- Home

- »

- Advanced Interior Materials

- »

-

Decks Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Decks Market Size, Share & Trends Report]()

Decks Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Wood, Metal, Plastic & Composite, Concrete), By Application (Railing, Floors), By End Use (Residential, Non-residential), By Fastening Method, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-154-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Decks Market Summary

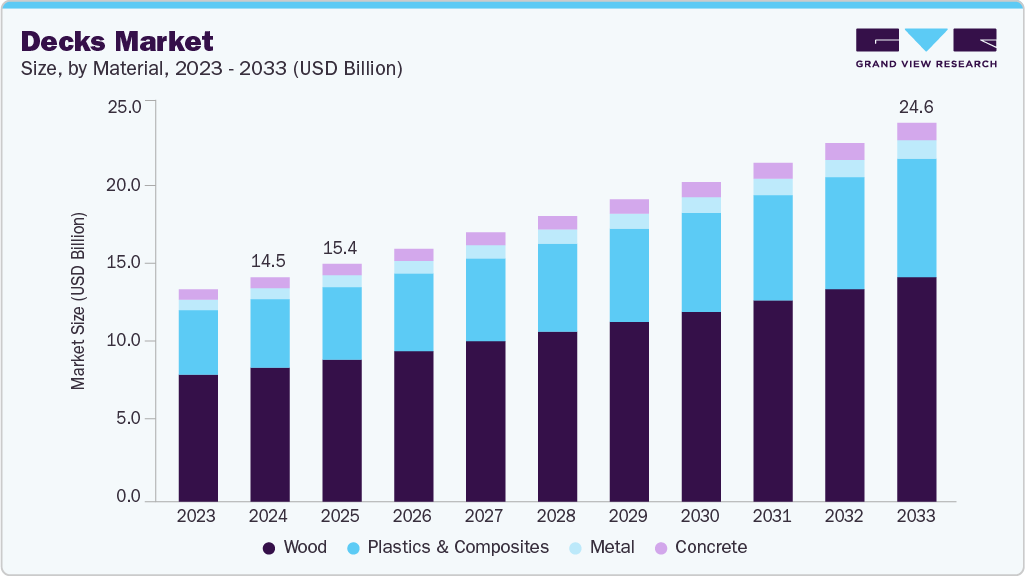

The decks market size was estimated at USD 14.54 billion in 2024 and is projected to reach USD 24.57 billion by 2033, growing at a CAGR of 6.0% from 2025 to 2033. This growth can be attributed to the increasing awareness about building aesthetics among consumers.

Key Market Trends & Insights

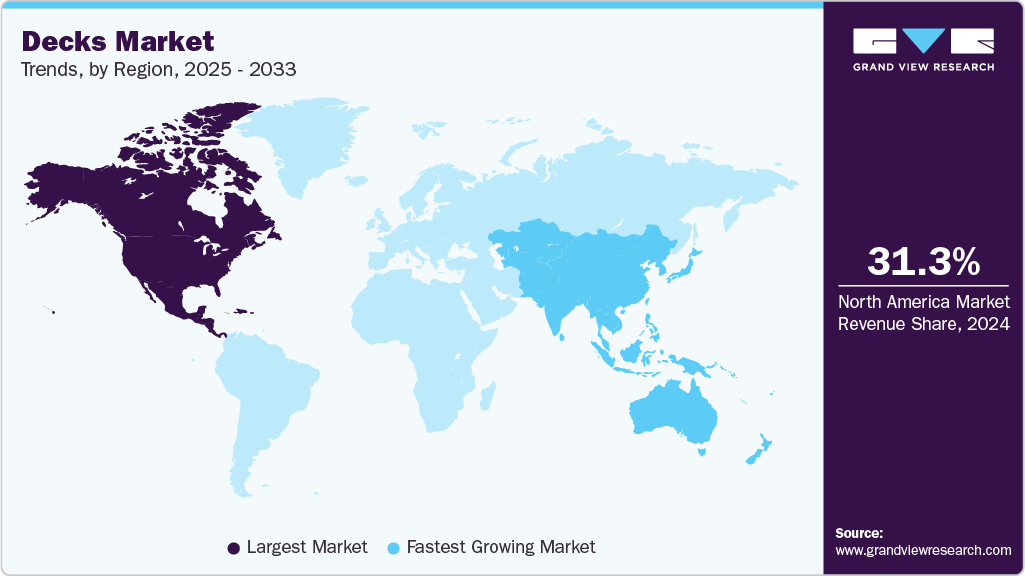

- North America dominated the market with the largest revenue share of 31.3% in 2024.

- By material, the plastics & composites segment is expected to grow at the fastest CAGR of 6.3% over the forecast period.

- By application, the floors segment is expected to grow at the fastest CAGR of 6.0% over the forecast period.

- By end use, the residential segment is expected to grow at the fastest CAGR of 6.0% over the forecast period.

- By fastening method, the deck board hidden fastening segment is expected to grow significantly at a CAGR of 5.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14.54 Billion

- 2033 Projected Market Size: USD 24.57 Billion

- CAGR (2025-2033): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest market

In addition, the growing trend of backyard remodeling and landscaping activities to spend time outdoors since the pandemic is another driving factor of the market. The growing per capita income of consumers is resulting in the growth of remodeling & refurbishment activities and lavish infrastructure. In addition, the market is also witnessing resilient repair and replacement demand owing to the growing interest of people in modifying their houses as per changing market trends. Furthermore, the rising inclination toward spending outdoor leisure time is further expected to boost market growth.

Prominent players in the market are forward-integrated as they directly cater to the requirements of different end use industries through online portals. These portals increase the profit margins for deck manufacturers by eliminating distributors from their supply chain. Online portals also provide them with an improved understanding of the changing preferences of customers, as well as offer insights regarding market evolution. This is an expected benefit for the manufacturers in understanding the consumer behavior, thereby increasing their overall profit margin.

Material Insights

Metal deck held the largest revenue share of 59.6% in 2024, due to its superior durability and structural strength. Unlike wood or composite alternatives, metal decks-particularly those made from galvanized steel or aluminum-exhibit high resistance to rot, insect damage, warping, and fire. This makes them ideal for both commercial and high-end residential applications where long-term structural performance and minimal maintenance are critical. Their ability to bear heavy loads also makes metal decks a preferred choice for multi-story buildings and industrial platforms, thereby expanding their use in urban infrastructure development.

The plastics & composites segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. These materials are resistant to rot, mold, warping, and insect infestation, which significantly reduces the need for regular staining, sealing, or repairs. Homeowners and commercial property developers seeking long-term value are drawn to the extended lifespan and consistent appearance that plastic and composite decking provide, contributing to their growing adoption in residential, hospitality, and institutional applications.

Application Insights

The floor segment held the largest revenue market share of 35.17% in 2024, driven by the growing trend of outdoor living and lifestyle enhancements, especially in residential spaces. Homeowners are increasingly investing in aesthetically pleasing and functional outdoor flooring solutions such as wood, composite, and PVC decking. These materials offer durability, slip resistance, and design versatility, making them suitable for patios, balconies, and pool surrounds. The demand is further accelerated by rising disposable incomes, urban housing developments with private outdoor spaces, and a shift toward naturalistic and low-maintenance landscaping designs.

The railings segment is expected to grow at the fastest CAGR of 6.2% over the forecast period. The growing consumer inclination toward enhancing outdoor living spaces has significantly fueled the demand for railing systems in the market. Homeowners are increasingly investing in functional and aesthetically pleasing deck structures, where railings play a crucial role in ensuring both safety and style. As decks are elevated structures, especially in residential settings, the inclusion of sturdy railings is vital to prevent falls and accidents, particularly in households with children and elderly individuals. This rising emphasis on safety regulations and building code compliance further supports the growth of the railing segment across new construction and renovation projects.

Fastening Method Insights

The deck board face fastening segment held the largest revenue share of 56.42% in 2024, driven by the enduring appeal of traditional deck aesthetics. Many homeowners and contractors favor the visible, aligned screw or nail heads along the face of decking boards for their classic, reliable look. In addition to its visual familiarity, face fastening is generally more cost-effective than hidden fastening systems, both in terms of hardware and labor. This affordability makes it especially attractive for budget-conscious residential projects and small-scale deck installations, particularly in emerging markets where cost is a primary consideration.

The deck board hidden fastening segment is expected to grow significantly at a CAGR of 5.6% over the forecast period. Hidden fastening systems eliminate the appearance of surface screws or nails, offering a seamless and polished look. This is particularly appealing in premium residential and commercial decking projects where design aesthetics are crucial. As homeowners increasingly seek modern and minimalist outdoor spaces, the demand for fastening solutions that enhance the deck’s visual appeal without compromising structural integrity is on the rise.

End Use Insights

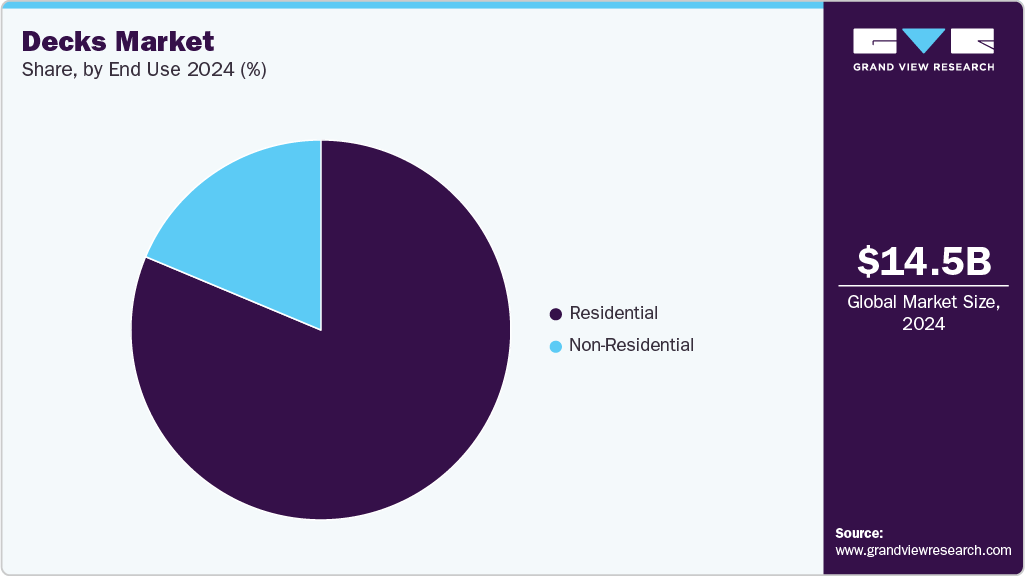

The residential end use segment held the largest revenue share of 81.31% in 2024. The demand for sustainable and low-maintenance decking materials is propelling growth in the residential sector. Consumers are increasingly aware of environmental concerns and prefer eco-friendly materials such as composite decking made from recycled content. These materials offer durability, resistance to weathering, and reduced upkeep compared to traditional wood, making them highly attractive for residential applications.

The non-residential segment is expected to grow significantly at a CAGR of 5.8% over the forecast period, driven by increasing investment in commercial infrastructure development. The construction of hotels, resorts, restaurants, and recreational spaces is growing across both developed and emerging economies, creating robust demand for aesthetically pleasing and durable outdoor decking solutions. Businesses in the hospitality sector prioritize enhanced outdoor guest experiences, and decks made from composite, wood-plastic, or tropical hardwood materials offer the visual appeal and structural reliability necessary for such applications.

Regional Insights

North America decks industry dominated the market with the largest revenue share of about 31.3% in 2024, driven by strong consumer spending on home improvement and outdoor living enhancements. Homeowners are increasingly investing in expanding usable living space through the addition of outdoor decks, driven by lifestyle trends favoring entertaining, relaxation, and backyard functionality. Additionally, the growing demand for eco-friendly composite decking materials and advanced fastening systems is shaping market dynamics in the region.

U.S. Decks Market Trends

The decks industry in the U.S. benefits from a robust housing market and a deep-rooted culture of DIY renovations and outdoor living. The presence of a large base of single-family homes with private yards creates high demand for deck installations and renovations. Furthermore, the rise in customized deck designs, including multi-level and smart decking solutions with integrated lighting and tech, is spurring innovation and market expansion.

Asia Pacific Decks Market Trends

The Asia Pacific decks industry is experiencing rapid growth due to increasing urbanization, infrastructure development, and rising middle-class incomes. As outdoor leisure becomes a greater priority in urban planning and residential projects, demand for modern decking systems in apartment complexes, hotels, and luxury homes is increasing. Additionally, the adoption of low-maintenance composite decking materials is gaining momentum, especially in countries with tropical climates.

China’s decks industry is propelled by massive residential and commercial construction activity. Urban redevelopment projects and the government’s focus on improving green spaces in cities are expanding the application of outdoor decks in parks, rooftop gardens, and recreational zones. Furthermore, the country’s growing tourism infrastructure-such as hotels, resorts, and theme parks-is also generating demand for durable and aesthetically appealing decking solutions.

Europe Decks Market Trends

Europe’s decks industry is driven by stringent building regulations promoting sustainable construction practices. Consumers in the region increasingly prefer environmentally friendly materials such as recycled wood-plastic composites. In addition, the renovation of historic homes and outdoor spaces, coupled with trends in eco-tourism and hospitality sector expansion, is accelerating demand for stylish and low-maintenance decking products across residential and commercial applications.

Germany’s decks industry is supported by a well-established construction industry and a strong emphasis on quality and sustainability. German consumers prefer premium decking materials that align with green building certifications and energy-efficient design principles. The demand for thermally modified wood and advanced fastening systems is particularly high, given the country’s focus on precision engineering and craftsmanship in residential landscaping projects.

Latin America Decks Market Trends

The decks industry in Latin America is expanding due to the growing popularity of outdoor entertainment spaces and rising disposable income among the urban middle class. Countries like Brazil and Mexico are witnessing increased demand for decks in both residential and commercial settings, especially in coastal and resort areas. The region’s tropical climate also drives the need for moisture- and insect-resistant decking materials, fueling growth in composite and PVC deck boards.

Middle East & Africa Decks Market Trends

The Middle East & Africa decks industry is gaining traction due to urban development initiatives and a surge in hospitality and luxury real estate projects. In the Gulf countries, outdoor decks are becoming integral to upscale villas, hotels, and beachfront developments. Meanwhile, in parts of Africa, donor-funded housing and infrastructure projects are incorporating decked public spaces. The emphasis on heat- and UV-resistant materials is also influencing product innovation in this region.

Key Decks Company Insights

The decks industry consists of key players such as The AZEK Company Inc., Trex Company, Inc., METSA WOOD, WEARDECK (Owens Corning), Deckorators, Inc., and MoistureShield. These players in the industry are involved in adopting various strategies such as new product development, collaboration, and expansion of the distribution network to gain a competitive advantage in the market.

Moreover, major market players are also opting for strategies such as mergers and acquisitions to expand into new markets. For instance, in January 2022, The Azek Company, Inc., acquired StruXure Outdoor, Inc., a manufacturer and designer of innovative and high-quality aluminum pergolas and cabanas. The acquisition is expected to expand the company’s position in the outdoor living category products and benefit its well-developed product portfolio.

Key Decks Companies:

The following are the leading companies in the decks market. These companies collectively hold the largest market share and dictate industry trends.

- Inovar Floor Industries Sdn Bhd.

- The AZEK Company Inc.

- Trex Company, Inc.

- METSA WOOD

- VETEDY

- Koppers Inc.

- Alfresco Floors

- Thermory

- Nexan Building Products, Inc.

- Deck West

- Cordeck Building Solutions

- Verco Decking, Inc.

- CSM Product & Solutions, LLC

- Fiberon

- Humboldt Redwood Company

- WEARDECK (Owens Corning)

- Deckorators, Inc.

- MoistureShield

Decks Market Report Scope

Attribute

Details

Market size value in 2025

USD 15.42 billion

Revenue forecast in 2033

USD 24.57 billion

Growth Rate

CAGR of 6.0% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end use, fastening method, region

Regional scope

Global

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; South Korea; Brazil; UAE

Key companies profiled

Inovar Floor Industries Sdn Bhd.; The AZEK Company Inc.; Trex Company, Inc.; METSA WOOD; VETEDY; Koppers Inc.; Alfresco Floors; Thermory; Nexan Building Products, Inc.; Deck West; Cordeck Building Solutions; Verco Decking, Inc.; CSM Product & Solutions, LLC; Fiberon; Humboldt Redwood Company; WEARDECK (Owens Corning); Deckorators, Inc.; MoistureShield

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Decks Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global decks market report based on material, application, end use, fastening method, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Metal

-

Wood

-

Plastic & Composites

-

Concrete

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Railing

-

Walls

-

Floors

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Residential

-

Non-residential

-

-

Fastening Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Deck Board Face Fastening

-

Deck Board Hidden Fastening

-

Deck Board Edge Fastening

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.