- Home

- »

- Display Technologies

- »

-

Digital Signage Market Size & Share, Industry Report, 2030GVR Report cover

![Digital Signage Market Size, Share & Trends Report]()

Digital Signage Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Component (Solution, Services, Software), By Technology (LCD, OLED), By Screen Size, By Resolution, By Content Category, By Application, By Location, And Segment Forecasts

- Report ID: 978-1-68038-157-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Digital Signage Market Summary

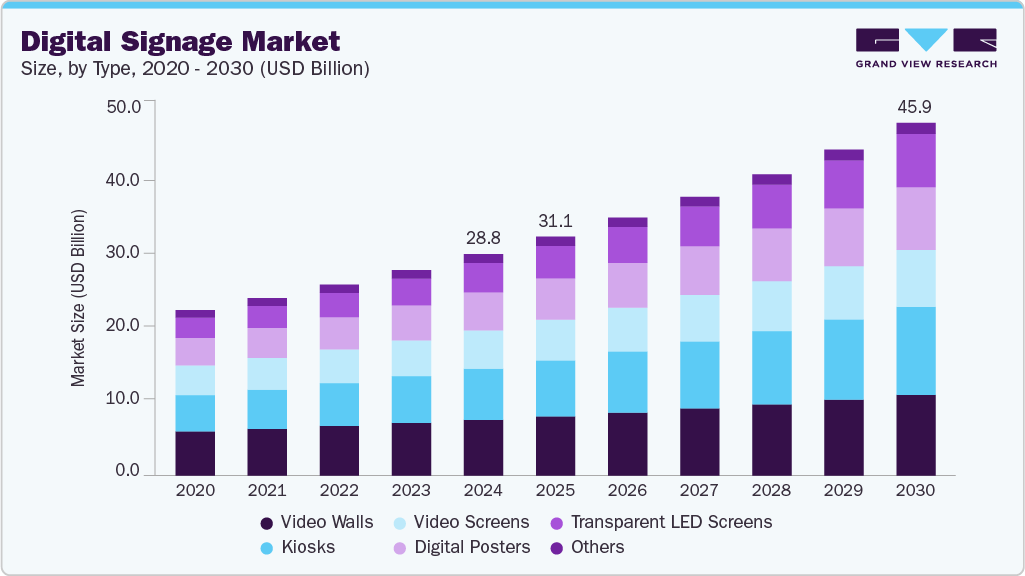

The global digital signage market size was estimated at USD 28.83 billion in 2024 and is projected to reach USD 45.94 billion by 2030, growing at a CAGR of 8.1% from 2025 to 2030. This market growth is attributed to the increasing demand for the digitized promotion of products and services to attract the attention of the target audience effectively.

Key Market Trends & Insights

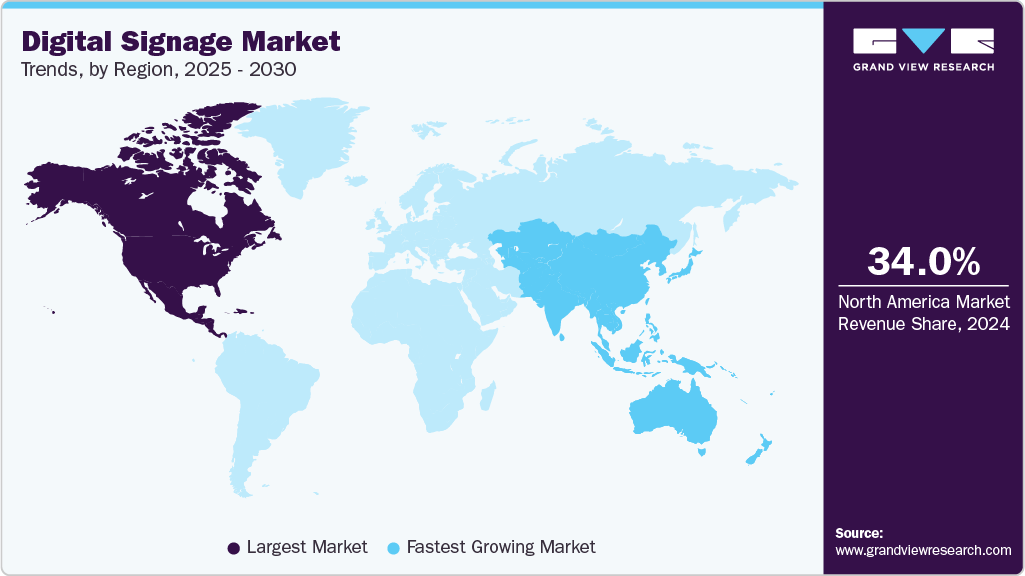

- North America dominated the digital signage market with a market share of over 34.0% in 2024.

- The U.S. digital signage market is projected to grow during the forecast period.

- By type, the video walls segment dominated the digital signage market with a revenue share of over 25.0% in 2024.

- By resolution, the 4K segment dominated the digital signage market with a revenue share of over 40.0% in 2024.

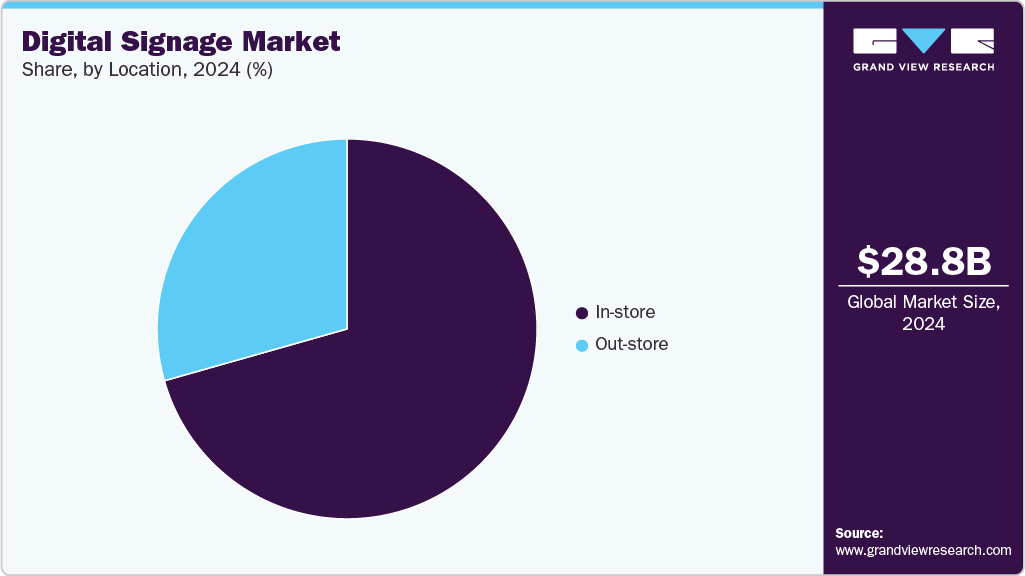

- By location, the in-store segment dominated the digital signage market with a revenue share of over 70.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 28.83 Billion

- 2030 Projected Market Size: USD 45.94 Billion

- CAGR (2025-2030): 8.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, the demand for 4K digitized sign displays (digital signage displays) with embedded software and media players is rising as it offers customers an affordable Ultra HD digital signage solution, which is also expected to drive the demand. The evolution of innovative products, such as home monitoring systems, leak detector systems, and so on, along with complicated monetary products, such as forex cards, that need informative and succinct advertisement content, are some of the factors that are predicted to drive the product demand.Moreover, there is a rising demand for adopting advanced products that require digitized information management and guidance that can be accessed from remote locations. This is one of the key drivers anticipated to drive the global industry during the forecast period. Digital signage boards offer the necessary quality information to a large number of viewers by utilizing large display screens across the location with a concentrated target audience. With digital signage display technology, information is provided in a digitized format that includes motion and pictures to attract customers with more impact as compared to the traditional modes of reaching out to customers. In addition, the integration of biometric technology with modern digitized signs has developed products, such as track heat paths and gaze tracking.

Gaze tracking technology helps in locating the area, which is crowded with a greater number of consumers, thereby helping the companies to track consumer behavior for effective marketing of products. Thus, the growing use of the technology above is expected to strengthen the demand in the next few years. Eventually, the growing awareness among consumers regarding the drawbacks and complexity of traditional advertising, such as short-lived print marketing and so on, is instigating digitized advertisement adoption. Furthermore, display designers, researchers, and advertisement companies are spending more on the improvement of the product's display technology.

All these factors are expected to catalyze the overall industry growth. With the advancement in display technologies, the evolution of LCD, LED, UHD, OLED, and Super AMOLED is further strengthening the industry's growth. These technologies have led to the enhancement of the quality of advertisement content, thus creating a favorable impact on the target audience. The adoption of such technologies by digital poster providers is anticipated to boost overall industry growth. However, factors such as software & hardware compatibility, electrical interface, and connectivity are some prevailing issues that may hinder market growth. Moreover, the complex taxations levied upon the erection of digitized signs and screens, coupled with the regulatory processes, such as licensing, are projected to hamper the growth.

Type Insights

The video walls segment dominated the digital signage market with a revenue share of over 25.0% in 2024.Increasing deployment of video walls in public spaces and transportation hubs. Airports, train stations, and bus terminals are installing video walls to provide travelers with real-time information, advertisements, and entertainment. These large-format displays are highly effective for displaying schedules, wayfinding information, and emergency alerts, ensuring that critical messages are delivered clearly and efficiently to large audiences. Additionally, video walls are widely used in sports arenas and entertainment venues, where they enhance the overall spectator experience by offering high-definition replays, live feeds, and interactive content.

The transparent LED screens segment is projected to grow at a significant CAGR from 2025 to 2030. Transparent LED screens are capable of offering a transparency level beyond 80%, coupled with high resolution. In addition, they are adequately efficient in terms of energy, thus reducing energy consumption and optimizing the overhead expenditure of users. All these factors are anticipated to catapult the demand for transparent LED screens in the next six years, thereby supporting the growth of the segment.

Component Insights

The hardware segment dominated the digital signage market in 2024. Hardware components consist of displays, components required to manufacture a digital panel, banners, and so on. Compared to software, the hardware requirement is huge, and thus, the segment accounts for a large share of the industry. The growing number of innovative display technologies, such as 1080p, 4K, and 8K displays, is expected to propel the demand for hardware components in the coming years. Advancement in 3D technology have developed glasses-free 3D displays. Such displays are used in the product.

The software segment is projected to grow at a significant CAGR from 2025 to 2030. The growth of omnichannel marketing strategies has also driven demand for comprehensive digital signage software solutions. Brands are increasingly looking for ways to create a seamless and integrated experience across physical and digital channels. Digital signage software acts as a crucial tool in ensuring that messaging is consistent and synchronized with other marketing efforts, whether they are online, on mobile apps, or in-store. The ability to manage and deploy content that aligns with digital and social media campaigns helps create a unified brand identity, improving brand recall and enhancing customer loyalty.

Technology Insights

The LCD segment dominated the digital signage market in 2024. LCD technology is one of the most extensively adopted technologies in the advertisement & marketing industry. The ease of producing LCDs and their lower manufacturing costs are a few factors behind the significant adoption of LCD technology in digital posters. However, LEDs have successfully made a mark as a standard product with their high-quality display. Manufacturers remain aspirant in the designing of flat-panel, larger, brighter, and slimmer displays.

The OLED segment is projected to be the fastest-growing segment from 2025 to 2030. Growing focus on enhancing in-store experiences drives segment growth. OLED displays are particularly effective because of their superior visual quality, making them highly engaging. Retailers and luxury brands use OLED screens to create unique, eye-catching advertisements and product showcases that cater to customers and provide a more interactive shopping experience. These displays can be used for everything from displaying high-definition product images and videos to interactive touch interfaces that guide customers through product information or allow them to customize their shopping experience. According to Electro IQ, in 2023, the sales of consumer electronics featuring OLED reached 900 million units, a 15% rise from the 780 million units sold in 2022.

Screen Size Insights

The 32 to 52 inches segment dominated the digital signage market in 2024. The rise of interactive and self-service solutions is a key driver for adopting the digital signage market's 32 to 52 inches’ segment. As customers seek faster and more convenient ways to interact with services, businesses are implementing digital displays that can double as interactive kiosks for self-service ordering, information retrieval, and customer feedback. In sectors such as hospitality, transport, and public services, 32 to 52 inches screens are used to streamline check-ins, provide real-time travel information, and facilitate ticketing processes, thereby improving operational efficiency and reducing wait times.

The more than 52 inches segment is projected to be the fastest-growing segment from 2025 to 2030. The demand for larger digital signage is also driven by the adoption of innovative marketing strategies focusing on visual storytelling and experiential marketing. Large-format displays, which fall into the category of more than 52 inches, allow businesses to use high-resolution video, eye-catching graphics, and interactive content that engages viewers and encourages them to interact with the brand. This has led to a surge in investment by companies that want to stand out in a crowded market and deliver powerful, impactful messaging. According to OMDIA, in 2023, the shipment of the 65-inch size was 2.5 million units, marking a 20% YoY growth. The shipment of the 75-inch, 85-inch, and 98-inch sizes achieved a YoY growth of 33%, 155%, and 48%, respectively.

Resolution Insights

The 4K segment dominated the digital signage market with a revenue share of over 40.0% in 2024. The availability of 4K video cameras, production tools, and content management systems has made it easier for businesses to create high-quality, 4 K-compatible media. This trend is important as companies can leverage more visually engaging content tailored for 4K displays without facing significant production barriers. Industries that rely heavily on visual presentations, such as retail, entertainment, and hospitality, have quickly adopted 4K technology to offer richer, more impactful advertising and customer experiences. Similarly, in the hospitality industry, 4K displays can be used for virtual tours of hotels, interactive restaurant menus, and high-quality video marketing that enhances the appeal of accommodations and services.

The 8K segment is projected to be the fastest-growing segment from 2025 to 2030. The use of 8K displays in digital signage provides realistic and immersive graphics, making them suitable for applications such as video walls, shop displays, and digital signage. The high resolution of 8K displays enables more detail and clarity, which can be impactful for advertising and promotional content.

Content Category Insights

The non-broadcast segment dominated the digital signage market in 2024. Non-broadcast digital signage is increasingly adopted in the corporate sector to enhance internal communication and employee engagement. Offices use these systems for various purposes, including displaying announcements, sharing company updates, showcasing key performance indicators, and even recognizing employee achievements. By replacing static bulletin boards with dynamic, visually engaging displays, organizations improve the dissemination of information and encourage a more connected workforce. Additionally, integrating real-time data into non-broadcast signage ensures employees receive relevant and timely updates.

The broadcast segment is projected to be the fastest-growing segment from 2025 to 2030. The rise of programmatic advertising drives market growth. Digital signage networks support programmatic platforms, enabling advertisers to purchase and deploy targeted campaigns more efficiently. Programmatic systems deliver highly specific messages that resonate with viewers by leveraging data such as location, time of day, and audience demographics. This level of precision reduces ad wastage and increases ROI for advertisers. Programmatic advertising opens new revenue streams for broadcasters and digital signage operators, as campaigns can be dynamically adjusted and optimized in real-time. The growing popularity of this model aligns with the broader digital transformation trends in the advertising industry, further fueling the adoption of broadcast digital signage.

Application Insights

The retail segment dominated the digital signage market in 2024. The retail sector is the most prominent, demanding digitized advertisements for marketing and promoting products and services. The competition among retailers, owing to the variety of product offerings in the industry, has led to the growing awareness of effective marketing strategies. Thus, digital posters are adopted largely in the retail sector as digitized advertising is an effective way of marketing a product, which attracts the attention of target consumers.

The healthcare segment is projected to be the fastest-growing segment from 2025 to 2030. The integration of interactive digital signage has driven growth within the healthcare market. Interactive kiosks and touch-screen displays allow patients and visitors to access information, find directions, schedule appointments, and even complete basic administrative tasks on their own. This self-service capability helps reduce wait times, allows better time management, and enhances the patient experience. Interactive kiosks are used to gather patient feedback in real-time, providing healthcare facilities with valuable insights that are used to improve services and care quality.

Location Insights

The in-store segment dominated the digital signage market with a revenue share of over 70.0% in 2024. The in-store locations include the deployment of digital posters within closed premises, such as malls, corporate offices, retail shops, banks, and healthcare centers. The high share of this segment can be attributed to the heavy demand from retail stores, as the retail sector is the most promising application sector for digital displays for advertisement purposes. The segment is also predicted to maintain its position in the global market and exhibit a steady growth rate over the forecast period due to consistent demand.

The out-store segment is projected to be the fastest-growing segment from 2025 to 2030. The demand at out-store locations is expected to rise owing to the growing transportation sector, especially in developing countries. In addition, the rising need to promote products effectively and on a large scale and emerging popular trends, such as election campaigns, introductory offers on products & services, and the increasing number of live concerts & shows, are likely to boost the adoption of digital posters in open premises, thereby augmenting the out-store segment growth.

Regional Insights

North America dominated the digital signage market with a market share of over 34.0% in 2024. The high share is attributed to the growing presence of dedicated suppliers of the product, along with rising demand for signage in the retail industry. The U.S., in particular, is projected to exhibit considerable growth primarily due to the rising R&D activities by companies to enhance product quality and increasing government initiatives to install digital signage at various offices for maintaining continuous information flow systems.

U.S. Digital Signage Market Trends

The U.S. digital signage market is projected to grow during the forecast period. The U.S. is experiencing strong adoption of digital signage in corporate and institutional environments. Organizations are using digital displays to communicate with employees, manage visitor check-ins, and share performance metrics or safety alerts in real-time. Educational campuses are deploying digital signage to relay event information, emergency announcements, and wayfinding guidance. HD facilities, meanwhile, rely on digital signage to enhance patient experiences, provide queue management, and support telehealth messaging. These applications highlight the versatility of digital signage and its value in delivering timely, relevant content across both public and private spaces.

Europe Digital Signage Market Trends

The digital signage market in Europe is expected to grow during the forecast period. The European digital signage market benefits from adopting interactive kiosks as part of broader efforts to enhance customer service and streamline business operations. These kiosks can be integrated with loyalty programs, enabling businesses to offer targeted promotions and personalized discounts that appeal to individual customers. The 2023 Square Future of Restaurants Report reveals that 79% of consumers believe kiosks simplify ordering.

Additionally, 44% appreciate kiosks enabling them to browse the menu at their own pace, while 38% value the ease with which kiosks allow them to search for their favorite menu items. This ability to tailor marketing efforts to specific audiences ensures higher engagement rates and encourages repeat business. Moreover, in the hospitality industry, interactive kiosks facilitate seamless check-in and check-out processes, improving customer experiences and reducing wait times.

The digital signage industry in the UK is expected to grow during the forecast period. The UK's sports and entertainment industry is driving digital signage growth by adopting advanced displays to enhance fan and visitor experiences. PREMIER LEAGUE stadiums, music venues, and theaters are using dynamic signage for live updates, interactive content, and targeted advertising, creating new revenue streams. These installations not only improve audience engagement but also provide sponsors with high-impact advertising opportunities. As the sector continues to invest in modernizing facilities, the demand for innovative and immersive digital signage solutions is steadily increasing.

Asia Pacific Digital Signage Market Trends

The Asia Pacific digital signage market is expected to be the fastest-growing segment, with a CAGR of 26.5% over the forecast period. The growth can be attributed to the growing awareness regarding the benefits of digital signage. India and China are anticipated to witness significant growth primarily due to the rising application in retail stores, corporate offices, hospitals, and hotels. Increasing disposable income has surged the visitors to malls and multiplex stores in the emerging countries of Asia Pacific. Enterprise is therefore leveraging this opportunity to promote their offerings through large displays, which helps them attract the targeted audience in a better manner. With the rising number of shopping malls and multiplexes, the adoption of digital signage in the hospitality industry is expected to increase over the forecast period.

The digital signage market in Japan is projected to grow during the forecast period. Japan’s extensive railway and subway systems also rely heavily on digital signage for real-time passenger communication. Digital boards in stations and onboard trains deliver updates on arrival times, service disruptions, platform changes, and multilingual instructions. This is particularly crucial in cities like Tokyo, where millions of passengers rely on accurate and up-to-the-minute information to navigate the transit network efficiently. The digital transformation of Japan’s public transport system has made these signage installations functional and essential to urban mobility.

Key Digital Signage Company Insights

Some of the key companies operating in the market LG Electronics and Samsung Electronics Co., Ltd., among others, are some of the leading participants in the digital signage market.

-

LG Electronics is a provider of electronic products and technology solutions. It operates through five business divisions, namely Home Appliances & Air Solutions, Mobile Communications, Vehicle Components, Business to Business, and Home Entertainment. It is a publicly listed company traded as KRX: 066570 on the Korea Exchange and as LSE: LGLD on the London Stock Exchange. LG Electronics provides TVs, washing machines, refrigerators, mobile devices, and air conditioners. The company also offers products, such as commercial displays, solar panels, lightning products, vehicle components, and solutions, including integrated solutions and enterprise mobility solutions. Under commercial displays, LG Electronics offers a wide range of products, such as OLED displays, digital signage, video walls, outdoor displays, display TVs, display monitors, and IT products.

-

Samsung Electronics Co., Ltd. is a multinational electronics company engaged in providing consumer electronic products and solutions, Information Technology (IT) solutions, and mobile communication worldwide. The company caters to government agencies and the incumbents of finance, healthcare, education, hospitality, healthcare, transportation, retail, legal, and public safety, among other industries and resolutions. SAMSUNG offers a wide range of products, including phones, tablets, wearables, computing & SSD, digital signage and video walls, TVs, printers & copiers, networking & voice, medical devices, and air conditioning.

BrightSign, LLC, and Omnivex Corporation are some emerging market participants in the digital signage market.

-

BrightSign, LLC is engaged in the manufacturing, designing, and sales of digital signage media players and other accessories. The company provides networking solutions and software for digital signage. The company also provides networking solutions, software, and digital signage media players for commercial applications. The company’s offerings include portable tabletop displays, display bundles, networked interactive sign controllers, Wi-Fi sign controllers, networked-looping sign controllers, and interactive sign controllers.

-

Omnivex Corporation provides software solutions to convert data into visual communications and experiences. The company offers advertising, communication, kiosks, menu boards, and reception applications solutions. The company’s digital signage solution, Omnivex Moxie, delivers targeted visual messaging. It provides support services like project frameworks, service packages, and training. It caters to the requirements of government agencies and the incumbents of various industries and resolutions, including banking & finance, food service, corporate communications, entertainment, education, hospitality, healthcare, manufacturing, transportation, and retail.

Key Digital Signage Companies:

The following are the leading companies in the digital signage market. These companies collectively hold the largest market share and dictate industry trends.

- BrightSign, LLC

- Cisco Systems, Inc.

- Daktronics Dr.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- Omnivex Corporation

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

- Scala

- Sharp NEC Display Solutions

- Winmate Inc.

Recent Developments

-

In May 2025, Daktronics partnered with the University of Delaware to design, manufacture, and install a cutting-edge LED video display at the university's stadium. Engineered with advanced environmental protection, the display is built to perform reliably in the outdoor conditions of Newark. In addition, Daktronics provided a comprehensive Show Control system. This solution integrates display control software, high-quality video processing, data integration, and playback hardware into a powerful yet intuitive production platform.

-

In February 2025, NoviSign partnered with BrightSign, LLC, to enhance the flexibility and scalability of its digital signage solutions. This collaboration allows businesses to combine NoviSign’s robust software with the trusted reliability and security of BrightSign’s media players. The partnership ensures complete compatibility across BrightSign’s entire product line, enabling smooth integration and high-performance functionality. Designed with user experience in mind, NoviSign’s platform offers interactive features, including touchscreen capabilities, real-time data feeds, and IoT integrations, all optimized for seamless operation with BrightSign hardware.

-

In February 2025, Daktronics Dr. launched the next generation of digital billboard technology for the out-of-home (OOH) advertising market with the launch of the DB-7000. Building on a legacy of proven reliability, the DB-7000 incorporates state-of-the-art, energy-efficient innovations designed to enhance return on investment (ROI) and reduce operational expenses. Developed in collaboration with vendors, the DB-7000 is engineered to lower site power demands and cut operational costs by up to 20%, minimizing environmental impact while ensuring long-lasting, high-quality image performance.

-

In February 2025, Samsung Electronics Co., Ltd. partnered with Cielo to revolutionize retail advertising and franchise operations. This strategic collaboration merges Samsung’s VXT display technology with Cielo’s AI-powered platform, offering innovative tools that enhance digital marketing and operational performance. As part of the alliance, Cielo is launching SmartSigns, a Digital Signage as a Service (DaaS) solution that utilizes Samsung’s VXT technology to deliver targeted messaging with precision.

Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 31.09 billion

Revenue forecast in 2030

USD 45.94 billion

Growth rate

CAGR of 8.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Type, component, technology, screen size, resolution, content category, application, location, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Daktronics Dr.; BrightSign, LLC; Cisco Systems, Inc.; Intel Corporation; KeyWest Technology, Inc.; LG Electronics; Microsoft Corporation; Sharp NEC Display Solutions; Omnivex Corporation; Panasonic Corporation; Samsung Electronics Co., Ltd.; Scala; Winmate Inc.

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Signage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global digital signage market report based on type, component, technology, screen size, resolution, content category, application, location, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Walls

-

Video Screens

-

Transparent LED Screens

-

Digital Posters

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Display

-

Media Player

-

Projectors

-

Others

-

-

Software

-

Services

-

Installation Services

-

Maintenance & Support Services

-

Consulting Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Screen Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Resolution Outlook (Revenue, USD Billion, 2018 - 2030)

-

8K

-

4K

-

FHD

-

HD

-

Lower than HD

-

-

Content Category Outlook (Revenue, USD Billion, 2018 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

-

Non-Broadcast

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

HD

-

Education

-

Transportation

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

In-store

-

Out-store

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital signage market size was estimated at USD 28.83 billion in 2024 and is expected to reach USD 31.09 billion in 2025.

b. The global digital signage market is expected to grow at a compound annual growth rate of 8.1% from 2025 to 2030 to reach USD 45.94 billion by 2030.

b. The video walls segment dominated the global digital signage market and accounted for the largest market share of over 25.0% in 2024.

b. The hardware component segment led the global digital signage market and accounted for the largest revenue share of more than 58.0% in 2024.

b. The retail sector dominated the global digital signage market and accounted for the largest market share of over 19.0% in 2023.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.