- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Digestive Diamine Oxidase Enzyme For Supplements Market Report, 2030GVR Report cover

![Digestive Diamine Oxidase Enzyme For Supplements Market Size, Share & Trends Report]()

Digestive Diamine Oxidase Enzyme For Supplements Market Size, Share & Trends Analysis Report By Ingredient, By Final Dosage Form, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

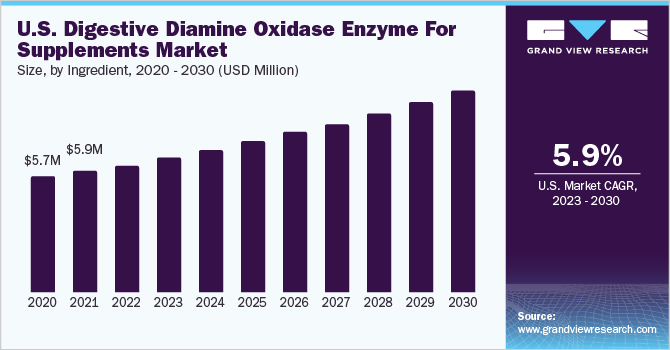

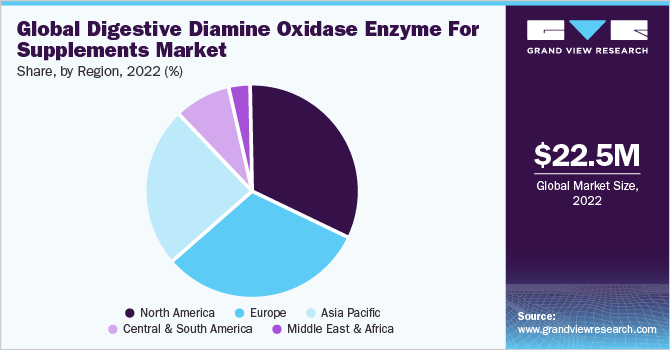

The global digestive diamine oxidase enzyme for supplements market size was USD 22.53 million in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.64% from 2023 to 2030. The growth of the DAO enzymes for supplements is driven by the rising cases of histamine intolerance coupled with the rising interest in natural remedies. Furthermore, the growing availability of digestive diamine oxidase supplements at online retailers is anticipated to fuel the demand for the market.

The COVID-19 pandemic positively impacted the demand for DAO supplements owing to the rise in the number of consumers adopting healthier lifestyles coupled with the growing demand for health supplements is fueling the demand for the market. The demand for digestive diamine oxidase (DAO) enzymes as supplements is primarily driven by the increasing awareness of histamine intolerance and its associated symptoms. Histamine intolerance in the field of medicine has gained more attention among healthcare professionals and the general public. For instance, the American Journal of Critical Nutrition states that 1% of the global population suffers from histamine tolerance. As more consumers become aware of histamine intolerance, there is a growing demand for natural ways to manage and reduce symptoms.

In addition to increasing awareness of histamine intolerance, there is also a growing interest in using natural remedies and supplements to support digestive health. Many people are turning to dietary supplements as a way to complement their existing diet and lifestyle habits and to support their overall health and wellness. Supplements containing digestive diamine oxidase enzymes are commonly used by people who experience symptoms of histamine intolerance, which can include headaches, skin rashes, hives, digestive issues, and other allergy-like symptoms.

Moreover, the rise in the number of companies offering DAO supplements for histamine intolerance is supporting the growth of the market. For instance, a Spain-based provider of animal and plant health products offers DAOgest, an ingredient for usage in DAO supplements.

Ingredient Insights

The ingredient segment is predicted to grow at a CAGR of 5.64% by revenue from 2023 to 2030. The demand for DAO is being driven by the rising cases of food allergies coupled with the rising demand for functional foods. Consumer awareness of gut health and the prevention of gastrointestinal disorders has compelled manufacturers to use DAO as the primary ingredient in digestive supplements.In addition, the aging populace is also fueling the demand for DAO health supplements. As people age, their digestive system can become less efficient, leading to several health issues. DAO can help support gut health and promote overall health and prevent the risk of food allergies.

Furthermore, there is a growing demand for natural, specialty, and organic food items, particularly among high-income consumers. These consumers are willing to pay a premium price for products that are perceived as healthier or more environmentally friendly. As a result, food items containing digestive health ingredients like probiotics, prebiotics, and digestive enzymes have become increasingly popular among consumers looking for natural and organic alternatives to conventional products.

Final Dosage Form (FDF) Insights

The demand for diamine oxidase in the final dosage form (FDF) is anticipated to grow at a CAGR of 5.35% by revenue during the forecast period. Digestive Diamine Oxidase (DAO) supplements are typically packaged in the form of oral capsules or tablets. These dosage forms are designed to protect the DAO enzyme from degradation in the acidic environment of the stomach and deliver it in an intact manner to the small intestine.

Supportive regulatory initiatives and favorable initiatives from governments globally are also supporting the growth of the FDF segment. Growing technological innovations in the supplement sector also offer lucrative opportunities for the players operating in the digestive health products market. The Federation of European Nutrition Societies (FENS) and the European Society for Clinical Nutrition and Metabolism (ESPEN) fund and invest in various nutritional foods and nutraceutical businesses, thereby, fueling the growth of the segment.

There is a growing presence of branded and private-label products as well as retail channels in the digestive diamine oxidase for the supplements industry. This results in the addition of new and interesting flavors of digestive health products to make them more appealing to consumers. This remains the popular trend in the market. Companies are also using natural ingredients, which are often perceived as being healthier and more sustainable, to develop products that are in line with consumer demands.

Regional Insights

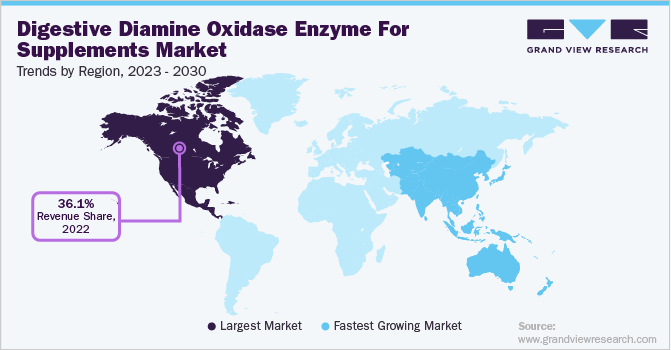

The European region is estimated to grow at the fastest CAGR of 7.09% from 2023 to 2030. The prevalence of histamine intolerance is higher in Europe due to differences in diet and genetic factors. For example, fermented foods and drinks, which are common in many European countries, are known to be high in histamine and can trigger symptoms in people with histamine intolerance.

The demand for digestive enzymes in Europe is primarily driven by increasing awareness of digestive health and the benefits of digestive enzyme supplements. Digestive enzyme supplements are designed to help break down and digest food more efficiently, which can help alleviate digestive symptoms like bloating, gas, and indigestion.Another factor driving the demand for digestive enzymes in Europe is the increasing popularity of plant-based diets. Plant-based diets can be higher in fiber, which can be difficult to digest and may require additional digestive enzymes to break them down and absorb nutrients from plant foods. This is a promising driver for future market growth.

North America led the market and accounted for a 32.19% share of the global revenue by ingredient in 2022. Changes in diet and lifestyle have significantly contributed to the growing demand for digestive health products in the region. Consumers in the region consume large portions of processed and fast foods, which can be harder to digest. This, combined with a sedentary lifestyle, can lead to numerous digestive issues.

In recent years, there has been an increase in awareness and concern about digestive health and several consumers are realizing that a healthy gut is essential for overall well-being. This has fueled the demand for DAO-based supplements in the region.

Key Companies & Market Share Insights

The global digestive diamine oxidase enzymes for supplements industry is anticipated to witness competition among the companies due to the presence of many players across the industry. Several companies are increasing their product portfolio to gain a competitive edge in the market.Some of the key players include Seeking Health, LLC; Eat All (Stada Group); Pure Encapsulations, LLC; Enzymedica, Inc.; Swanson; XYMOGEN; and Klaire Labs. Manufacturers are engaged in research & development activities related to products that are used in the manufacturing of digestive diamine oxidase enzymes for supplements. Some prominent players in the global digestive diamine oxidase enzyme for supplements market include:

-

Seeking Health, LLC

-

Eat All (Stada Group)

-

Pure Encapsulations, LLC

-

Enzymedica, Inc.

-

Swanson

-

XYMOGEN

-

Klaire Labs

Digestive Diamine Oxidase Enzyme for Supplements Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 22.53 million

Revenue forecast in 2030

USD 34.94 million

Growth rate (Revenue)

CAGR of 5.64% from 2022 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredient, FDF, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; South Korea, Brazil, South Africa

Key companies profiled

Seeking Health, LLC; Eat All (Stada Group); Pure Encapsulations, LLC; Enzymedica, Inc.; Swanson; XYMOGEN; Klaire Labs.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digestive Diamine Oxidase Enzyme For Supplements Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global digestive diamine oxidase enzyme for supplements market report based on ingredient, application, and region:

-

Ingredient Outlook (Volume, Kilogram; Revenue, USD Million, 2017 - 2030)

-

FDF Outlook (Volume, Kilogram; Revenue, USD Million, 2017 - 2030)

-

Regional Outlook (Volume, Kilogram; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digestive diamine oxidase enzyme for supplements market size was estimated at USD 22.53 million in 2022 and is expected to reach USD 23.69 million in 2023

b. The global digestive diamine oxidase enzyme for supplements market is expected to grow at a compound annual growth rate of 5.64% from 2023 to 2030 to reach USD 34.94 million by 2030

b. North America region dominated the Digestive Diamine Oxidase Enzymes for Supplements market with a revenue share of 32.19% in the year 2022

b. Some of the key market players in the digestive diamine oxidase enzyme for supplements market are Seeking Health, LLC, Eat All (Stada Group), Pure Encapsulations, LLC, Enzymedica, Inc., Swanson, XYMOGEN, and Klaire Labs

b. Key factors that are driving the digestive diamine oxidase enzyme for supplements market growth is increasing consumer awareness regarding digestive and gut health issues

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We offer custom report options, including stand-alone sections and country-level data. Special pricing is available for start-ups and universities.

Request Customization![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."