- Home

- »

- Pharmaceuticals

- »

-

Digestive & Intestinal Remedies Market Size Report, 2030GVR Report cover

![Digestive & Intestinal Remedies Market Size, Share & Trends Report]()

Digestive & Intestinal Remedies Market Size, Share & Trends Analysis Report By Type (Digestive Medicines), By Age Group (Adult & Geriatric, Pediatric), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-931-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

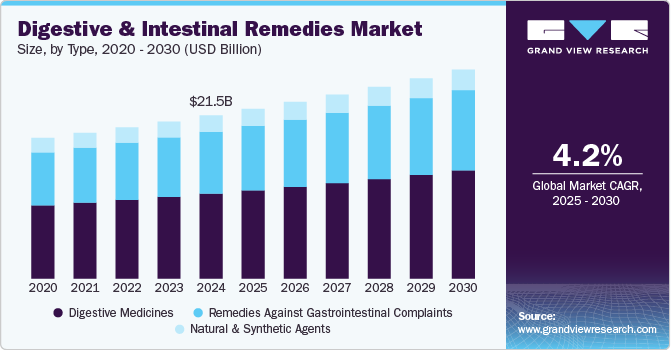

The global digestive & intestinal remedies market size was estimated at USD 21.50 billion in 2024 and is projected to grow at a CAGR of 4.25% from 2025 to 2030. The market for digestive medicine products, such as Perenterol, Iberogast, and Dulcolax, is experiencing significant growth due to rising consumer demand. This surge is largely driven by the increasing prevalence of gastrointestinal disorders globally. Conditions such as inflammatory bowel disease (IBD), constipation, irritable bowel syndrome (IBS), and gastroesophageal reflux disease (GERD) are becoming more common, further fueling the demand for these OTC solutions. As awareness of these conditions grows, the need for accessible, effective treatments is expected to drive market expansion throughout the forecast period. This trend offers substantial opportunities for businesses to tap into a thriving market sector.

A 2023 study by the National Center for Biotechnology and Information (NCBI) highlighted the significant global health burden of digestive diseases, with 88.99 million disability-adjusted life years (DALYs) lost due to these conditions in 2019. This disease ranked as the 13th leading cause of disability worldwide that year, with the middle socioeconomic quintile and regions such as South Asia being the most impacted. Notably, the burden was higher among males than females, with cirrhosis and other chronic liver diseases accounting for the largest share of DALYs. This rising global burden underscores the growing demand for intestinal remedies, particularly in regions with high incidence rates.

With a high volume of patient cases and visits to healthcare settings, the need for innovative, accessible, and effective intestinal health products is more pressing than ever. The industry is poised to see increased demand for remedies that address both common and chronic gastrointestinal conditions, providing a valuable market opportunity for companies offering solutions in this space. According to the CDC's annual estimates, digestive diseases are a significant healthcare burden, accounting for approximately 66.4 million visits to physicians’ offices, hospital emergency rooms, and outpatient departments annually. This staggering figure highlights the widespread need for effective treatment solutions for conditions affecting the digestive system.

Furthermore, the growth of the market is largely influenced by evolving dietary patterns, lifestyle changes, and the rising prevalence of processed foods. As consumers increasingly adopt convenience-oriented eating habits-such as dining out and opting for packaged products-the incidence of gastrointestinal disorders has also risen. This shift towards chemically processed ingredients and the consumption of quick meals has created a heightened demand for effective digestive health solutions. Consequently, the companies in this market have a unique opportunity to develop innovative products that cater to consumers seeking relief from intestinal issues. Thus, with a growing awareness of digestive health and the increasing prevalence of related disorders, the market is positioned for robust growth, making it an attractive avenue for investment and development.

Type Insights

The digestive medicines segment dominated the market and accounted for 51.98% of the global revenue in 2024. It is commonly used for the treatment of acid reflux, heartburn, stomach ulcer, and excess stomach acid. Peptic ulcer disease (PUD) is a significant health concern, impacting approximately four million individuals globally each year, as estimated by the National Institutes of Health (NIH) in 2022. The lifetime prevalence of PUD ranges from 5% to 10% within the general population, highlighting its relevance as a prevalent gastrointestinal disorder. The rising number of patients with these conditions is expected to drive demand for digestive medicines worldwide.

The remedies against gastrointestinal complaints segment is expected to register significant market growth during the forecast period owing to growing research and development in remedies against gastrointestinal complaints. The increasing prevalence of gastrointestinal (GI) disorders, coupled with a growing consumer preference for natural and holistic health solutions, presents a significant opportunity in the digestive and intestinal remedies market. Remedies targeting GI complaints not only address prevalent issues such as bloating, indigestion, and constipation but also cater to a more health-conscious demographic seeking effective, safe, and sustainable options.

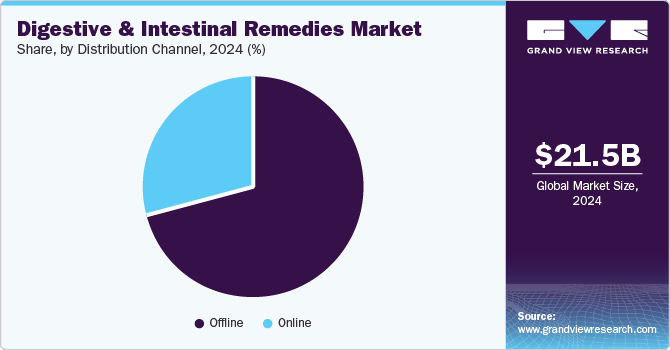

Distribution Channel Insights

The offline segment held a considerable market share in 2024 and is expected to grow at a CAGR of 4.11% over the forecast period. The demand for digestive and intestinal remedies is increasing as consumers prefer shopping in physical stores that focus on sustainability. People believe these stores are better at providing clear information about where products come from and offer more eco-friendly choices compared to online options. As a result, sales in brick-and-mortar stores are expected to grow significantly, which will have a positive impact on the overall market.

The online segment is projected to witness a significant growth rate over the forecast period. With more people gaining access to the internet, especially in developing regions, online shopping has become more accessible, driving demand for digestive remedies through e-commerce platforms. Consumers prefer the convenience of purchasing products online from the comfort of their homes. This is particularly appealing for products related to digestive health, which can sometimes carry a stigma, making people hesitant to purchase them in-store. Furthermore, Online platforms often offer a wider range of products compared to physical stores. Consumers can easily compare different brands, formulations, and prices, which can enhance their purchasing decisions.

Age Group Insights

Adult & geriatric segment dominated the market with a market share of 62.98% in 2024. According to a 2022 report from the United European Gastroenterology, digestive diseases impact over 300 million individuals in Europe and the Mediterranean region, leading to significant economic burdens. Notably, the incidence and prevalence of these conditions are most pronounced among both young children and the elderly. This growing prevalence of digestive disorders highlights a substantial opportunity within the segment.

The pediatric segment is projected to experience the fastest growth in the market during the forecast period. This can be attributed to the increase in the diagnosis of digestive issues among children, such as irritable bowel syndrome, constipation, and gastroesophageal reflux disease (GERD). This growing prevalence is driving demand for effective remedies. In addition, parents and healthcare providers are becoming more aware of digestive health issues in children, leading to greater demand for specialized treatments and remedies tailored to pediatric patients. Thus, this development positions the pediatric segment for rapid growth in the digestives & intestinal remedies market.

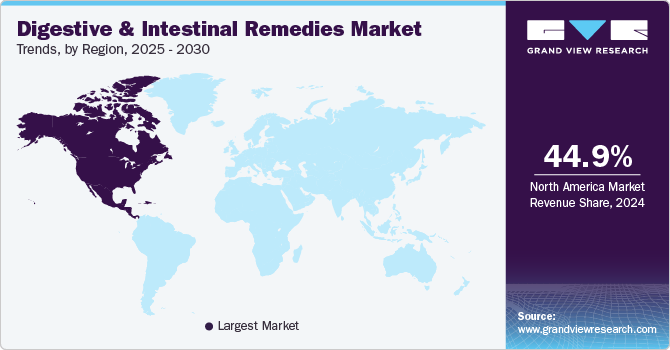

Regional Insights

The North America digestive & intestinal remedies market accounted for 44.92% share in 2024. This dominance is largely due to the high prevalence of gastrointestinal disorders, coupled with a robust healthcare infrastructure that promotes both natural and synthetic agents. The region benefits from advanced research initiatives and a strong emphasis on patient-centered care, which supports the development and adoption of innovative remedies against gastrointestinal complaints. However, challenges such as escalating healthcare costs and variations in insurance coverage may pose obstacles to market expansion.

U.S. Digestive & Intestinal Remedies Market Trends

The digestive & intestinal remedies market in the U.S. is anticipated to dominate North America in 2024, fueled by the rising incidence of gastrointestinal disorders among adults and pediatric populations is driving demand for both over-the-counter (OTC) and prescription-based treatments. The increasing utilization of telemedicine and online platforms for consultations is enhancing patient access to remedies, although disparities in healthcare access and educational gaps among providers regarding new treatment options remain critical challenges.

Europe Digestive & Intestinal Remedies Market Trends

Europe digestive & intestinal remedies market was identified as a lucrative region in this industry. Growth is fueled by heightened awareness and improved diagnosis rates for gastrointestinal disorders. The region is experiencing an increase in clinical trials for novel treatments and the growing popularity of combination therapies, which are known to enhance efficacy. In addition, favorable regulatory frameworks for new medications and better patient access to these remedies are contributing to market growth.

The digestive & intestinal remedies market in UK holds a significant share of the Europe digestive & intestinal remedies market, driven by advancements in treatment technologies, including innovative systemic therapies and enhanced formulations. Increased patient access to both offline and online healthcare services, along with educational campaigns aimed at improving treatment adherence, is yielding positive results for individuals suffering from digestive complaints.

The digestive & intestinal remedies market Germany is anticipated to exhibit strong growth within Europe in 2024, fueled by a rising incidence of chronic gastrointestinal disorders that require effective management. The demand for both natural and synthetic agents is increasing, particularly for products that offer relief from symptoms associated with these conditions.

The digestive & intestinal remedies market in France is poised for expansion, supported by government-led public health initiatives that aim to raise awareness of gastrointestinal health. Furthermore, enhanced reimbursement frameworks for innovative treatments and a push for improved care within primary healthcare settings are expected to stimulate growth in the sector.

Asia Pacific Digestive & Intestinal Remedies Market Trends

The Asia Pacific digestive & intestinal remedies market is expected to experience the fastest growth globally. This growth is driven by the increasing prevalence of gastrointestinal complaints, a growing middle class with rising disposable incomes, and heightened awareness of digestive health. The adoption of advanced therapies and a surge in both offline and online health resources are pivotal in propelling this market segment forward.

The digestive & intestinal remedies market in China held a notable revenue share in 2024. This dominance of supported by a rising focus on digestive and intestinal disease treatments. The government’s initiatives to improve healthcare access and investment in research and development are expected to stimulate market growth further.

The digestive & intestinal remedies market in Japan continues to maintain a significant revenue share in 2024, driven by advancements in personalized medicine and innovative therapeutic agents for intestinal issues. The emphasis on patient education and adherence to treatment regimens is fostering improved management of digestive disorders among both adults and children.

Latin America Digestive & Intestinal Remedies Market Trends

Latin America digestive & intestinal remedies market is recognized as a growing region for digestive medicines and remedies due to rising investments in gastrointestinal research and growing patient awareness of available treatments. The market is benefitting from increased disposable incomes and a greater focus on healthcare, facilitating the introduction of effective remedies targeting diverse demographics.

The digestive & intestinal remedies market in Brazil is driven by an expanding network of healthcare facilities and pharmacies. In addition, increased access to innovative treatment options for gastrointestinal complaints, particularly among pediatric patients, is propelling growth in this region.

MEA Digestive & Intestinal Remedies Market Trends

The MEA digestive & intestinal remedies market is expected to grow due to increased government investments in healthcare and improved access to treatments. In addition, rising awareness of gastrointestinal disorders is boosting demand for effective medicines and remedies, with a particular focus on both safety and efficacy.

The digestive & intestinal remedies market in Saudi Arabia is projected to be one of the fastest-growing markets in the MEA region in the coming years. This growth can be attributed to a growing population and heightened healthcare expenditure. Efforts to improve chronic disease management and patient education initiatives are supporting market development. As the healthcare system evolves, the accessibility of modern remedies for gastrointestinal complaints is expected to improve significantly in Saudi Arabia.

Key Digestive & Intestinal Remedies Company Insights

Some of the key players in the market include Bayer AG, Johnson & Johnson Services Inc., GSK plc, Procter & Gamble, Sanofi, Boehringer Ingelheim GmbH, Reckitt Benckiser Group PLC, Abbott, Takeda Pharmaceutical Company Limited, and Menarini Group. These companies are implementing various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to address the unmet needs of their customers.

Key Digestive & Intestinal Remedies Companies:

The following are the leading companies in the digestive & intestinal remedies market. These companies collectively hold the largest market share and dictate industry trends.

- Bayer AG

- Johnson & Johnson Services Inc.

- GSK plc.

- Procter & Gamble

- Sanofi

- Boehringer Ingelheim GmbH

- Reckitt Benckiser Group PLC

- Abbott

- Takeda Pharmaceutical Company Limited

- Menarini Group

Recent Developments

-

In August 2024, the U.S. FDA approved VOQUEZNA (vonoprazan) developed by Phathom Pharmaceuticals, for the treatment of heartburn related to non-erosive gastroesophageal reflux disease (Non-Erosive GERD) in adults. This approval is expected to boost market growth.

-

In April 2024, Bayer AG introduced Iberogast, is a plant-based digestive relief solution now available in the U.S. This product features a unique blend of six clinically proven herbs designed to harness the benefits of nature. Iberogast offers dual-action support, effectively alleviating occasional digestive discomfort while promoting overall digestive health.

-

In October 2024, Dulcolax, the laxative brand from Sanofi, launched a new campaign aimed at prioritizing digestive health. The Pooping Princesses initiative seeks to challenge the stigma surrounding constipation, particularly among women. The launch of Dulcolax’s Pooping Princesses campaign is likely to have a significant impact on the Digestive & Intestinal Remedies Market.

Digestive & Intestinal Remedies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.37 billion

Revenue forecast in 2030

USD 27.54 billion

Growth rate

CAGR of 4.25% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, age group, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Bayer AG; Johnson & Johnson Services Inc; GSK plc; Procter & Gamble; Sanofi; Boehringer Ingelheim GmbH; Reckitt Benckiser Group PLC; Abbott; Takeda Pharmaceutical Company Limited; Menarini Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

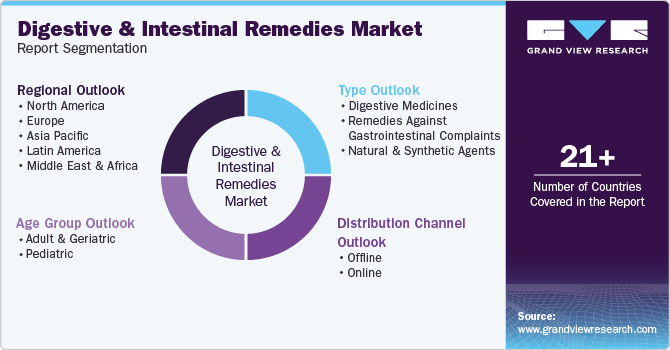

Global Digestives & Intestinal Remedies Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digestive & intestinal remedies market report based on type, age group, distribution channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Digestive Medicines

-

Remedies Against Gastrointestinal Complaints

-

Natural and Synthetic Agents

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult & Geriatric

-

Pediatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global digestives & intestinal remedies market size was estimated at USD 21.50 billion in 2024 and is expected to reach USD 22.37 billion in 2025.

b. The global digestives & intestinal remedies market is expected to grow at a compound annual growth rate of 4.25% from 2025 to 2030 to reach USD 27.54 billion by 2030.

b. North America dominated the digestives & intestinal remedies market with a share of 44.92% in 2024. This is attributable to higher obese population, awareness about the over the counter medicine, and strong presence and distribution network of the key players.

b. Some key players operating in the digestives & intestinal remedies market include Bayer Healthcare; Johnson & Johnson; GlaxoSmithKline Plc; Procter & Gamble Co; Sanofi; Boehringer Ingelheim GmbH; Reckitt Benckiser; Group Plc (RB); Abbott Laboratories Inc.; Takeda Pharmaceutical Co Ltd; and Menarini Group.

b. Key factors that are driving the digestives & intestinal remedies market growth include increasing sedentary lifestyle, rising eating out trend and increasing consumption of fast food.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."