- Home

- »

- Advanced Interior Materials

- »

-

Die Bonder Equipment Market Size, Industry Report, 2030GVR Report cover

![Die Bonder Equipment Market Size, Share & Trends Report]()

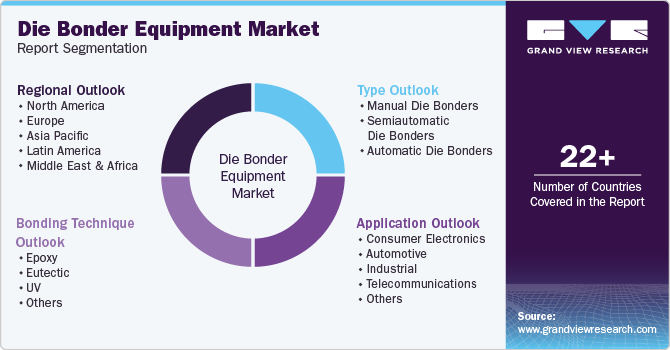

Die Bonder Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Manual Die Bonders, Automatic Die Bonders), By Bonding Technique (Epoxy, UV), By Application (Automotive, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-421-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Die Bonder Equipment Market Summary

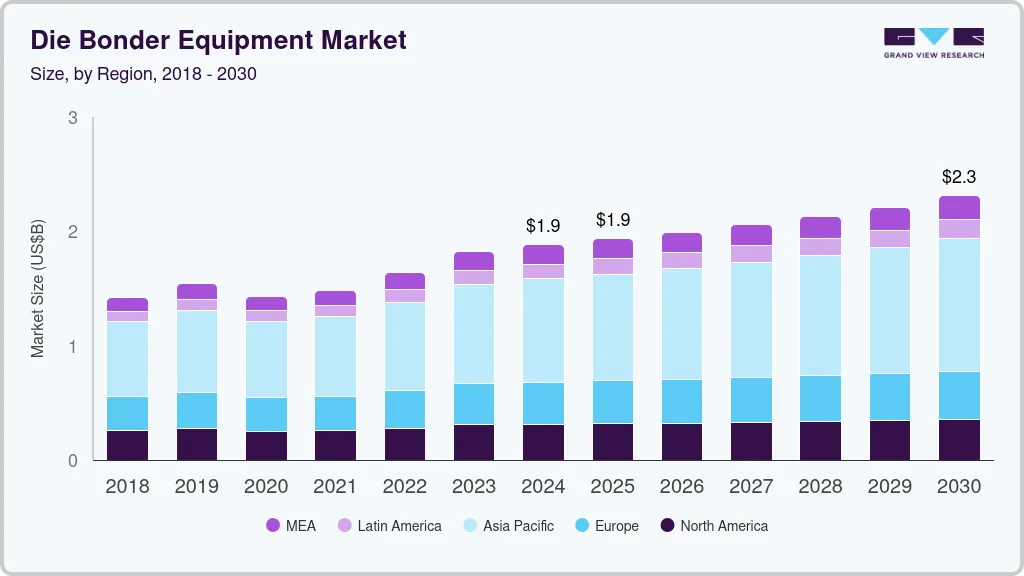

The global die bonder equipment market size was estimated at USD 1.88 billion in 2024 and is projected to reach USD 2.31 billion by 2030, growing at a CAGR of 3.6% from 2025 to 2030. The market is currently experiencing robust growth, attributed largely to the increasing demand for semiconductor devices across various industries, including automotive, consumer electronics, and IT & telecommunications.

Key Market Trends & Insights

- The Asia Pacific die bonder equipment market dominated the global market and accounted for the largest revenue share of 48.0% in 2024.

- The die bonder equipment market in China led the Asia Pacific market and held the largest revenue share in 2024.

- By type, the automatic die bonders segment led the market and accounted for the largest revenue share of 47.0% in 2024.

- By bonding technique, the epoxy segment led the market and accounted for the largest revenue share of 33.5% in 2024.

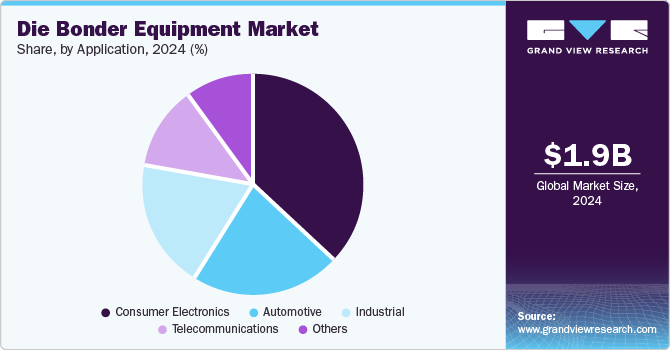

- By application, the consumer electronics segment dominated the global die bonder equipment market and held the largest revenue share of 36.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.88 Billion

- 2030 Projected Market Size: USD 2.31 Billion

- CAGR (2025-2030): 3.6%

- Asia Pacific: Largest market in 2024

This surge in demand is fueled by ongoing technological advancements and the growing need for high-performance and miniaturized electronic components. As devices become more integrated and complex, the precision and efficiency offered by die bonder equipment become crucial, driving manufacturers to invest in the latest technologies to stay competitive. Advancements in die bonding technologies, such as the development of automated and semi-automated systems, are significantly contributing to the market's growth. These technologies not only improve the throughput and accuracy of the die bonding process but also reduce the likelihood of human error, ensuring higher product reliability. Furthermore, the push for electric vehicles and the expansion of 5G networks globally are creating substantial opportunities for die bonder equipment manufacturers, as these sectors require sophisticated semiconductors produced with high-precision equipment.

Die bonder equipment varies significantly in terms of precision, speed, and bonding techniques to meet the diverse needs of different semiconductor devices and applications. It is a sophisticated piece of machinery designed to handle the delicate process of placing and securing dies, requiring precision alignment and bonding capabilities to ensure high yields and reliability of the final electronic component.

The exponential growth of the market is fueled by the escalating demand for semiconductor devices across diverse sectors, including automotive, consumer electronics, and healthcare. This surge is significantly attributed to technological advancements, such as the fabrication of intricate microelectronic devices, the ongoing trend of component miniaturization, and the introduction of 5G technology, all of which necessitate refined die bonding techniques. Moreover, the shift towards automation and the incorporation of artificial intelligence in manufacturing processes underscore the need for more sophisticated, efficient, and precise die bonder equipment, bolstering the market's expansion.

With the rapid expansion of the Internet of Things (IoT), wearable technology, and smart devices, there is a significant opportunity for the market to expand its reach. The automotive industry, with its increasing focus on electric vehicles (EVs) and autonomous vehicles, presents another lucrative segment for growth. These sectors require high reliability and quality in semiconductor devices, which can only be achieved with advanced packaging technologies, thereby creating opportunities for innovations and advancements in die-bonding equipment. In addition, the push towards renewable energy and power electronics offers new avenues for the application of die-bonding technology.

Type Insights

The automatic die bonders segment led the market and accounted for the largest revenue share of 47.0% in 2024. The growth is driven by the increasing demand for high precision and efficiency in the semiconductor manufacturing process. These machines are critical for the accurate placement of dies onto substrates, offering advanced capabilities such as high-speed bonding, flexibility in handling different die sizes, and the ability to work with various substrates. This makes them indispensable for applications requiring high throughput and precision, such as advanced consumer electronics, automotive electronics, and LED lighting technologies.

Semiautomatic die bonders are expected to grow at a significant CAGR of 3.4% over the forecast period, primarily driven by their cost-effectiveness and ease of use, which make them accessible to smaller manufacturers. In addition, they offer a balance between manual control and automation, which is beneficial for low—to medium-volume production. Furthermore, they cater to industries requiring moderate precision and throughput, such as consumer electronics and automotive electronics, providing a reliable and efficient solution for die bonding needs.

The manual die bonders segment remains a vital part of the market, catering to applications where precision, flexibility, and customization are paramount. These systems are especially favored in research and development environments, prototype manufacturing, and specialized low-volume production, where the intricacies of the bonding process can be manually adjusted and closely monitored. This will further drive the demand for market growth.

Bonding Technique Insights

The epoxy segment led the market and accounted for the largest revenue share of 33.5% in 2024. Epoxy-based die bonding is widely used in the assembly of semiconductor devices, particularly where high reliability under harsh environmental conditions is crucial, such as in automotive and military applications. This adhesive method is favored for its versatility, allowing for bonding a wide range of materials, including those with mismatched coefficients of thermal expansion. The strength of epoxy bonds, coupled with their longevity and the ability to cure at room temperature or with heat, makes epoxy an attractive choice for manufacturers seeking to enhance device performance and reliability.

The UV (ultraviolet) curing segment in the market is expected to grow at a CAGR of 4.3% over the forecast period, owing to applications requiring rapid processing and high throughput. UV curing technology uses ultraviolet light to quickly cure or solidify photo-reactive polymers, offering a faster, more efficient bonding process compared to traditional thermal curing methods. This technology is highly valued in the electronics manufacturing sector, where speed and precision are critical to productivity and profitability. UV curing is well-suited for complex, high-density electronic assemblies where thermal management is crucial, as it minimizes thermal stress on delicate components. The above factor may positively impact the market growth.

Application Insights

The consumer electronics segment dominated the global die bonder equipment market and held the largest revenue share of 36.3% in 2024. The consumer electronics segment is a major driving force in the market, propelled by the escalating demand for smaller, more powerful, and energy-efficient devices such as smartphones, tablets, laptops, and wearables. As these devices evolve, becoming more complex with each iteration, the need for precise, reliable die-bonding processes intensifies. Die bonder equipment plays a crucial role in the assembly of semiconductor chips within these devices, ensuring the integrity and performance of the final product.

The telecommunications segment is expected to grow at a CAGR of 4.2% from 2025 to 2030, owing to rapid technological advancements, including the rise of 5G and IoT, an increasing number of smartphone users, and the need for efficient communication. In addition, telecommunications applications are fueled by the need for high-performance semiconductor devices. Furthermore, advancements in 5G and IoT require reliable, miniaturized chips, driving the adoption of precise die-bonding technologies.

The automotive segment represents a significant and growing avenue in the market, underscored by the increasing electronic content in vehicles and the push toward electric and autonomous driving technologies. As modern vehicles incorporate more sophisticated electronic systems for navigation, safety, infotainment, and vehicle management, the precision and reliability of semiconductor components become paramount. Die bonder equipment is essential in the production of these components, offering the high-precision bonding necessary for ensuring the durability and reliability required in the automotive environment, which often involves exposure to extreme temperatures, vibrations, and moisture.

Regional Insights

The Asia Pacific die bonder equipment market dominated the global market and accounted for the largest revenue share of 48.0% in 2024. This growth is attributed to the booming semiconductor industry in countries such as China, South Korea, Japan, and Taiwan. The substantial demand for consumer electronics, the increasing adoption of advanced technologies such as 5G, IoT (Internet of Things), artificial intelligence (AI), and electric vehicles (EVs), and strong government support for semiconductor self-sufficiency and technological advancements are anticipated to drive the demand for die bonder equipment over the forecast period.

China Die Bonder Equipment Market Trends

The die bonder equipment market in China led the Asia Pacific market and held the largest revenue share in 2024, driven by the country's ambitious efforts to become self-sufficient in semiconductor manufacturing. The Chinese government's substantial financial and policy support for the semiconductor sector, as part of its Made in China 2025 initiative, has led to an increase in the number of semiconductor fabrication plants (fabs) and research and development activities in the country. This expansion is driving the demand for die bonder equipment, which is crucial in the assembly process of semiconductors, as China aims to climb up the value chain in semiconductor production.

Middle East & Africa Die Bonder Equipment Market Trends

The Middle East and Africa die bonder equipment market is expected to grow at a CAGR of 3.9% over the forecast period, owing to increasing investments in technology and manufacturing infrastructure. As these regions modernize their industrial sectors, there is a rising demand for advanced semiconductor devices. Consequently, the need for precise die-bonding technologies has become more pronounced, supporting market expansion. This trend is further enhanced by government initiatives aimed at diversifying economies and fostering technological innovation.

North America Die Bonder Equipment Market Trends

The die bonder equipment market in North America is expected to grow significantly over the forecast period, primarily driven by the region's robust technological advancement, particularly in the semiconductor and electronics sectors. This growth is bolstered by the presence f leading semiconductor manufacturers and a strong focus on research and development activities, aiming to meet the escalating demand for more sophisticated and efficient electronics. Factors such as the surge in demand for consumer electronics, the rise of electric vehicles requiring advanced semiconductor components, and the growing need for miniaturized electronic devices further fuel the market's expansion.

The U.S. die bonder equipment market led the North American market and accounted for the largest revenue share in 2024, driven by robust technological advancements and a strong focus on semiconductor manufacturing. In addition, the presence of leading semiconductor companies and ongoing research in electronics fuels the demand for high-performance die-bonding solutions. Furthermore, the U.S. market benefits from a well-established supply chain and significant investments in emerging technologies such as IoT and 5G.

Europe Die Bonder Equipment Market Trends

The die bonder equipment market in Europe is experiencing steady growth, driven by the region's strong focus on the automotive, healthcare, and industrial electronics sectors. Europe's commitment to innovation and sustainability, particularly in automotive manufacturing with a surge in electric vehicle production, necessitates advanced semiconductor components, thereby increasing the demand for die bonder equipment. Moreover, Europe's emphasis on advanced medical devices for its aging population and the region's push towards Industry 4.0 is further catalyzing the growth of the market.

Key Die Bonder Equipment Company Insights

Some of the key players operating in the market include Kulicke & Soffa Industries, TRESKY GmbH, and Shibuya Corporation.

-

Kulicke & Soffa Industries, widely recognized by its abbreviation K&S, is a premier global provider of semiconductor assembly and packaging equipment and solutions. The company's product portfolio encompasses a broad range of equipment designed to support multiple steps in the semiconductor manufacturing process, with a particular focus on wire bonding and die bonding technologies.

-

TRESKY GmbH specializes in the development and manufacture of manual to fully automatic die bonding systems. The company's die bonding equipment is highly versatile, catering to a wide array of applications including R&D, prototyping, and volume production across various sectors such as photonics, hybrid circuits, microwave devices, and optoelectronics.

Key Die Bonder Equipment Companies:

The following are the leading companies in the die bonder equipment market. These companies collectively hold the largest market share and dictate industry trends.

- MicroAssembly Technologies, Ltd.

- West·Bond, Inc.

- Kulicke & Soffa Industries

- TRESKY GmbH

- Shibuya Corporation

- ASM Pacific Technology

- Palomar Technologies

- Hybond Inc.

- MRSI Systems

- Finetech GmbH & Co. KG

- Besi

- ITEC

- SHINKAWA Electric Co., Ltd.

Recent Developments

-

In July 2024, Adeia entered a long-term license agreement with Hamamatsu Photonics for hybrid bonding technologies, including wafer-to-wafer and die-to-wafer solutions. This agreement builds upon a previous development license that involved transferring DBI Ultra technology.

-

In May 2024, ITEC introduced the ADAT3 XF TwinRevolve Flip-Chip Die Bonder, which is changing the game in the electronics manufacturing industry. This cutting-edge piece of equipment is reported to operate at speeds up to five times faster than competing die bonders on the market.

-

In April 2024, SK Hynix announced an investment of USD 3.87 billion in West Lafayette, Indiana, to establish an advanced packaging fabrication and R&D facility for AI products. This groundbreaking project marks the first investment of its kind in the U.S. and aims to enhance the nation's AI supply chain. The facility is expected to feature an advanced semiconductor production line for next-generation HBM chips, utilizing precise die bonder equipment for assembly.

-

In September 2023, MRSI Systems, part of Mycronic Group, launched the high force die bonder MRSI-705HF. This new model, based on the MRSI-705 platform, capable of applying up to 500N of force and heating up to 400°C, features a heated bond head. It's ideal for applications such as sintering for power semiconductors and thermocompression bonding for advanced IC packaging.

Die Bonder Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.93 billion

Revenue forecast in 2030

USD 2.31 billion

Growth Rate

CAGR of 3.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, bonding technique, application, region

Regional scope

North America; Asia Pacific; Europe; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

MicroAssembly Technologies, Ltd.; West·Bond, Inc.; Kulicke & Soffa Industries; TRESKY GmbH; Shibuya Corporation; ASM Pacific Technology; Palomar Technologies; Hybond Inc.; MRSI Systems; Finetech GmbH & Co. KG; Besi; ITEC; SHINKAWA Electric Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Die Bonder Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global die bonder equipment market report based on type, bonding technique, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Manual Die Bonders

-

Semiautomatic Die Bonders

-

Automatic Die Bonders

-

-

Bonding Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Eutectic

-

UV

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.