- Home

- »

- Consumer F&B

- »

-

Diet Soft Drinks Market Size & Share, Industry Report, 2030GVR Report cover

![Diet Soft Drinks Market Size, Share & Trends Report]()

Diet Soft Drinks Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Zero Calorie, Low Calorie), By End-use (Teenagers, Young Adults), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-540-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Diet Soft Drinks Market Summary

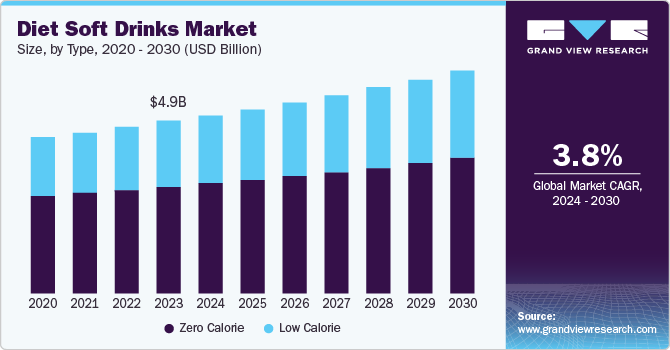

The global diet soft drinks market size was estimated at USD 4.87 billion in 2023 and is projected to reach USD 6.29 billion by 2030, growing at a CAGR of 3.8% from 2024 to 2030. The market is primarily driven by the escalating prevalence of obesity prompting consumers to seek lower-calorie alternatives.

Key Market Trends & Insights

- North America diet soft drinks market held a majority of the market share of 33.5% in 2023.

- The U.S. diet soft drinks market held a substantial market share in 2023.

- By type, the zero-calorie segment dominated the market and accounted for a revenue share of 62.0% in 2023.

- By end-use, the young adults segment dominated the market in 2023.

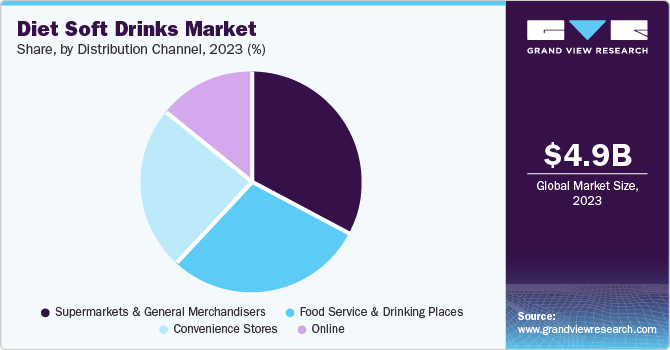

- By distribution channel, the supermarkets & general merchandise segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.87 Billion

- 2030 Projected Market Size: USD 6.29 Billion

- CAGR (2024-2030): 3.8%

- North America: Largest market in 2023

According to WHO, in 2022, 1 in 8 people in the world were living with obesity and according to NIH; 38.4 million people of all ages had diabetes (11.6% of the population) in 2021.

The growing health consciousness among individuals has fueled demand for products that align with weight management and sugar reduction goals. Additionally, the expanding range of flavors and sweeteners in diet soft drinks caters to diverse consumer preferences, boosting market growth. Additionally, the increasing penetration of diet soft drinks across various distribution channels, including convenience stores and online platforms, has contributed to market expansion.

Demographic shifts, particularly the increasing number of health-conscious consumers, especially among millennials and Gen Z, have significantly influenced the diet soft drink market. These age groups prioritize wellness and are more likely to choose low-calorie beverages. Additionally, the rising disposable incomes in emerging economies have expanded the consumer base for diet soft drinks as affordability becomes less of a barrier.

The growing focus on active lifestyles and fitness has created a demand for products that support athletic performance and recovery. Diet soft drinks are often considered suitable hydration options for individuals engaged in physical activities. Furthermore, the evolving regulatory landscape, with stricter guidelines on sugar content in beverages, has accelerated the adoption of diet soft drinks as a compliant alternative, further strengthening the growth.

Type Insights

The zero-calorie segment dominated the market and accounted for a revenue share of 62.0% in 2023. Diet drinks are becoming popular as individuals become more health and weight-conscious. Individuals taking fitness seriously and counting calorie intake may opt for zero-calorie soft drinks over regular ones. The zero-calorie beverage market provides many different flavors and options. Key industry companies offer no-calorie options of popular brands such as cola, lemon-lime, orange, and other fruit-flavored drinks. Flavored water, carbonated water, and energy drinks provide calorie-free choices.

The low-calorie segment is expected to register the fastest CAGR of 4.4% over the forecast period. The factor driving the growth is the increasing awareness of health among consumers globally. With the increase in obesity rates and growing chronic diseases, people are constantly looking for dietary choices that align with their health objectives. The increasing interest in fitness programs and weight management initiatives also increases the request for low-calorie options. Additionally, efforts by the government to encourage healthier habits and create appealing low-calorie products have helped drive growth in this sector. The anticipation is that the segment's growth is expected to continue in the future due to the increasing number of low-calorie choices in different food categories and their perceived positive impact on health.

End-use Insights

The young adults segment dominated the market in 2023. This demographic is increasingly health-conscious and actively demands products aligning with their fitness and wellness goals. Diet soft drinks offer a healthier alternative to regular soft drinks while satisfying the desire for refreshing beverages. The wellness and fitness industry further promotes healthy lifestyles, driving demand for diet soft drinks. Moreover, this segment often prioritizes convenience and portability, making ready-to-consume diet soft drinks a preferred choice.

The teenagers segment is expected to register the fastest CAGR during the forecast period. The growth is primarily attributed to several key factors. The rising rates of obesity and health-related issues in teenagers have led to increased awareness of calorie consumption and a growing preference for low-calorie options. Moreover, teenagers are strongly impacted by social media trends and celebrity endorsements, leading to an increase in the consumption of diet soft drinks that often promote health and fitness. Furthermore, teenagers are often influenced to go for products seen as trendy and modern beverages such as diet soft drinks.

Distribution Channel Insights

The supermarkets & general merchandise segment dominated the market in 2023.A wide range of products is available in such stores, making it convenient for consumers to choose their favorite option. Furthermore, the increased presence of diet soft drinks on store shelves is supported by the expanding organized retail industry and frequent promotions by significant companies. Moreover, the convenience of having everything under one roof and the option to physically inspect items have led consumers looking for diet drinks to choose supermarkets and general merchandise stores as their preferred choice.

The online segment is expected to register the fastest CAGR during the forecast period. The growing adoption of e-commerce platforms and the increasing preference for convenient and contactless shopping experiences. Additionally, the expanding reach of internet connectivity and the increasing penetration of smartphones have enabled seamless online shopping for a wider audience. Furthermore, the availability of various products, competitive pricing, and personalized recommendations through online platforms have contributed to the segment's growth. As consumer behavior continues to evolve, the online segment is poised to maintain its upward trajectory in the diet soft drinks market.

Regional Insights

North America diet soft drinks market held a majority of the market share of 33.5% in 2023. The region's strong focus on health maintenance and weight control has increased the demand for low-calorie soft drinks. Furthermore, the region has established industry leaders with extensive distribution channels, and diverse product selections have reinforced their dominance. The market has also grown due to North America's higher purchasing power and consumers' preference for soft drinks. Moreover, ongoing product innovation and a wide range of flavors to meet changing consumer preferences, maintain its position in the market, and strengthen the market in North America.

U.S. Diet Soft Drinks Market Trends

The U.S. diet soft drinks market held a substantial market share in 2023. Young adults and teenagers in the U.S. attribute this to their high beverage intake. Furthermore, major players in the market are acquiring new sectors by offering high-quality products, such as soft drinks with distinct flavors, and providing health benefits to attract customers with higher purchasing power.

Europe Diet Soft Drinks Market Trends

Europe diet soft drinks market is anticipated to grow due to the wide availability of low-calorie or zero-calorie soft drinks in the region. In addition, an increasing number of health-conscious population is expected to drive market growth.

The UK diet soft drinks market held a substantial market share in 2023. Introducing innovative flavors and diverse product types contributed to the country's overall market expansion. Additionally, the demand for diet soft drinks has increased due to the country's focus on health awareness and an older consumer group that seeks convenient and flavorful options.

Asia Pacific Diet Soft Drinks Market Trends

Asia Pacific diet soft drinks market is anticipated to witness significant growth of CAGR of 4.3% over the forecast period.Growing urbanization and evolving lifestyles have led to a higher demand for quick and go-to drink choices. The region's large young population provides a sizable market for diet soft drinks. Additionally, the arrival of global beverage companies and the growth of distribution systems have improved market reach in the Asia Pacific region.

India's diet soft drinks market is expected to grow rapidly in the coming years. The young and health-conscious demographic is increasingly adopting diet soft drinks as a convenient and rejuvenating option. The increasing distribution networks and the arrival of international players are also fueling the market growth. Moreover, the government's focus on health and wellness programs is increasing the popularity of diet drinks in India.

Key Diet Soft Drinks Company Insights

Some of the key companies in the diet soft drink market include Coca-Cola, PepsiCo, Keurig Dr Pepper, Inc., Nestle, Cott Corporation, Polar Beverages, Unilever, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as redesigning old products and launching new ones.

-

The Coca-Cola Company is a prominent players in the beverage sector, famous for its well-known Coca-Cola products and a wide range of other drinks. Coca-Cola’s operational framework revolves around manufacturing, marketing, and selling concentrates and syrups to authorized bottling partners, which produce and distribute finished beverages. Diet Coke is the most famous product in the diet soft drinks market.

-

PepsiCo is a well-known multinational food, snacks, and beverages company renowned for its famous Pepsi brand. PepsiCo has strengthened its market presence by acquiring brands such as Quaker Oats, Gatorade, and Tropicana. PepsiCo is known for its diet soft drinks, providing varied choices such as Diet Pepsi and Pepsi Zero Sugar. The company's strong distribution network, effective marketing strategies, and attention to consumer trends have reinforced its position as a significant player in this market.

Key Diet Soft Drinks Companies:

The following are the leading companies in the diet soft drinks market. These companies collectively hold the largest market share and dictate industry trends.

- The Coca-Cola Company

- PepsiCo

- Keurig Dr Pepper, Inc.

- Nestle

- Cott Corporation

- Polar Beverages

- Unilever

- Dr Pepper Snapple Group, Inc.

- National Beverage crop.,

- Big Red, Inc.

Recent Developments

-

In May 2024, Coca-Cola Co. introduced Coca-Cola Lens, a growth-focused insights platform for food service and retail operators to make informed data-based decisions.

-

In March 2024, PepsiCo takes over iconic landmarks worldwide to reveal its new look the re-designed and refreshed Pepsi globe logo, marking its first visual rebrand in 14 years across 120 countries globally.

-

In March 2023, Jack Daniel's, a brand of Brown-Forman Corp., Louisville, Ky., and The Coca-Cola Co. introduced the classic Jack Daniel's & Coca-Cola cocktail as a pre-mixed, ready-to-drink option in the U.S. for the first time.

Diet Soft Drinks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.04 billion

Revenue forecast in 2030

USD 6.29 billion

Growth Rate

CAGR of 3.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE

Key companies profiled

The Coca-Cola Company.; PepsiCo; Keurig Dr Pepper, Inc.; Nestle; Cott Corporation; Polar Beverages; Unilever; Dr Pepper Snapple Group, Inc.; National Beverage crop.; Big Red, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Diet Soft Drinks Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global diet soft drinks market report based on type, end-use, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Zero Calorie

-

Low Calorie

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Teenagers

-

Young Adults

-

Middle Aged Adults

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & General Merchandisers

-

Convenience Stores

-

Food Service & Drinking Places

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.