- Home

- »

- Medical Devices

- »

-

Dental Contouring Market Size, Share & Growth Report, 2030GVR Report cover

![Dental Contouring Market Size, Share & Trends Report]()

Dental Contouring Market (2022 - 2030) Size, Share & Trends Analysis Report By Instrument Type (Sanding Discs, Diamond Burs, Dental Drills), By Site, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-975-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

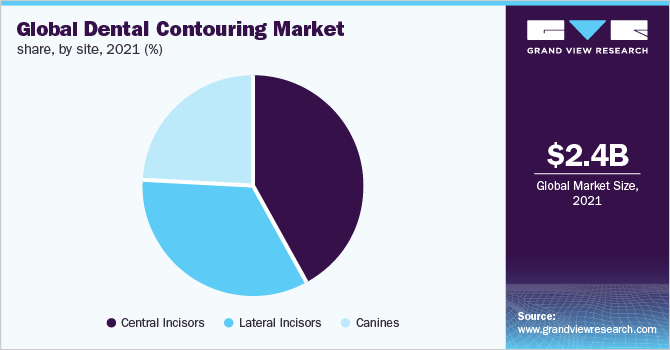

The global dental contouring market size was valued at USD 2.4 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2022 to 2030. An increase in the prevalence of dental caries, high expenditure on dental care, and a rise in out-of-pocket expenditure are some of the major factors driving the market. Increasing demand for advanced high precision cutting equipment, cost-effective treatment, and rising aesthetic consciousness is likely to support the market growth during the forecast period. The market witnessed a minor setback due to COVID-19 in the second and third quarters of 2020, particularly due to supply chain bottlenecks and the closure of dental clinics. However, after the second quarter of 2020, dental procedures started to resume leading to full market recovery by 2021.

Dental contouring is a cosmetic procedure that can correct minor or subtle imperfections on the teeth. Dental issues such as chipping or cracks in the teeth, uneven or poorly aligned teeth, issues from grinding the teeth (bruxism), imperfections that make it hard to clean between your teeth, or minor overlapping can be treated by dental contouring. However, the application of the procedure will depend upon the thickness of the enamel as teeth reshaping involves removing tiny pieces of the enamel, and if large amounts of enamel are removed, the risk of exposing the nerve increases, which leads to teeth sensitivity and pains. This factor might hinder the market growth.

A rise in the consumption of sugar and tobacco has led to an increased prevalence of tooth decay and infection in children and adults. Poor oral health leads to expensive treatments, resulting in a significant burden on the national government. As per the NCBI, dental caries are a predisposing factor for tooth fracture even after the slightest trauma.

As per the Centers for Disease Control & Prevention, more than one in four (26%) adults in the U.S. have untreated tooth decay and the number is even higher for the older population. As per the WHO, Asian countries currently have a high prevalence of dental diseases with dental caries being the most frequent dental condition. Developing Asian countries like India and China are witnessing an increase in dental diseases due to the growing consumption of sugary foods, poor tooth brushing habits, and a low level of awareness regarding dental caries. This might increase the chances of weakened teeth leading to easy chipping and fractures.

The onset of COVID-19 impacted the overall dental and oral hygiene market. Regular dental visits, appointments, and consultations ceased in many countries and key manufacturers reported supply chain and operational constraints in 2020. However, the market resumed by the end of 2020 and the revenue started to recover in 2021. According to the American Dental Association, 39% of practices in the U.S. are fully operational with the volume of patients they had before the pandemic.

Dentsply Sirona, a key market player in the dental market, reported that its technologies & equipment segment, which includes dental contouring, witnessed 6.8% growth in the fourth quarter of 2021 as compared to 2020. This indicates that the dental market is recovering from the losses caused by the pandemic.

Instrument Type Insights

The diamond burs segment held the largest revenue share of over 35.0% in 2021 and is expected to witness the highest growth during the forecast period. The adoption of the instrument depends upon the efficiency of cutting. Diamond burs have high effectiveness in safely removing and polishing the targeted teeth, which is, in turn, fueling segment growth.

As per Diatech USA, diamond burs assist in faster and smoother cutting, and are needed when a cut requires extreme precision. Diamond burs with a finer grit can create a higher polish and are therefore more appropriate for precise work instead. Diamond burs manufactured by companies like Dentsply Sirona, Neodent, and Institut Straumann are highly adopted by dentists to carry out dental contouring procedures. Diamond bur brands like Midwest from Dentsply Sirona offer multiple, evenly distributed layers for optimum concentricity and reliable cutting with lesser vibrations and high control. These factors are expected to boost the demand for diamond burs during the forecast period.

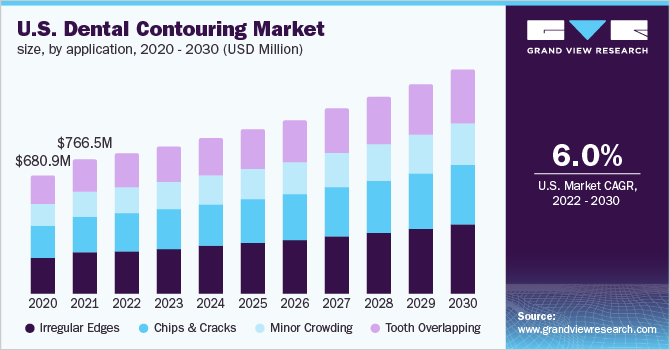

Application Insights

The irregular edges application segment held the largest revenue share of over 30.0% in 2021. As per Healthline, Jagged teeth or irregular-edged teeth in adults are usually the results of chipping related to trauma, wear and tear, and improper dental health. Often Jagged teeth might result in the tooth's nerve becoming exposed leading to sensitivity and pain. In such cases, dental contouring offers immediate relief at an inexpensive cost and also enhances the aesthetic appearance by smoothening the teeth.

Dental contouring can also treat minor teeth overlapping in just one session by cutting and reshaping the teeth giving them a smooth appearance. This is only true in the case of minor overlapping as severe overlapping treatments like braces, veneers, or aligners are recommended. Hospital facilities are well equipped with advanced devices for effective diagnosis and quality treatment of dental conditions. Moreover, many patients prefer dental hospitals to undergo surgical dental treatments as the quality of dental care and service provided to the patients is high.

Site Insights

The central incisors segment led the global market in 2021 with a revenue share of over 40.0%. The largest share of the central incisors segment can be attributed to the fact that the majority of dental cracks, chips, and fractures occur on this site as this is the most exposed area (usually the most visible teeth) and is the most prominent teeth in the human mouth. Any defect in the central or lateral incisors such as crooked teeth or a misaligned jaw can impact the bite. Minor crooked incisors and mild malocclusion can be addressed through orthodontics in severe cases, or with dental contouring in less severe cases.

As per the NCBI, maxillary (central) incisors are the most frequently injured teeth. The NCBI also reported that most traumatic dental injuries involved maxillary teeth (92.4%). Maxillary central incisors were the most commonly involved (83.8%), followed by maxillary lateral incisors (8.3%), mandibular central incisors (5.3%), mandibular lateral incisors (2.3%), and maxillary canine (0.2%). This implies that dental reshaping of central incisors is carried out most frequently.

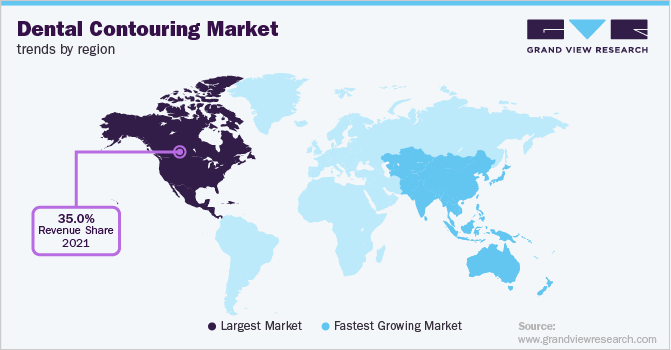

Regional Insights

North America emerged as the largest regional market in 2021 with a revenue share of more than 35.0% and is estimated to retain the leading position throughout the forecast period. As per a Journal of the American Dental Association (JADA), 13-39% of all dental injuries are sports-related in the U.S. A study conducted in December 2020 by the U.S. CDC also states that one in four adults have untreated dental problems, and 46% of adults aged over 30 years have signs of gum disease; the prevalence of dental caries was 13%. As dental contouring assists in removing the decayed enamel layer and polishing it to give a finer aesthetic look, the demand for the treatment is expected to increase in the region.

Asia Pacific is anticipated to be the fastest-growing regional market with a CAGR of 6.4% during the forecast period. This growth can be credited to the rising number of dental care centers, growing dental tourism, and increasing R&D activities in this field. The growing adoption of new technologies and increasing awareness regarding dental care among people are expected to be the factors aiding growth. Factors like the availability of highly skilled professionals, adoption of advanced technology, rise in healthcare expenditure, and low-cost treatments are expected to drive the regional market.

Key Companies & Market Share Insights

Major industry players are undertaking various strategies to strengthen their market presence. New product launches, mergers, acquisitions, partnerships, and geographical expansions are some of the key strategies adopted by market players. For instance, in May 2019, Microcopy Dental added six pediatric diamond burs to its NeoDiamond line. The burs are designed to offer a precise, minimally invasive cut, which will assist greatly in dental contouring procedures for effective aesthetic results. Some prominent players in the global dental contouring market include:

-

Mount Sinai Family Dental

-

Mayo Clinic Dentistry

-

Newton Dental Group

-

Cleveland Clinic

-

All Smiles Dental

-

Highfield Dental & Facial Clinic

-

Elleven Dental

Dental Contouring Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 2.49 billion

Revenue forecast in 2030

USD 3.86 billion

Growth rate

CAGR of 5.7% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Instrument type, site, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; Japan; India; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Mount Sinai Family Dental; Mayo Clinic Dentistry; Newton Dental Group; Cleveland Clinic; All Smiles Dental; Highfield Dental & Facial Clinic; Elleven Dental

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Contouring Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global dental contouring market report on the basis of instrument type, site, application, and region:

-

Instrument Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Sanding Discs

-

Diamond Burs

-

Dental Drills

-

-

Site Outlook (Revenue, USD Million, 2018 - 2030)

-

Central Incisors

-

Lateral Incisors

-

Canines

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Irregular Edges

-

Chips and Cracks

-

Minor Crowding

-

Tooth Overlapping

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global dental contouring market size was estimated at USD 2.4 billion in 2021 and is expected to reach USD 2.4 billion in 2022.

b. The global dental contouring market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 3.8 billion by 2030

b. The dental burs segment is projected to dominate the market throughout the forecast period as it enables faster and more precision cutting and shaping of the teeth

b. Some key players operating in the dental contouring market Mount Sinai Family Dental, Mayo Clinic Dentistry, Newton Dental Group, Cleveland Clinic, All Smiles Dental, Highfield Dental & Facial Clinic, Elleven Dental, Etc

b. An increase in the prevalence of dental caries, high expenditure on dental care, and a rise in out-of-pocket expenditure are some of the major factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.