- Home

- »

- Medical Devices

- »

-

Dental Equipment Market Size, Share & Trends Report, 2030GVR Report cover

![Dental Equipment Market Size, Share & Trends Report]()

Dental Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Dental Radiology Equipment, Laboratory Machines, Dental Lasers, Systems & Parts, Hygiene Maintenance Devices, Other Equipment), By Region, And Segment Forecasts

- Report ID: 978-1-68038-097-2

- Number of Report Pages: 137

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Equipment Market Summary

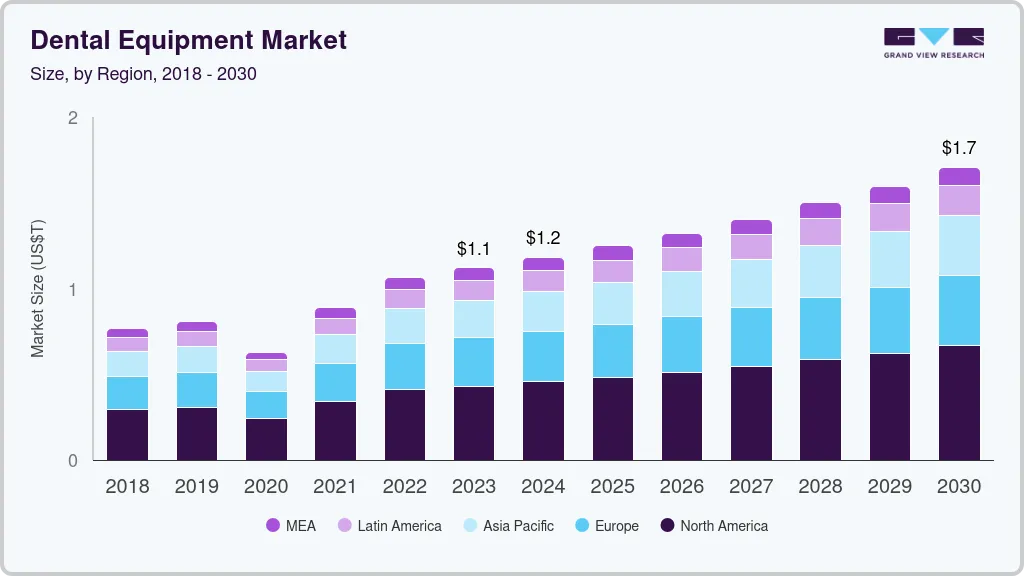

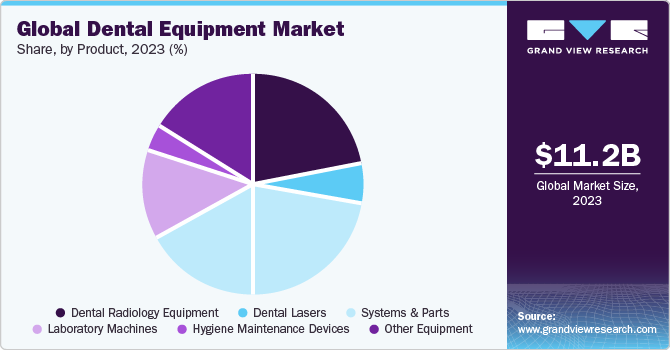

The global dental equipment market size was estimated at USD 11.2 billion in 2023 and is projected to reach USD 17.06 billion by 2030, growing at a CAGR of 6.3% from 2024 to 2030.Dental equipment includes a set of tools used to examine, manipulate, treat, and restore any oral disorders.

Key Market Trends & Insights

- North America dominated the global dental industry in 2023 with a market share of more than 38.4%.

- The APAC region is anticipated to witness the fastest CAGR of 7.1% over the forecast period.

- By product, the dental systems and parts segment held the largest revenue share of 39.6% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 11.2 Billion

- 2030 Projected Market Size: USD 17.06 Billion

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

Factors such as the increasing geriatric population that is suffering from oral diseases, evolving medical tourism concerning dental treatment, and the launch of multiple government initiatives for public oral health care are expected to drive industry expansion. Moreover, the introduction of advanced and efficient dental products by major companies is also fueling market growth.

Companies like DENTSPLY Sirona, Planmeca Oy, and Danaher Corp., are introducing advanced computer-aided imaging technology that will allow professionals to prepare a precise course of dental treatment. However, the COVID-19 pandemic has hugely affected the overall dental and oral hygiene industry. Routine dental care was largely unavailable during the pandemic, as many dental practices were forced to close as they were deemed elective procedures. The continuous operation and long-term survival of many dental practices are also threatened by the economic and social challenges arising due to care restrictions, practice closures, and shortages of personal protective equipment (PPE), as well as the need to invest in new types of PPE and technology.

While many practices and clinics worldwide re-opened in 2021, the market recovered soon, as there were numerous concerns about the availability of dental services and ensuring the safety of dentists and dental teams. A review article published by The Journal of Contemporary Dental Practice stated that COVID-19 is expected to be a watershed moment in the field of dentistry. While the industry expected to see positive changes in the safe delivery of dental care, an increase in the cost of availing care is imminent. According to the FDI World Dental Federation, oral diseases impact 3.9 billion people worldwide, with untreated tooth decay (dental caries) impacting more than half of the global population (44%), making it the most prevalent of all the 291 conditions included in the Global Burden of Disease Study.

The most frequently performed dental procedures during these visits include dental fillings, bonding, root canals, dental crowns, dental bridges, periodontal treatments, and oral & maxillofacial procedures. These showcase the existing potential dental procedures globally. Dental disorders such as periodontal disease, oral cancers, and environmental injuries resulting in oro-dental trauma are expected to further assist the overall market growth.

Furthermore, high consumption of tobacco & alcohol, unhealthy diet, and high intake of sugar are the leading causes of dental caries, which is the most common type of chronic disease prevalent globally. The rising geriatric population and their demand for dental services have also seen a surge. According to the World Population Prospects, by 2050, 1 in 6 people in the world will be over the age of 65 globally, up from 1 in 11 in 2019, providing a population pool of about 1.5 billion people above the age of 65 years by 2050.

Market Dynamics

Teeth possess limited self-regeneration capability, necessitating reliance on dental materials for oral health improvement. According to the NCBI article published in June 2023, enamel lacks self-regenerative capacity, and dentin's ability is constrained by dental pulp stem cells. Dental materials are crucial in modifying, preventing, diagnosing, and alleviating oral and dental conditions. Resin composites, for instance, restore tooth function after tissue damage by pathogens. In addition, superparamagnetic iron oxide (SPIO)/colloidal gold nanoparticles serve as a theranostic agent for dental pulp capping, displaying enhanced magnetic resonance imaging and dentin regeneration capabilities. Despite advancements, the prevalence of major oral diseases, such as dental caries affecting 92% of US adults, remains high. This ongoing oral health challenge sustains the importance of dental materials, indirectly contributing to the demand for innovative dental equipment in the market.

According to the NCBI article published in September 2023, 13% of adults seek dental care for infections or toothaches within a four-year period. Alarmingly, 1 in 2600 individuals in the United States are hospitalized due to dental infections. The prevalence of untreated dental caries is noteworthy, affecting more than 20% of the population. At the same time, a significant three-quarters of individuals have undergone at least one dental restoration in their lifetime. Periodontal disease, impacting an estimated 35% of Americans aged 30 to 90, further emphasizes the widespread need for advanced dental technologies and equipment. These figures position the dental equipment industry as a crucial factor in addressing and capitalizing on the continuous demand for improved oral health solutions.

Product Insights

The dental systems and parts segment held the largest revenue share of 39.6% in 2023 and is projected to grow at a significant CAGR of 7.5% over the forecast period. The global industry is segmented into dental radiology equipment, dental lasers, dental systems & parts, laboratory machines, and hygiene maintenance devices. The dental systems & parts segment is sub-segmented into instrument delivery systems, vacuums & compressors, cone beam CT systems, cast machines, furnaces and ovens, electrosurgical equipment, other systems and parts, CAD/CAM. These devices are quintessential tools required to perform any dental procedures.

The performance and functionality of these systems and parts are key factors for a successful dental treatment. The major driver for this segment is the technological advancement and rigorous R&D activities undertaken by key players to provide practitioner-friendly and highly efficient equipment to provide smooth procedures.

The dental lasers segment is anticipated to register the fastest CAGR of 8.8% over the forecast period due to the fact that it is being rapidly used in surgical and teeth whitening procedures. Dental lasers are also used for reshaping gum tissues and removing inflamed tissues. The other benefit of using dental lasers is controlled blood loss during the procedures, thus lessening the need for sutures. The dental laser segment is further sub-segmented into diode lasers, carbon dioxide lasers, and yttrium aluminum garnet lasers. Favorable technological adoption, satisfactory reimbursement scenario, increasing geriatric population, and growing awareness about oral care are the key factors assisting the market growth.

Regional Insights

North America dominated the global dental industry in 2023 with a market share of more than 38.4% and it is anticipated to register a significant CAGR of 6.5% over the forecast period. This is attributed to the rising geriatric population, strong medical infrastructure, well-established reimbursement policies, the existence of key players, and advancement in preventive and restorative dental treatments. Moreover, according to the American Dental Association, 85% of individuals in the United States truly value dental health and consider oral health an essential aspect of overall care. The combination of all these factors will make North America the most promising regional market over the forecast period.

The APAC region is anticipated to witness the fastest CAGR of 7.1% over the forecast period. China, Japan, and India are emerging economies with well-developed healthcare infrastructure & facilities and they are now more focused on leading the basis of R&D activities. They have suitable infrastructure and funding for the same. A total of 43.6% of the spending is expected to emanate from Asia with countries like China, Japan, and India being the topmost to spend on R&D activities.

Attributes like favorable government policies, a rising geriatric population, the presence of key players, and a rise in the demand for dental procedures are paving the way for the market in the Asia Pacific region. Moreover, medical tourism in the region is rapidly increasing due to shorter patient waiting times, low-cost treatment, availability of a large pool of skilled dental practitioners & high-end technology, and the presence of tourist destinations & quality accommodations. These aforementioned factors will assist in the market growth in the region.

Key Companies & Market Share Insights

The global industry is highly competitive. One of the key factors driving competitiveness among industry players is the rapid adoption of advanced technology like computer-aided scanners for precise imaging and diagnosis of dental disorders. Moreover, a prominent number of companies are opting for geographical expansions, strategic collaborations, and partnerships through mergers & acquisitions in emerging and economically favorable regions.

In June 2023, A-dec launched its digitally connected dental chair and transport system, marking a significant leap in dental technology. The A-dec 300 Pro and A-dec 500 Pro delivery systems are now accessible in the North American markets.

In March 2023, Planmeca revolutionized the dental industry with its fully integrated digital workflow solutions, spanning dental units, imaging devices, CAD/CAM, and software. At IDS 2023, the company is unveiling new products across these categories, enhancing its advanced digital dental equipment portfolio. The highlight is the Planmeca Pro50 dental care unit, a technological masterpiece with adaptability, sophisticated features, and exceptional ergonomics.

Key Dental Equipment Companies:

- A-Dec Inc.

- Planmeca Oy

- Dentsply Sirona

- Patterson Companies Inc.

- Straumann

- GC Corp.

- Carestream Health Inc.

- Biolase Inc.

- Danaher Corp.

- 3M ESPE

Dental Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.81 billion

Revenue forecast in 2030

USD 17.06 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Brazil; Mexico; Argentina; China; India; Japan; Australia; South Korea; Thailand; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

A-Dec Inc.; Planmeca Oy; Dentsply Sirona; Patterson Companies Inc.;Straumann; GC Corp.; Carestream Health Inc.; Biolase Inc.; Danaher Corp.; 3M EPSE

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental equipment market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dental Radiology Equipment

-

Intra-Oral

-

Digital X-ray Units

-

Digital Sensors

-

-

Extra-Oral

-

Digital Units

-

Analog Units

-

-

Dental Lasers

-

Diode Lasers

-

Quantum well lasers

-

Distributed feedback lasers

-

Vertical cavity surface emitting lasers

-

Heterostructure lasers

-

Quantum cascade lasers

-

Separate confinement heterostructure lasers

-

Vertical external cavity surface emitting lasers

-

-

Carbon Dioxide Lasers

-

Yttrium Aluminium Garnet Lasers

-

-

Systems & Parts

-

Instrument Delivery systems

-

Vacuums & Compressors

-

Cone Beam CT Systems

-

Cast Machine

-

Furnace and Ovens

-

Electrosurgical Equipment

-

Other System and Parts

-

CAD/CAM

-

-

Laboratory Machines

-

Ceramic Furnaces

-

Hydraulic Press

-

Electronic Waxer

-

Suction Unit

-

Micro Motor

-

-

Hygiene Maintenance Devices

-

Sterilizers

-

Air Purification & Filters

-

Hypodermic Needle Incinerator

-

-

Other Equipment

-

Chairs

-

Hand Piece

-

Light Cure

-

Scaling Unit

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental equipment market size was estimated at USD 11.2 billion in 2023 and is expected to reach USD 11.81 billion in 2024.

b. The global dental equipment market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 17.06 billion by 2030.

b. North America led with the highest dental equipment market share of 38.4% in 2023. The key contributors include technological advancements, rising demand for cosmetic surgeries, and growing geriatric population, and a number of dentists and dental clinics.

b. Few significant dental equipment market players include Denstply International Inc.; A-Dec Inc.; Planmeca Oy; Sirona Dental Systems Inc.; Patterson Companies Inc.; Straumann; GC Corporation; Carestream Health Inc.; Biolase Inc.; Danaher Corporation; and 3M.

b. The growth can be attributed to key factors such as rising demand for dental procedures, the prevalence of dental disorders, and the rise in medical tourism activities pertaining to these procedures. Furthermore, the rising geriatric population and demand for preventive, restorative, and surgical services for dental care are likely to boost the growth.

b. The dental system and parts product segment accounted for the largest revenue share of 39.6% in the dental equipment market in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.