include Microsoft Corporation, Accenture plc, Wipro Limited and Subsidiaries, Secure Technologies Inc., Persistent Systems Limited, Avast Software s.r.o., Civic Technologies, Inc., R3, Validated ID, SL; Dragonchain, Nuggets, and Kosmos Inc.

b. Key factors that are driving the decentralized identity market growth include increasing thefts and fraudulent incidences and increasing applications of blockchain technology

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.