- Home

- »

- Medical Devices

- »

-

Diabetic Foot Ulcer Treatment Market Size Report, 2030GVR Report cover

![Diabetic Foot Ulcer Treatment Market Size, Share & Trends Report]()

Diabetic Foot Ulcer Treatment Market Size, Share & Trends Analysis Report By Treatment (Biologics, Therapy Devices), By Ulcer Type (Ischemic, Neuropathic), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-742-1

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Diabetic Foot Ulcer Treatment Market Trends

The global diabetic foot ulcer treatment market size was estimated at USD 5.18 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030. Diabetes is one of the most common health conditions across the globe. It affected nearly 537 million adults in 2021 and is predicted to rise to 643 million by 2030 and 783 million by 2045, as per the International Diabetes Federation. In Europe, in 2019, nearly 19.3 million people aged 60-79 years, 11.3 million aged 40-59 years, and 1.7 million aged 20-39 years suffered from diabetes. Germany accounted for the largest share of ~10.5% of the diabetic population in Europe, followed by Portugal (~9.5%) and Cyprus (~9.0%).

Studies suggest that ~15% of the diabetic population across the globe develops foot ulcers and ~6% need hospitalization. In the U.S., nearly 14% to 24% of the diabetic population with foot ulcers undergo foot amputation. About 60% of diabetes leads to neuropathy, causing foot ulcers. Hence, it is also the leading cause of non-traumatic lower extremity amputations in the U.S. Prevalence rate of diabetes in Asia is ~5.5%. An increased risk of obesity, chronic diabetic conditions, peripheral artery diseases, poor glycemic control, underlying neuropathy, or poor foot care are expected to increase the risk of DFU, eventually decreasing mobility and leading to amputation of lower extremities.

Factors, such as increasing obesity and physical inactivity, are said to influence the rise in diabetic population. Poorly managed diabetes leads to blindness, kidney failure, cardiac arrest, liver failure, and limb amputation due to untreated foot ulcers. The global prevalence rate of foot ulcers in diabetic patients ranges between 4.0% and 10.0%; the incidence rate lies between 1.0% and 4.1%. According to statistics published by the International Diabetes Federation, 10%–15% of diabetic patients may develop lesions once in their lifetime. Type 2 diabetic (T2D) patients are at a higher risk of developing DFUs compared to Type 1 Diabetic (T1D) patients.

The statistics mentioned above are expected to boost market growth. DFUs are the leading cause of hospitalization among patients who have diabetes; a significant number of cases result in lower limb amputation. The prevalence of DFU varies significantly across continents. The COVID-19 pandemic led to an increase in the prevalence of diabetes and fatal complications. Clinicians faced critical challenges managing diabetic foot ulcers (DFUs) during the pandemic due to limited access to laboratories, radiological testing, and reduced admissions in care settings. Despite the adoption of telehealth and telemedicine, DFUs needed personal attention and care.

This situation augmented the demand for DFU management tools, leading to increased supply by manufacturers. Companies like Smith and Nephew claimed that their revenues increased in 2020 due to the enormous sales of their leading DFU care products. In addition, studies published by the British Diabetic Association stated that, in England, nearly 5% of COVID-19-infected patients developed diabetes within seven months post-discharge. Thus, the need for DFU treatment products increased at large- and small-scale hospitals, community clinics, surgery centers, nursing homes, and outpatient care settings.

Market Dynamics

According to the WHO, chronic conditions, such as diabetes, are highly prevalent in older people aged 65 years and above. Growing geriatric population is the leading driver of the diabetes epidemic, as diabetes in older people induces higher mortality rates and reduced functional status. According to the WHO, 80% of older people are expected to live in low- and middle-income nations by 2050. The population is aging at a considerably higher rate than in the past. In 2020, the number of people aged 60 years and older will outnumber children aged under five years.

Between 2015 and 2050, the proportion of the global population aged over 60 years will nearly double, from 12% to 22%. Moreover, a rise in the geriatric population in Asia Pacific, especially in countries with untapped opportunities, such as Japan, India, and China, is expected to drive growth. As per the estimates by the World Bank, in 2019, more than 28.00% of the population in Japan was over the age of 65 years. Therefore, with the increase in aging population, the demand for short- and long-term healthcare needs is also increasing, which is expected to drive industry growth.

Treatment Insights

The biologics segment dominated the industry with a share of 36.46% in 2023. Biologics include growth factors, such as vascular endothelial growth factor (VEGF) and platelet-derived growth factor (PDGF). The segment is further divided into stem cells and other anti-diabetic drugs. These agents help reduce hyperglycemia, increase oxygenation & circulation, and repair lost tissues. As a result, they are increasingly used to treat DFU and are considered ideal for managing wounds at different stages.

The therapy devices segment is expected to register the fastest CAGR from 2024 to 2030. Therapy devices include negative pressure wound therapy (NPWT), oxygen & hyperbaric oxygen equipment, electric stimulation devices, pressure relief devices, and others. The introduction of new product lines related to wound therapy devices by major market players is also expected to boost demand for such devices. For instance, in January 2022, Smith & Nephew announced that the FDA cleared its Single-Use Negative Pressure Wound Therapy (sNPWT) Systems PICO 7 and PICO 14.

End-use Insights

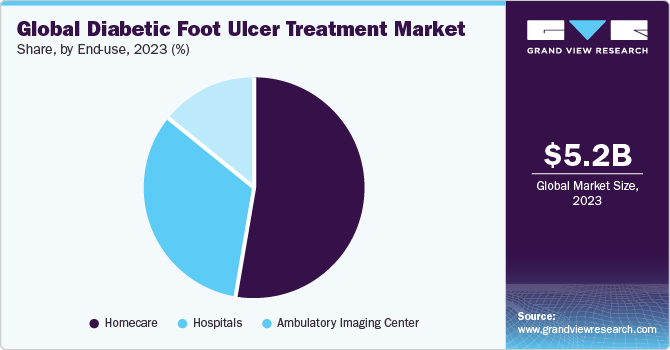

The hospital segment accounted for a share of 33.29% in 2023. The segment growth is attributed to factors, such as widespread adoption of treatments, presence of skilled staff, and favorable reimbursement policies. In the U.S., the annual cost of DFU treatment has reached approximately USD 1 billion and is on the rise. Studies indicate a notable surge in DFU cases, leading to an 11-fold increase in admissions and contributing to over 80% of amputations. This surge has also resulted in a 10-fold rise in hospital costs over a span of 5 years. To address this substantial economic burden, education initiatives and early prevention strategies, especially through outpatient multidisciplinary care focused on high-risk populations, are crucial.

The homecare settings segment accounted for the largest share of 52.71% in 2023. It is projected t0 expand further at the fastest CAGR from 2024 to 2030 due to the growing geriatric patient population, a shift toward home-based care, and increased adoption of telemedicine. The COVID-19 pandemic played a pivotal role in shaping this trend, with most clinics embracing telemedicine for DFU treatment. Utilizing digital photography for monitoring foot ulcers proved to be a valid, reliable, and feasible method for telehealth purposes. The use of audio, video, and online communication, particularly for foot ulcer monitoring, further propelled segment growth.

Ulcer Type Insights

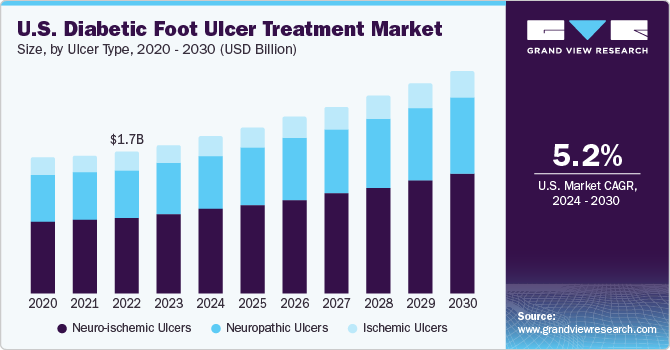

The neuro-ischemic ulcers segment dominated the market in 2023 by capturing a revenue share of 53.1%; the segment is projected to expand at the fastest CAGR from 2024 to 2030. The growth in this segment can be linked to various risks associated with neuro-ischemic ulcers, including infection, amputation, and even death. While neuropathic ulcers impact nearly 35% of all ulcers, neuro-ischemia is prevalent in around 50% of the diabetic population. Significant contributors to DFU are sensorimotor and sympathetic diabetic neuropathy. Sensory neuropathy causes a loss of sensation to pain, pressure, and temperature, making trauma and minor ulcers less perceptible or entirely unnoticed.

Moreover, motor neuropathy results in muscle weakness and lower foot and ankle atrophy, leading to abnormal loading on the plantar aspect of the foot. Among the extensively researched treatments for neuro-ischemic ulcers, hyperbaric oxygen therapy and sucrose octa sulfate dressing stand out. The contact cast is considered the most effective option for addressing neuro-ischemic ulcers. The annual cost of treating DFU is approximately USD 779.50 million in the UK and around USD 10.21 billion across Europe, emphasizing the economic impact of DFU management.

Regional Insights

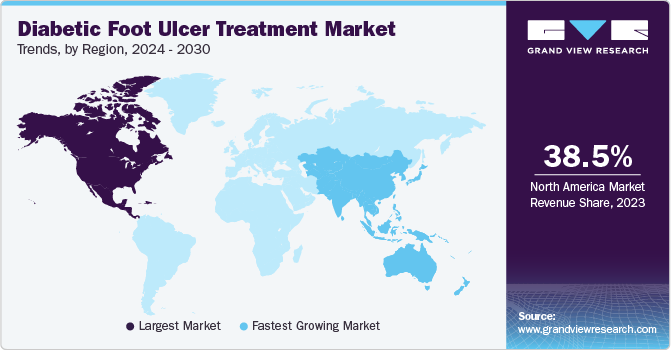

In 2023, North America accounted for the largest share of 38.5%. There are 51 million diabetes patients in North America and the Caribbean region. The number is said to go up by 24% by 2045. Factors, such as the presence of key players, increased healthcare GDP expenditure, and improved reimbursement for DFU treatment influence industry growth. Asia Pacific is estimated to regisster the fastest CAGR of 7.5% from 2024 to 2030. In South East Aisa, nearly 90 million people suffered from diabetes in 2021 and is expected to reach 152 million in 2045, according to the International Diabetes Federation. Presence of a diabetic population, a large number of juvenile diabetic patients , increased insulin resistance relative to reduced insulin secretory function, and high cost of treatment are factors responsible for the rise of DFU in this region.

Nearly 60% of people with Type 2 diabetes live in China and India. Sedentary lifestyles, food habits, and limited access to healthy foods are also factors responsible for a rise in the diabetic population in the country. In China, the annual incidence of ulceration and amputation was ~8% and 5% among the diabetic population, and the fatality rate among patients with ulceration was 14.4%. Treatment for DFU in China costs nearly USD 2,550, and the average length of stay is 18 days. The International Diabetes Foundation and governments across all countries in Asia are taking initiative to increase awareness to ease the social and medical burdens.

Key Companies & Market Share Insights

Major industry participants are working to improve their service offerings by investing heavily in research and development to introduce newer and more efficient products. Activities, such as acquisitions, partnerships, expansions, along with supportive government initiatives, help strengthen market position of key players. For instance, in March 2023, 3M received FDA 510(k) clearance for its innovative 3M Veraflo therapy, with both 3M V.A.C. Veraflo Cleanse Choice Dressing and 3M Veraflo Cleanse Choice Complete Dressing. Also, in May 2023, Mölnlycke Health Care AB attended the International Symposium on the Diabetic Foot (ISDF), which highlighted lower extremity and diabetic foot wound care.

Key Diabetic Foot Ulcer Treatment Companies:

- ConvaTec, Group Plc

- Acelity L.P., Inc.

- 3M Health Care

- Coloplast Corp.

- Smith & Nephew Plc

- B Braun Melsungen AG

- Medline Industries, LP.

- Molnlycke Health Care AB

- Medtronic Plc

Diabetic Foot Ulcer Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.47 billion

Revenue forecast in 2030

USD 7.76 billion

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, ulcer type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ConvaTec Group Plc; Acelity L.P. Inc.; 3M Health Care; Coloplast Corp.; Smith & Nephew Plc.; B Braun Melsungen AG; Medline Industries, LP; Molnlycke Health Care AB; Medtronic Plc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diabetic Foot Ulcer Treatment Market Report Segmentation

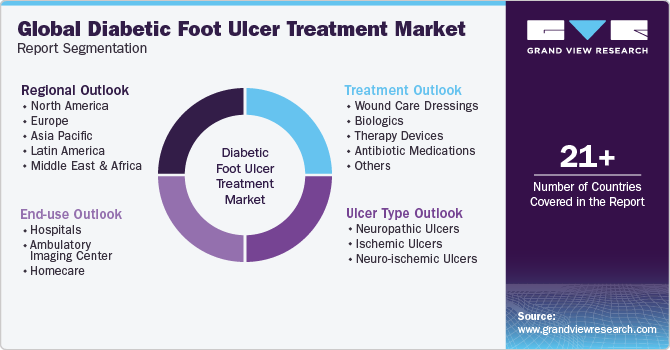

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the diabetic foot ulcer treatment market report on the basis of treatment, end-use, ulcer type, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Wound Care Dressings

-

Alginate Dressings

-

Hydrofiber Dressings

-

Foam Dressings

-

Film Dressing

-

Hydrocolloid Dressings

-

Surgical Dressings

-

Hydrogel Dressings

-

-

Biologics

-

Growth Factors

-

Skin Grafts

-

-

Therapy Devices

-

Negative Pressure Wound Therapy

-

Ultrasound Therapy

-

-

Antibiotic Medications

-

Others

-

-

Ulcer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neuropathic Ulcers

-

Ischemic Ulcers

-

Neuro-ischemic Ulcers

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Imaging Center

-

Homecare

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global diabetes foot ulcer market size was estimated at USD 5.18 billion in 2023 and is expected to reach USD 5.47 billion in 2024

b. The global diabetes foot ulcer market is expected to grow at a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 7.76 billion by 2030.

b. North America dominated the diabetes foot ulcer market with a share of 38.5% in 2022. This is attributable to the rising prevalence of diabetes coupled with the rapid increase in the geriatric population.

b. Some key players operating in the diabetes foot ulcer market include ConvaTec, Inc.; Acelity L.P. Inc.; 3M Healthcare; Coloplast A/S; Smith & Nephew Plc.; B. Braun Melsungen AG; Medline Industries, Inc.; Medtronic Plc.; Organogenesis, Inc.; Molnlycke Health Care AB; and BSN Medical GMBH.

b. Key factors that are driving the diabetes foot ulcer market growth include the rising adoption of novel biologics and wound care devices for treatment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."