- Home

- »

- Display Technologies

- »

-

Digital Signage Market Size, Share & Growth Report, 2030GVR Report cover

![Digital Signage Market Size, Share, & Trends Report]()

Digital Signage Market Size, Share, & Trends Analysis Report By Type, By Component, By Technology, By Resolution, By Application, By Location, By Content Category, By Size, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-157-3

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Digital Signage Market Size & Trends

The global digital signage market size was estimated at USD 26.76 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. This market growth is accredited to the increasing demand for the digitized promotion of products and services to attract the attention of the target audience in an effective manner. Furthermore, the demand for 4K digitized sign displays (digital signage displays) with embedded software and media player is rising as it offers customers an affordable Ultra HD digital signage solution, which is also expected to drive the demand. The evolution of innovative products, such as home monitoring systems, leak detector systems, and so on, along with complicated monetary products, such as forex cards, that need informative and succinct advertisement content are some of the factors that are predicted to drive the product demand.

Moreover, there is a rising demand for adopting advanced products that require digitized information management and guidance that can be accessed from remote locations. This is one of the key drivers anticipated to drive the global industry during the forecast period. Digital signage boards offer the necessary quality information to a large number of viewers by utilizing large display screens across the location with a concentrated target audience. With digital signage display technology, information is provided in a digitized format that includes motion and pictures to attract customers with more impact as compared to the traditional modes of reaching out to customers. In addition, the integration of biometric technology with modern digitized signs has developed products, such as track heat paths and gaze tracking.

Gaze tracking technology helps in locating the area, which is crowded with a greater number of consumers, thereby helping the companies to track consumer behavior for effective marketing of products. Thus, the growing use of the aforementioned technology is expected to strengthen the demand in the next few years. Eventually, the growing awareness among consumers regarding the drawbacks and complexity of traditional advertising, such as short-lived print marketing and so on, is instigating digitized advertisement adoption. Furthermore, display designers, researchers, and advertisement companies are spending more on the improvement of the product’s display technology.

All these factors are expected to catalyze the overall industry growth. With the advancement in display technologies, the evolution of LCD, LED, UHD, OLED, and Super AMOLED is further strengthening the industry growth. These technologies have led to the enhancement of the quality of advertisement content, thus creating a favorable impact on the target audience. The adoption of such technologies by digital poster providers is anticipated to boost overall industry growth. However, factors, such as software & hardware compatibility, electrical interface, and connectivity, are some prevailing issues that may hinder market growth. Moreover, the complex taxations levied upon the erection of digitized signs and screens, coupled with the regulatory processes, such as licensing, are projected to hamper the growth.

Market Concentration & Characteristics

The digital signage market growth stage is moderate. The digital signage market has witnessed significant technological advancements in recent years, marked by the adoption of advanced technologies such as artificial intelligence & machine learning, 5G technology, touchless & interactive solutions, and the Internet of Things (IoT). The retail industry is rapidly adopting digital signage with AI and machine learning capabilities to maximize customer data. These advanced technologies enable personalized content delivery, audience analytics, and real-time data-driven decision-making.

The target market is also characterized by a high level of products/services launched by the leading companies in the market. Additionally, the high level of partnerships and collaborations in the digital signage market is driven by the pursuit of market consolidation and strategic expansion. Leading companies engage in partnerships and collaboration activities to leverage each other's expertise and resources. By collaborating with complementary companies, digital signage providers can enhance their offerings and provide a more comprehensive solution to their customers.

The digital signage market faces several restraints, such as increased spending on online advertisement & broadcast and deployment of widescreen alternatives that impact its growth and adoption. With the rise of internet users and the popularity of online advertising, companies are targeting large audiences through online promotions, which impacts the demand for digital signage solutions. Online advertising offers the advantage of reaching a vast and diverse audience. Social media platforms, apps, retail media, and digital gaming environments have become popular advertising channels. Companies can leverage advanced targeting capabilities provided by online platforms to deliver personalized and relevant advertisements to specific consumer segments.

End user concentration is one of the significant factors in the digital signage market. End-user industry concentration in the 3PL market varies, with sectors such as retail, banking, hospitality, entertainment, and healthcare demonstrating notable reliance on digital signage for dynamic content delivery, real-time updates, and targeted messaging, enabling businesses to engage with their customers in a visually appealing and interactive manner. Additionally, the retail industry extensively uses digital signage for advertising, product promotion, and enhancing the in-store customer experience. Digital signage displays are commonly found in retail stores, shopping malls, and supermarkets, providing eye-catching content to attract customers and drive sales.

Location Insights

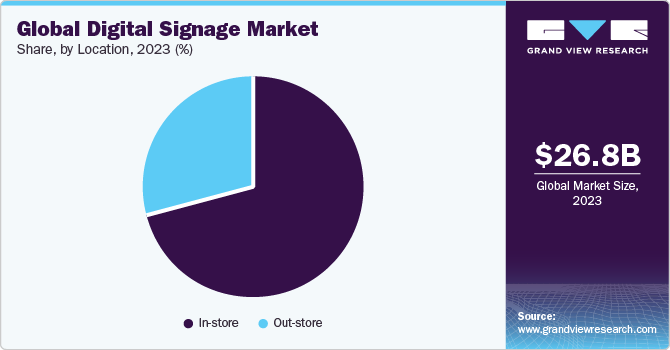

The in-store location segment accounted for the largest market share of 71.1% in 2023. The in-store locations include the deployment of digital posters within closed premises, such as malls, corporate offices, retail shops, banks, and healthcare centers. The high share of this segment can be attributed to the heavy demand from retail stores as the retail sector is the most promising application sector for digital displays for advertisement purposes. The segment is also predicted to maintain its position in the global market and exhibit a steady growth rate over the forecast period due to consistent demand.

However, the demand from the out-store location segment is expected to exhibit the fastest CAGR of 9.4% from 2024 to 2030. The demand at out-store locations is expected to rise owing to the growing transportation sector, especially in developing countries. In addition, the rising need of promoting products effectively and on a large scale and emerging popular trends, such as election campaigns, introductory offers on products & services, and the increasing number of live concerts & shows, are likely to boost the adoption of digital posters in open premises, thereby augmenting the out-store segment growth.

Type Insights

The video walls segment accounted for the largest market share of more than 26.4% in 2023 and this trend is expected to continue during the forecast period. The video screens and kiosks segments gained a high share in 2023 followed by the video screens segment. Video walls and screens have captured a major market share across shopping malls and other public places. However, the kiosks segment is estimated to account for the maximum revenue share by 2030 becoming the largest type segment in the global market. Kiosks are generally used to provide information and for advertising in institutes and retail verticals.

However, the transparent LED screens segment is expected to emerge as the fastest-growing segment expanding at a CAGR of 10.5% from 2024 to 2030. Transparent LED screens are capable of offering a transparency level beyond 80% coupled with high resolution. In addition, they are adequately efficient, in terms of energy, thus, reducing energy consumption and optimizing the overhead expenditure of users. All these factors are anticipated to catapult the demand for transparent LED screens in the next six years, thereby supporting the growth of the segment.

Component Insights

The hardware components segment accounted for the largest market share of 57.8% in 2023 and is anticipated to maintain its position during the forecast period. Hardware components consist of displays, components required to manufacture a digital panel, banners, and so on. Compared to software, the hardware requirement is huge, and thus, the segment accounts for a large share in the industry. The growing number of innovative display technologies, such as 1080p, 4K, and 8K display, is expected to propel the demand for hardware components in the coming years. Advancement in 3D technology has developed glasses-free 3D displays. Such displays are used in the product.

Furthermore, the graphics design agencies are shifting their focus towards 3D holographic display cases. HYPERVSN, a European provider of holographic technology, is providing them for numerous applications, from advertising in malls to showpieces at trade shows. The services segment registers a comparatively lower demand owing to fewer maintenance and service issues occurring in the product. The services offered in the industry include integration & installation, maintenance, and consulting. The installation of a digital display and internet connectivity are the major services involved here. Therefore, the service offerings are quite cheaper compared to the hardware and software requirements. This leads to a lesser market share.

Application Insights

The retail sector accounted for the largest market share of 19.5% in 2023. The retail sector is the most prominent sector demanding digitized advertisements for marketing and promoting products and services. The competition among retailers owing to the variety of product offerings in the industry has led to the growing awareness of effective marketing strategies. Thus, digital posters are adopted largely in the retail sector as digitized advertising is an effective way of marketing a product, which attracts the attention of target consumers.

The transportation segment is expected to emerge as the fastest-growing segment expanding at a CAGR of 9.9% from 2024 to 2030. The transportation sector includes the application of digitized promotions & posters at airports, railway stations, metro stations, and bus stands. In addition, the digital display is also extensively used on the roads by cabs, public transport buses, and other vehicles that advertise products and services. Owing to the rapid urbanization and the development of the transportation sector in emerging countries, the advertisement industry is expected to grow, ultimately boosting the growth of the market for digital signage.

Resolution Insights

The resolution segment is further segmented into 8K, 4K, full high definition (FHD), high definition (HD), and lower than HD. The use of 8K displays in digital signage provides realistic and immersive graphics, making them suitable for applications such as video walls, shop displays, and digital signage. The high resolution of 8K displays enables more detail and clarity, which can be impactful for advertising and promotional content.

Full High Definition (FHD) resolution is a widely used display resolution in the digital signage market. FHD resolution has become the standard for most displays available in the market today. It provides superior image display quality compared to lower-resolution options, such as HD. FHD displays offer more than twice the detail of standard HD, resulting in a sharper and more defined picture. FHD displays are widely adopted due to their affordability, accessibility, and superior image quality.

Size Insights

The signage size segment is further bifurcated into below 32 inches, 32 to 52 inches, and above 52 inches. Displays below 32 inches are employed in confined spaces, where size constraints or limited available space necessitate smaller signage solutions. These environments often include retail counters and small offices, where the compact nature of these displays proves advantageous. In retail settings, below 32 inches, digital signage is commonly utilized for specific applications such as menu boards, providing a concise and easily readable format for presenting available products and pricing. Additionally, in small offices, these displays may serve as promotional tools, conveying important information or advertisements in a space-efficient manner.

Displays larger than 52 inches are strategically positioned in areas with substantial foot traffic due to their size, with the objective of attracting the attention of a wider audience. These displays are typically situated in locations such as shopping malls, airports, and large corporate offices. Their selection is based on the capacity to convey messages and content in a manner that is easily visible from a distance.

Content Category Insights

Broadcast content category is expected to emerge as the fastest-growing segment expanding at a CAGR of 8.9% from 2024 to 2030. The broadcast content category is further segregated into the news, weather, sports, and others. The sports segment dominated the market in 2023 and accounted for a market share of over 36%. The increasing adoption of digital signage for displaying sports-related content across the stadium and sports ground during the tournaments is driving segment growth.

The news category is likely to account for a considerable share as well, followed by the sports content category. These segments are anticipated to witness significant growth in the forthcoming years owing to the rapidly increasing demand from the corporate sectors where digital signage is used extensively for communication purposes. In addition, the weather forecast is displayed majorly on external premises, such as roads and transport facilities along with offices. The market for weather content is projected to maintain its share and generate stable revenue over the coming years.

Technology Insights

LED segment accounted for the largest market share of 47.7% in 2023. LCD technology is one of the most extensively adopted technologies in the advertisement & marketing industry. The ease of producing LCDs and their lower manufacturing costs are a few factors behind the significant adoption of LCD technology in digital posters. However, LEDs have successfully made a mark as a standard product with their high-quality display. Manufacturers remain aspirant in the designing of flat-paneled, larger, brighter, and slimmer displays.

LEDs are one of the achievements in display technology. Further advancements in LEDs have led to the evolution of OLED displays that are anticipated to propel the overall adoption of LEDs in displays. Superior picture quality offered by OLEDs is predicted to be a prominent factor for the increasing demand. However, the production costs and complicated manufacturing process, coupled with a shorter lifespan of LED displays could hamper the growth of this segment to some extent.

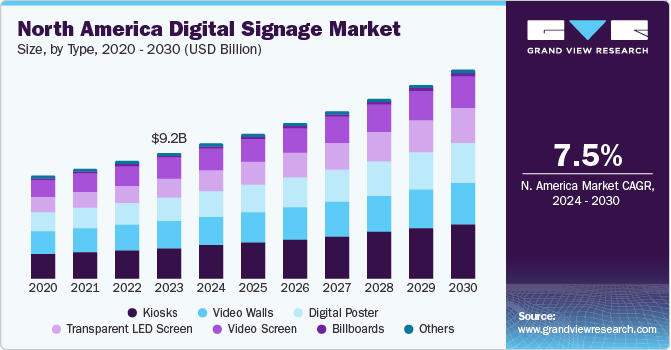

Regional Insights

North America emerged as the dominant segment in 2023 with a revenue share of 34.4%, followed by Europe. The high share is attributed to the growing presence of dedicated suppliers of the product along with rising demand for signage in the retail industry. The U.S., in particular, is projected to exhibit considerable growth primarily due to the rising R&D activities by companies to enhance product quality and increasing government initiatives to install digital signage at various offices for maintaining continuous information flow systems.

U.S. Digital Signage Market Trends

The U.S. digital signage market is expected to grow at a CAGR of 6.6% from 2024 to 2030. The key factors contributing to the growth are surging consumer demand for concise and comprehensive information and the presence of dedicated suppliers of digital signage products and services.

Europe Digital Signage Market Trends

The digital signage market in Europe accounted for a revenue share of 28.3%. Digital signage is gaining traction in healthcare facilities and educational institutions across Europe. It is used for patient communication, appointment schedules, educational content, and general information dissemination.

The UK digital signage market is experiencing growth and accounted for a revenue share of over 25% in the European market. Advancements in display technology and the increasing demand for advertising content with enhanced quality and better sharpness are driving the market growth. The adoption of digital signage solutions is prominent in industries such as transportation, hospitality, and retail. In the transportation sector, digital signage is used for displaying information, schedules, and advertisements in airports, train stations, and bus terminals.

Digital signage market in Germany is expected to grow at a CAGR of 8.1% from 2024 to 2030. A key factor fueling the demand for digital signage is the rising adoption of these products in various commercial sectors, with a particular emphasis on the retail industry. In Germany, retail businesses are increasingly integrating digital signage displays to elevate the overall shopping experience for customers and to convey information about their products and services effectively.

France digital signage market accounted for a revenue share of less than 14% in the European market. The growing demand for personalized and interactive experiences, along with the integration of 4K displays, serves as a catalyst for the growth of the digital signage market in France. These elements play a crucial role in delivering more immersive content, improving user engagement, and aligning with the changing expectations of both businesses and consumers.

Asia Pacific Digital Signage Market Trends

Asia Pacific is expected to emerge as the fastest-growing segment growing at a CAGR of 9.5% from 2024 to 2030. The growth can be attributed to the growing awareness regarding the benefits of digital signage. India and China are anticipated to witness significant growth primarily due to the rising application in retail stores, corporate offices, hospitals, and hotels. Increasing disposable income has surged the visitors to malls and multiplex stores in the emerging countries of Asia Pacific. Enterprise is therefore leveraging this opportunity to promote their offerings through large displays, which helps them attract the targeted audience in a better manner. With the rising number of shopping malls and multiplexes, the adoption of digital signage in the hospitality industry is expected to increase over the forecast period.

The digital signage market in China accounted for a revenue share of 37.7% in the Asia Pacific market. The growth can be attributed to the flourishing retail industry, rising sales of consumer electronics, and the booming mobile gaming industry.

Japan digital signage market is expected to grow at a CAGR of 7.6% from 2024 to 2030 in the Asia Pacific market. The availability of advanced and cost-effective display technologies has made digital signage more accessible to businesses of all sizes. This has encouraged widespread adoption across various industries.

The digital signage market in India accounted for a revenue share of 12.8% in the Asia Pacific market. The revenue share can be attributed to the rising advertising expenditure in India. Prominent retail chains in India, such as RELIANCE RETAIL LIMITED, Big Bazaar, Pantaloons, and Food Bazaar, are increasingly adopting digital signage for advertising purposes.

Middle East & Africa (MEA) Digital Signage Market Trends

Middle East & Africa digital signage market accounted for a revenue share of over 3%. The MEA region is a popular destination for tourism and business events. The hospitality sector utilizes digital signage for information dissemination, wayfinding, and promotional purposes, contributing to the demand for digital signage in the region.

The digital signage in Kingdom of Saudi Arabia (KSA) is experiencing an increasing demand for digital signage, driven by various factors. Rapid infrastructural developments, technological innovations, and growing government investment in public infrastructure are propelling the digital signage market in the country.

Key Digital Signage Company Insights

Some of the key companies operating in the digital signage market include SAMSUNG, and LG Electronics among others.

-

LG Electronics is a provider of electronic products and technology solutions. It operates through five business divisions, namely Home Appliances & Air Solutions, Mobile Communications, Vehicle Component, Business to Business, and Home Entertainment. It is a publicly listed company traded as KRX: 066570 on the Korea Exchange and as LSE: LGLD on the London Stock Exchange. LG Electronics provides TVs, washing machines, refrigerators, mobile devices, and air conditioners. The company also offers products, such as commercial displays, solar panels, lightning products, vehicle components, and solutions, including integrated solutions and enterprise mobility solutions. Under commercial displays, LG Electronics offers a wide range of products, such as OLED displays, digital signage, video walls, outdoor displays, display TVs, display monitors, and IT products.

-

SAMSUNG is a multinational electronics company engaged in providing consumer electronic products and solutions, Information Technology (IT) solutions, and mobile communication worldwide. The company caters to government agencies and the incumbents of finance, healthcare, education, hospitality, healthcare, transportation, retail, legal, and public safety, among other industries and industry verticals. SAMSUNG offers a wide range of products, including phones, tablets, wearables, computing & SSD, digital signage and video walls, TVs, printers & copiers, networking & voice, medical devices, and air conditioning.

BrightSign, LLC and ADFLOW Networks are some of the emerging companies in the digital signage market.

-

BrightSign, LLC is engaged in the manufacturing, designing, and sales of digital signage media players and other accessories. The company provides networking solutions and software for digital signage. The company also provides networking solutions, software, and digital signage media players for commercial applications. The company’s offerings include portable tabletop displays, display bundles, networked interactive sign controllers, Wi-Fi sign controllers, networked-looping sign controllers, and interactive sign controllers.

-

ADFLOW Networks is an interactive kiosk and digital signage technology company that provides interactive digital signage, video-wall solutions, and web-hosted solutions for digital media management. The company provides Digital Multi-Media Services (DMS), a web-based platform for digital signage and interactive digital signage that facilitates product information and customer education. The company’s DMS software platform is ideal for menu boards, video walls, interactive kiosks, corporate communication, customer loyalty stations, in-store music, and lift & touch experiences. The company also offers digital signage, product display, projection, audience detection, and enterprise integration applications.

Key Digital Signage Companies:

The following are the leading companies in the digital signage market. These companies collectively hold the largest market share and dictate industry trends.

- ADFLOW Networks

- BrightSign, LLC

- Cisco Systems, Inc.

- Intel Corporation

- KeyWest Technology, Inc.

- LG Electronics

- Microsoft Corporation

- NEC Display Solutions

- Omnivex Corporation

- Panasonic Corporation

- SAMSUNG

- Scala

- Winmate Inc.

Recent Developments

-

In September 2023, SAMSUNG launched 'The Wall for Virtual Production' in Europe, introducing two models, P1.68 and P2.1, as part of its digital signage series. Designed for virtual content creation, these ultra-large LED walls offer enhanced visual effects, reduced production time and costs, and features, such as a curvature range up to 5,800R for a more realistic field of view, genlock for seamless signal alignment, and Virtual Production Management (VPM) software for efficient screen management and high picture quality in virtual production environments.

-

In February 2023, Cisco Systems Inc. announced a partnership with St. Louis CITY SC to roll out a highly connected and fan-centric environment in Major League Soccer. The partnership envisaged Cisco Systems Inc. serving as a Proud Technology Partner and leveraging its expertise in networking, security, Wi-Fi, and digital signage solutions to deploy a fully converged network across the 31-acre CITYPARK stadium district and enhance the matchday experience for fans through immersive technologies, such as Wi-Fi 6.

-

In February 2023, Winamte Inc. announced the launch of an outdoor display series that brings higher visibility for bus shelter advertising, digital drive-thru menus, smart cities, and window displays, among other applications. The company was looking forward to offering enhanced image clarity and light transmission coupled with stable, drift-free operation.

Digital Signage Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 28.83 billion

Revenue forecast in 2030

USD 45.94 billion

Growth rate

CAGR of 8.1% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, technology, resolution, location, component, size, content category, region

Regional scope

North America, Europe, Asia Pacific, South America, MEA

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; China; India; Japan; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

ADFLOW Networks, BrightSign, LLC, Cisco Systems, Inc., Intel Corporation, KeyWest Technology, Inc., LG Electronics, Microsoft Corporation, NEC Display Solutions, Omnivex Corporation, Panasonic Corporation, SAMSUNG, Scala, Winmate Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Signage Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global digital signage market report based on type, component, technology, resolution, application, location, content category, size, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Video Walls

-

Video Screen

-

Transparent LED Screen

-

Digital Poster

-

Billboards

-

Kiosks

-

Interactive Kiosks

-

Self-service Kiosks

-

Others

-

-

Others

-

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Displays

-

Media Players

-

Projectors

-

Others

-

-

Software

-

Service

-

Installation Services

-

Maintenance & Support Services

-

Consulting Services

-

Others

-

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

LCD

-

LED

-

OLED

-

Projection

-

-

Resolution Outlook (Revenue, USD Million, 2017 - 2030)

-

8K

-

4K

-

Full High Definition (FHD)

-

High Definition (HD)

-

Lower than HD

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Retail

-

Hospitality

-

Entertainment

-

Stadiums & Playgrounds

-

Corporate

-

Banking

-

Healthcare

-

Education

-

Transport

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

In-store

-

Out-store

-

-

Content Category Outlook (Revenue, USD Million, 2017 - 2030)

-

Broadcast

-

News

-

Weather

-

Sports

-

Others

-

Non-Broadcast

-

-

Signage Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 32 Inches

-

32 to 52 Inches

-

More than 52 Inches

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital signage market size was estimated at USD 24.86 billion in 2022 and is expected to reach USD 26.76 billion in 2023.

b. The global digital signage market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 45.94 billion by 2030.

b. The video walls segment dominated the global digital signage market and accounted for the largest market share of over 26% in 2022.

b. The hardware component segment led the global digital signage market and accounted for the largest revenue share of more than 57% in 2022.

b. The retail sector dominated the global digital signage market and accounted for the largest market share of over 19% in 2022.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Digital Signage Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Industry Value Chain Analysis

3.3. Market Dynamics

3.3.1. Market Drivers Analysis

3.3.1.1. Increasing demand for customized digital signage solutions across different sectors, especially healthcare and public transportation sectors

3.3.1.2. Rising demand for 4K and 8K resolution displays

3.3.1.3. Rising infrastructure developments in developing countries

3.3.1.4. Rising demand for enhanced customer experience and satisfaction is fueling the demand for interactive kiosks under digital signage solutions

3.3.2. Market Restraints Analysis

3.3.2.1. High initial investments and ambiguous returns hinder growth rate

3.3.2.2. Alternative modes of merchandizing products such as online advertisement and broadcasting is further triggered after the on-set of COVID-19 pandemic

3.3.2.3. High cost of maintenance and support required for digital signage products hinders the growth of the market

3.3.3. Industry Opportunities

3.3.3.1. Advancement in the digital signage technology solution

3.3.3.2. Increasing demand for contactless kiosk solutions due to the pandemic

3.3.4. Industry Challenges

3.3.4.1. Developing effective digital signage content creation

3.3.4.2. Threat of cyber attacks, data privacy and security

3.4. Digital Signage Market Analysis Tools

3.4.1. Porter’s Analysis

3.4.1.1. Bargaining power of the suppliers

3.4.1.2. Bargaining power of the buyers

3.4.1.3. Threats of substitution

3.4.1.4. Threats from new entrants

3.4.1.5. Competitive rivalry

3.4.2. PESTEL Analysis

3.4.2.1. Political landscape

3.4.2.2. Economic and Social landscape

3.4.2.3. Technological landscape

3.4.2.4. Environmental landscape

3.4.2.5. Legal landscape

3.4.3. Digital Signage Market - Regional Average Pricing Analysis, By Screen Type, 2023

3.4.4. Digital Signage Market -Global Average Pricing Analysis, By Screen Type, 2017 - 2030

3.4.5. Total Digital Signage Viewers, By Region and Screen Type, 2023

3.4.6. Digital Signage Market - Case Study Analysis

3.4.7. Digital Signage Market - Trade and Regulatory Landscape

3.4.8. Digital Signage Market - Patent Analysis

Chapter 4. Digital Signage Market: Type Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Digital Signage Market: Type Movement Analysis, 2023 & 2030 (USD Million)

4.3. Video Walls

4.3.1. Video Walls Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.3.2. Video Walls Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.3.3. Video Walls Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.3.4. Video Walls Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

4.4. Video Screens

4.4.1. Video Screens Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.4.2. Video Screens Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.4.3. Video Screens Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.4.4. Video Screens Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

4.5. Transparent LED Screen

4.5.1. Transparent LED Screen Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5.2. Transparent LED Screen Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.5.3. Transparent LED Screen Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.5.4. Transparent LED Screen Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.5.5. Transparent LED Screen Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

4.6. Digital Poster

4.6.1. Digital Poster Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.6.2. Digital Poster Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.6.3. Digital Poster Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.6.4. Digital Poster Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

4.7. Kiosks

4.7.1. Kiosks Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.7.2. Kiosks Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.7.3. Kiosks Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.7.4. Kiosks Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

4.7.5. Interactive Kiosk

4.7.5.1. Interactive Kiosk Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.7.6. Self-service Kiosk

4.7.6.1. Self-service Kiosk Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.7.7. Others

4.7.7.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.8. Others

4.8.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

4.8.2. Others Market Revenue Estimates and Forecasts, by application, 2017 - 2030 (USD Million)

4.8.3. Others Market Revenue Estimates and Forecasts, by location, 2017 - 2030 (USD Million)

4.8.4. Others Market Revenue Estimates and Forecasts, by technology, 2017 - 2030 (USD Million)

Chapter 5. Digital Signage Market: Component Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Digital Signage Market: Component Movement Analysis, 2023 & 2030 (USD Million)

5.3. Hardware

5.3.1. Hardware Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.2. Displays

5.3.2.1. Displays Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.3. Media Players

5.3.3.1. Media Players Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.4. Projectors

5.3.4.1. Projectors Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.3.5. Others

5.3.5.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.4. Software

5.4.1. Software Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5. Services

5.5.1. Services Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5.2. Installation

5.5.2.1. Installation Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5.3. Maintenance & Support

5.5.3.1. Maintenance & Support Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

5.5.4. Consulting & Other Services

5.5.4.1. Consulting & Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 6. Digital Signage Market: Technology Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Digital Signage Market: Technology Movement Analysis, 2023 & 2030 (USD Million)

6.3. LCD

6.3.1. LCD Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.4. LED

6.4.1. LED Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.5. OLED

6.5.1. OLED Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

6.6. Projection

6.6.1. Projection Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 7. Digital Signage Market: Resolution Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Digital Signage Market: Resolution Movement Analysis, 2023 & 2030 (USD Million)

7.3. 8K

7.3.1. 8K Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.4. 4K

7.4.1. 4K Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.5. FHD

7.5.1. FHD Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.6. HD

7.6.1. HD Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

7.7. Less than HD

7.7.1. Less than HD Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 8. Digital Signage Market: Application Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Digital Signage Market: Application Movement Analysis, 2023 & 2030 (USD Million)

8.3. Retail

8.3.1. Retail Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.4. Hospitality

8.4.1. Hospitality Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.5. Entertainment

8.5.1. Entertainment Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.6. Stadiums & Playgrounds

8.6.1. Stadiums & Playgrounds Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.7. Corporate

8.7.1. Corporate Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.8. Banking

8.8.1. Banking Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.9. Healthcare

8.9.1. Healthcare Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.10. Education

8.10.1. Education Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

8.11. Transport

8.11.1. Transport Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 9. Digital Signage Market: Location Estimates & Trend Analysis

9.1. Segment Dashboard

9.2. Digital Signage Market: Location Movement Analysis, 2023 & 2030 (USD Million)

9.3. In-store

9.3.1. In-store Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

9.4. Out-store

9.4.1. Out-store Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 10. Digital Signage Market: Content Category Estimates & Trend Analysis

10.1. Segment Dashboard

10.2. Digital Signage Market: Content Category Movement Analysis, 2023 & 2030 (USD Million)

10.3. Broadcast

10.3.1. Broadcast Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.3.2. News

10.3.2.1. News Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.3.3. Weather

10.3.3.1. Weather Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.3.4. Sports

10.3.4.1. Sports Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.3.5. Others

10.3.5.1. Others Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

10.4. Non-Broadcast

10.4.1. Non-Broadcast Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 11. Digital Signage Market: Size Estimates & Trend Analysis

11.1. Segment Dashboard

11.2. Digital Signage Market: Signage Size Movement Analysis, 2023 & 2030 (USD Million)

11.3. Below 32 Inches

11.3.1. Below 32 Inches Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

11.4. 32 to 52 Inches

11.4.1. 32 to 52 Inches Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

11.5. More than 32 Inches

11.5.1. More than 32 Inches Market Revenue Estimates and Forecasts, 2017 - 2030 (USD Million)

Chapter 12. Digital Signage Market: Regional Estimates & Trend Analysis

12.1. Digital Signage Market Share, By Region, 2023 & 2030, USD Million

12.2. North America

12.2.1. North America Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.2.2. North America Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.2.3. North America Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.2.4. North America Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.2.5. North America Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.2.6. North America Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.2.7. North America Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.2.8. North America Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.2.9. North America Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.2.10. U.S.

12.2.10.1. U.S. Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.2.10.2. U.S. Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.2.10.3. U.S. Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.2.10.4. U.S. Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.2.10.5. U.S. Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.2.10.6. U.S. Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.2.10.7. U.S. Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.2.10.8. U.S. Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.2.10.9. U.S. Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.2.11. Canada

12.2.11.1. Canada Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.2.11.2. Canada Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.2.11.3. Canada Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.2.11.4. Canada Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.2.11.5. Canada Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.2.11.6. Canada Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.2.11.7. Canada Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.2.11.8. Canada Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.2.11.9. Canada Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.2.12. Mexico

12.2.12.1. Mexico Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.2.12.2. Mexico Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.2.12.3. Mexico Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.2.12.4. Mexico Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.2.12.5. Mexico Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.2.12.6. Mexico Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.2.12.7. Mexico Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.2.12.8. Mexico Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.2.12.9. Mexico Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.3. Europe

12.3.1. Europe Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.3.2. Europe Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.3.3. Europe Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.3.4. Europe Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.3.5. Europe Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.3.6. Europe Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.3.7. Europe Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.3.8. Europe Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.3.9. Europe Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.3.10. UK

12.3.10.1. UK Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.3.10.2. UK Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.3.10.3. UK Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.3.10.4. UK Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.3.10.5. UK Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.3.10.6. UK Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.3.10.7. UK Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.3.10.8. UK Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.3.10.9. UK Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.3.11. Germany

12.3.11.1. Germany Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.3.11.2. Germany Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.3.11.3. Germany Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.3.11.4. Germany Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.3.11.5. Germany Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.3.11.6. Germany Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.3.11.7. Germany Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.3.11.8. Germany Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.3.11.9. Germany Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.3.12. France

12.3.12.1. France Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.3.12.2. France Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.3.12.3. France Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.3.12.4. France Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.3.12.5. France Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.3.12.6. France Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.3.12.7. France Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.3.12.8. France Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.3.12.9. France Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.4. Asia Pacific

12.4.1. Asia Pacific Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.2. Asia Pacific Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.4.3. Asia Pacific Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.4.4. Asia Pacific Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.5. Asia Pacific Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.6. Asia Pacific Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.4.7. Asia Pacific Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.8. Asia Pacific Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.9. Asia Pacific Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.4.10. China

12.4.10.1. China Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.10.2. China Digital Signage Market Estimates and Forecasts, By Type, 2017 - 2030 (USD Million)

12.4.10.3. China Digital Signage Market Estimates and Forecasts, By Component, 2017 - 2030 (USD Million)

12.4.10.4. China Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.10.5. China Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.10.6. China Digital Signage Market Estimates and Forecasts, By Application, 2017 - 2030 (USD Million)

12.4.10.7. China Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.10.8. China Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.10.9. China Digital Signage Market Estimates And Forecasts, By Signage Size, 2017 - 2030 (USD Million)

12.4.11. Japan

12.4.11.1. Japan Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.11.2. Japan Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.4.11.3. Japan Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.4.11.4. Japan Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.11.5. Japan Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.11.6. Japan Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.4.11.7. Japan Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.11.8. Japan Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.11.9. Japan Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.4.12. India

12.4.12.1. India Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.12.2. India Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.4.12.3. India Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.4.12.4. India Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.12.5. India Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.12.6. India Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.4.12.7. India Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.12.8. India Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.12.9. India Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.4.13. Australia

12.4.13.1. Australia Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.13.2. Australia Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.4.13.3. Australia Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.4.13.4. Australia Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.13.5. Australia Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.13.6. Australia Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.4.13.7. Australia Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.13.8. Australia Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.13.9. Australia Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.4.14. South Korea

12.4.14.1. South Korea Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.4.14.2. South Korea Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.4.14.3. South Korea Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.4.14.4. South Korea Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.4.14.5. South Korea Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.4.14.6. South Korea Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.4.14.7. South Korea Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.4.14.8. South Korea Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.4.14.9. South Korea Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.5. South America

12.5.1. South America Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.5.2. South America Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.5.3. South America Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.5.4. South America Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.5.5. South America Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.5.6. South America Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.5.7. South America Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.5.8. South America Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.5.9. Brazil

12.5.9.1. Brazil Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.5.9.2. Brazil Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.5.9.3. Brazil Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.5.9.4. Brazil Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.5.9.5. Brazil Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.5.9.6. Brazil Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.5.9.7. Brazil Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.5.9.8. Brazil Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.5.9.9. Brazil Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.6. Middle East & Africa

12.6.1. Middle East & Africa Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.6.2. Middle East & Africa Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.6.3. Middle East & Africa Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.6.4. Middle East & Africa Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.6.5. Middle East & Africa Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.6.6. Middle East & Africa Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.6.7. Middle East & Africa Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.6.8. Middle East & Africa Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.6.9. Middle East & Africa Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.6.10. UAE

12.6.10.1. UAE Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.6.10.2. UAE Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.6.10.3. UAE Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.6.10.4. UAE Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.6.10.5. UAE Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.6.10.6. UAE Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.6.10.7. UAE Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.6.10.8. UAE Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.6.10.9. UAE Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.6.11. KSA

12.6.11.1. KSA Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.6.11.2. KSA Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.6.11.3. KSA Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.6.11.4. KSA Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.6.11.5. KSA Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.6.11.6. KSA Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.6.11.7. KSA Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.6.11.8. KSA Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.6.11.9. KSA Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

12.6.12. South Africa

12.6.12.1. South Africa Digital Signage Market Estimates and Forecasts, 2017 - 2030 (USD Million)

12.6.12.2. South Africa Digital Signage Market Estimates and Forecasts, by Type, 2017 - 2030 (USD Million)

12.6.12.3. South Africa Digital Signage Market Estimates and Forecasts, by Component, 2017 - 2030 (USD Million)

12.6.12.4. South Africa Digital Signage Market Estimates and Forecasts, By Technology, 2017 - 2030 (USD Million)

12.6.12.5. South Africa Digital Signage Market Estimates and Forecasts, By Resolution, 2017 - 2030 (USD Million)

12.6.12.6. South Africa Digital Signage Market Estimates and Forecasts, by Application, 2017 - 2030 (USD Million)

12.6.12.7. South Africa Digital Signage Market Estimates and Forecasts, By Location, 2017 - 2030 (USD Million)

12.6.12.8. South Africa Digital Signage Market Estimates and Forecasts, By Content Category, 2017 - 2030 (USD Million)

12.6.12.9. South Africa Digital Signage Market Estimates and Forecasts, by Signage Size, 2017 - 2030 (USD Million)

Chapter 13. Competitor Analysis

13.1. Operations, Developments & Service Analysis, By Key Market Companies

13.1.1. Retail

13.1.1.1. Types of locations

13.1.1.2. Use cases

13.1.2. Hospitality

13.1.2.1. Types of locations

13.1.2.2. Use cases

13.1.3. Entertainment

13.1.3.1. Types of locations

13.1.3.2. Use cases

13.1.4. Stadiums and playgrounds

13.1.4.1. Types of locations

13.1.4.2. Use cases

13.1.5. Corporate

13.1.5.1. Types of locations

13.1.5.2. Use cases

13.1.6. Healthcare

13.1.6.1. Types of locations

13.1.6.2. Use cases

13.1.7. Education

13.1.7.1. Types of locations

13.1.7.2. Use cases

13.1.8. Transportation

13.1.8.1. Types of locations

13.1.8.2. Use cases

Chapter 14. Competitive Landscape

14.1. Recent Developments & Impact Analysis by Key Market Companies

14.2. Company Categorization

14.3. Company Market Share Analysis

14.4. Strategy Mapping

14.4.1. Expansion

14.4.2. Mergers & Acquisition

14.4.3. Partnerships & Collaborations

14.4.4. New Product Launches

14.5. Company Profiles

14.5.1. ADFLOW Networks

14.5.1.1. Company Overview

14.5.1.2. Financial Performance

14.5.1.3. Product Benchmarking

14.5.1.4. Recent Developments

14.5.2. BrightSign, LLC

14.5.2.1. Company Overview

14.5.2.2. Financial Performance

14.5.2.3. Product Benchmarking

14.5.2.4. Recent Developments

14.5.3. Cisco Systems, Inc.

14.5.3.1. Company Overview

14.5.3.2. Financial Performance

14.5.3.3. Product Benchmarking

14.5.3.4. Recent Developments

14.5.4. Intel Corporation

14.5.4.1. Company Overview

14.5.4.2. Financial Performance

14.5.4.3. Product Benchmarking

14.5.4.4. Recent Developments

14.5.5. KeyWest Technology, Inc.

14.5.5.1. Company Overview

14.5.5.2. Financial Performance

14.5.5.3. Product Benchmarking

14.5.5.4. Recent Developments

14.5.6. LG Electronics (LG Corporation)

14.5.6.1. Company Overview

14.5.6.2. Financial Performance

14.5.6.3. Product Benchmarking

14.5.6.4. Recent Developments

14.5.7. Microsoft Corporation

14.5.7.1. Company Overview

14.5.7.2. Financial Performance

14.5.7.3. Product Benchmarking

14.5.7.4. Recent Developments

14.5.8. NEC Display Solutions

14.5.8.1. Company Overview

14.5.8.2. Financial Performance

14.5.8.3. Product Benchmarking

14.5.8.4. Recent Developments

14.5.9. Omnivex Corporation

14.5.9.1. Company Overview

14.5.9.2. Financial Performance

14.5.9.3. Product Benchmarking

14.5.9.4. Recent Developments

14.5.10. Panasonic Corporation

14.5.10.1. Company Overview

14.5.10.2. Financial Performance

14.5.10.3. Product Benchmarking

14.5.10.4. Recent Developments

14.5.11. SAMSUNG

14.5.11.1. Company Overview

14.5.11.2. Financial Performance

14.5.11.3. Product Benchmarking

14.5.11.4. Recent Developments

14.5.12. Scala Digital Signage

14.5.12.1. Company Overview

14.5.12.2. Financial Performance

14.5.12.3. Product Benchmarking

14.5.12.4. Recent Developments

14.5.13. Winmate Inc.

14.5.13.1. Company Overview

14.5.13.2. Financial Performance

14.5.13.3. Product Benchmarking

14.5.13.4. Recent Developments

List of Tables

Table 1 Digital signage market by region, 2017 - 2030 (USD Million)

Table 2 Global digital signage market by type, 2017 - 2030 (USD Million)

Table 3 Global digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 4 Global digital signage market by component, 2017 - 2030 (USD Million)

Table 5 Global digital signage market by hardware, 2017 - 2030 (USD Million)

Table 6 Global digital signage market by services, 2017 - 2030 (USD Million)

Table 7 Global digital signage market by technology, 2017 - 2030 (USD Million)

Table 8 Global digital signage market by resolution, 2017 - 2030 (USD Million)

Table 9 Global digital signage market by application, 2017 - 2030 (USD Million)

Table 10 Global digital signage market by location, 2017 - 2030 (USD Million)

Table 11 Global digital signage market by content category, 2017 - 2030 (USD Million)

Table 12 Global digital signage market by broadcast content category, 2017 - 2030 (USD Million)

Table 13 Global digital signage market by size, 2017 - 2030 (USD Million)

Table 14 Digital signage market revenue, by region, 2017 - 2030 (USD Million)

Table 15 Digital signage market volume, by region, 2017 - 2030 (Thousand Units)

Table 16 Hardware market by region, 2017 - 2030 (USD Million)

Table 17 Displays market by region, 2017 - 2030 (USD Million)

Table 18 Media Players market by region, 2017 - 2030 (USD Million)

Table 19 Projectors market by region, 2017 - 2030 (USD Million)

Table 20 Software market by region, 2017 - 2030 (USD Million)

Table 21 Services market by region, 2017 - 2030 (USD Million)

Table 22 Installation services market by region, 2017 - 2030 (USD Million)

Table 23 Maintenance & Support services market by region, 2017 - 2030 (USD Million)

Table 24 Consulting & Other services market by region, 2017 - 2030 (USD Million)

Table 25 Video walls market by region, 2017 - 2030 (USD Million)

Table 26 Video walls market by application, 2017 - 2030 (USD Million)

Table 27 Video walls market by location, 2017 - 2030 (USD Million)

Table 28 Video walls market by technology, 2017 - 2030 (USD Million)

Table 29 Video screens market by region, 2017 - 2030 (USD Million)

Table 30 Video screens market by application, 2017 - 2030 (USD Million)

Table 31 Video screens market by location, 2017 - 2030 (USD Million)

Table 32 Video screens market by technology, 2017 - 2030 (USD Million)

Table 33 Transparent LED screens market by region, 2017 - 2030 (USD Million)

Table 34 Transparent LED screens market by application, 2017 - 2030 (USD Million)

Table 35 Transparent LED screens market by location, 2017 - 2030 (USD Million)

Table 36 Transparent LED screens market by technology, 2017 - 2030 (USD Million)

Table 37 Digital posters market by region, 2017 - 2030 (USD Million)

Table 38 Digital posters market by application, 2017 - 2030 (USD Million)

Table 39 Digital posters market by location, 2017 - 2030 (USD Million)

Table 40 Digital posters market by technology, 2017 - 2030 (USD Million)

Table 41 Kiosks market by region, 2017 - 2030 (USD Million)

Table 42 Kiosks market by application, 2017 - 2030 (USD Million)

Table 43 Kiosks market by location, 2017 - 2030 (USD Million)

Table 44 Kiosks market by technology, 2017 - 2030 (USD Million)

Table 45 Interactive Kiosks market by region, 2017 - 2030 (USD Million)

Table 46 Self-service Kiosks market by region, 2017 - 2030 (USD Million)

Table 47 Other Kiosks market by region, 2017 - 2030 (USD Million)

Table 48 Other signage market by region, 2017 - 2030 (USD Million)

Table 49 Other signage market by application, 2017 - 2030 (USD Million)

Table 50 Other signage market by location, 2017 - 2030 (USD Million)

Table 51 Other signage market by technology, 2017 - 2030 (USD Million)

Table 52 Digital signage hardware market by region, 2017 - 2030 (USD Million)

Table 53 Digital signage software market, by region, 2017 - 2030 (USD Million)

Table 54 Digital signage service market, by region, 2017 - 2030 (USD Million)

Table 55 LCD-based digital signage market by region, 2017 - 2030 (USD Million)

Table 56 LED-based digital signage market, by region, 2017 - 2030 (USD Million)

Table 57 Projection-based digital signage market, by region, 2017 - 2030 (USD Million)

Table 58 Resolution digital signage market, by region, 2017 - 2030 (USD Million)

Table 59 8K digital signage market, by region, 2017 - 2030 (USD Million)

Table 60 4K digital signage market, by region, 2017 - 2030 (USD Million)

Table 61 FHD digital signage market, by region, 2017 - 2030 (USD Million)

Table 62 HD digital signage market, by region, 2017 - 2030 (USD Million)

Table 63 Lower than HD digital signage market, by region, 2017 - 2030 (USD Million)

Table 64 Digital signage market for in-store locations by region, 2017 - 2030 (USD Million)

Table 65 Digital signage market for out-store locations by region, 2017 - 2030 (USD Million)

Table 66 Digital signage market in broadcast content category by region, 2017 - 2030 (USD Million)

Table 67 Digital signage market in news broadcast content category by region, 2017 - 2030 (USD Million)

Table 68 Digital signage market in weather content category by region, 2017 - 2030 (USD Million)

Table 69 Digital signage market in sports content category by region, 2017 - 2030 (USD Million)

Table 70 Digital signage market in others content category by region, 2017 - 2030 (USD Million)

Table 71 Digital signage market in non-broadcast content category by region, 2017 - 2030 (USD Million)

Table 72 Digital signage market for below 32 inches size by region, 2017 - 2030 (USD Million)

Table 73 Digital signage market for 32 to 52 inches size by region, 2017 - 2030 (USD Million)

Table 74 Digital signage market for more than 52 inches size by region, 2017 - 2030 (USD Million)

Table 75 Digital signage market in retail sector by region, 2017 - 2030 (USD Million)

Table 76 Digital signage market in hospitality sector, by region, 2017 - 2030 (USD Million)

Table 77 Digital signage market in entertainment sector, by region, 2017 - 2030 (USD Million)

Table 78 Digital signage market in stadiums & playgrounds sector, by region, 2017 - 2030 (USD Million)

Table 79 Digital signage market in corporate sector, by region, 2017 - 2030 (USD Million)

Table 80 Digital signage market in banking sector, by region, 2017 - 2030 (USD Million)

Table 81 Digital signage market in healthcare, by region, 2017 - 2030 (USD Million)

Table 82 Digital signage market in education, by region, 2017 - 2030 (USD Million)

Table 83 Digital signage market in transportation sector, by region, 2017 - 2030 (USD Million)

Table 84 North America digital signage market by type, 2017 - 2030 (USD Million)

Table 85 North America digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 86 North America digital signage market by component, 2017 - 2030 (USD Million)

Table 87 North America digital signage market by hardware, 2017 - 2030 (USD Million)

Table 88 North America digital signage market by services, 2017 - 2030 (USD Million)

Table 89 North America digital signage market by technology, 2017 - 2030 (USD Million)

Table 90 North America digital signage market by resolution, 2017 - 2030 (USD Million)

Table 91 North America digital signage market by application, 2017 - 2030 (USD Million)

Table 92 North America digital signage market by location, 2017 - 2030 (USD Million)

Table 93 North America digital signage market by content category, 2017 - 2030 (USD Million)

Table 94 North America digital signage market by broadcast content category, 2017 - 2030 (USD Million)

Table 95 North America digital signage market by size, 2017 - 2030 (USD Million)

Table 96 U.S. digital signage market by type, 2017 - 2030 (USD Million)

Table 97 U.S. digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 98 U.S. digital signage market by component, 2017 - 2030 (USD Million)

Table 99 U.S. digital signage market by hardware, 2017 - 2030 (USD Million)

Table 100 U.S. digital signage market by services, 2017 - 2030 (USD Million)

Table 101 U.S. digital signage market by technology, 2017 - 2030 (USD Million)

Table 102 U.S. digital signage market by resolution, 2017 - 2030 (USD Million)

Table 103 U.S. digital signage market by application, 2017 - 2030 (USD Million)

Table 104 U.S. digital signage market by location, 2017 - 2030 (USD Million)

Table 105 U.S. digital signage market by content category, 2017 - 2030 (USD Million)

Table 106 U.S. digital signage market by broadcast content category, 2017 - 2030 (USD Million)

Table 107 U.S. digital signage market by size, 2017 - 2030 (USD Million)

Table 108 U.S. digital signage market by region, 2017 - 2030 (USD Million)

Table 109 Canada digital signage market by type, 2017 - 2030 (USD Million)

Table 110 Canada digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 111 Canada digital signage market by component, 2017 - 2030 (USD Million)

Table 112 Canada digital signage market by hardware, 2017 - 2030 (USD Million)

Table 113 Canada digital signage market by services, 2017 - 2030 (USD Million)

Table 114 Canada digital signage market by technology, 2017 - 2030 (USD Million)

Table 115 Canada digital signage market by resolution, 2017 - 2030 (USD Million)

Table 116 Canada digital signage market by application, 2017 - 2030 (USD Million)

Table 117 Canada digital signage market by location, 2017 - 2030 (USD Million)

Table 118 Canada digital signage market by content category, 2017 - 2030 (USD Million)

Table 119 Canada digital signage market by broadcast content category, 2017 - 2030 (USD Million)

Table 120 Canada digital signage market by size, 2017 - 2030 (USD Million)

Table 121 Mexico digital signage market by type, 2017 - 2030 (USD Million)

Table 122 Mexico digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 123 Mexico digital signage market by component, 2017 - 2030 (USD Million)

Table 124 Mexico digital signage market by hardware, 2017 - 2030 (USD Million)

Table 125 Mexico digital signage market by services, 2017 - 2030 (USD Million)

Table 126 Mexico digital signage market by technology, 2017 - 2030 (USD Million)

Table 127 Mexico digital signage market by resolution, 2017 - 2030 (USD Million)

Table 128 Mexico digital signage market by application, 2017 - 2030 (USD Million)

Table 129 Mexico digital signage market by location, 2017 - 2030 (USD Million)

Table 130 Mexico digital signage market by content category, 2017 - 2030 (USD Million)

Table 131 Mexico digital signage market by broadcast content category, 2017 - 2030 (USD Million)

Table 132 Mexico digital signage market by size, 2017 - 2030 (USD Million)

Table 133 Europe digital signage market by type, 2017 - 2030 (USD Million)

Table 134 Europe digital signage market by kiosk, 2017 - 2030 (USD Million)

Table 135 Europe digital signage market by component, 2017 - 2030 (USD Million)

Table 136 Europe digital signage market by hardware, 2017 - 2030 (USD Million)

Table 137 Europe digital signage market by services, 2017 - 2030 (USD Million)

Table 138 Europe digital signage market by technology, 2017 - 2030 (USD Million)

Table 139 Europe digital signage market by resolution, 2017 - 2030 (USD Million)