- Home

- »

- Next Generation Technologies

- »

-

Digital Banking Platform Market Size, Industry Report, 2033GVR Report cover

![Digital Banking Platform Market Size, Share & Trends Report]()

Digital Banking Platform Market (2026 - 2033) Size, Share & Trends Analysis Report By Deployment (On-premise, Cloud), By Mode (Online Banking, Mobile Banking), By Component, By Service, By Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-969-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Banking Platform Market Summary

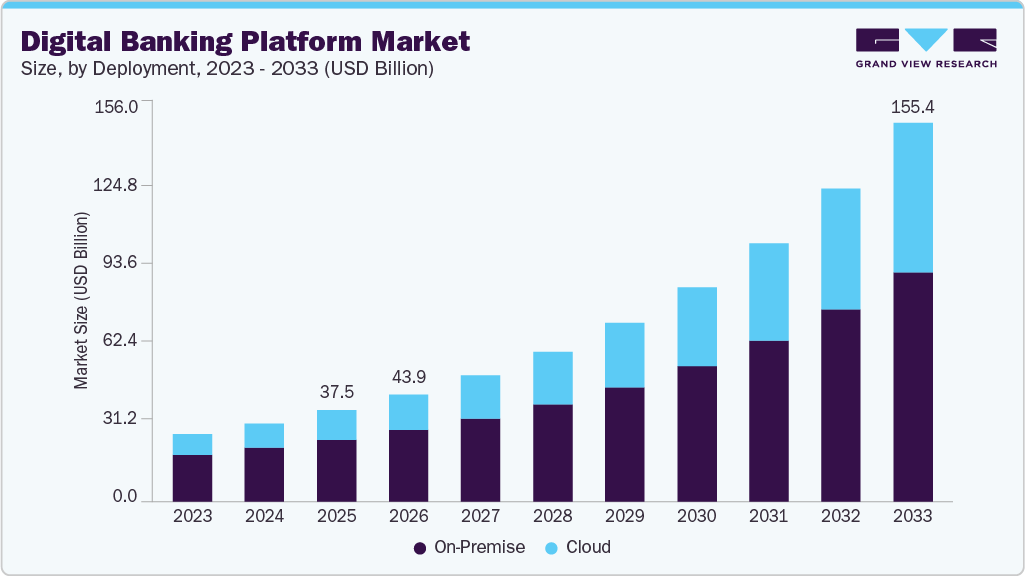

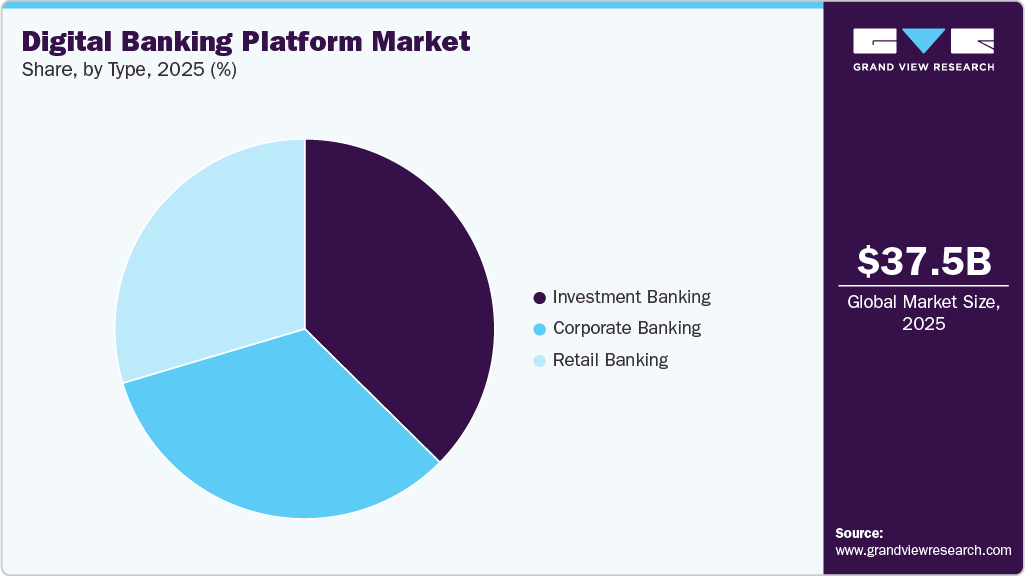

The global digital banking platform market size was estimated at USD 37.49 billion in 2025 and is projected to reach USD 155.44 billion by 2033, growing at a CAGR of 19.8% from 2026 to 2033. The demand for digital banking is growing because of the increased penetration of smartphones, computers, internet connectivity, IoT devices, and Artificial Intelligence (AI).

Key Market Trends & Insights

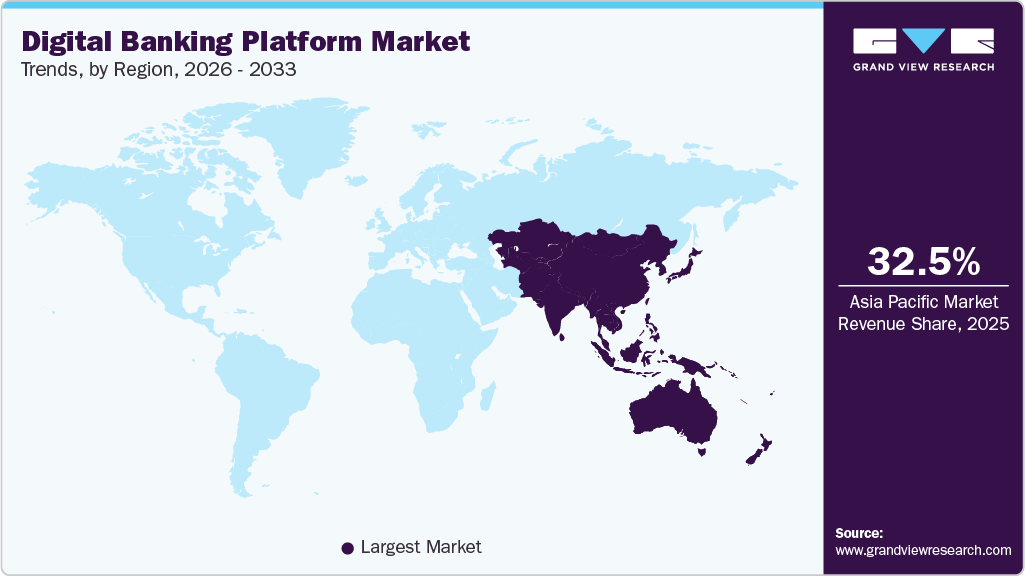

- Asia Pacific dominated the global digital banking platform market with the largest revenue share of 32.5% in 2025.

- The digital banking platform market in India is expected to grow at the fastest CAGR during the forecast period.

- By deployment, the on-premise charging segment led the market with the largest revenue share of 67.5% in 2025.

- By mode, the online banking segment accounted for the largest market revenue share in 2025.

- By component, the platforms segment accounted for the largest market revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 37.49 Billion

- 2033 Projected Market Size: USD 155.44 Billion

- CAGR (2026-2033): 19.8%

- Asia Pacific: Largest market in 2025

The digital banking platform industry has been driven by the accelerating demand for seamless, real-time financial services and the increasing adoption of digital channels among consumers and enterprises. The shift toward mobile and online banking has been fueled by changing customer expectations for convenience, personalization, and 24/7 accessibility. Financial institutions have been compelled to digitize their operations to improve customer engagement, operational efficiency, and cost-effectiveness. The widespread use of smartphones, higher internet penetration, and growing fintech collaboration have further strengthened the adoption of digital banking platforms across both developed and emerging economies.The incorporation of AI and machine learning (ML) has transformed digital banking platforms into intelligent, data-driven systems capable of understanding customer behavior and anticipating financial needs. AI is being used to automate customer support through chatbots and virtual assistants, while ML algorithms enable personalized product recommendations, credit scoring, and fraud detection. Predictive analytics powered by AI allows banks to proactively address customer issues, optimize risk management, and improve decision-making. This trend has significantly enhanced operational efficiency and customer satisfaction while reducing manual intervention and errors, positioning AI as a cornerstone of next-generation digital banking platforms.

The shift toward cloud-based infrastructure has been a defining trend in the digital banking platform industry, offering scalability, flexibility, and cost optimization for financial institutions. Cloud deployment allows banks to modernize their core systems, accelerate digital transformation, and quickly roll out new digital services. In addition, cloud-native platforms enable better data management, enhanced disaster recovery, and real-time analytics capabilities. The adoption of hybrid and multi-cloud strategies has also allowed financial institutions to balance regulatory compliance with operational efficiency. Digital banks and fintechs continue to emerge, making cloud-based platforms the preferred choice for innovation and rapid scalability in the competitive banking landscape.

Despite strong growth prospects, the digital banking platform industry has faced several challenges that have limited adoption in certain regions. High implementation costs and complex integration with legacy core banking systems have slowed digital transformation among traditional banks. Cybersecurity risks, including phishing and ransomware attacks, have posed ongoing threats to data integrity and customer trust. In emerging economies, limited digital literacy and inadequate infrastructure have also hindered the seamless deployment of digital banking platforms.

Deployment Insights

The on-premise charging segment led the market with the largest revenue share of 67.5%.The on-premise model is favored by many users and it is safer than using cloud software. In addition, security and IT staff have direct access to the software as it is installed and used exclusively within the user's network. There is complete control by the staff over its configuration, management, and security.

The cloud segment is expected to grow at the fastest CAGR over the forecast period. Banks and financial institutions are increasingly adopting cloud-based solutions to achieve greater scalability and flexibility, allowing them to quickly adjust computing resources in response to fluctuating customer demands and transaction volumes. Cost optimization remains a significant incentive, as cloud deployment reduces the need for heavy upfront investments in IT infrastructure and lowers ongoing maintenance expenses. The shift toward cloud is also driven by the pursuit of operational efficiency and faster time-to-market, enabling banks to roll out new digital services and innovations more rapidly.

Mode Insights

The online banking segment accounted for the largest market revenue share in 2025. The online banking segment is driven by the rapid digital transformation of traditional banking services and the increasing demand for convenient, anytime access to financial services through web browsers. Customers, especially businesses and digitally savvy users favor online banking for its comprehensive service offerings, such as detailed account management, fund transfers, loan applications, and investment tracking, all accessible from desktops or laptops. The push from financial institutions to reduce operational costs associated with branch networks and paper-based processes further accelerates the shift to online platforms.

The mobile banking segment is expected to grow at the fastest CAGR of 25.6% during the forecast period. The mobile banking segment’s growth is being propelled by the widespread adoption of smartphones and improving mobile internet connectivity, which together enable users to conduct banking activities on the go. Rising expectations for instant, frictionless experiences have pushed banks to innovate mobile-first features such as biometric login, real-time alerts, digital wallets, peer-to-peer payments, and AI-powered personal financial management tools. Younger demographics, in particular, prefer mobile interactions over traditional channels, driving banks to invest heavily in app capabilities to boost engagement and retention.

Component Insights

The platforms segment accounted for the largest market revenue share in 2025.The platform component of the digital banking market is driven by the growing need for core digital infrastructure that enables banks to transform traditional legacy systems into agile, scalable environments. Financial institutions are increasingly prioritizing end-to-end digitalization, and robust digital banking platforms serve as the foundation for integrating omnichannel services, customer data management, and real-time processing capabilities. The demand for modular and API-enabled platforms supports faster innovation, seamless third-party integrations, and open banking compliance, allowing banks to expand their ecosystem and deliver personalized offerings.

The services segment is expected to grow at the fastest CAGR during the forecast period. The services component of the digital banking platform industry is fueled by the increasing need for consulting, implementation, customization, and managed services that help financial institutions extract value from technology investments. As banks adopt digital platforms, they require support in system integration, data migration, change management, and optimization to ensure seamless deployment and user adoption. The complexity of digital transformation projects, coupled with a shortage of in-house expertise in emerging technologies, has driven demand for external specialists who can accelerate time-to-value and de-risk implementations.

Service Insights

The professional service segment accounted for the largest market revenue share in 2025. The professional services segment is driven by financial institutions’ need for expert guidance and specialized skills to successfully plan, design, and implement digital banking platforms. As banks pursue complex digital transformation initiatives, they increasingly rely on professional services, including strategy consulting, system integration, custom development, and change management to bridge gaps in internal expertise. These services help accelerate project execution and ensure smooth implementation of digital banking solutions.

The managed service segment is expected to witness at the fastest CAGR over the forecast period. The managed services segment is propelled by the ongoing need for banks to outsource the operation, monitoring, maintenance, and continuous improvement of their digital banking platforms to third-party experts. With the increasing complexity of digital ecosystems and the imperative to ensure high uptime, performance, and security, many financial institutions prefer managed services that provide cost-effective, scalable support while freeing internal teams to focus on core business priorities. The rise of cloud adoption and hybrid IT environments has further amplified demand for managed services, as institutions seek partners capable of handling infrastructure management, patching, compliance reporting, and proactive threat detection across distributed systems.

Type Insights

The investment banking segment accounted for the largest market revenue share in 2025. The growth of the segment is driven by the need for sophisticated digital tools and automation that support complex financial activities such as trading, capital markets operations, portfolio management, and risk analytics. Investment banks are increasingly adopting digital platforms to enhance data-driven decision-making, leverage AI and advanced analytics, and improve operational efficiency in areas like algorithmic trading, compliance reporting, and deal execution. The rising demand for real-time insights, secure transaction processing, and seamless connectivity with global markets has accelerated digital transformation in this segment, enabling firms to innovate while managing regulatory pressures and market volatility.

The retail banking segment is expected to witness at the fastest CAGR over the forecast period. The retail banking segment’s growth is driven by widespread consumer demand for convenient, personalized, and accessible banking services. Retail customers increasingly expect seamless digital experiences across channels, such as instant payments, digital wallets, loan origination, and personalized financial management features, prompting banks to invest heavily in robust digital platforms. Enhanced smartphone penetration, mobile internet adoption, and supportive government initiatives promoting financial inclusion further accelerate digital uptake among individuals.

Regional Insights

The digital banking platform market in North America is expected to grow at a moderate CAGR during the forecast period. The regions market growth is driven by mature banking infrastructure, high customer expectations for frictionless digital experiences, and growing investments in cloud modernization.

U.S. Digital Banking Platform Market Trends

The digital banking platform market in the U.S. accounted for the largest market revenue share in North America in 2025.The U.S. market leads the region in adopting advanced digital banking platforms, driven by competitive pressures from fintech disruptors, neo-banks, and big-tech firms entering financial services.

Asia Pacific Digital Banking Platform Market Trends

Asia Pacific dominated the digital banking platform market with the largest revenue share of 32.5% in 2025. Asia Pacific market is set for unprecedented expansion. New digital firms are radically changing the sector and revolutionizing banking for both individuals and businesses as demand for mobile and online alternatives increases. There is an exceptional potential for both existing players and new entrants to participate as regulators raise license allocations and define standards for a new age of banking.

The digital banking platform market in India is expected to grow at the fastest CAGR during the forecast period. The country’s growth is fueled by the its growing digital population and the success of initiatives such as UPI, Aadhaar-enabled services, and the Digital India program.

The China digital banking platform market held a significant market share in 2025. China remains one of the world’s most advanced digital banking markets, supported by the dominance of digital financial ecosystems. High levels of mobile payment adoption and rapid innovation in digital wealth management, micro-lending, and insurance technology are fueling continuous market expansion.

Europe Digital Banking Platform Market Trends

The digital banking platform market in Europe is expected to register at a moderate CAGR from 2026 to 2033. Europe’s market is shaped by strong regulatory frameworks such as PSD2 and open banking, which require banks to adopt API-driven architectures and enhance data-sharing capabilities. The region has a robust digital adoption rate, with customers expecting seamless digital services across retail and corporate banking.

The UK digital banking platform market is expected to grow at a significant CAGR during the forecast period. The UK is one of Europe’s most advanced digital banking markets, propelled by an active fintech ecosystem and early adoption of open banking. Furthermore, the UK banking sector is leveraging AI, automation, and real-time analytics to enhance customer experience and operational efficiency.

The digital banking platform market in Germany held a substantial market share in Europe in 2025, due to increasing demand for secure and efficient digital financial services. While consumer adoption has historically been more conservative, the shift toward cashless payments and digital interactions has accelerated significantly in recent years.

Key Digital Banking Platform Company Insights

Some of the key companies in the digital banking platform industry include Temenos AG, Fiserv, Inc., and Finastra, among others. These companies are focusing on developing cloud-native, AI-driven, and API-integrated platforms to provide banks with scalable and flexible digital infrastructures. Strategic collaborations between banks, fintech firms, and technology providers are being actively pursued to accelerate innovation and reduce time-to-market for new digital services.

-

Temenos AG is one of the major players in the digital banking platform industry, recognized for its robust core banking and front-office solutions tailored to support digital transformation across financial institutions. The company’s flagship product, Temenos Infinity, offers an open, cloud-native, and API-driven platform that enables banks to deliver seamless, personalized digital experiences to their customers.

-

Fiserv, Inc. is a prominent U.S.-based financial technology company that plays a critical role in advancing digital banking capabilities for financial institutions worldwide. The company offers a comprehensive suite of digital banking solutions, including online and mobile banking, payments, and core account processing. Fiserv’s platform focuses on integrating advanced data analytics, real-time payment processing, and enhanced cybersecurity to deliver secure and efficient customer experiences.

Key Digital Banking Platform Companies:

The following are the leading companies in the digital banking platform market. These companies collectively hold the largest market share and dictate industry trends.

- Fiserv, Inc.

- Temenos

- Finacle

- Backbase

- Alkami Technology Inc.

- Finastra

- Crealogix AG

- Q2 Software, Inc.

- SBS

- Tata Consultancy Services

Recent Developments

-

In May 2025, Capital Bank, N.A. unveiled a new digital banking platform powered by Q2, a prominent provider of digital transformation solutions for financial institutions. This enhancement provides business customers with a secure, modernized banking experience, marking a significant milestone in the bank’s ongoing digital transformation.

-

In July 2025, IndusInd Bank introduced ‘INDIE for Business’, a digital platform aimed at empowering MSMEs through a comprehensive suite of banking solutions. Targeting over 60 million enterprises, the platform provides integrated tools for payments, loans, collections, and account management. It streamlines financial operations with digital onboarding and real-time tracking features, enabling greater operational flexibility and ensuring secure, efficient transactions.

Digital Banking Platform Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 43.98 billion

Revenue forecast in 2033

USD 155.44 billion

Growth rate

CAGR of 19.8% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, mode, component, service, type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Fiserv, Inc.; Temenos; Finacle; Backbase; Alkami Technology Inc.; Finastra; Crealogix AG; Q2 Software, Inc.; SBS; Tata Consultancy Service

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Banking Platform Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global digital banking platform market report based on deployment, mode, component, service, type, and region:

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premise

-

Cloud

-

-

Mode Outlook (Revenue, USD Million, 2021 - 2033)

-

Online Banking

-

Mobile Banking

-

-

Component Outlook (Revenue, USD Million, 2021 - 2033)

-

Platforms

-

Service

-

-

Service Outlook (Revenue, USD Million, 2021 - 2033)

-

Professional Service

-

Managed Service

-

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Retail Banking

-

Corporate Banking

-

Investment Banking

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital banking platform market size was estimated at USD 37.49 billion in 2025 and is expected to reach USD 43.98 billion in 2026.

b. The global digital banking platform market is expected to grow at a compound annual growth rate of 19.8% from 2026 to 2033 to reach USD 155.44 billion by 2033.

b. Asia Pacific dominated the digital banking platform industry and accounted for a share of 32.5% in 2025. The Asia Pacific is expected to maintain its dominance in the coming years, as the region is home to some of the world's largest digital banking software providers.

b. Some of the key player operating in the digital banking platform market includes Fiserv, Inc., Temenos, Finacle, Backbase, Alkami Technology Inc., Finastra, Crealogix AG, Q2 Software, Inc., SBS, Tata Consultancy Service

b. The key factors driving the demand for the digital banking platform market include rising demand for smart mobile devices, shift from traditional to digital channels, and an increase in Machine Learning (ML) and Artificial Intelligence (AI) applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.