- Home

- »

- Medical Devices

- »

-

Dental Sterilization Market Size, Share, Industry Report 2030GVR Report cover

![Dental Sterilization Market Size, Share & Trends Report]()

Dental Sterilization Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Instruments, Consumables and Accessories), By End Use (Hospitals, Dental Clinics, Dental Laboratories), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-597-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Dental Sterilization Market Size & Trends

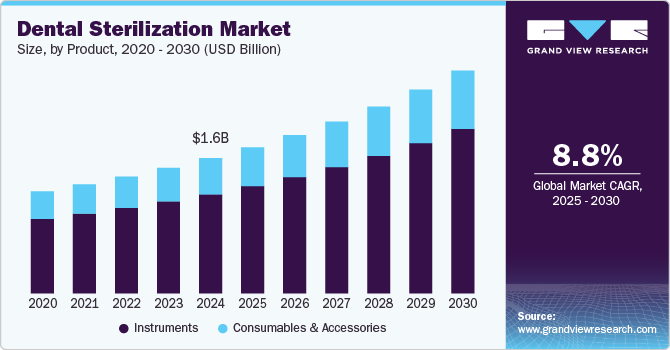

The global dental sterilization market size was estimated at USD 1.63 billion in 2024 and is projected to grow at a CAGR of 8.8% from 2025 to 2030. Growing awareness of the necessity of infection control in dental settings is a key factor for the market growth. Dental practitioners and patients are becoming more and more concerned about the lack of sterility of the instruments, which is likely to cause the spread of infections. Moreover, the rising trend in the number of dental procedures across the world, such as check-ups, surgeries, and cosmetic dentistry, has led to the increasing demand for dental sterilization products.

The rising awareness of infection control standards in dental practices is a major driver for the dental sterilization industry. As patients and healthcare providers emphasize hygiene and safety, the demand for advanced sterilization equipment to eliminate cross-contamination risks is growing significantly. This trend is further supported by stringent regulatory guidelines mandating sterilization practices in clinics.

Continuous innovation in sterilization technologies is propelling market growth. Modern systems, such as automated washer disinfectors and low-temperature sterilizers, offer enhanced efficiency, ease of use, and compatibility with a wide range of dental instruments. These advancements cater to the evolving needs of dental practitioners, ensuring optimal infection control and patient safety. In July 2024, Flight Dental Systems introduced the Flight Clave45+ Steam Sterilizer, designed for efficient and intuitive sterilization in dental settings. Its durable stainless-steel chamber has a capacity of 45 liters, making it suitable for larger instrument loads. The sterilizer features an LCD interface for easy cycle selection and programmable settings to meet various sterilization needs.

The global increase in the number of dental clinics, particularly in emerging economies, is boosting the adoption of sterilization solutions. Growing awareness of oral health, supported by government initiatives and private investments, has led to the expansion of dental facilities. As a result, the demand for reliable and cost-effective sterilization systems to meet hygiene standards continues to rise.In November 2024, as reported in Dental statistics, England recorded 34 million dental treatments in the 2023-2024 period, marking a 4.3% rise compared to 2022-2023. Over the two years leading up to March 2024, 18 million adult patients received care, with total dental activity units increasing by 3.4% to reach 73 million.

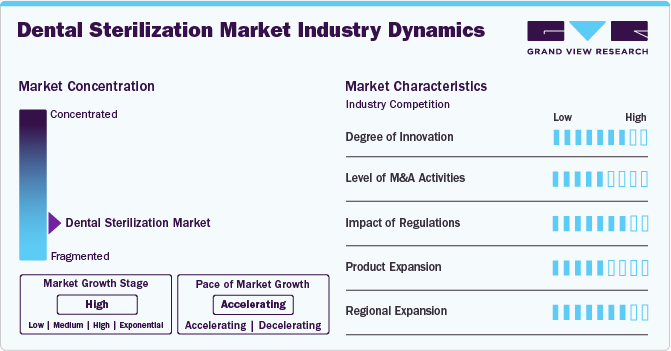

Market Concentration & Characteristics

The degree of innovation in the dental sterilization industry is high as companies focus on advanced technologies to enhance efficiency, safety, and ease of use. Innovations include automated sterilization systems, portable sterilizers, and devices integrating real-time monitoring. These advancements are driven by the need to meet evolving infection control standards and rising patient expectations. The integration of AI and IoT is further transforming the market by enabling predictive maintenance and operational automation.

The level of M&A activities in the dental sterilization industry is moderate as companies seek to expand their product portfolios, geographic presence, and technological capabilities. Acquisitions often target companies with niche expertise in sterilization, allowing market leaders to stay competitive while addressing emerging customer needs. Collaborative partnerships are also being leveraged to enhance R&D efforts and accelerate innovation in sterilization solutions.

The impact of regulation in the dental sterilization industry is high, with stringent guidelines on infection control and device safety. Compliance with international norms such as FDA, CE, and ISO certifications adds to the operational complexity and cost for manufacturers, impacting product development timelines and market entry. Manufacturers also face increasing scrutiny to ensure environmental compliance in sterilization processes. This has spurred the adoption of eco-friendly sterilization methods and sustainable materials.

Product expansion in the dental sterilization industry is moderate, with companies introducing new sterilization devices tailored to specific needs, such as compact models for small clinics and advanced systems for larger practices. Expanded service offerings, including technical support and training programs, enhance customer retention and strengthen brand loyalty. Digital platforms are also being deployed to enable seamless service delivery and improve customer engagement.

Regional expansion in the dental sterilization industry is high. Investments in infrastructure, training, and localized manufacturing drive market penetration in Asia-Pacific, Latin America, and parts of the Middle East and Africa, highlighting the importance of global outreach. The adoption of region-specific strategies helps address diverse regulatory requirements and cultural preferences.

Product Insights

The instruments segment led the market with the largest revenue share of 73.3% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030, fueled bythe increasing prevalence of dental diseases and disorders worldwide. As a result, there is an increased need for effective sterilization of dental instruments to prevent infections and ensure patient safety. High demand for advanced sterilization equipment such as autoclaves, ultrasonic cleaners, and sterilization pouches is driving the market. In November 2024, W&H Group displayed its latest innovations, featuring the Lexa Mini Class B rapid sterilizer and Synea Power Edition handpieces, at the 100th Annual Greater New York Dental Meeting. This event was held in December 2024 at the Jacob K. Javits Convention Center in New York City.

The consumables and accessories segment is expected to grow at the fastest CAGR of 8.5% from 2024 to 2030. This segment includes items such as sterilization packaging accessories, sterilization indicators, surface disinfectants, and cleaning solutions. The increasing awareness about infection control practices and the emphasis on maintaining strict sterilization protocols in dental settings are driving the demand for these consumables and accessories. In May 2024, the CDC emphasized infection control guidelines in dental settings, focusing on sterilization and instrument cleaning. It highlighted the importance of following updated protocols to reduce infection risks ensuring compliance with sterilization monitoring processes. The guidelines aimed to reinforce safe practices across dental practices.

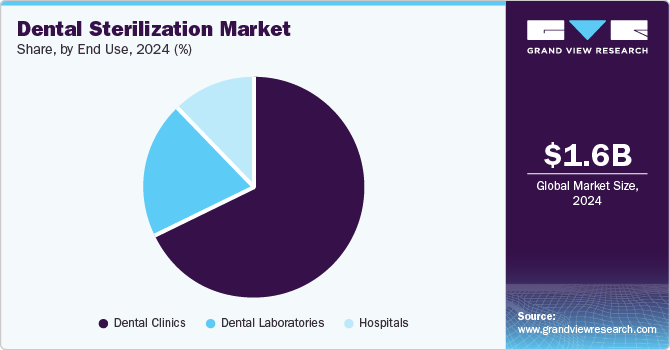

End Use Insights

Based on end use, the dental clinics segment led the market with the largest revenue share of 67.9% in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Dental clinics are staffed with trained professionals who understand the importance of proper sterilization procedures, ensuring that equipment is effectively cleaned and maintained. In addition, dental clinics are required to adhere to the strict sterilization protocols mandated by regulatory authorities to ensure patient safety. The continuous advancement in dental sterilization technologies has made it more efficient, convenient, and effective for dental clinics to maintain sterile environments, thus driving their dominance in the market.

The hospitals segment is projected to experience at a significant CAGR of 8.2% during the forecast period. Growth is anticipated owing to factors such as rising dental processes, strict rules and regulations, emphasis on patient safety, introduction of new technologies, infrastructure with professionals, high-end equipment, and quality assurance within the hospital environment. The increasing trend towards performing dental procedures in hospitals worldwide is a key trend that will further fuel the dental sterilization opportunity in this segment.

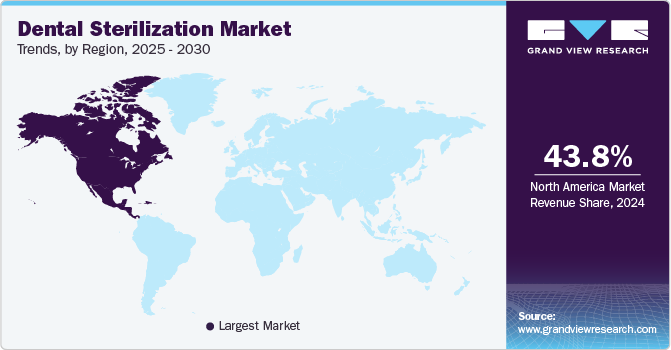

Regional Insights

North America dominated the dental sterilization market with the largest revenue share of 43.8% in 2024, driven by advanced healthcare infrastructure, high adoption of cutting-edge technologies, and stringent infection control protocols. The region benefits from robust government initiatives and funding for dental care, with a significant contribution from private dental practices emphasizing patient safety. In November 2024, W&H launched the Lexa Mini, a Class B rapid sterilizer designed for the US and Canadian markets. This innovative device prioritizes reliability, efficiency, and safety, making it a versatile addition to dental practices. It can rapidly sterilize handpieces and serve as an emergency backup for tabletop sterilizers.

U.S. Dental Sterilization Market Trends

The dental sterilization market in the U.S. held a significant share of North America in 2024, due to a high concentration of dental clinics and a strong emphasis on compliance with regulatory standards. Innovations in sterilization devices, coupled with the widespread adoption of digital technologies, further bolster market growth in the country. In November 2024, an inventor from Dallas developed a Protective Sterilization System for dental offices to protect ultrasonic inserts during cleaning. This patented invention submitted to InventHelp features a cassette for individual tool sterilization, enhancing infection control and safety.

Europe Dental Sterilization Market Trends

The dental sterilization market in Europe is experiencing significant growth, driven by growing awareness of infection control and a strong focus on sustainability. Key players are investing in eco-friendly sterilization technologies to comply with the region's stringent environmental regulations, creating opportunities for growth. In January 2024, an article published in Medicina Oral, Patología Oral y Cirugía Bucal discussed indoor air quality concerns in dental clinics due to aerosols. Using an OH˙ radical generator, surface samples showed a 76.9% reduction in colony-forming units, and air samples also decreased significantly. The study concluded that this technology effectively reduces molds, yeasts, and bacteria.

The UK dental sterilization market is witnessing notable growth due to advancements in portable and compact sterilization systems tailored to small dental clinics. The increasing popularity of home dental care kits is also influencing demand for smaller, cost-effective sterilization solutions. In May 2024, an article published in Dentistry UK addressed the Department of Health's guidelines mandating dental practices to appoint a lead staff member for infection control and decontamination. The article emphasized the need to assess patient contact, hand contact frequency, and contamination risks to ensure a sterile environment for patients and staff.

The dental sterilization market in Germany is experiencing significant growth, driven by its strong industrial base, fostering innovation in sterilization technologies. High dental insurance coverage and a culture of preventive healthcare drive the consistent demand for advanced infection control systems. In August 2023, KUKA published an article highlighting the use of its robotic system in an Italian dental practice for sterilizing instruments. Developed in Germany, the technology automates processes like decontamination, disinfection, and packaging, enhancing efficiency and reducing manual tasks. This innovation showcases the potential of robotics in streamlining dental workflows.

Asia Pacific Dental Sterilization Market Trends

The dental sterilization market in Asia Pacific is growing rapidly, driven by rapid urbanization and increasing investments in healthcare infrastructure. Public health campaigns and rising awareness about oral hygiene are accelerating the adoption of sterilization systems in emerging economies. A study published in January 2024 in the Journal of Oral Science evaluated the effectiveness of various antiseptics for disinfecting rubber dams used in endodontic treatments. Results showed that one antiseptic completely eradicated E. faecalis and C. albicans and remained effective for 120 minutes, while a common two-step disinfection protocol used in Thai dental schools was found to be inadequate and needs revision.

The China dental sterilization market is growing, with the booming dental care sector, supported by a rising middle-class population and local manufacturing capabilities. Government initiatives to improve rural healthcare access are expanding the reach of sterilization technologies. In July 2024, Shanghai JPS Medical Co., Ltd introduced the JP-STE-18L/23 autoclave, a cutting-edge dental sterilization solution. This advanced autoclave was engineered to meet top dental hygiene standards, providing reliable sterilization for a wide array of dental instruments and ensuring a safe, sterile clinical environment.

The dental sterilization market in Japan is experiencing growth driven by its aging population and high demand for premium dental care services. The adoption of automated and energy-efficient sterilization systems is growing as clinics strive to enhance efficiency and reduce operational costs. In February 2022, a study in Process Biochemistry reported on a radical vapor reactor (RVR) that effectively sterilizes dental instruments. Generating reactive oxygen species offers a fast and cost-efficient sterilization method while being more environmentally sustainable than traditional approaches.

Latin America Dental Sterilization Market Trends

The dental sterilization market in Latin America is expanding due to increasing government healthcare expenditure and a growing private sector. Rising demand for mobile and easy-to-maintain sterilization devices is particularly strong in rural and underserved areas. In a study conducted by the Journal of Materials Science in July 2024, Materials in Medicine assessed the effects of sterilization methods on dental implant surfaces. It found that while surface morphology remained unchanged, autoclaving negatively impacted hydrophilic surfaces, which were also sensitive to air exposure. The study highlighted the need for careful selection of sterilization methods to prevent inaccurate results.

The Brazil dental sterilization market is growing as a robust dental industry and extensive training programs for dental professionals. The country’s focus on improving healthcare access in urban and semi-urban areas drives demand for advanced sterilization solutions. A November 2024 article in Scientific Reports found that many Brazilian dentist surgeons prescribe antibiotics for all surgical procedures, often without a solid scientific basis. The study highlights the need for better education among these professionals to combat antibiotic resistance.

Middle East & Africa Dental Sterilization Market Trends

The dentalsterilization market in the Middle East & Africa is expanding as governments invest in modernizing healthcare facilities and infection control measures. Growth is particularly strong in dental clinics catering to medical tourists in the region. In September 2022, The Journal of Contemporary Dental Practice emphasized the crucial role of infection control in prosthodontics to prevent transmission of infectious microorganisms. It highlighted the need for sterilization of reusable instruments and disinfection of non-sterilizable items, advocating for strict infection prevention measures in dental settings.

The Saudi Arabia dental sterilization market is expanding with substantial investments in healthcare infrastructure as part of Vision 2030. The country’s focus on adopting international infection control standards in private and public dental clinics drives demand for high-quality sterilization systems. In March 2024, BMC Medical Education published a study on dental health professionals in Saudi Arabia, assessing their knowledge and practices regarding dental impression disinfection in clinics. The results showed average knowledge and attitudes, but good adherence to disinfection practices, highlighting the need for continued education to improve patient safety and infection control.

Key Dental Sterilization Company Insights

The competitive scenario in the market is high, with key players holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers. These companies collectively hold the largest market share and dictate industry trends.

Key Dental Sterilization Companies:

The following are the leading companies in the dental sterilization market. These companies collectively hold the largest market share and dictate industry trends.

- Hu-Friedy Mfg. Co., LLC.

- Dentsply Sirona

- Midmark Corporation

- MATACHANA

- W&H Dentalwerk

- Nakanishi inc.

- SciCan Ltd.

- Getinge

- Tuttnauer U.S.A. Co., Ltd.

Recent Developments

-

In September 2024, the Association for Dental Safety, formerly OSAP, introduced Dental Infection Control Awareness Month with the theme Embracing a Culture of Safety Empowering Patients and Dental Teams. The initiative emphasized weekly topics such as hand hygiene, dental unit waterlines, instrument reprocessing, and personal protective equipment, accompanied by a toolkit designed for dental professionals.

-

In July 2024, Midmark Corporation launched its next generation M9 and M11 Steam Sterilizers, focusing on enhanced durability and user-friendliness for dental teams. These sterilizers streamline instrument processing and compliance, featuring tools that improve workflow efficiency and reduce training time for new staff, thereby promoting safe and effective patient care.

-

In February 2024, W&H proudly became a Super Sponsor for the Organization for Safety, Asepsis and Prevention (OSAP). This partnership reinforces their commitment to enhancing safety and hygiene in dental practices, aligning with their ongoing efforts to educate the community about effective infection prevention.

Dental Sterilization Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.76 billion

Revenue forecast in 2030

USD 2.69 billion

Growth rate

CAGR of 8.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Hu-Friedy Mfg. Co., LLC.; Dentsply Sirona; Midmark Corporation; MATACHANA; W&H Dentalwerk; Nakanishi inc.; SciCan Ltd.; Getinge and Tuttnauer U.S.A. Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Dental Sterilization Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global dental sterilization market report based on the product, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Sterilization Equipment

-

High-temperature Sterilizers

-

Low- temperature Sterilizers

-

-

Cleaning and Disinfectant Equipment

-

Washer Disinfectants

-

Ultrasonic Cleaners

-

-

Packaging Equipment

-

-

Consumables and Accessories

-

Sterilization Packaging Accessories

-

Instrument Disinfectants

-

Surface Disinfectants

-

Sterilization Indicators

-

Lubrication and Cleaning Solutions

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Dental Clinics

-

Dental Laboratories

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global dental sterilization market size was estimated at USD 1.63 billion in 2024 and is expected to reach USD 1.76 billion in 2025.

b. The global dental sterilization market is expected to grow at a compound annual growth rate of 8.8% from 2025 to 2030 to reach USD 2.69 billion by 2030.

b. North America dominated the dental sterilization market with a share of 43.8% in 2024. This is attributable to the availability of advanced medical facilities, high awareness among individuals related to dental healthcare, and rising disposable income coupled with supportive reimbursements for several dental procedures.

b. Some of the key companies operating in this industry are Hu-Friedy, Dentsply Sirona, Midmark, Matachana Group, W & H, Getinge, Nakanishi, Crosstex and Scican.

b. Key factors that are driving the market growth include the increasing prevalence of dental conditions and the widening base of dental care personnel.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.