- Home

- »

- Next Generation Technologies

- »

-

Digital Signature Market Size, Share & Growth Report, 2030GVR Report cover

![Digital Signature Market Size, Share & Trends Report]()

Digital Signature Market Size, Share & Trends Analysis Report By Component, By Level, By Deployment, By End-user, By Industry Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-074-9

- Number of Pages: 110

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Technology

Report Overview

The global digital signature market size was valued at USD 3.18 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 37.9% from 2023 to 2030. The growth of the digital signature market can be attributed to the growing adoption of digital signatures for signing documents digitally. Adoption is driven by various factors such as customer expectation for digital interaction, increasing awareness of legal acceptance of e-signature, a greater focus on compliance & security, and the desire of businesses to remain competitive in the market. Furthermore, the increasing number of online contracts and agreements also bodes well for the market's growth.

Digital signature market growth can also be attributed to its benefits, such as reduced errors while signing a document electronically. For instance, companies notice an 80% reduction in signing errors when their clients sign a document electronically. Furthermore, according to LunarPen, in 2020, using e-signatures in financial institutions decreased the number of missing files by 66%. Additionally, in 2021, according to DocuSign, digital signatures increased customer loyalty by 500%. Hence, such benefits offered by digital signatures are anticipated to fuel the market's growth over the forecast period.

Technological advancement in digital signature has made the process highly secure and user-friendly. Digital certificates, Hash functions, Public Key Infrastructure (PKI), asymmetric cryptography, and time-stamping are some of the key technologies contributing to the market's growth. Furthermore, increasing digitalization across various industries, including BFSI, healthcare, retail, and real estate, among others, has created growth opportunities for the digital signature market. Additionally, the growing demand for digital transformation in various industries, such as finance, healthcare, and government, has also boosted the growth of the digital signature market.

Increasing investments into digital signature companies from venture capital firms bode well for the market's growth. For instance, in November 2022, PT Privy Identitas Digital, a Jakarta-based digital signature startup, announced that it raised USD 48 million through a series C funding round. The round was led by KKR, a private equity company, and backed by existing investors, including GGV Capital, MDI Ventures, and Telkomsel Mitra Inovasi. The company planned to utilize these funds to accelerate its digital transformation.

Though the digital signature market is anticipated to grow exponentially, some challenges, such as a high cost of investment, are expected to restrain the market's growth. Furthermore, people can trust technology but resist change, so wet signatures are still common in developing or underdeveloped countries. Additionally, the threat of altering digital signatures might also hinder the growth of the market. However, the benefits of digital signatures, the adoption of digital signatures by government organizations, and the growing cloud technology infrastructure are expected to overcome these challenges and result in the growth of the digital signature market over a forecast period.

COVID-19 Impact Analysis

The COVID-19 pandemic had a positive impact on the digital signature market. With the growth in digitalization and to avoid physical contact, businesses, and individuals were forced to adopt digital signatures for signing documents electronically. Furthermore, government across various jurisdictions was also poised to modernize legislation around digital signatures during a pandemic. For instance, in September 2020, U.S. Senate Committee on Commerce, Science, and Transportation voted to approve S.4159 (the "E-SIGN Modernization Act"). This bill repealed certain requirements related to electronic records in commerce. Furthermore, increasing launches of digital signature solutions during the COVID-19 pandemic have also fueled the market's growth over the forecast period.

Market Dynamics

Continuous advances in various technologies are transforming the digital signature market, enhancing security, accessibility, and user experience. Mobile integration is a prominent trend, enabling individuals to sign documents on the go using smartphones and tablets. Blockchain integration is gaining traction, offering tamper-proof storage and verification of signed documents. Artificial Intelligence (AI) and Machine Learning (ML) are being leveraged for signature verification and advanced authentication. Cloud-based solutions are on the rise, facilitating seamless collaboration and document management. Integrating emerging technologies such as AI, blockchain, and IoT unlocks new possibilities in the digital signature market.

Suppliers in the digital signature market are focusing on adapting to customers' evolving needs and industry demands. Industry consolidation is evident as larger companies acquire or merge with digital signature solution providers to offer comprehensive offerings. Partnerships and collaborations are fostering integration and expanding market reach. Suppliers focus on vertical-specific solutions tailored to specific industry requirements, ensuring compliance and specialized functionalities. Security and compliance remain key priorities, with suppliers investing in robust encryption, secure key management, and adherence to industry regulations. User-friendly interfaces, scalability, and flexible deployment options are emphasized to meet diverse customer demands. Furthermore, suppliers strongly focus on customer support and services to drive customer satisfaction.

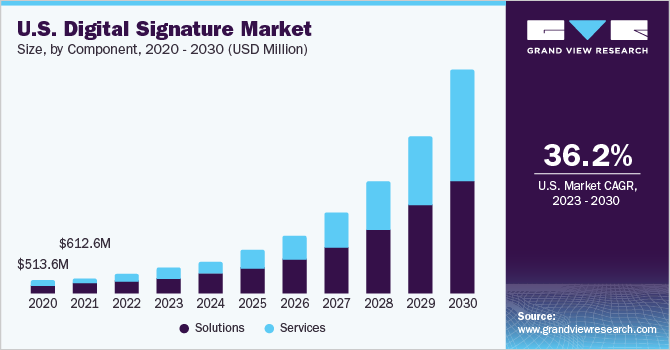

Component Insights

The solutions segment dominated the market in 2022, accounting for more than 65.0% revenue share. The solutions segment includes software and hardware required for signing documents digitally. The growth of the solutions segment can be attributed to the convenience offered by this solution to users. It enables users to sign documents remotely and digitally safely and securely. For instance, in March 2021, Amazon Web Services, Inc., an IT services management company, enabled its users to digitally sign documents by leveraging an e-signature solution named signNow.

The services segment is anticipated to grow fastest over the forecast period. The growth of this segment can be attributed to increasing safety and security concerns while signing a document. Furthermore, rising cloud adoption for digital signature services also bodes well for the segment's growth. Additionally, Digital Signature Services (DSS) enable businesses, organizations, and individuals to access services focusing on consulting, implementation, and training. For instance, nowina.lu provides DSS that helps businesses transition from paper-based processes to digital workflows and enhance digital experience by prioritizing interoperability, which can drive growth and give businesses a competitive advantage.

Level Insights

The Advanced Electronic Signatures (AES) segment dominated the market in 2022, accounting for more than 56.0% revenue share. The dominance of AES segment is primarily due to the adoption of AES for signatures for sensitive documents and high-value transactions. AES signatures are created by leveraging cryptographic algorithms that protect signatures from forgery. Furthermore, AES eliminates the need for physical documents and wet ink signatures, thereby reducing the costs of digital signatures.

The Qualified Electronic Signatures (QES) segment is expected to register the fastest growth over the forecast period. QES segment's growth can be attributed to its high level of trust via face-to-face ID verification. QES requires an identity authentication before issuing a digital certificate, and customers are requested to electronically identify themselves during the signing process when prompted to verify their ID. Hence, as the most secure and assured signing method, demand for QES will grow over the forecast period.

Deployment Insights

The on-premise segment dominated the digital signature market in 2022 and accounted for a global revenue share of more than 55.0%. Enterprises operating across industries, including healthcare, government, and medical, are sometimes subject to stringent state and federal laws governing the security and protection of their data and digital signature processes. For these companies, on-premise digital signature solutions are often required to ensure compliance with these regulations. This approach allows companies to have greater control over their data and signature flow while adhering to strict guidelines. As a result, on-premise digital signature solutions are the preferred choice for many enterprises, as they offer the best way to secure and manage their data and online signatures. Furthermore, companies such as airSlate Inc. and DigiSigner offer on-premise digital signature solutions to users, enabling them to ensure and maintain high data security.

The cloud segment is anticipated to grow fastest over the forecast period. Increasing adoption of the cloud by several enterprises across the globe is expected to drive the segment's growth. For instance, in December 2022, according to Zippia, Inc., an internet publishing company, nearly 94% of enterprises across the U.S. used cloud services. Furthermore, companies such as Entrust Corporation are involved in offering a cloud-based turnkey solution that integrates with desktop and web applications supporting digital signatures. Hence, the aforementioned factors are expected to fuel the segment’s growth over the forecast period.

End-user Insights

The businesses segment dominated the market in 2022, accounting for more than 39.0% revenue share. Businesses segment growth can be attributed to the increasing adoption of digital signatures by businesses across the globe. For instance, in May 2021, according to airSlate Inc., a document workflow automation platform, with the rise of COVID-19, the number of eSignature adopters among businesses has increased by 50%. Furthermore, benefits, such as improved customer experience by adding a digital signature, are expected to fuel the segment’s growth over the forecast period.

Organizations segment is projected to grow fastest over the forecast period. Organizations segment's growth can be attributed to non-profit organizations' increasing adoption of digital signatures. Furthermore, various market players offer non-profit organizations digital signature solutions. For instance, market players such as Zoho Corporation Pvt. Ltd. and DocuSign, Inc. provide digital signature solutions specifically for non-profit organizations. Moreover, increasing partnerships between market players to provide digital signature solutions for non-profits are anticipated to drive segment’s growth. For instance, in September 2021, airSlate, a workflow automation solution, announced that its electronic signature solution, signNow, partnered with TechSoup, a network facilitating the distribution of technology solutions to non-profit organizations. The purpose of this collaboration was to incorporate the use of eSignatures, which would provide discounted access to the benefits of electronic signature technology. This integration aims to improve workflow processes with donors and volunteers, increasing cost savings for TechSoup's network of more than 1.6 million global non-profit organizations.

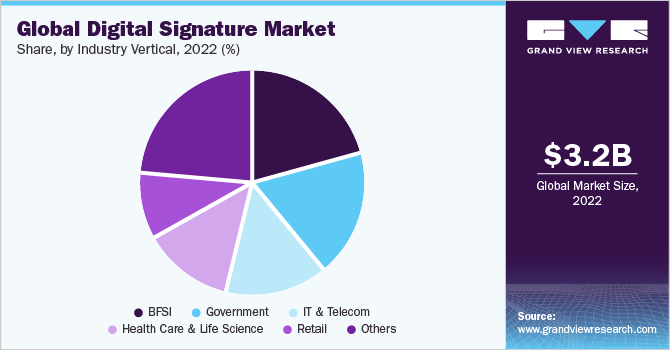

Industry Vertical Insights

The BFSI segment accounted for a significant market share of more than 20.0% in 2022. The BFSI segment's growth is propelled by the rising adoption of digital transformation and the imperative for secure and efficient authentication procedures. Digital signatures provide various benefits, such as reduced paperwork, enhanced security, and streamlined operations. In the BFSI sector, where security and compliance are paramount, digital signatures offer a reliable way to authenticate and authorize contracts, transactions, and other finance-related documents. Hence, growing digitalization across BFSI sectors is anticipated to propel the segment's growth.

The government segment is anticipated to grow fastest over the forecast period. The COVID-19 pandemic compelled government organizations and agencies to embrace digital signatures for signing documents electronically. Additionally, governments in various jurisdictions have enacted revisions to digital signature laws, approving their usage. As a result, government agencies are now actively seeking to provide citizens with a highly digitized experience. E-signature technology empowers individuals, non-profits, and government entities to continue conducting essential business in a secure and contact-free manner through digital signatures.

Regional Insights

North America dominated the digital signature market in 2022 and accounted for more than 30.0% of revenue share. The presence of prominent digital signature solution providers, such as DocuSign, Inc., Adobe, and Entrust Corporation, across the region is anticipated to fuel the regional market’s growth. Furthermore, a favorable legal environment for digital signatures across the North American region is anticipated to fuel its adoption over the forecast period. In addition, a region is an early adopter of technology and suitable cloud infrastructure; the North American region is embracing the use of digital signatures.

Asia Pacific is projected to emerge as the fastest-growing region over the forecast period. Asia Pacific region's growth can be attributed to efforts put in by the government to enhance citizens' access to digital experiences. Countries, including India and China, are adopting digital technologies, leading to growth in the adoption of digital signatures across regions. Furthermore, a favorable legal environment across the region is anticipated to fuel regional growth over the forecast period.

Key Companies & Market Share Insights

The digital signature market is characterized as a consolidated market. Prominent market players are investing in expansion initiatives, research & development, strategic partnerships, and joint ventures to gain a competitive edge. Initiatives represent an effort to introduce new products and services leveraging advanced technologies such as Distributed Ledger Technology (DLT). For instance, in March 2023, docStribute, a RegTech startup in London, announced the launch of its digital signing solution named dSign. With this launch, a company aimed towards leveraging the power of DLT and the current infrastructure of flagship product dSend. As a result of this launch, the company enabled all sized businesses to democratize digital signatures by making all features available for all sectors with low-cost, flat fees.

Though the largest players dominate the market, it is a competitive market with high growth potential. Key market players are also involved in mergers & acquisitions to expand their offerings in the digital signature market. For instance, in February 2021, Box, a cloud storage company, announced the acquisition of SignRequest, an e-signature startup based in the Netherlands, for USD 55 million. This acquisition was aimed at launching Box Sign, an e-signature product built on SignRequest’s technology that would be integrated natively into Box. Some of the prominent players in the global digital signature market include:

-

DocuSign, Inc.

-

SIGNiX, Inc.

-

Adobe

-

OneSpan

-

GlobalSign

-

IdenTrust, Inc.

-

PrimeKey AB

-

Visma

-

Ascertia

-

Topaz Systems, Inc.

-

Entrust Corporation

Digital Signature Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.03 billion

Revenue forecast in 2030

USD 38.16 billion

Growth rate

CAGR of 37.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, level, deployment, end user, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; Spain; France; Italy; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; The Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

DocuSign, Inc.; SIGNiX, Inc.; Adobe; OneSpan; GlobalSign; IdenTrust, Inc.; PrimeKey AB; Visma; Ascertia; Topaz Systems, Inc.; Entrust Corporation

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Digital Signature Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels providing an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global digital signature market report based on component, level, deployment, end user, industry vertical, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solutions

-

Services

-

-

Level Outlook (Revenue, USD Billion, 2017 - 2030)

-

Advanced Electronic Signatures (AES)

-

Qualified Electronic Signatures (QES)

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premise

-

-

End-user Outlook (Revenue, USD Billion, 2017 - 2030)

-

Individuals

-

Businesses

-

Organizations

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Health Care & Life Science

-

IT & Telecom

-

Government

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Spain

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa (MEA)

-

UAE

-

The Kingdom Of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global digital signature market size was estimated at USD 3.18 billion in 2022 and is expected to reach USD 4.03 billion in 2023.

b. The global digital signature market is expected to grow at a compound annual growth rate of 37.9% from 2023 to 2030 to reach USD 38.16 billion by 2030.

b. North America dominated the digital signature market with a share of 30.43% in 2022. The presence of prominent digital signature solution providers, such as DocuSign, Inc., Adobe, and Entrust Corporation, across the region is anticipated to fuel the regional market’s growth.

b. Some key players operating in the digital signature market include DocuSign, Inc.; SIGNiX, Inc.; Adobe; OneSpan; GlobalSign; IdenTrust, Inc.; PrimeKey AB; Visma; Ascertia; Topaz Systems, Inc.; and Entrust Corporation.

b. Key factors that are driving the digital signature market growth include a rise in internet and smartphone penetration and growing investments in digital signature solution-providing companies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."